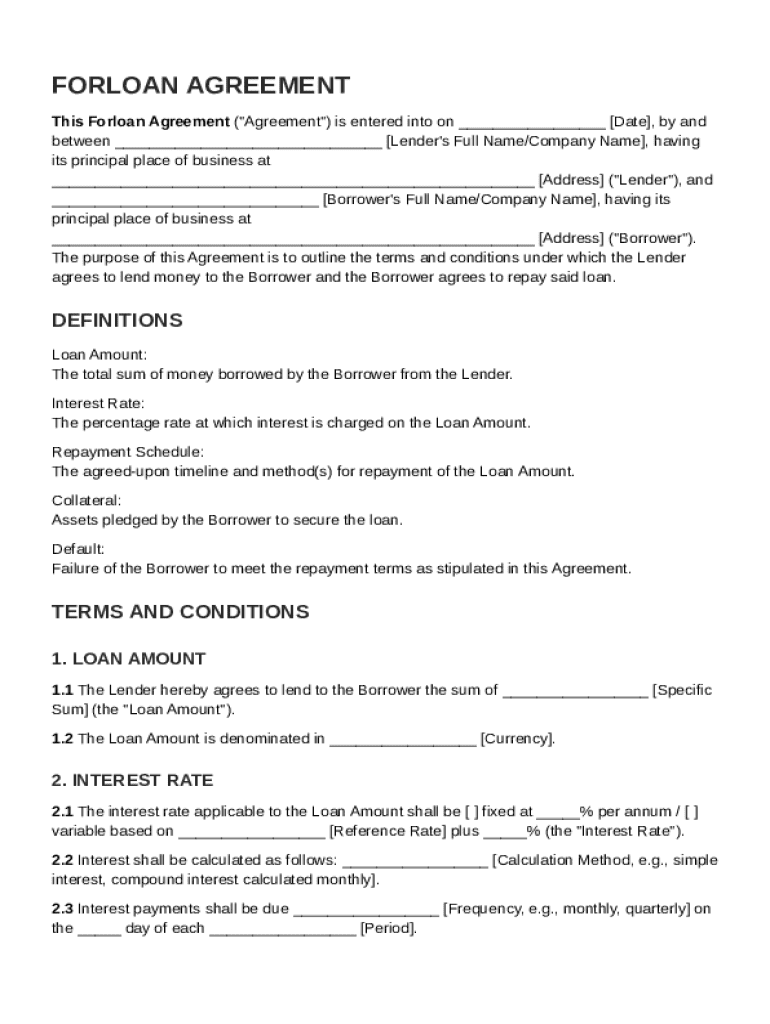

Forloan Agreement Template free printable template

Show details

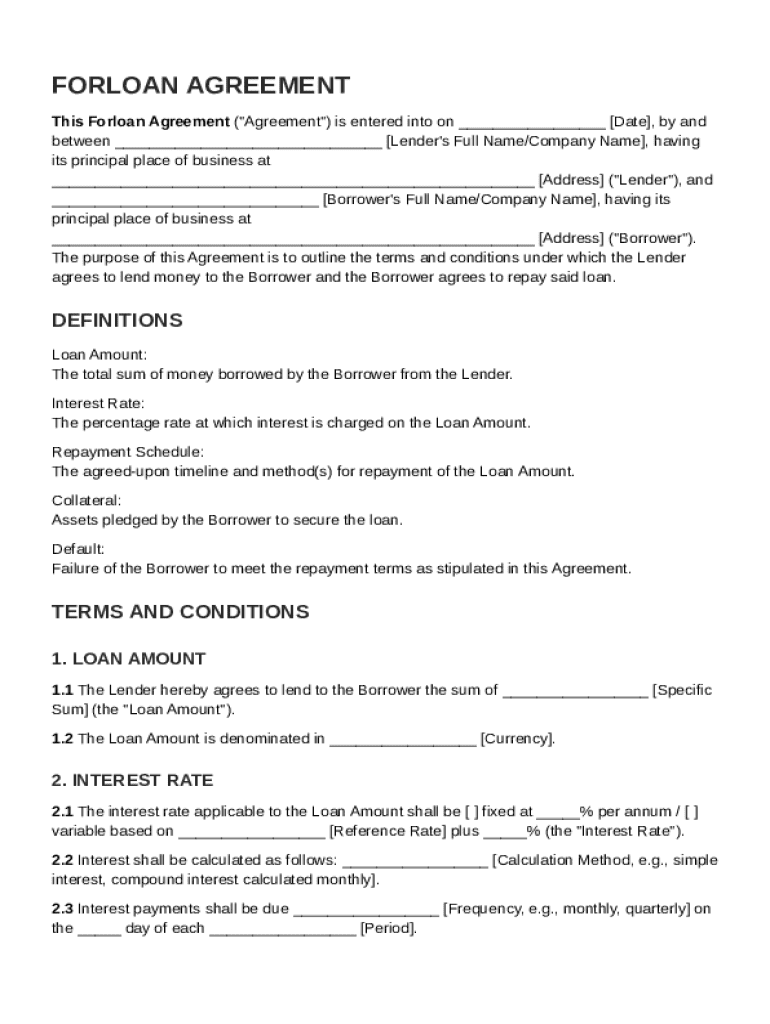

This document outlines the terms and conditions under which a lender agrees to lend money to a borrower and the borrower\'s obligations to repay the loan, including definitions, terms, repayment conditions,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Forloan Agreement Template

A Forloan Agreement Template is a legal document outlining the terms and conditions of a loan between a lender and a borrower.

pdfFiller scores top ratings on review platforms

so far so good

GREAT

Family Tree Project

This is my first experience with an Online system. After overcoming initial issues. I now am very pleased, except you 15 limit on merge. Plus some limitations on writing MS Publisher files.

A very good product, however, I don't have a need for it on an ongoing basis.

Excellent!

This is a great tool to work with, unfortunately, every good service comes at a price

Who needs Forloan Agreement Template?

Explore how professionals across industries use pdfFiller.

Long-Read How-to Guide on Forloan Agreement Template Form

How do you understand the Forloan Agreement?

The Forloan Agreement serves as a vital document that outlines the terms between lenders and borrowers. Having a written agreement is crucial for legal clarity and setting expectations. It’s commonly used in various scenarios such as personal loans, business loans, or even casual lending among friends. Without this document, misunderstandings can arise, leading to disputes or legal challenges.

-

Definition of a Forloan Agreement: This is a formal document that details the loan amount, terms of repayment, interest rates, and any collateral involved.

-

Importance of having a written agreement: It protects both parties by defining obligations and rights clearly.

-

Common scenarios for using a Forloan Agreement: Typically involves personal loans, mortgages, and commercial borrowings.

What are the key elements of a Forloan Agreement?

Key elements of the Forloan Agreement significantly affect the outcome of the loan process. These include significant details such as the Loan Amount, Interest Rate, and Repayment Schedule. It’s also crucial to define what constitutes Collateral and the ramifications of Default. Understanding these elements ensures both the lender and borrower are well-versed in their responsibilities.

-

Loan Amount, Interest Rate, and Repayment Schedule: These are central components that define how much money is borrowed, how much interest will be charged, and the timeline for repayment.

-

What constitutes Collateral?: This refers to assets pledged as security for the loan, often necessary to reduce the lender's risk.

-

Defining Default and its implications: Default occurs when a borrower fails to fulfill repayment duties, leading to penalties or legal action.

How do you fill out your Forloan Agreement?

Filling out the Forloan Agreement requires precision and the correct information. The process involves a step-by-step guide to ensure accuracy in entering Lender and Borrower details. Moreover, calculating the Loan Amount and Interest Rate correctly is vital to avoid future discrepancies.

-

Step-by-step process: Carefully follow each section of the template, ensuring all fields are filled out correctly.

-

Focus on correct input for Lender and Borrower details: Double-check these sections to prevent issues down the line.

-

Tips for calculating Loan Amount and Interest Rate accurately: Use reliable financial calculators or tools for precision.

How can you edit and customize the Forloan Agreement Template?

Using pdfFiller's tools simplifies the process of editing and customizing your Forloan Agreement. The platform allows you to add or remove clauses based on your specific needs, ensuring compliance with legal standards. Saving your changes efficiently is essential to maintain a clear record of all edits.

-

Using pdfFiller's tools: The platform provides intuitive editing capabilities suitable for all users.

-

How to add or remove clauses as needed: This flexibility allows better customization to fit various scenarios.

-

Saving your changes and ensuring compliance: Always save versions and check for legal adherence.

What options are there for signing the Forloan Agreement?

Signing the Forloan Agreement can efficiently be done using electronic signatures through pdfFiller. Understanding the legal legitimacy of eSignatures is crucial, as they hold the same validity as physical signatures in many jurisdictions. Additionally, there are various platforms available that offer eSigning options, providing flexibility in how agreements are finalized.

-

Options for electronic signatures using pdfFiller: You can create a secure signature directly on the platform.

-

Understanding the legal legitimacy of eSignatures: Ensure familiarity with local laws for signatory requirements.

-

Where to find additional signing options: Explore multiple digital platforms if alternative methods are preferred.

How do you manage your Forloan Agreement post-signing?

After signing your Forloan Agreement, effective management becomes critical. Tools within pdfFiller assist users in storing and retrieving important documents efficiently. Moreover, collaboration features paralleled with strategies for tracking payments ensure that all parties remain on the same page regarding obligations.

-

How to store and retrieve documents using pdfFiller: The platform offers cloud storage solutions for easy access.

-

Collaboration features for teams handling loan agreements: Facilitate communication and task distribution with team members.

-

Best practices for keeping track of payments and follow-ups: Utilize reminder tools for payment schedules.

What are the updates and best practices for Forloan Agreements?

Staying updated on the current industry standards for loan agreements is essential for successful transactions. Utilizing best practices ensures that your agreement remains relevant and effective. Additionally, being aware of common pitfalls when using template agreements helps avoid costly mistakes.

-

Current industry standards for loan agreements: Regularly consult industry publications to stay informed.

-

Tips for ensuring your agreement is up-to-date: Regularly review terms and conditions as market dynamics change.

-

Common pitfalls to avoid when using template agreements: Inspect templates carefully for outdated clauses.

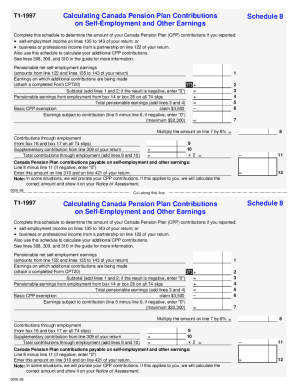

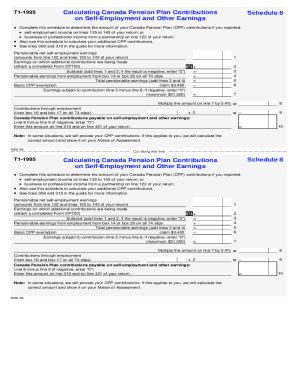

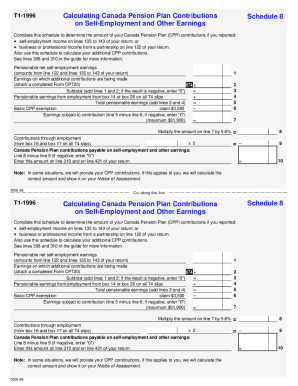

How to fill out the Forloan Agreement Template

-

1.Download the Forloan Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Begin filling in the borrower's and lender's names in the designated sections.

-

4.Specify the loan amount to be borrowed in the loan amount field.

-

5.Set the interest rate applicable to the loan agreement.

-

6.Indicate the repayment schedule, including start date and duration of the loan.

-

7.Include any collateral details if applicable to the loan.

-

8.Review the terms and conditions section and modify as necessary to fit your agreement.

-

9.Sign the document electronically to validate it; both parties should do this.

-

10.Save the completed form and consider sharing a copy with the other party for their records.

How to fill a loan agreement form?

Here are the essential items your loan agreement form sample must cover: Parties Involved. Clearly identify the lender and borrower with their full legal names. Loan Amount & Interest. Repayment Schedule. Late Payment Fees. Collateral (For Secured Loans) Default Consequences. Governing Law. Signatures.

How to write up a loan agreement?

What does a Loan Agreement include? The location. Details about the lender and borrower. The loan amount and loan date. Interest and late fees. The repayment method. Collateral and insurance.

How to set up a formal loan agreement?

Loan agreements between family members or friends should include: Details of who is lending the money and who is borrowing it. The exact amount of money being lent. The purpose of the loan. How and when the loan will be repaid. If interest will be charged on the loan, the interest rate, and how it will be calculated.

What is a legally binding agreement between the borrower and the lender?

A loan contract is a legal agreement between a lender and a borrower that outlines the terms and conditions of a loan.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.