Gift Donation Agreement Template free printable template

Show details

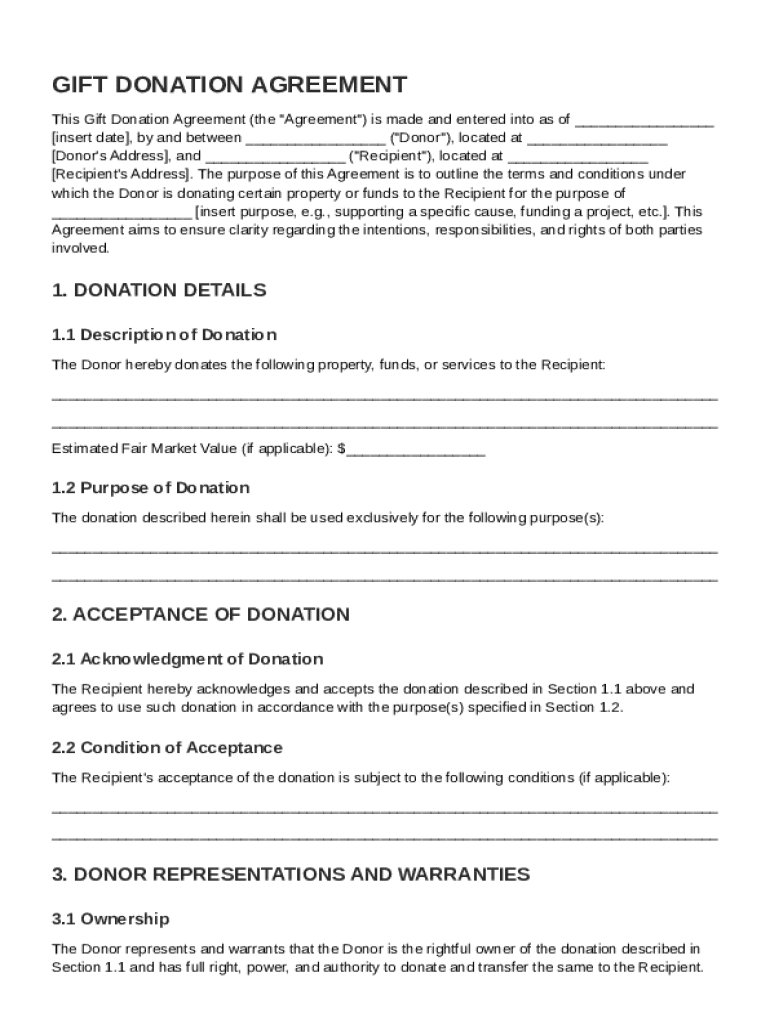

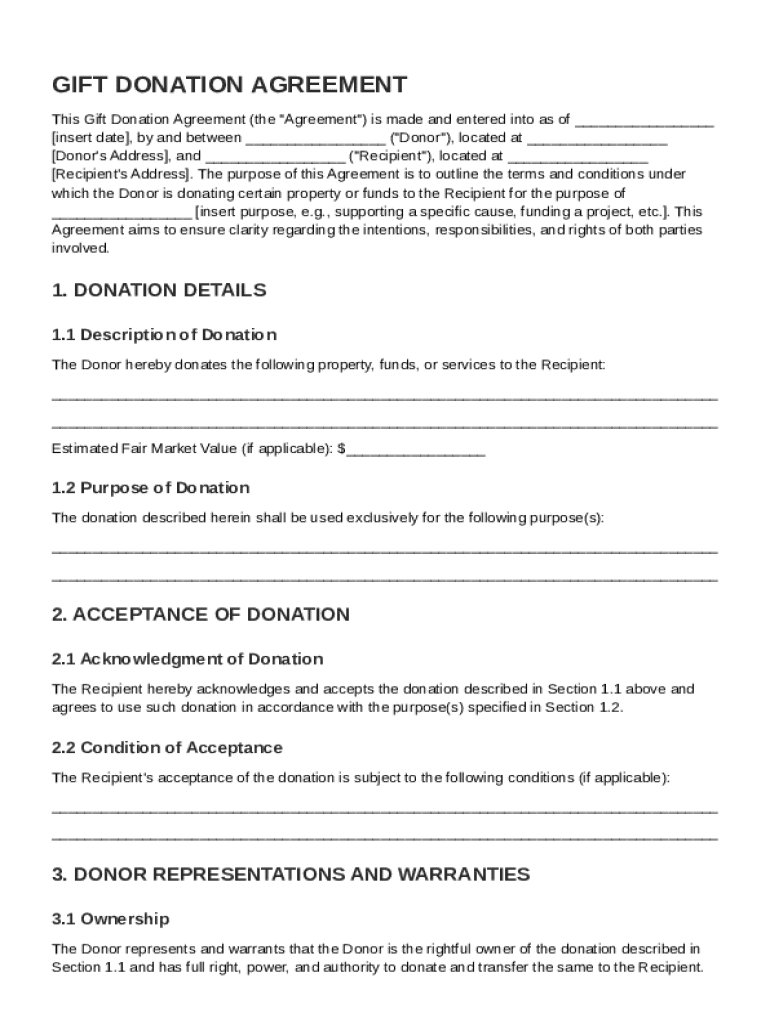

This document outlines the terms and conditions under which a donor provides a donation to a recipient, ensuring clarity regarding the intentions, responsibilities, and rights of both parties involved.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Gift Donation Agreement Template

A Gift Donation Agreement Template is a legal document that outlines the terms and conditions under which a donor agrees to donate a gift to a recipient organization or individual.

pdfFiller scores top ratings on review platforms

ROXANNE WAS A LIFE SAVER UPLOADING FORM FOR ME

Just what I needed to help me out of sticky wicket!

I am having some trouble navigating. I want to bring back 2 copies of a form which I printed but want now to make minor corrections. Can't seem to find the way bac. Maybe I did not save them properly

I love the website but the pricing is ridiculous.

Plenty of functionality but sometimes not as intuitive as it could be

This PDFfiller is user friendly. I really enjoy using it. But as you mentioned, the printing takes a while to print. That's my only Probles.

Who needs Gift Donation Agreement Template?

Explore how professionals across industries use pdfFiller.

Detailed Guide to Crafting a Gift Donation Agreement

How does a gift donation agreement serve your needs?

A Gift Donation Agreement Template form form is essential for ensuring a transparent transaction between the donor and the recipient. It delineates responsibilities, rights, and legal obligations, significantly reducing the potential for misunderstandings or legal conflicts.

-

It ensures that both parties understand the terms of the donation, creating a clear framework for the donation's acceptance and use.

-

The document protects the rights of both the donor and recipient, ensuring that intentions are honored throughout the process.

What are the key components of a gift donation agreement?

The effectiveness of a Gift Donation Agreement hinges on its key components. Each part of the agreement plays an integral role in ensuring proper documentation and understanding.

-

Identifying the parties involved forms the core of the agreement. Clearly defined roles prevent ambiguity.

-

Stating when the agreement is effective helps establish a timeline for the donation.

-

This section specifies what is being donated, whether it’s property, funds, or services.

-

Providing an estimated fair market value and purpose highlights the donation's importance and proper allocation.

How does the acceptance process work for donations?

Understanding the acceptance process is crucial in a gift donation agreement framework. It outlines the formal acknowledgement by the recipient of the donation.

-

The recipient must formally acknowledge receipt of the donation to validate the agreement.

-

Conditions that must be met for acceptance protect both parties and clarify expectations.

-

Requisite documentation must be completed for the donation to be officially accepted.

What representations and warranties should donors include?

Donor representations and warranties serve as legal statements affirming various aspects of the donation. They ensure the donor's legitimacy and compliance.

-

The donor should confirm ownership, ensuring that the property being donated is theirs to give.

-

The donor warrants that the donation is free from liens and other claims, protecting the recipient.

What obligations does the recipient have post-donation?

After the donation is accepted, the recipient bears specific responsibilities. These obligations are designed to fulfill the donor's intentions.

-

Recipients must utilize the donation as delineated in the agreement, ensuring its intended purpose.

-

Accurate record-keeping is essential for transparency and accountability regarding the usage of the donation.

-

Recipients may be obligated to report back to donors, providing updates on how the donation is utilized.

What legal considerations and compliance issues exist?

Legal considerations are integral to gift donation agreements, ensuring compliance with local and federal regulations. Failing to understand these can lead to unforeseen liabilities.

-

Local and federal regulations govern gift donations, necessitating that both parties familiarize themselves with applicable laws.

-

Both donor and recipient may face tax consequences, making it essential to navigate these implications effectively.

How can pdfFiller assist you in creating your gift donation agreement?

Using pdfFiller simplifies the gift donation agreement creation process. This platform offers various interactive tools designed to enhance user experience.

-

pdfFiller provides intuitive instructions that guide users through drafting their agreements.

-

Users can choose from various templates and personalize them to suit their specific needs.

-

The platform allows users to manage document signing digitally, streamlining the completion process.

How to fill out the Gift Donation Agreement Template

-

1.Begin by downloading the Gift Donation Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller platform and familiarize yourself with the sections.

-

3.Fill in the date at the top of the document to establish when the agreement is effective.

-

4.Enter the donor's full name and contact information in the designated fields.

-

5.Provide the recipient's details, including the organization name and address.

-

6.Describe the gift being donated, including its type, value, and any specific conditions attached.

-

7.Detail the purpose of the donation, ensuring it aligns with any organizational goals.

-

8.Include a clause about how the gift may be used, especially if there are restrictions.

-

9.Add a statement regarding the donor’s acknowledgment of the agreement and a section for the donor's signature.

-

10.Finally, ensure both donor and recipient sign the agreement, and save a copy for both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.