Finance Agreement Template free printable template

Show details

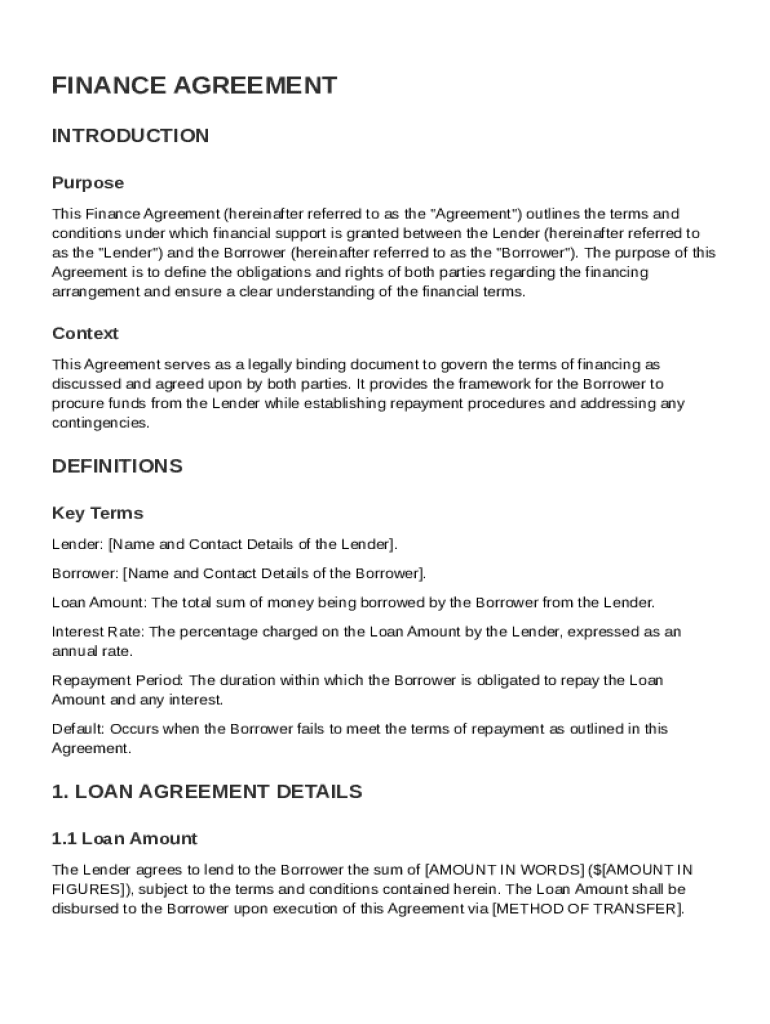

This document outlines the terms and conditions under which financial support is granted between the Lender and the Borrower, detailing obligations, rights, and repayment procedures.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Finance Agreement Template

A Finance Agreement Template is a standardized document outlining the terms and conditions of a financial transaction between parties.

pdfFiller scores top ratings on review platforms

Awesome service!

Really easy to use

Really easy to use, it has been really helpfull to use this app

Very user friendly and convienienr

Easy site to fix a document

Awesome

the best pdffiller ever would definitely recommend it

Grade A business right highly…

Grade A business right highly recommended

Who needs Finance Agreement Template?

Explore how professionals across industries use pdfFiller.

Finance Agreement Template Guide

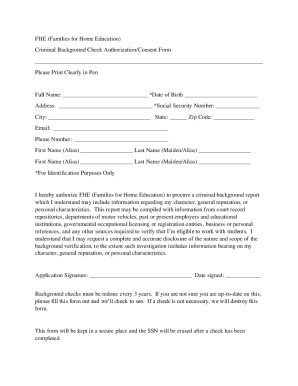

How to fill out a Finance Agreement Template form

Filling out a Finance Agreement Template form involves providing key details such as loan amount, interest rate, and repayment terms. Proper guidance can help in navigating each section effectively, ensuring that all necessary information is accurately included. By following a structured approach, you can simplify the process and avoid common errors.

What is a finance agreement?

A finance agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This agreement is crucial in financial transactions as it clarifies the rights and obligations of both parties. Understanding its legal enforceability ensures that both the lender and borrower are protected under the law.

-

A finance agreement defines the responsibilities and rights of both parties engaging in a loan.

-

These agreements mitigate risks involved in borrowing and lending, increasing trust and transparency.

-

Typically, the lender provides the funds while the borrower agrees to repay the loan as per the agreed terms.

What are the key components of a finance agreement?

A comprehensive finance agreement includes several critical components that define the loan's structure. Each term is essential for clear communication between both parties, ensuring that there are no misunderstandings regarding repayment obligations and terms.

-

The total amount of money that the borrower will receive from the lender.

-

The percentage charged on the borrowed amount, which can be fixed or variable.

-

The timeframe within which the borrower must repay the loan.

-

Terms defining the consequences if the borrower fails to meet repayment requirements.

-

Contact information for both the lender and borrower, facilitating communication.

-

Predefined conditions under which the agreement may change or terminate.

How do fill out the finance agreement template?

Completing the finance agreement template requires careful attention to detail. Follow a step-by-step approach to ensure each section is filled out correctly, such as accurately entering the loan amount and interest rate.

-

Read through the entire document before filling it out to understand all requirements.

-

Fill in your personal information accurately to avoid delays.

-

Double-check entered information, particularly numbers related to loan amounts and interest rates.

-

Save a draft before finalizing to ensure all details are correct.

What are loan terms and interest rates?

Understanding loan terms and interest rates is vital for managing your finances. A fixed interest rate remains the same throughout the loan, while a variable rate may change, potentially affecting the overall repayment amount.

-

Fixed rates provide stability, whereas variable rates might be lower initially but could rise over time.

-

Interest can be calculated based on different repayment schedules, varying the total amount payable.

-

Knowing these terms is essential to understand penalties in case of missed payments.

What are repayment plans and obligations?

Having a clear repayment plan is essential for loan management. Understanding timelines and consequences helps borrowers maintain financial stability while fulfilling obligations.

-

Explore various strategies that align with your financial situation to manage repayments effectively.

-

Missing repayments can lead to penalties, increased interest rates, or default.

-

Regular reviews of your repayment strategy can help you stay on track and avoid potential issues.

How can edit and customize my finance agreement?

With pdfFiller's tools, you can easily edit your finance agreement template. Customizing your document enhances its relevance to your particular needs, ensuring all information is accurate and up-to-date.

-

Use pdfFiller’s seamless editing features to adjust terms, contact details, and edit clauses.

-

Storing and editing documents in the cloud facilitates easy access from anywhere.

-

Leverage pdfFiller’s capabilities to save different versions and share your agreements quickly.

How to submit your finance agreement?

Submitting your completed finance agreement requires careful attention to submission guidelines. Ensuring that your document reaches the correct recipient is crucial to finalize the lending process.

-

Follow platform guidelines to submit your finance agreement electronically.

-

Identify the proper channels for submitting your document, whether through email or a lender’s platform.

-

Keep confirmation receipts and track the status of your submission to ensure it is processed.

How to fill out the Finance Agreement Template

-

1.Download the Finance Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller to start editing.

-

3.Enter the names and addresses of all parties involved at the top of the template.

-

4.Fill in the details of the financial transaction, including the amount, interest rate, and payment terms.

-

5.Specify the due dates for payments and any late fee policies.

-

6.Include any additional terms and conditions relevant to the agreement.

-

7.Review the completed document for accuracy and completeness.

-

8.Save your changes and export the document as a PDF.

-

9.Share the finalized Finance Agreement Template with all parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.