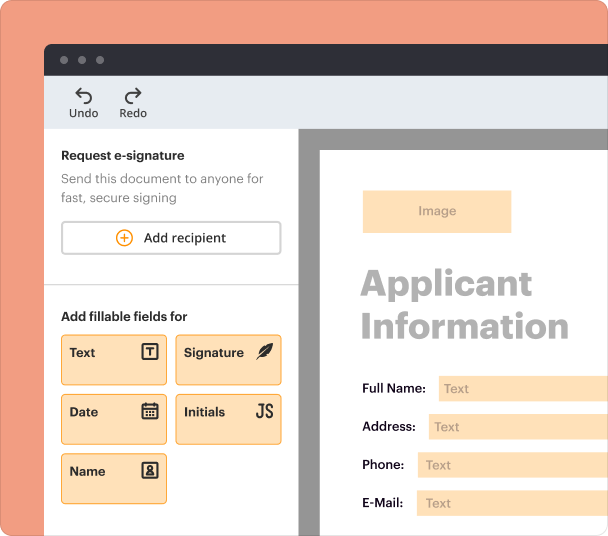

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Get the free Financial Planning Agreement Template

Show details

A contract between a financial planner and a client outlining the scope of financial planning services, responsibilities, fee structures, and terms of service.

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

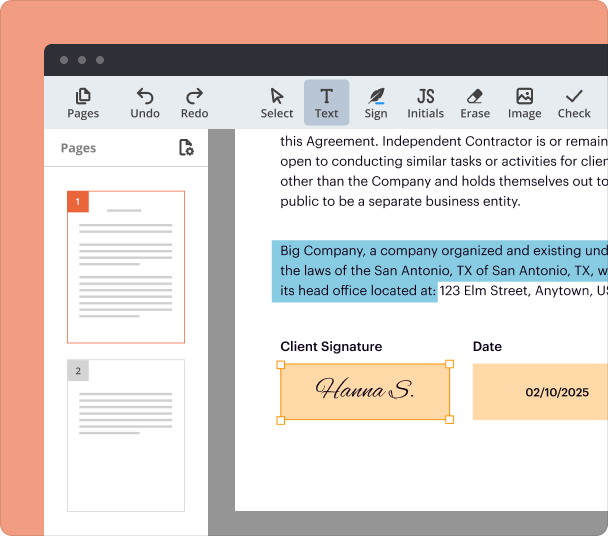

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

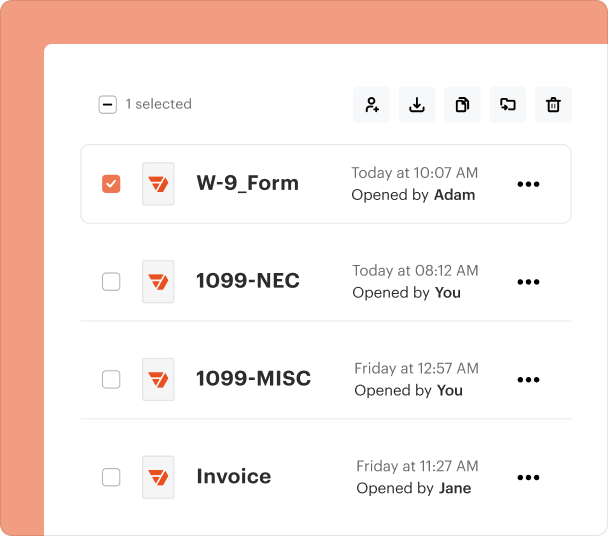

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Financial Planning Agreement Template

Here's everything you need to know to effectively edit and fill out your Financial Planning Agreement Template using pdfFiller.

How to edit Financial Planning Agreement Template

With pdfFiller, editing your Financial Planning Agreement Template is a simple and efficient process. Follow these steps to get started:

-

1.Click the ‘Get form’ button on this page to begin the process.

-

2.Create a pdfFiller account by providing your email address and selecting a password.

-

3.Once your account is set up, log in to your dashboard.

-

4.Access the form you want to edit by choosing it from your documents or uploading a new one.

-

5.Utilize the editing tools available in pdfFiller to make necessary changes, including text modifications, adding signatures, and inserting images.

How to fill out Financial Planning Agreement Template

Filling out the Financial Planning Agreement Template accurately is crucial for creating a clear and professional document. The best way to obtain this form is to click ‘Get form’ on this page. Here’s how to properly fill it out:

-

1.Click the ‘Get form’ button to access the Financial Planning Agreement Template.

-

2.Download the form and open it in pdfFiller for filling.

-

3.Start by entering the required personal information on the first page, such as your name and contact details.

-

4.Proceed to the sections outlining your financial goals and objectives, ensuring all details are accurate.

-

5.Review any legal or financial terms included in the document to confirm understanding.

-

6.Complete the signature fields where required, ensuring all parties present sign the document.

-

7.Once everything is filled out, review the form for accuracy and completeness.

-

8.Save your filled-out Financial Planning Agreement Template for your records.

All you need to know about Financial Planning Agreement Template

This section provides you with a comprehensive overview of the Financial Planning Agreement Template to ensure you understand its purpose and contents.

What is a Financial Planning Agreement Template?

A Financial Planning Agreement Template is a formal document that outlines the terms of engagement between a financial planner and a client. It serves as a contract that specifies the services to be provided, the expectations of both parties, and the associated fees.

Definition and key provisions of a Financial Planning Agreement Template

This template is essential for establishing a professional relationship between a client and a financial advisor. It typically includes the following key provisions:

-

1.Scope of Services

-

2.Fees and Payment Structure

-

3.Duration of Agreement

-

4.Confidentiality Clause

-

5.Termination Conditions

When is a Financial Planning Agreement Template used?

A Financial Planning Agreement Template is utilized whenever a client seeks to establish a formal relationship with a financial planner. It is primarily used in scenarios involving financial advice on investments, retirement planning, estate planning, and tax-related strategies.

Main sections and clauses of a Financial Planning Agreement Template

The typical sections and clauses found in a Financial Planning Agreement Template include:

-

1.Introduction: Overview of the agreement

-

2.Parties Involved: Identification of the client and the financial planner

-

3.Services Offered: Detailed description of financial planning services

-

4.Compensation: Explanation of fees and payment terms

-

5.Client Responsibilities: Expectations of the client's participation

-

6.Disclaimer: Legal disclaimers regarding advice

What needs to be included in a Financial Planning Agreement Template?

To ensure the effectiveness of the Financial Planning Agreement Template, it should include:

-

1.Clear definition of services provided

-

2.Detailed fee structure and payment method

-

3.Duration and review process of the agreement

-

4.Indication of the jurisdiction and governing law

-

5.Contact information for both parties

What is a financial planning agreement?

A financial planning and management agreement is a crucial document that outlines the scope of work, responsibilities, and expectations between a financial advisor and their client. Drafting a comprehensive agreement requires careful consideration of various factors to ensure it meets the needs of both parties.

Is 1% too much to pay a financial advisor?

Many financial advisers charge based on how much money they manage on your behalf, and 1% of your total assets under management is a pretty standard fee. But psst: If you have over $1 million, a flat fee might make a lot more financial sense for you, pros say.

What are the 7 steps of financial planning?

The 7 Steps in the Financial Planning Process Step 1: Set Your Financial Goals. Step 2: Gather Financial Information. Step 3: Assess Your Current Financial Situation. Step 4: Create a Budget. Step 5: Build an Emergency Fund. Step 6: Invest for the Future. Step 7: Review and Adjust Regular.

Can I do my own financial planning?

Getting all your financial essentials in order is very time consuming and requires extensive knowledge. When people take a DIY approach to financial planning, they often overlook many essential components and tap into just a few of the outliers (eg setting up an investment account).

pdfFiller scores top ratings on review platforms

Easy to use, high degree of utility. Immediate results.

You make it easy to prepare forms-especially older ones.

VERY EASY TO USE. IT WAS GREAT AND PRINTED WELL.

PDF FILLER is most helpful!! A great asset to any office.

Great product. One of the few that can erase.

I haven't used it long, but so far so good

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.