Friends and Family Loan Agreement Template free printable template

Show details

This Agreement outlines the terms and conditions under which a loan is provided by the Lender to the Borrower for personal use, focusing on clarity and transparency in the lenderborrower relationship.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Friends and Family Loan Agreement Template

The Friends and Family Loan Agreement Template is a document used to outline the terms and conditions of a loan given between friends or family members.

pdfFiller scores top ratings on review platforms

I am satisfied with the website. It helps me a lot in case of editing PDF.

Be the one who gets things done right

this app has everything i need including electronic signature. If you ever find yourself needing to file legal documents all you need is right here.

Filled My Document My Way

Appreciate the abilty to pull in my own form and add to it. I would like an option to duplicate my current sheet, making my document 2+ pages like the import (or add a document) button and without loosing my comments.

it works great! I appreciate the effort

Very easy to use

I like to learn to more about how to fill everything that I need to know

Who needs Friends and Family Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive guide to Friends and Family Loan Agreement using pdfFiller

Navigating the complexities of borrowing or lending money within personal circles can be daunting. A Friends and Family Loan Agreement serves as a structured blueprint for these transactions, ensuring clarity and protection for both parties. Enter pdfFiller, a powerful tool that simplifies the creation and management of these vital documents.

What constitutes a Friends and Family Loan Agreement?

A Friends and Family Loan Agreement is a written document outlining the terms under which one party lends money to another. This agreement typically specifies the loan amount, repayment terms, and interest rates, ensuring there are no misunderstandings. Having a formal agreement fosters trust and provides legal protection, should any disputes arise.

Importance of having a formal agreement

-

A formal document helps both the lender and borrower to clearly understand their commitments, reducing the risk of miscommunication.

-

Should disputes arise, a signed agreement can serve as a legal reference point, protecting both parties.

-

With clear terms, families can navigate financial transactions without damaging personal relationships.

Understanding the roles: Lender vs. Borrower

The lender is the person who provides the funds, whereas the borrower is the one receiving the loan. Each party has distinct rights and responsibilities that should be clearly articulated in the loan agreement to avoid future conflicts.

Defining Loan Amount, Interest Rate, and Loan Term

-

The total sum of money being borrowed.

-

The fee charged for borrowing, expressed as a percentage of the loan amount.

-

The duration over which the loan must be repaid.

Clarifying Default and its implications

Default occurs when the borrower fails to repay the loan as outlined in the agreement. It's essential to define circumstances that may result in default and the subsequent consequences, such as accrued interest or legal actions.

Essential components of a family loan agreement

-

Includes detailed information about both the lender and borrower.

-

Outlines the amount to be borrowed, the purpose of the loan, and the disbursement schedule.

-

Specifies interest rates, payment methods, and schedules for repayment.

Step-by-step guide to utilizing pdfFiller for document creation

pdfFiller provides users with a user-friendly platform to create, edit, and manage Friends and Family Loan Agreements. By following a simple step-by-step process, users can ensure all necessary details are captured in the agreement.

How to input terms and conditions effortlessly

-

Choose a pre-made Friends and Family Loan Agreement template from pdfFiller.

-

Fill in necessary details like loan amounts, repayment dates, and other conditions.

-

Go through the document and make sure everything is accurate before signing.

Using interactive tools for customized adjustments

pdfFiller offers interactive tools that allow for real-time edits and adjustments, ensuring users can tailor their loan agreements to fit unique circumstances.

How formal agreements help prevent misunderstandings

Establishing a formal loan agreement can significantly reduce potential misunderstandings between lender and borrower. By documenting all terms, both parties eliminate ambiguities that could lead to friction.

Maintaining transparency and open communication

Open lines of communication are critical. During the loan period, regular updates and discussions can help ensure both parties are aligned and any issues are promptly addressed.

Potential risks and considerations

While borrowing from friends and family can be advantageous, it comes with risks. Understanding tax implications, the impact on personal relationships, and potential repercussions of informal agreements is essential.

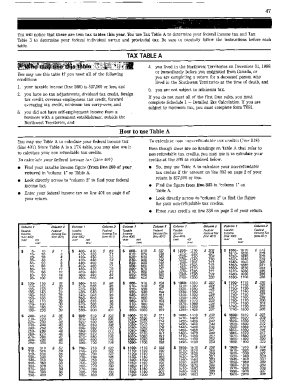

Tax implications of family loans

-

Family loans can have tax ramifications depending on the interest rates set.

-

Failures in documenting loans properly can lead to unexpected tax obligations.

-

Lenders might need to report interest income on their tax returns.

Impact on personal relationships when borrowing/lending money

Mixing finances with personal relationships can lead to strain. It's crucial for both parties to approach the transaction with clarity to avoid any negative consequences.

Risks of informal agreements

Without a formal agreement, misunderstandings and disputes are likely. This can lead to further complications in both personal and financial spheres.

Exploring official lending options and their implications

In some cases, alternative lending options may provide better terms than what friends or family can offer. It's essential to assess these options carefully to choose the best financial path.

Comparing interest rates and conditions with family loans

By comparing the rates of friends and family loans with those from traditional lending institutions, borrowers can make informed decisions.

When to consider formal financial institutions

If the amount required is substantial or if the relationship dynamics may be strained, opting for a formal financial institution might be beneficial.

Assessing financial needs and capabilities

Before entering into a family loan, it’s vital to assess personal financial needs. Understanding one’s financial capabilities can help in determining whether borrowing is necessary or feasible.

Factors to weigh before proceeding with a family loan

Consider the amount needed, potential repayment challenges, and the impact on familial relationships. These factors can influence the decision to borrow or lend.

Advice on approaching the topic with family

Approaching family about loans should be done thoughtfully. Being upfront about the need and outlining the agreement terms can ease potential tension.

How pdfFiller facilitates document signing and management

pdfFiller streamlines the entire process by allowing users to create, edit, and sign documents online. This enhances the efficiency of handling Friends and Family Loan Agreements.

Storing and sharing documents securely in a cloud-based platform

With all documents stored securely in the cloud, users can share agreements with relevant parties easily, while ensuring the utmost security.

Collaborative tools available to handle changes in agreements

pdfFiller offers collaborative tools enabling users to make real-time edits and adjustments, ensuring that any changes to terms are promptly and accurately reflected in the document.

Understanding IRS regulations regarding family loans

It’s essential to familiarize oneself with IRS regulations surrounding family loans to ensure legal compliance and avoid potential penalties.

Impact on both Borrower and Lender tax responsibilities

Each party may have tax obligations based on the terms of the loan. Proper documentation ensures clarity in tax responsibilities.

Documentation necessary for tax purposes

Maintaining accurate records is essential for both parties to demonstrate the loan’s legitimacy should the IRS inquire.

In conclusion, a Friends and Family Loan Agreement is a crucial tool that shouldn’t be overlooked. Using pdfFiller, individuals can draft clear, effective, and legally sound agreements. By understanding the components, following the right steps, and leveraging the functionalities offered by pdfFiller, users can facilitate smoother financial transactions and safeguard their personal relationships.

How to fill out the Friends and Family Loan Agreement Template

-

1.Download the Friends and Family Loan Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller to access editing options.

-

3.Fill in the borrower’s name and address in the designated fields.

-

4.Enter the lender’s name and address into the corresponding sections.

-

5.Specify the loan amount clearly and ensure it is digitally or manually verified.

-

6.Set the repayment terms including the payment schedule, interest rate (if any), and due dates.

-

7.Include any collateral details if the loan is secured.

-

8.Add a section for signatures, ensuring both parties date the document as well.

-

9.Review all entries to ensure accuracy before saving or printing.

-

10.Save the completed document on pdfFiller and email copies to both parties for record-keeping.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.