Fee Payment Agreement Template free printable template

Show details

This document outlines the terms and conditions governing payment for services rendered by the Service Provider to the Client.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Fee Payment Agreement Template

A Fee Payment Agreement Template is a legal document outlining the terms of payment for services rendered between two parties.

pdfFiller scores top ratings on review platforms

Found myself in a pinch, found the forms I needed and cannot believe the ease of use. Thank you PDFfiller.

Learning a lot thanks for the info an help

So far, so good. I don't like that it seems to lose its connection frequently and I have lost data a time or two but that may be a function of where/what I work on. Otherwise, fair deal for the price.

It's incredibly easy to use! I *love* that I don't have to print this stuff out and fill it in by hand anymore. And making edits to what I do is super easy too! I'm so glad I found this website!

IT WORKS .....HAVE YOU YOUR PDF FILLER FOR YEARS

Program works good for online non-filable forms

Who needs Fee Payment Agreement Template?

Explore how professionals across industries use pdfFiller.

Fee Payment Agreement Template Guide

How do you understand a Fee Payment Agreement?

A Fee Payment Agreement is a contractual document that outlines the terms and conditions under which a client agrees to pay for services rendered. It serves to protect both parties involved—clients and service providers—by ensuring clarity around expectations. Key terms such as 'services', 'payment', and 'due date' are critical to understand when creating a robust agreement. Having a formal agreement mitigates misunderstandings and establishes a clear framework for the business relationship.

What are the key components of a Fee Payment Agreement?

-

This section includes the names, addresses, and contact details of both parties, forming the basis of the agreement.

-

Clearly defined services help prevent disputes and ensure that both parties have aligned expectations.

-

An appendix or section that provides an in-depth look at the specific services offered, timelines, and deliverables.

-

This should outline how any additional services will be managed within the contract, including amendment procedures.

What are the financial obligations regarding fees and payment terms?

Understanding financial obligations is pivotal for effective financial management. The agreement must explicitly state the total fees payable for services rendered. It should also include options for payment, such as one-time payments or installment plans, allowing flexibility for both clients and service providers. Additionally, due dates for payments should be clearly defined to ensure all parties understand the financial expectations.

-

The agreed payment amount must be transparently stated in the agreement.

-

Whether you choose to pay upfront, monthly, or by installment, clarity on this point is vital.

-

Understanding why due dates matter aids in planning and maintaining good credit or relationships.

How can interactive tools help create a Fee Payment Agreement?

Using digital tools like pdfFiller simplifies the process of creating a Fee Payment Agreement. Users can easily fill out forms, make edits, and ensure their documents adhere to legal standards. Additionally, eSigning capabilities streamline the approval process, providing a cloud-based solution for document management that is both efficient and effective.

-

This platform allows users to create, edit, and customize agreements to fit specific needs.

-

E-signatures make it easy to formalize agreements without the need for physical meetings.

-

A guided approach ensures that all necessary details are included and correctly formatted.

What are the best practices for using a Fee Payment Agreement?

To maximize the effectiveness of a Fee Payment Agreement, clarity and mutual understanding between parties are essential. Regular updates can prevent complications arising from changes in services or financial terms. Documentation is key; keeping records of communications and amendments ensures a transparent and secure agreement process.

-

Both parties should review and agree on terms to lessen the risk of conflict.

-

Review agreements periodically to ensure they stay relevant and reflect current needs.

-

Good documentation practices offer legal protection and clarify expectations over time.

What future considerations exist in Fee Payment Agreements?

As the landscape of business changes, including shifts to digital documentation, the nature of Fee Payment Agreements is evolving. Keeping pace with regulatory compliance ensures that these agreements remain valid and enforceable. Tools like pdfFiller are designed to adapt to these changes, providing features that accommodate new trends in document management.

-

Digital solutions and cloud-based agreements are on the rise for convenience and efficiency.

-

Staying updated on applicable laws helps to tailor agreements to compliant formats.

-

The platform consistently integrates new features to enhance document management based on user needs.

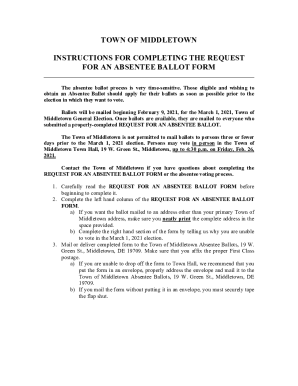

How to fill out the Fee Payment Agreement Template

-

1.Download the Fee Payment Agreement Template from pdfFiller or open the file in your account.

-

2.Begin by entering the date at the top of the document to specify when the agreement is being signed.

-

3.Fill in the names and contact information of both parties involved in the agreement, including any relevant titles.

-

4.Clearly state the services being provided and the agreed fee for those services, ensuring all amounts are precise.

-

5.Specify the payment schedule, including due dates and acceptable methods of payment.

-

6.Add any terms and conditions related to late payments or other fees that may apply.

-

7.Include spaces for both parties to sign and date the document to validate the agreement.

-

8.Review all completed fields for accuracy and completeness before saving the final version.

-

9.Save the completed document as a PDF for distribution or for your records.

How do I make a simple payment agreement?

You can create a simple payment contract with these steps: Look for examples of payment agreement contracts online. Format your document. Write your title. Outline the parties involved in the agreement. Clearly write out the terms of the loan. Explain that the contract represents the entire agreement.

What is an example of a payment arrangement?

Example of a payment arrangement clause "The Client agrees to pay the total sum of [$amount] to the Supplier as follows: an upfront deposit of [$amount], due upon signing this Agreement; a second payment of [$amount] due on [specified date], and the remaining balance of [$amount] due upon completion of the project.

How to write a payment plan template?

What to Include (7) Date: The date the agreement is being completed should be clearly listed at the top of the document. Parties Involved: The names and addresses of the lender and borrower. Amount: The balance ($) the lender owes to the creditor. Reason for Loan: Why the lender owes money to the creditor.

What is the agreement to pay remaining balance?

The 'Payment of Remaining Balance' clause requires a party to pay any outstanding amounts owed under the agreement. Typically, this clause specifies when and how the remaining balance must be settled, such as upon completion of services, delivery of goods, or termination of the contract.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.