Forbearance Agreement Template free printable template

Show details

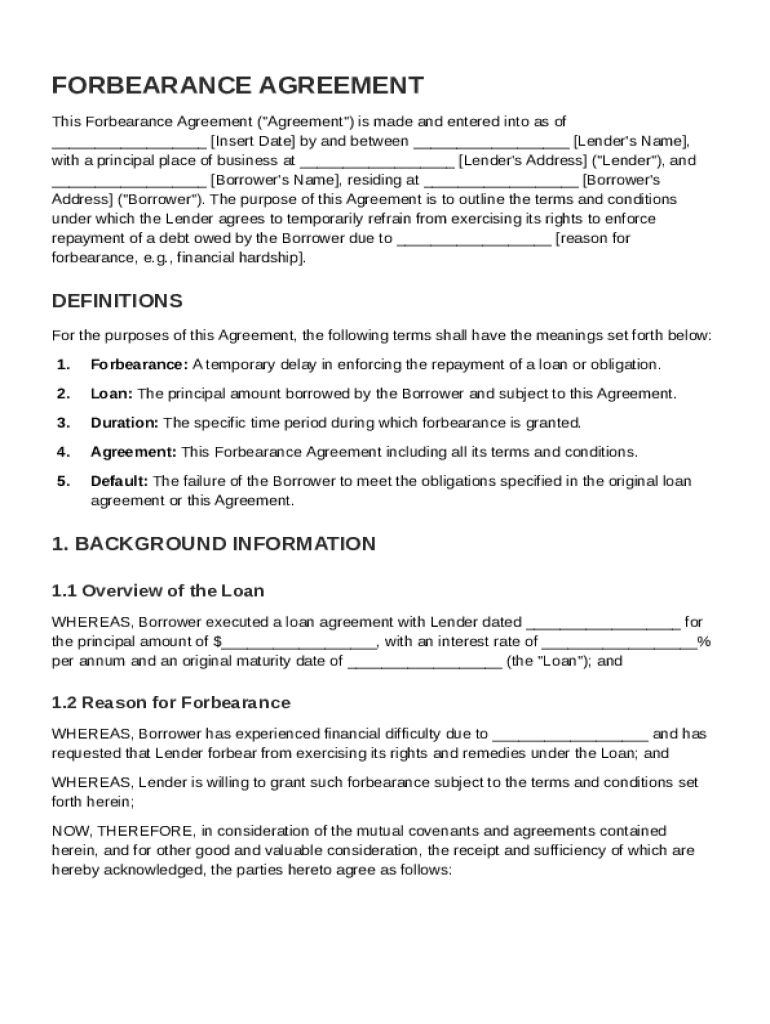

This document outlines the terms and conditions under which a lender agrees to temporarily refrain from enforcing the repayment of a debt owed by a borrower due to financial hardship.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Forbearance Agreement Template

A Forbearance Agreement Template is a legal document outlining an arrangement between a borrower and lender to delay debt repayment for a specified period while avoiding default.

pdfFiller scores top ratings on review platforms

good

happy user of your program

00

good

It gives me a lot of options to pdf editing

It gives me a lot of options to pdf works that I did not find somewhere else, and even when I cannot readily pay for the service, I was given a trial with no gimmicks attached

makes documentation a sinch

I can just upload a document edit to my satisfaction , import signatures and auto correct to have the most professional , and correct document.

Who needs Forbearance Agreement Template?

Explore how professionals across industries use pdfFiller.

Forbearance Agreement Guide

How to fill out a Forbearance Agreement form

Filling out a Forbearance Agreement involves understanding its purpose and the specific requirements needed to complete it accurately. First, you will need all pertinent information regarding the borrower and lender, as well as the financial hardship details. Utilize tools provided on platforms like pdfFiller to simplify this process and ensure that all necessary components are addressed efficiently.

What is a Forbearance Agreement?

A Forbearance Agreement is a temporary agreement between a borrower and a lender, allowing for the postponement of loan repayments due to financial hardship. This agreement is typically used when the borrower is experiencing short-term financial challenges and needs time to stabilize their situation.

-

Defines what a Forbearance Agreement is, highlighting its role in aiding borrowers facing temporary financial setbacks.

-

Forbearance Agreements are commonly used during events like job loss, medical emergencies, or economic downturns.

-

While these agreements provide immediate relief, they could lead to a higher overall debt burden if not managed efficiently.

What key terms should be defined?

Understanding specific terms is vital to effectively engage with a Forbearance Agreement. These terms help clarify expectations and responsibilities for both parties involved.

-

Forbearance refers to the temporary suspension or reduction of payments.

-

A loan is money borrowed, which must be repaid, often with interest, according to the terms set in the agreement.

-

The forbearance period is the length of time during which payments are temporarily halted.

-

Default is when a borrower fails to make the expected payments as per the loan agreement.

What are the components of a Forbearance Agreement?

A Forbearance Agreement includes several essential components that detail the terms and conditions of the arrangement between the lender and borrower.

-

Identify both parties involved, including names, addresses, and contact details.

-

Outline the specific reasons for requesting forbearance.

-

Detail how and when repayments will resume after the forbearance period.

-

Utilize pdfFiller to seamlessly outline proposed changes to the original agreement.

How to complete a Forbearance Agreement?

Completing a Forbearance Agreement accurately is crucial for both parties. It ensures everyone is on the same page and helps prevent future complications.

-

Use pdfFiller to illustrate each step in filling out the agreement clearly and efficiently.

-

Double-check all fields for accuracy and completeness before finalizing the document.

-

E-signing options on pdfFiller make the process simpler and legally binding.

When should a Forbearance Agreement be used?

Certain circumstances and financial hardships may necessitate the use of a Forbearance Agreement. Understanding these situations can help in deciding when to initiate such an agreement.

-

Emergencies like job loss or unexpected medical expenses may prompt the need for a forbearance.

-

Specific criteria, such as the type of loan, determine eligibility for forbearance.

-

Loans such as mortgages, student loans, and personal loans can fall under a Forbearance Agreement.

How to update terms in your Forbearance Agreement?

Changes in a borrower's financial situation may require updates to the Forbearance Agreement. Understanding the amendment process is crucial.

-

The process involves clear communication with your lender and providing updated financial information.

-

Interactive tools can assist in making necessary amendments efficiently.

-

Ensure all changes comply with local laws and regulations.

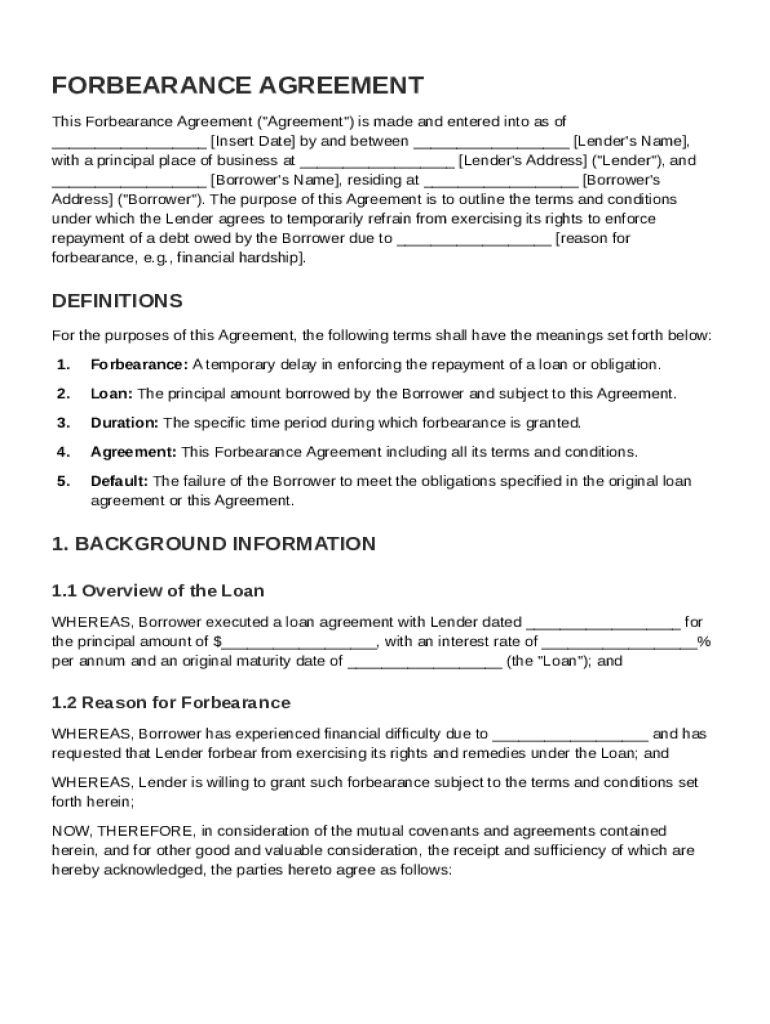

What does a Sample Forbearance Agreement look like?

Referencing a sample Forbearance Agreement can provide insight into structuring your own document. It can serve as a guide for expectations and specific clauses.

-

Make use of a sample form that outlines the typical agreements and important sections.

-

Leverage pdfFiller’s tools when drafting your agreement, ensuring customization based on personal needs.

-

Include personal details and unique circumstances to align the agreement with your situation.

What legal considerations are associated with Forbearance Agreements?

Signing a Forbearance Agreement carries legal obligations and implications. It's essential to be informed about these factors before proceeding.

-

Review the legal responsibilities outlined in the agreement and potential consequences of breach.

-

Consider any region-specific compliance notes that apply to your situation.

-

Consulting a legal professional can provide valuable insights and confirm that the agreement aligns with your rights.

Looking for something else?

If you require more than just a Forbearance Agreement, pdfFiller offers a variety of templates and forms catering to different needs, such as loan modification agreements.

-

Check out additional document options available on pdfFiller to fulfill your documentation needs.

-

Incorporate related documents to ensure comprehensive coverage of all legal needs.

-

Utilize pdfFiller's robust document management features for exploring and adapting alternative solutions.

How to fill out the Forbearance Agreement Template

-

1.Open the Forbearance Agreement Template on pdfFiller.

-

2.Begin by entering the date at the top of the document where indicated.

-

3.Fill in the borrower’s full name and contact information in the designated fields.

-

4.Next, input the lender's name and their contact information.

-

5.Specify the nature of the loan, including loan number and original amount borrowed.

-

6.Clearly outline the terms of the forbearance, including the start and end dates of the forbearance period.

-

7.List any terms regarding the payment schedule, such as whether interest will continue to accrue.

-

8.Include any additional terms and conditions relevant to the forbearance agreement.

-

9.Review all the information for accuracy and completeness to ensure clarity and legality.

-

10.Once completed, save the document and print it for signature.

What is a forbearance agreement?

Forbearance is a process that can help if you're struggling to pay your mortgage. Your servicer or lender arranges for you to temporarily pause mortgage payments or make smaller payments. You still owe the full amount, and you pay back the difference later. Forbearance can help you deal with a financial hardship.

How to get a forbearance agreement?

How do I get a forbearance agreement? To request a mortgage forbearance agreement, contact your lender or whoever services your mortgage payments. You will likely need to provide documentation (like a lay-off notice) proving that you're experiencing financial difficulties.

What is a forbearance plan example?

If you have a loan balance of $30,000 and an interest rate of 6% and you are in forbearance for a year right after you enter repayment, $1,800 in interest will accrue on your loans. If you do not pay that interest, it will be added to any non-capitalizing interest that accrued on your loan before the forbearance began.

What does forbearance mean in contracts?

Forbearance is the intentional action of abstaining from doing something. In the context of the law, it refers to the act of delaying from enforcing a right, obligation, or debt. For example, a creditor may forbear legal action against the debtor if they settle the debt payment with new payment conditions.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.