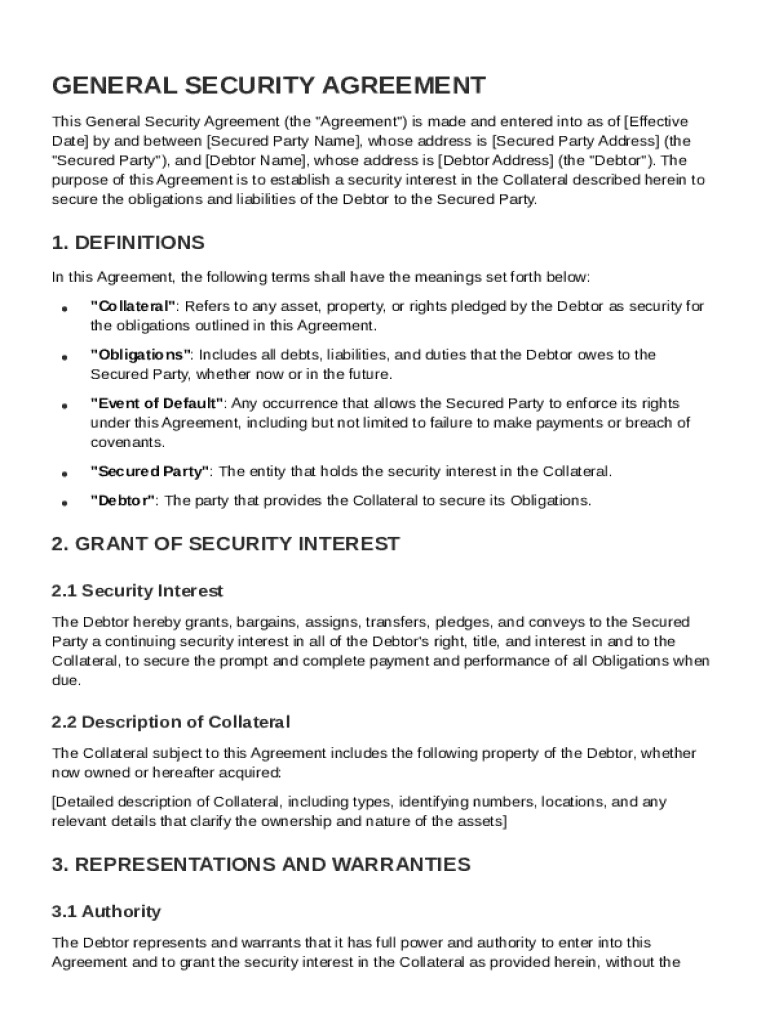

General Security Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a debtor grants a security interest in collateral to secure obligations to a secured party.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is General Security Agreement Template

A General Security Agreement Template is a legal document that establishes a security interest in personal property to secure payment obligations.

pdfFiller scores top ratings on review platforms

Great experience. Easy instructiolns

AWESOME!

It was easy to follow and maneuver.

Easy for editing however the "Enter" icon covers some of the information when you are trying to enter information.

Just started but lost my completed form #1544 to print it ASAP!

Great Experience. Very User Friendly.

Who needs General Security Agreement Template?

Explore how professionals across industries use pdfFiller.

General Security Agreement Template Guide

This guide will provide a comprehensive overview and detailed steps for filling out a General Security Agreement Template form. By understanding its essential components and definitions, you can better navigate the process of creating a legally binding document that outlines the security interest for both parties involved.

What is a General Security Agreement?

A General Security Agreement (GSA) is a legal document that secures the interests of a creditor by granting them a security interest in the assets of a debtor. This agreement is crucial for creditors as it ensures that they have recourse to specific assets in the event of default by the debtor. The main parties involved in this agreement are the Secured Party, who is the lender or creditor, and the Debtor, who is the borrower.

-

A General Security Agreement serves to protect the secured party’s interests by allowing them to claim collateral in case the debtor defaults.

-

Establishing a security interest is vital for creditors as it provides a legal claim to specific assets, enhancing recovery prospects.

-

The Secured Party holds the security interest, while the Debtor is responsible for fulfilling the obligations outlined in the agreement.

What are the essential components of the agreement?

The General Security Agreement should detail various components that define the agreement's parameters, including the effective date, the identities of the parties, and a thorough description of the collateral involved. Including these elements enhances clarity and legal enforceability.

-

The effective date marks when the agreement comes into force and is critical for establishing timelines for obligations.

-

Accurate documentation of the parties' names and addresses is critical for legal identification and correspondence.

-

Clearly outlining the collateral helps avoid ambiguities and ensures that both parties have a mutual understanding of what is covered under the agreement.

What key terms need defining in the agreement?

Defining key terms within the General Security Agreement is essential for comprehending the rights and responsibilities of both parties. Clear definitions reduce the potential for disputes and ensure all parties are aware of their roles and obligations.

-

This includes various assets such as property, equipment, or any valuables that serve as security for the loan.

-

These are the debts or commitments that the debtor must meet as specified in the agreement.

-

This term outlines specific situations that would enable the secured party to enforce their rights culminating in actions like seizing the collateral.

-

Clarifying these roles helps in understanding the rights of each party in regard to the collateral and obligations.

How do you fill out the General Security Agreement Template?

Filling out a General Security Agreement Template can be accomplished in several structured steps. This process ensures that no essential information is overlooked and that the agreement is customized to fit the particular circumstances of both parties.

-

Collect all necessary details about the secured party, debtor, and collateral beforehand to streamline filling out the template.

-

Fill in all information accurately as per the gathered details, paying special attention to the description of collateral.

-

Utilize pdfFiller tools to review your completed agreement, making necessary edits for clarity and correctness.

-

Complete the transaction by signing the agreement electronically, ensuring both parties retain a copy.

What do you need to know about granting a security interest?

The section concerning the grant of security interest is critical, as it delineates what collateral is secured by the GSA. Understanding this part of the agreement helps both parties manage expectations regarding the utilization and protection of the collateral.

-

This section clarifies which assets are secured and the privileges the secured party holds over these assets in case of default.

-

Having a checklist can help ensure that all applicable assets are covered and properly identified.

-

Establishing a security interest includes specific legal considerations that could affect the ability to foreclose on the collateral if necessary.

-

Incorporating best practices in drafting this section enhances the potential recovery for the secured party.

What are representations and warranties?

Representations and warranties are integral for verifying the legitimacy of the parties' existence and ability to enter into the agreement. This section ensures that the debtor has the authority to pledge the collateral outlined in the GSA.

-

It's crucial to confirm that the debtor has the legal right to offer the collateral for the debt.

-

Inaccurate representations can lead to legal challenges down the line, affecting the enforceability of the GSA.

-

If misrepresentation occurs, the secured party may be at risk of losing claims against the collateral.

What compliance notes should you consider?

Compliance with regional and industry-specific regulations is essential when drafting a General Security Agreement. The legal landscape differs across regions, so ensuring adherence to local laws avoids potential legal pitfalls.

-

Understanding local requirements empowers both parties to draft a compliant document.

-

Certain industries may impose additional obligations that should be reflected in the GSA.

-

Risks such as not correctly registering the security interest could lead to unenforceability of the GSA.

What are the benefits of using pdfFiller for document management?

Using pdfFiller provides several advantages for managing your General Security Agreement Template. The platform offers integrated features that enhance the document editing process while ensuring security and compliance.

-

pdfFiller's user-friendly interface allows you to edit documents easily and sign them electronically from any location.

-

Teams can work together efficiently, ensuring that revisions and comments are shared swiftly.

-

With cloud storage, you can access your documents from anywhere, facilitating remote work and document management.

How to fill out the General Security Agreement Template

-

1.Start by downloading the General Security Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller and locate the sections for personal and property details.

-

3.Fill in the borrower's name, address, and other identifying information in the designated fields.

-

4.Insert the lender's information including name and contact details.

-

5.Describe the collateral being secured, ensuring to detail all relevant items clearly.

-

6.Outline the specific payment obligations and terms associated with the loan.

-

7.Review all sections of the template for accuracy and completeness.

-

8.If required, include any additional clauses relevant to the specific agreement.

-

9.Save your completed document in pdfFiller and choose the option to print or send electronically.

-

10.Ensure both parties review and sign the document where indicated to make it legally binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.