Generic Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender provides a loan to a borrower, including details about the loan amount, interest rate, repayment schedule, default conditions,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Generic Loan Agreement Template

A Generic Loan Agreement Template is a legal document outlining the terms and conditions of a loan between a borrower and a lender.

pdfFiller scores top ratings on review platforms

Works great

Easy download, so far I like it

Excelent tool

Excelent tool for work

So easy

This was so easy to use.

Misappropriation of Assets originated from Investment Loan Account in FRAUDULENT

This is to inform the Public readers, that the property of 20 Glen Dhu Road Kilsyth 3137 Victoria Australia, in illegal documents from conveyancing from August 2019 and the amount with Realestate.com.au in forgery and fraudulent. The House has two living areas and commercial/residential road (corner) and the value posted for one living areas only. The person who deal with State Trustees Victoria Australia is for 40 years imprisonment.

PDF combine

Worked well combining PDF's

GREAT SERVICE

GREAT SERVICE, PROFESSIONAL AND RESONABLY PRICED

Who needs Generic Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Generic Loan Agreement Template

This article will guide you on how to effectively fill out a Generic Loan Agreement Template form, offering essential tips, insights into necessary components, and practical advice.

What is a Generic Loan Agreement?

A Generic Loan Agreement is a formal document between a lender and borrower that outlines the terms of a loan. The primary purpose is to protect both parties by clearly defining conditions such as repayment schedule, interest rates, and default terms.

-

It serves as a legally binding contract ensuring clarity in expectations between lenders and borrowers.

-

Important sections include loan amount, interest rates, maturity date, and collateral arrangements.

-

Having a detailed template helps streamline the loan process and reduces the chances of errors.

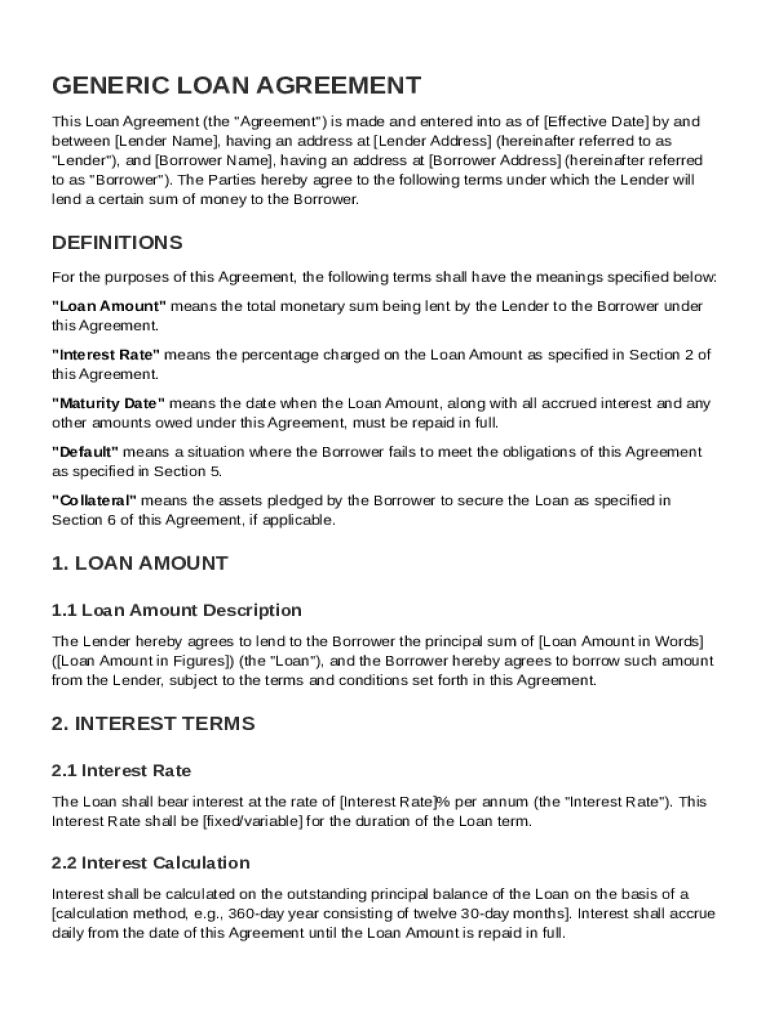

What are the essential elements of a loan agreement?

Understanding the essential elements of a loan agreement ensures protection for both parties involved.

-

This section clarifies critical terms, including the loan amount, interest rate, maturity date, default, and collateral.

-

Clearly specifying the loan amount in both words and figures improves clarity and reduces misunderstanding.

-

Outlining types of interest rates—fixed and variable—and how to calculate them is crucial for informed decision-making.

How to fill out the loan agreement: Step-by-step?

Accurate completion of the loan agreement is vital. Pay close attention to each detail in this step-by-step guide.

-

Ensure that all names and contact details are filled out correctly to avoid legal issues.

-

Verify all financial figures for accuracy to prevent disputes at a later date.

-

Be explicit in specifying interest rates and maturity dates, as these affect payment schedules.

How to manage the loan agreement?

After completion, managing your loan agreement can be simplified with certain tools.

-

Use pdfFiller to easily edit any section of the loan agreement whenever necessary.

-

Securely eSign your loan agreement using pdfFiller's features to ensure legal validity.

-

Utilize pdfFiller's tools to collaborate efficiently with stakeholders, which enhances overall communication.

What are the current trends in loan agreements?

Keeping abreast of trends is vital in loan documentation to adapt to evolving standards.

-

Stay informed about changes in loan agreement standards that may affect legal compliance.

-

Adapting to digital solutions like eSigning and online templates can streamline processes.

-

While trends shift, the fundamental components of loan agreements remain consistent across the board.

How to finalize your loan agreement?

Finalizing your loan agreement requires careful attention to detail to ensure accuracy and compliance with legal standards.

-

Conduct a thorough review of the completed document to catch any inaccuracies.

-

Avoid common mistakes, such as leaving terms vague, which can lead to disputes later.

-

Be aware of any applicable laws and regulations that may impact the enforceability of your agreement.

How to fill out the Generic Loan Agreement Template

-

1.Open the Generic Loan Agreement Template on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the full names and addresses of both the borrower and the lender in the designated sections.

-

4.Specify the loan amount clearly in both numerical and written form.

-

5.Outline the interest rate applicable to the loan, if any, along with the payment terms.

-

6.Indicate the repayment schedule, including due dates and payment methods.

-

7.Add any collateral requirements if applicable, detailing the assets involved.

-

8.Include any additional terms and conditions relevant to the agreement in the provided space.

-

9.Review the completed document for accuracy and completeness, ensuring all sections are filled as required.

-

10.Save the filled document and download or print it for both parties' signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.