Founder Stock Vesting Agreement Template free printable template

Show details

This document outlines the terms and conditions under which founders of a company receive and retain shares of the company\'s stock based on a vesting schedule, including definitions, core provisions,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Founder Stock Vesting Agreement Template

A Founder Stock Vesting Agreement Template is a legal document that outlines the terms under which founders of a startup will earn their equity over time.

pdfFiller scores top ratings on review platforms

I enjoy a simplified way of completing forms that are legible and professional; this is my benefit from using PDFfiller, now in my fifth year.

It's been a lifesaver for filling out forms that need to be faxed or mailed.

Easy to use after you get used to it. Good format and decent lay out.

It's been good thank you. Just need to know how to use the features more.

Works great to fill forms and print them but wouldn't let me send . so i had to print and mail it.

great for already established forms, limiting on calculations needed

Who needs Founder Stock Vesting Agreement Template?

Explore how professionals across industries use pdfFiller.

Founder Stock Vesting Agreement Guide

A Founder Stock Vesting Agreement Template form outlines the essential framework for allocating stock ownership to founders in a structured way. It helps to ensure that founders remain committed to the company during critical early stages.

By using a template form, startups can safeguard their interests while motivating founders to contribute long-term effort toward the company's success.

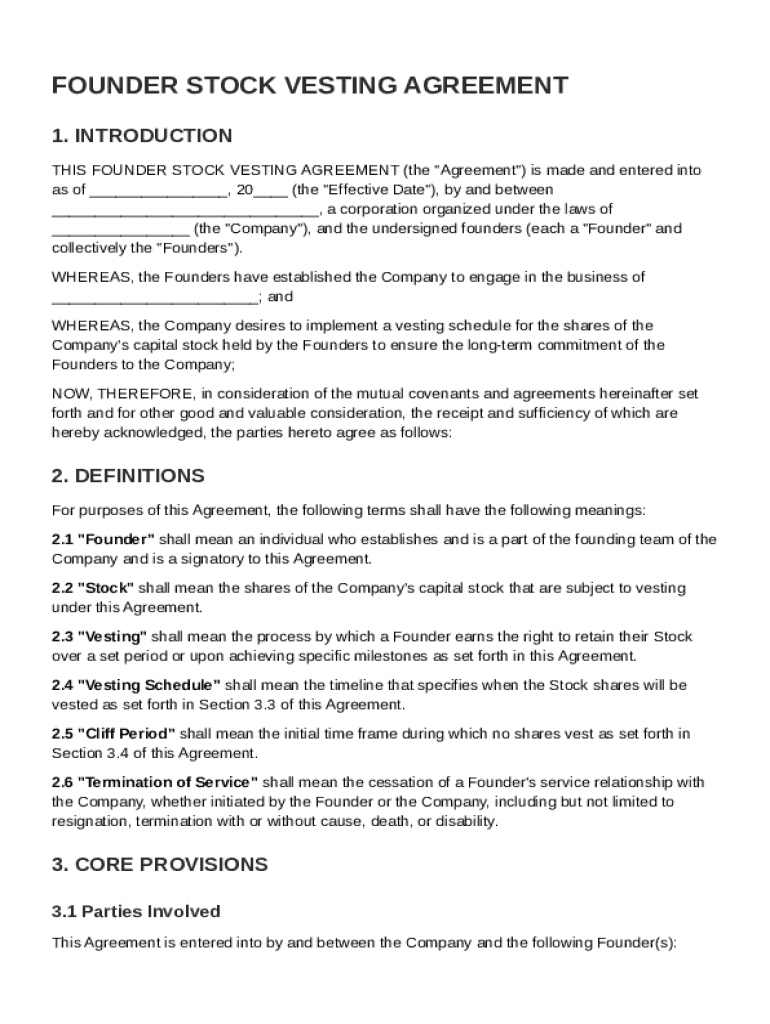

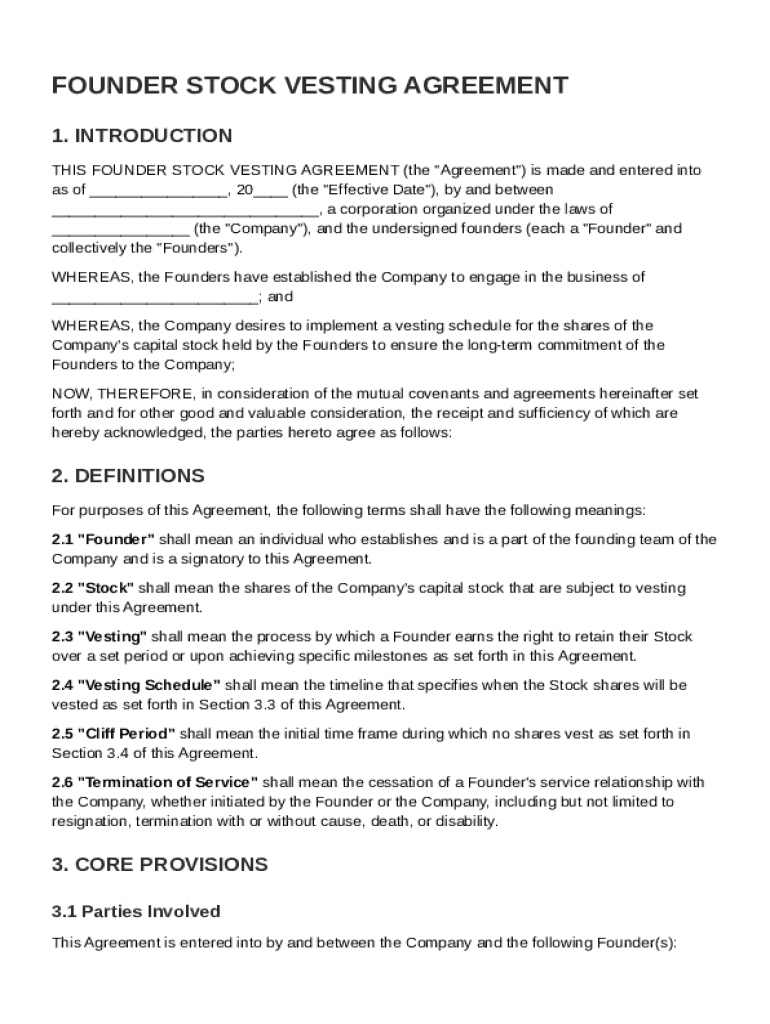

What is a founder stock vesting agreement?

A Founder Stock Vesting Agreement is a legal document that outlines the terms under which a founder will earn their equity in a startup. Typically, stocks are not entirely owned at the onset; they are earned over a specified period to ensure commitment and performance.

Why are vesting agreements important for startups?

Vesting agreements are crucial as they align the interests of founders with the long-term growth of the company. They incentivize founders to stay engaged and perform effectively, reducing the chances of them leaving with a substantial amount of unearned equity.

How do vesting agreements incentivize founders?

By linking stock ownership to performance milestones, vesting agreements motivate founders to actively contribute to the startup's growth. The structure often includes a cliff period, where founders must stay with the company for a minimum duration to start earning their shares.

Key components of the founder stock vesting agreement

-

The agreement should specify the commencement date and identify all parties, including founders and the startup.

-

Terms such as 'Founder,' 'Stock,' and 'Vesting Schedule' need to be clearly defined for legal clarity.

-

This explains how the shares will be vested, the timeline, and any conditions that might affect vesting, ensuring mutual understanding.

How is a vesting schedule defined?

The vesting schedule is a timeline that outlines when a founder earns their shares. Typically, it includes a cliff period followed by regular increments over time.

What is a cliff period?

A cliff period is a specific time frame at the beginning of the vesting schedule during which no shares are vested. The founder must remain with the company until the end of this period to start earning any equity.

What milestones can affect vesting?

-

Achieving certain funding rounds can result in acceleration of vesting for founders.

-

Specific targets or objectives set out in the agreement that trigger shares to vest earlier than scheduled.

Understanding acceleration provisions and their importance

Acceleration provisions are clauses that allow for the faster vesting of shares under specific conditions. For example, in the event of an acquisition, founders might retain the right to accelerate their vesting schedule.

What situations warrant acceleration?

-

In the event of a buyout, founders may have the option to accelerate the vesting of their unvested shares.

-

If new investors take over, it can trigger an acceleration clause to protect the interests of the founders.

Impact of acceleration on founder stock ownership

Understanding acceleration provisions is essential as they can significantly influence stock ownership, particularly in the event of unforeseen company changes. Founders who know these clauses are better equipped to advocate for their rights.

Termination provisions: what you need to know

Termination provisions outline what happens to a founder's shares in the event of their termination from the company. These provisions vary widely and require careful drafting.

What are the consequences of termination for founders?

-

Typically, if a founder is terminated before the vesting schedule is complete, they will lose their right to unvested shares.

-

The company may have the right to repurchase any vested shares at fair market value upon termination.

Understanding resignation versus termination

It's important to differentiate between voluntary resignation and involuntary termination. Each has distinct implications for stock ownership and should be clearly defined in the agreement.

Filling out your founder stock vesting agreement

Filling out a founder stock vesting agreement using a template form can facilitate the customization of key details. Use platforms like pdfFiller for a seamless experience.

Step-by-step guide to completing the agreement

-

Choose the correct Founder Stock Vesting Agreement Template form available on pdfFiller.

-

Fill out essential details such as parties involved, effective date, and vesting conditions.

-

Ensure all information is accurate; use digital signing features for quick turnaround.

Importance of clear information and accuracy

Providing accurate and clear information in your agreement is crucial. Errors can lead to disputes or unintended consequences, making careful drafting essential.

Tips for digital signing and collaboration features

-

Using digital signatures streamlines the signing process, enabling faster completion.

-

Take advantage of collaboration tools to gather input from team members quickly.

Editing and managing vesting agreements with pdfFiller

Once the vesting agreement is created, managing it through pdfFiller allows for easy version control and editing when necessary.

How to edit your agreement after it’s been created?

-

Open your created vesting agreement within your pdfFiller account.

-

Edit the document as needed, saving changes for future reference.

Collaboration tools for team members

pdfFiller provides robust collaboration features for teams, allowing multiple users to contribute input on the same document, thus ensuring all perspectives are captured.

Managing your documents within the cloud platform

With pdfFiller’s cloud platform, you can securely store and manage all your agreements in one place, making access simple and streamlined.

Common mistakes to avoid when drafting vesting agreements

-

Failing to clearly define key terms can lead to interpretation issues.

-

Ambiguous conditions may result in disputes; ensure clarity to avoid misunderstandings.

Legal considerations for different regions

Legal requirements around founder stock vesting agreements can differ by region. Always verify local regulations to ensure compliance.

When to consult a legal professional

It's advisable to seek legal guidance when drafting a founder stock vesting agreement, particularly if your startup anticipates complex equity structures or acceleration clauses.

Leveraging founder stock vesting agreements for future growth

Properly structured vesting agreements can enhance a founding team’s attractiveness to investors and help facilitate future funding rounds.

The role of vesting in future funding rounds

-

Investors often prefer startups with clear vesting structures as it indicates stability and commitment from founders.

-

Startups with fair vesting policies can attract high-quality talent when expanding their teams.

Impact on attracting additional talent

A well-structured founder stock vesting agreement not only secures the founders' interests but also conveys stability to potential employees, aiding in attracting the right talent.

Long-term business strategies for founders

Understanding and creating effective vesting agreements promote a strong organizational foundation and long-term success for the startup, aligning founder incentives with business growth.

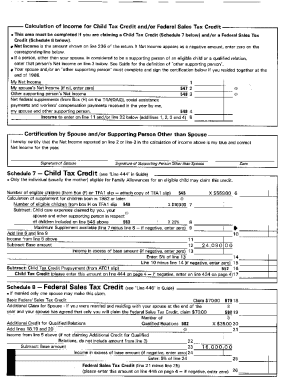

How to fill out the Founder Stock Vesting Agreement Template

-

1.Download the Founder Stock Vesting Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller for editing.

-

3.Fill in the names of the founders in the designated fields.

-

4.Specify the total number of shares being granted to the founders.

-

5.Input the vesting schedule, including start date and duration.

-

6.Indicate any cliff period before vesting begins, if applicable.

-

7.Review and adjust any additional clauses or terms as necessary.

-

8.Make sure to include signatures fields for all parties involved.

-

9.Save your completed agreement and share it with all founders for final review.

-

10.Print or send the finalized agreement as needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.