Family Memberloan Agreement Template free printable template

Show details

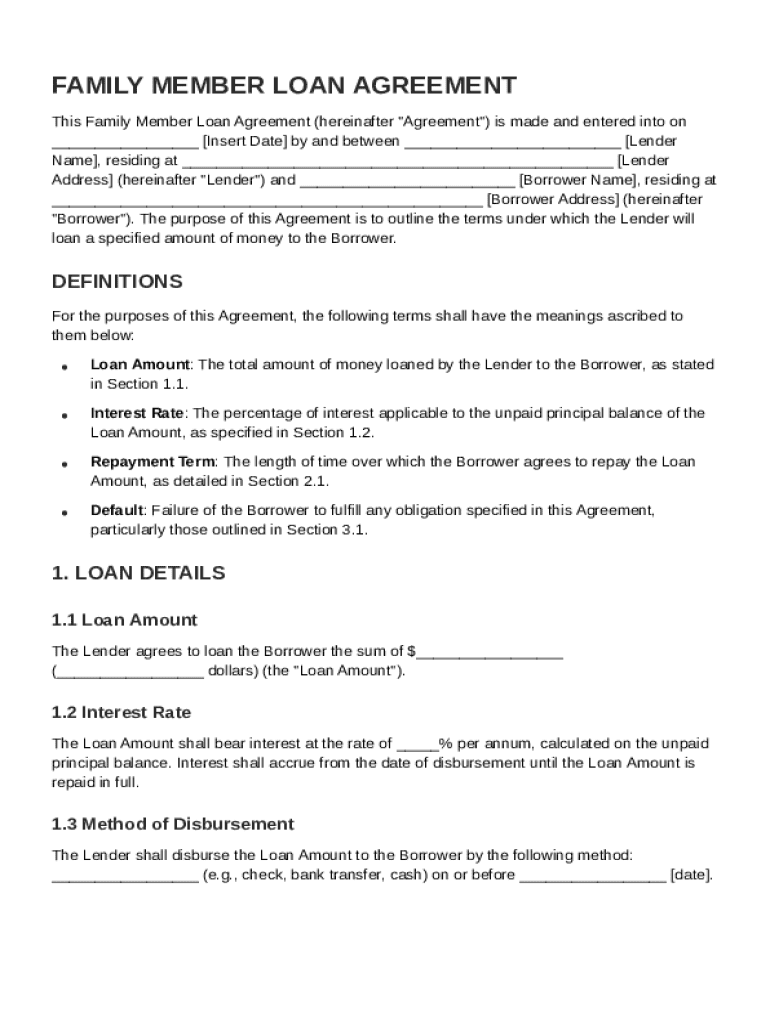

This document outlines the terms under which a lender provides a loan to a family member, including loan amount, interest rate, repayment terms, and default conditions.

We are not affiliated with any brand or entity on this form

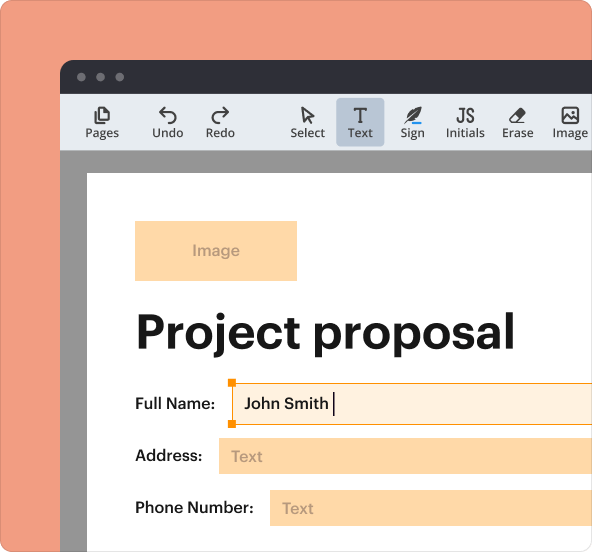

Why pdfFiller is the best tool for managing contracts

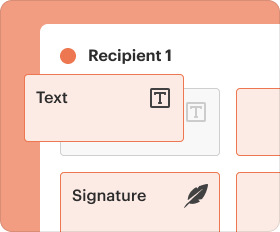

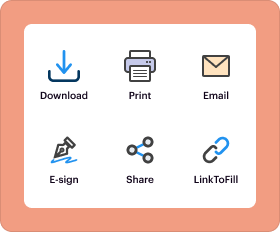

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

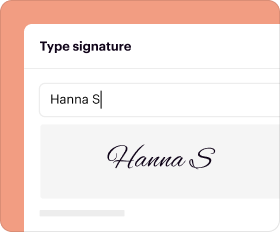

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Family Memberloan Agreement Template

A Family Member Loan Agreement Template is a document used to outline the terms and conditions of a loan between family members, ensuring clarity and legal protection for both parties.

pdfFiller scores top ratings on review platforms

honestly, I like it a lot, a lot. Easy to use and intuitive. You've done a great job!

d

PDFfiller is the best. I have never had an issue with PDFfiller. it has helped me in so many ways that without I really don't know what I would have done.

easy to use

easy

Its new to me but seems to be ok,

Who needs Family Memberloan Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Complete Family Member Loan Agreement Guide

TL;DR: How to fill out a Family Member Loan Agreement form

To fill out a Family Member Loan Agreement form, first define the loan amount and interest rate, followed by detailing the repayment schedule. Finally, both parties should sign the document to make it official.

What is a family member loan agreement?

A Family Member Loan Agreement is a legally binding document used when one family member lends money to another. This agreement outlines the loan's terms, ensuring both parties understand their responsibilities. It is essential in maintaining family harmony while formalizing the financial transaction.

-

This agreement clearly states the loan amount, interest rate, and repayment conditions.

-

A formal document minimizes misunderstandings and protects the rights of both the lender and borrower.

-

Understanding the legal implications can prevent future disputes or tax issues, reinforcing the importance of this agreement.

What are the key components of the agreement?

A Family Member Loan Agreement should include several crucial elements to ensure clarity and protect both parties involved. Properly detailing these components will help to avoid disputes and confusion.

-

Specifying the exact funds being lent is essential to avoid miscommunication regarding the total loan.

-

Establishing a fair interest rate ensures both parties have a clear understanding of the financial obligations.

-

The duration and repayment schedule should be specified to maintain organizational clarity and compliance.

-

This defines default situations and potential repercussions, protecting the lender's interests.

How do fill out the agreement step-by-step?

Filling out a Family Member Loan Agreement can be straightforward if you follow a structured approach. Here’s a step-by-step guide to ensure every important detail is included.

-

Clearly state the date of the agreement and the names of both the lender and borrower.

-

Outline the specific amount to be loaned and any applicable interest rates.

-

Indicate how and when repayments will be made, whether monthly, quarterly, or on another schedule.

-

Ensure both parties sign and date the agreement to make it legally binding.

What are the methods of disbursement?

Choosing a suitable method to disburse the loan is also critical. The method not only affects the transaction but also impacts how both parties record and manage the arrangement.

-

Options include cash, bank transfers, or checks, each with its own level of traceability.

-

Consider the preferences and convenience for both the lender and the borrower.

-

Maintaining records of the transaction is essential for both parties to avoid misunderstandings.

How to create a repayment plan and schedule?

The repayment plan is a vital aspect of the Family Member Loan Agreement. It ensures both parties are aligned on expectations and enhances the likelihood of repayment.

-

Discuss options such as monthly, quarterly, or annual payments to find what works best.

-

Examples of repayment structures can guide you in determining the best plan.

-

Be upfront about possible hardships and negotiate terms to manage these situations.

What common pitfalls should be avoided?

It may seem simple, but misunderstandings can arise if proper precautions aren't taken. Here are common issues to be mindful of while creating a Family Member Loan Agreement.

-

Communication is crucial to manage expectations and avoid disruptions in family dynamics.

-

Being upfront about terms helps avoid misunderstandings down the line.

-

Not adhering to the agreement can lead to disputes or legal challenges, emphasizing the importance of commitment.

Why should use a Family Loan Agreement template?

Using a Family Loan Agreement template can streamline the process significantly. It offers convenience, ensures compliance with legal standards, and reduces the time spent drafting documents.

-

Templates provide pre-formatted documents, simplifying the drafting process.

-

A comprehensive template helps ensure that necessary legal language is included.

-

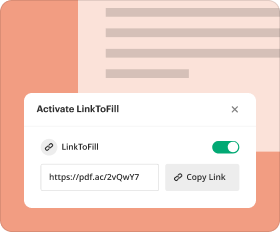

Use pdfFiller to edit, customize, and eSign the agreement, saving time and paperwork.

How to fill out the Family Memberloan Agreement Template

-

1.Download the Family Member Loan Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller editor.

-

3.Begin by filling in the names and addresses of both the lender and the borrower at the top of the document.

-

4.Specify the loan amount clearly.

-

5.Set the interest rate (if applicable) and repayment schedule, including due dates.

-

6.Include any provisions regarding late payments or defaults, if necessary.

-

7.Review the terms for accuracy and clarity.

-

8.Both parties should sign and date the document to make it legally binding.

-

9.Save the completed document as a PDF to share it with the other party.

How to write a family loan agreement?

Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

Can you make a loan to a family member?

A family loan is a loan between family members. You could create a similar loan arrangement between friends, significant others or roommates. With this type of loan, it's up to you and the lender to decide how it's structured. A family loan can have interest or not and be repaid in installments or a lump sum.

How to approach a family member for a loan?

Ask to speak with them about something important, then set a time and date. State what your situation is clearly and what the exact amount is. Tell them about your attempts at doing things a different way. Tell them what the consequences are. Ask them for a loan.

How do I write a personal loan contract agreement?

Preparing to Draft Your Personal Loan Agreement Gather Essential Information. Consult Legal and Financial Experts. Identifying the Parties Involved. Determining the Loan Amount and Purpose. Loan Purpose. Setting the Interest Rate and Repayment Terms. Default and Late Payment Penalties. Modifying and Terminating the Agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.