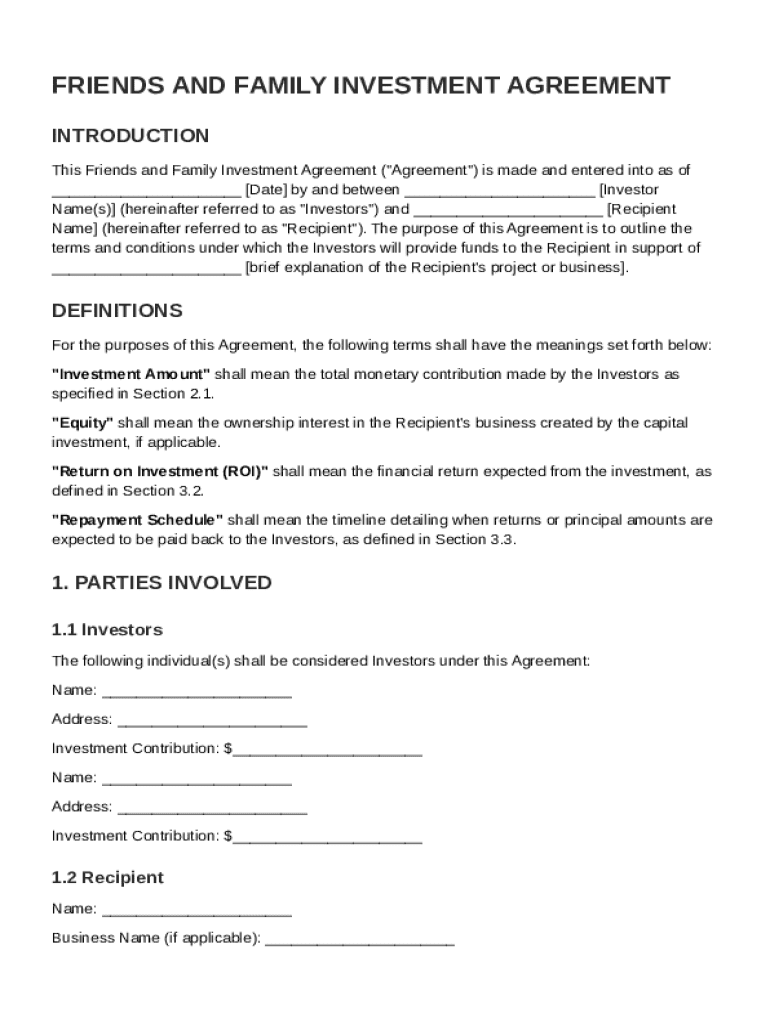

Friends and Family Investment Agreement Template free printable template

Show details

This Agreement outlines the terms and conditions under which Investors will provide funds to the Recipient in support of their project or business.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Friends and Family Investment Agreement Template

The Friends and Family Investment Agreement Template is a legal document used to outline the terms of an investment made by friends or family members into a business venture.

pdfFiller scores top ratings on review platforms

just started using it and it works fine so fa

too many download in converting documents to word Microsoft Program

I use the web software and the app. I love how it is seamless.

Easy to use once I learned the system. I would recommend to anyone.

So far it works great and has been a real time saver!!

I was disappointed with the services I purchased, but PDF filler made it right and refunded my money. I appreciate how attentive they were to my needs and what I was looking for.

Who needs Friends and Family Investment Agreement Template?

Explore how professionals across industries use pdfFiller.

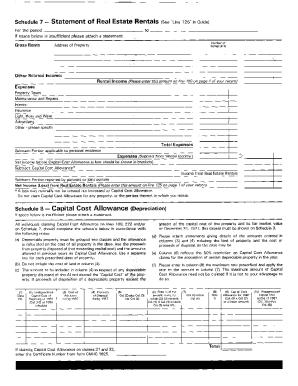

Comprehensive Guide to Friends and Family Investment Agreement Template

How does a Friends and Family Investment Agreement work?

A Friends and Family Investment Agreement serves to formalize financial contributions from friends and family members towards a business venture. This template is crucial, allowing both investors and recipients to clearly outline the nature of the investment, expectations regarding returns, and repayment schedules. Ultimately, it provides a structured approach that can prevent misunderstandings and preserve relationships.

Fostering transparency in such arrangements can help avoid potential pitfalls that might arise from informal agreements, such as assumptions about repayment terms or investment returns.

What are the key components of the agreement?

-

Clearly identify all investors and recipients, detailing their roles and responsibilities helps avoid confusion.

-

Clearly defining the investment amount ensures that all parties are aware of the financial contributions being made.

-

You must specify the expected Return on Investment (ROI) and create a timeline for repayment to set clear expectations.

-

This defines how equity interests will be distributed based on the specific terms of investment.

What is the step-by-step process for drafting the agreement?

-

Gather the personal details of all parties, including their full names, addresses, and contact information.

-

State the specific amount being invested and whether it will be a loan or an equity investment.

-

Describe what the funds will be used for, helping to ensure all parties align on the investment's purpose.

-

Outline how and when funds will be repaid, including consideration of interest.

-

Clarify how ownership will be segmented among the investors and recipients, protecting the interest of all stakeholders.

What legal considerations and compliance issues should be addressed?

Investors should be aware of the legal requirements surrounding investment agreements in their specific region. Compliance with local laws and regulations is essential for protecting both parties involved. Consulting with a legal professional ensures that the agreement adheres to all necessary guidelines, reducing the risk of future legal issues.

Understanding the importance of proper documentation cannot be underestimated. It lays a strong foundation for the investment relationship.

What are the advantages and disadvantages of friends and family funding?

-

Friends and family often provide low-interest or interest-free options, allowing for flexibility in funding without the pressure from traditional lenders.

-

The informal nature of friends and family investments can lead to emotional complications, which may jeopardize relationships if expectations aren’t managed properly.

-

Consider whether this type of funding is appropriate based on your project requirements. Not all funding should come from personal networks.

How to effectively manage your agreement?

-

Keeping an open line of communication with investors ensures that all parties feel informed and involved in the business.

-

Whenever project changes occur, updating the agreement can mitigate misunderstandings and keep all parties aligned.

-

Explore pdfFiller’s resources for editing, signing, and managing your Friends and Family Investment Agreement efficiently.

What interactive tools can assist in document management?

To streamline filling out and managing your investment agreement, using pdfFiller offers various tools for document management. Features such as eSigning and document sharing enhance collaboration and efficiency throughout the process.

A step-by-step guide on utilizing pdfFiller can help you navigate the features, ensuring you get the most out of your document management experience.

How to fill out the Friends and Family Investment Agreement Template

-

1.Download the Friends and Family Investment Agreement Template from pdfFiller.

-

2.Open the document in the pdfFiller editor.

-

3.Begin by filling in your name and contact information as the business owner or organizer.

-

4.Provide details about the investor, including their name, address, and contact information.

-

5.Clearly outline the amount of the investment and the type of investment being made.

-

6.Specify any interest rate or return on investment terms agreed upon.

-

7.Include terms regarding the duration of the investment and whether it is a loan or equity investment.

-

8.Add clauses about what happens in case of business failure or if the investor wants to withdraw.

-

9.Review the completed agreement to ensure all information is accurate and complete.

-

10.Have both parties sign and date the document electronically before finalizing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.