Home Buyout Agreement Template free printable template

Show details

This document outlines the terms and conditions for the buyout of a seller\'s interest in residential property, detailing definitions, payment terms, and responsibilities of both buyer and seller.

We are not affiliated with any brand or entity on this form

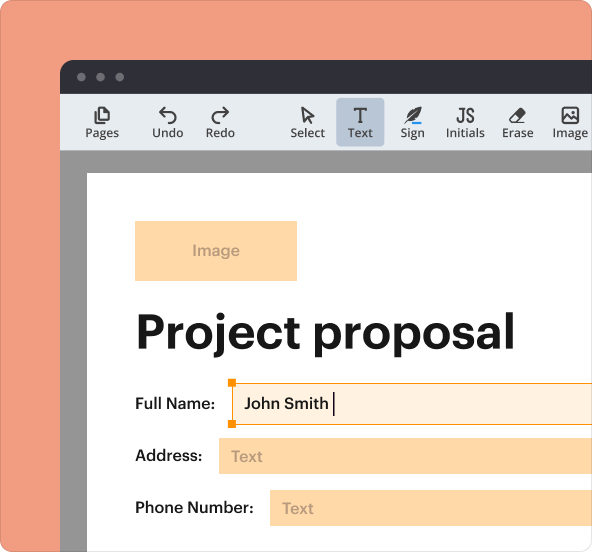

Why pdfFiller is the best tool for managing contracts

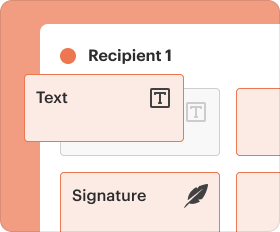

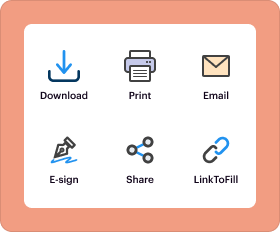

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

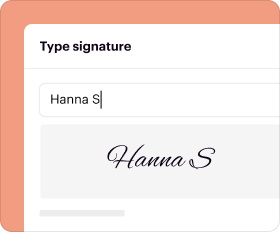

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Home Buyout Agreement Template

The Home Buyout Agreement Template is a legal document used to outline the terms under which one party buys out the other party's interest in a property.

pdfFiller scores top ratings on review platforms

It's fun, I'm new at this, still finding my way

Love this program...has made my business processes streamlined and simple!

So far every form that I need was available. I have spent hundreds of dollars a year in other software, staff and time what PDF Filler now does for me.

Good experience but unable to print etc. Needs more intuitive options.

I am enjoying working with the program a lot more to learn

It's been good so far. It tends towards American forms rather than UK forms, but that's OK. It's pretty intuitive.

Who needs Home Buyout Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Home Buyout Agreement Template form

Understanding Home Buyout Agreements

A Home Buyout Agreement is a legal document designed to facilitate the transfer of ownership interest in a co-owned property. This agreement is essential in scenarios where one party wishes to buy out the other, outlining the terms of the transaction.

-

A legal document that governs the terms and conditions for the buyout of a co-owner's interest in a property.

-

To formalize the process of one party buying out another’s stake, ensuring clarity and legality in the property transfer.

-

Failure to utilize this form can lead to disputes over ownership and financial arrangements, thus it safeguards both parties’ interests.

What are the key components of the Home Buyout Agreement?

Understanding the essential components is crucial for effective drafting. Each term within the agreement holds significance that can affect the overall transaction.

-

These fundamental elements define who is involved in the transaction, what property is involved, and the financial arrangements. Each detail should be meticulously documented.

-

Defining each element ensures there is no ambiguity in the transaction, helping to prevent future disputes.

-

Important clauses might include disclosures, representations, and warranties to protect both parties legally.

How to fill out the Home Buyout Agreement: Step-by-Step Guide

Filling out the Home Buyout Agreement correctly is vital for a smooth transaction. Both parties need to prepare specific information before starting the agreement.

-

Each party must provide personal details, property information, and financial circumstances to accurately reflect the terms.

-

It's important to follow structured guidelines ensuring all sections are completed with the required information.

-

Reviewing the agreement multiple times and consulting with a legal expert can prevent oversight and ensure all legal standards are met.

What conditions and contingencies should be included in the buyout agreement?

Including specific conditions can protect both parties from potential pitfalls during ownership transition. It sets expectations clearly.

-

Conditions may include financing requirements, inspection contingencies, and timelines.

-

Failure to meet these conditions could lead to cancellations or legal disputes.

-

Parties may seek mediation or initiation of legal claims to resolve breaches effectively.

How to determine the purchase price and payment terms?

The purchase price is a critical component that requires careful consideration and negotiation from both parties involved in the buyout.

-

Utilize property appraisal services to establish a fair market value for the co-owned property.

-

Outline all accepted methods of payment in the Agreement, clarifying how the buyer intends to settle the purchase.

-

An installment plan might be outlined, detailing due dates and amounts to ensure transparency.

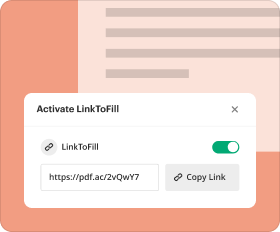

How can remote collaboration and document management features streamline the process?

In today's digital age, leveraging technology enhances the experience of filling out the Home Buyout Agreement, making collaboration seamless.

-

These tools allow both parties to collaborate in real-time, enhancing efficiency and ensuring accuracy.

-

Use protected document-sharing features to ensure that sensitive information remains confidential.

-

Utilizing cloud-based document access fosters better communication, allowing real-time updates and edits.

What common pitfalls should be avoided when drafting a Home Buyout Agreement?

Avoiding common mistakes in drafting can save time and legal fees. Awareness of these pitfalls can lead to a more robust agreement.

-

Parts like disclosure statements can be easily missed, leading to disputes later.

-

Establish open communication to clarify terms and expectations, minimizing future misunderstandings.

-

Regular consultation with legal professionals during the drafting process is crucial for validity.

What are the post-agreement steps and ownership transfer process?

Once the Home Buyout Agreement is executed, both parties must prepare for the transfer of ownership. This transition requires coordinated steps.

-

Official documentation and notification to relevant authorities must follow to enact the agreement.

-

Register the new ownership with the local land records office to formalize the transfer.

-

The buyer will manage ongoing property taxes and maintenance, while the seller should retain documentation for future reference.

How to fill out the Home Buyout Agreement Template

-

1.Open the Home Buyout Agreement Template in pdfFiller.

-

2.Begin by entering the names and contact details of all parties involved in the agreement at the top of the document.

-

3.Specify the property address and provide a description of the property being bought out.

-

4.Detail the buyout amount that will be paid by the buying party to the selling party, and include the payment method and timeline for the payment.

-

5.Include any conditions that may affect the buyout, such as mortgage responsibilities or existing tenants.

-

6.Review the agreement for clarity and accuracy, ensuring all parties' interests are represented fairly.

-

7.Sign and date the document to make it legally binding, and ensure all parties receive copies for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.