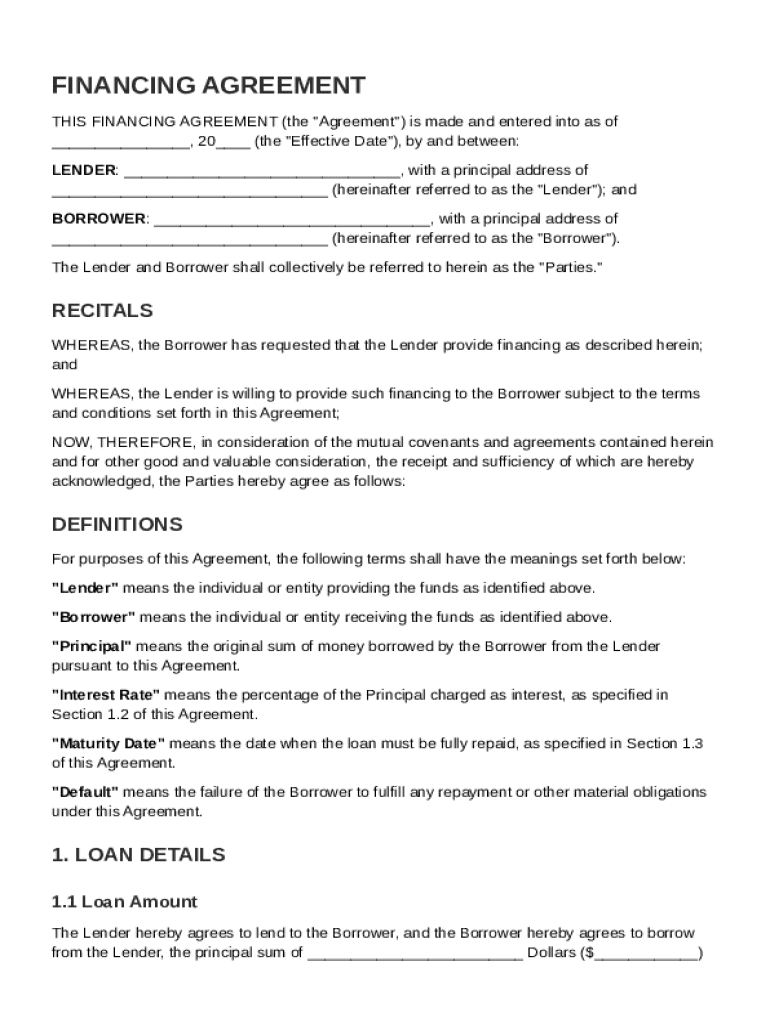

Financing Agreement Template free printable template

Show details

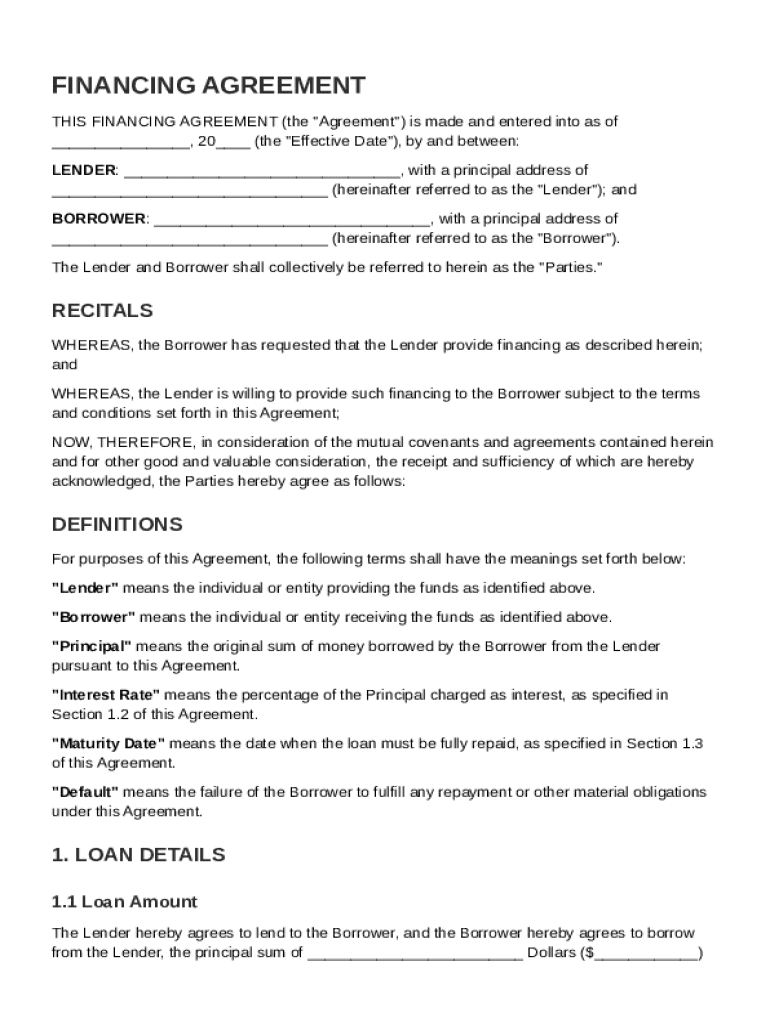

This document is a financing agreement between a lender and a borrower outlining the terms and conditions of a loan including definitions, loan details, representations, covenants, events of default,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Financing Agreement Template

A Financing Agreement Template is a legal document outlining the terms and conditions for funding between parties.

pdfFiller scores top ratings on review platforms

It's good!

how to fill the pdf online and print it how to print picture to pdf, how to send pdf to email address,

good editing file

I wish it was more explanatory on how to intergrate

A little difficult to figure out. Help is not very helpful but that is a common problem.

great!

Who needs Financing Agreement Template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to filling out a financing agreement template form

How does a financing agreement work?

A financing agreement serves as a legal document between the lender and borrower, establishing the terms under which funds are borrowed. This document details all pertinent information regarding repayments, interest rates, and other obligations. The primary purpose of this agreement is to protect the interests of both parties in a transaction.

Understanding the financing agreement

-

The financing agreement lays out the terms of how borrowed money will be repaid, including the consequences of default.

-

The lender provides the funds, while the borrower agrees to repay according to the specified terms.

-

These agreements create a clear understanding of obligations and can serve as a reference in case of disputes.

What are the key components of a financing agreement?

-

This marks the beginning of the agreement's timeline, determining when obligations start.

-

Key terms such as Principal, Interest Rate, and Maturity Date should be clearly defined to avoid confusion.

-

These state the context and background leading to the financing arrangement.

-

Details including the loan amount, interest rate, and repayment schedule should be explicitly listed.

How do you fill out a financing agreement form?

Filling out the Financing Agreement Template involves several key steps to ensure accuracy and compliance. You can use tools like pdfFiller to edit, sign, and collaborate on your form effortlessly. Streamlining the completion process can save time and help prevent common mistakes.

-

Collect all necessary data regarding loan requirements and borrower details before beginning.

-

Utilize pdfFiller’s features for efficient handling and completion of your form.

-

Review the agreement for any errors or omissions to avoid issues later.

How can you manage your financing agreement?

-

You can make changes to the Financing Agreement if terms need to be updated after initial completion.

-

Manage your document effectively through pdfFiller for secure access and storage.

-

Ensure your agreement adheres to local regulations, especially regarding interest rates and lending practices in your region.

What are the loan terms and their implications?

-

Understanding how interest is calculated is crucial; rates can significantly affect the total amount owed.

-

Knowing the repayment deadline is vital; late payments may incur penalties.

-

If obligations are not met, the lender can take specific actions that might include legal measures.

Exploring examples of financing agreements

-

Review successful financing agreements to understand practical applications and outcomes.

-

Examine terms in various agreements to identify the best practices in different industries.

-

Learn about frequently revised elements within loan agreement templates to better prepare your own.

How to fill out the Financing Agreement Template

-

1.Access the pdfFiller website and sign in to your account.

-

2.Select the Financing Agreement Template from the templates section.

-

3.Download the template in PDF format or open it directly in the editor.

-

4.Begin by entering the names and details of the parties involved at the top of the document.

-

5.Fill in the loan amount and specify the terms of repayment, including interest rates and payment schedules.

-

6.Include any collateral or guarantees if required, specifying details and responsibilities.

-

7.Detail any fees associated with the agreement, including late payment fees.

-

8.Clearly outline the rights and obligations of each party to avoid misunderstandings.

-

9.Finally, review the document for accuracy and completeness before saving or printing it for signatures.

What is an example of a financing agreement?

A loan is an example of a type of financing agreement. Financing agreements are often used by businesses that need capital for expansion or new equipment but don't have enough cash on hand or can't get traditional loans from banks because they are not credit-worthy.

How do I write a simple loan agreement?

Start Your Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

What is an example of a financing arrangement?

For example, a company may enter into a financial arrangement with a bank for a loan to finance its operations, with clearly defined repayment terms, interest rates, and conditions.

What is a financial agreement?

A financial agreement (also known as a Binding Financial Agreement) is a written agreement or contract between two parties that sets out how the parties would like to divide their financial resources if the relationship comes an end or has ended.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.