Home Equity Buyout Agreement Template free printable template

Show details

This document outlines the terms under which one Party will buy out the home equity of the other Party, establishing each Party\'s rights and obligations in the process.

We are not affiliated with any brand or entity on this form

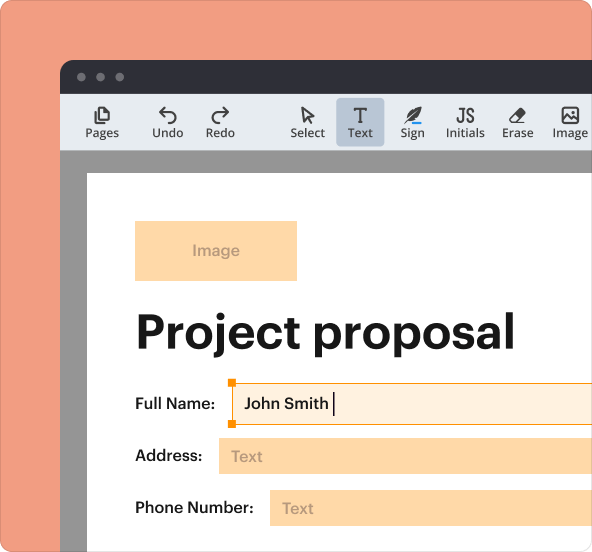

Why pdfFiller is the best tool for managing contracts

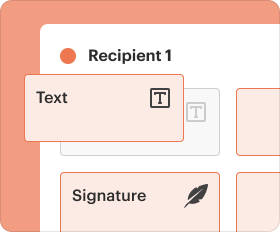

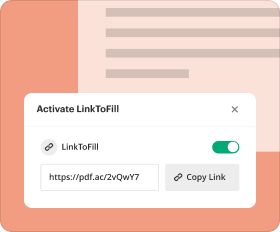

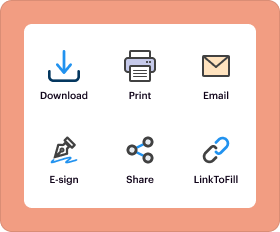

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

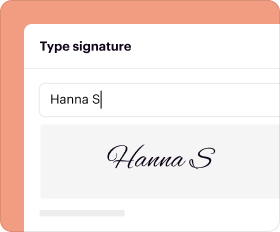

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Home Equity Buyout Agreement Template

A Home Equity Buyout Agreement Template is a legal document used to outline the terms and conditions under which one party can buy out the equity of another party in a property.

pdfFiller scores top ratings on review platforms

The ease of use.

erasing faster than Adobe

Easy to use, great price

Easy to use, fantastic tool for editing pdfs and drafting up invoices. I work from home and the interface is nice and easy and straightforward, especially when there's no one around to ask other than myself! A very reasonable price too. I'm very happy with the service provided here.

I am having some difficulties with the…formatting and printing

I am having some difficulties with the form printing properly. The formatting does not transfer for printing to landscape and thus loses portions of text contained within the form.

excellent

Fantastic! Very easy to use

Who needs Home Equity Buyout Agreement Template?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to filling out a Home Equity Buyout Agreement Template form

Understanding Home Equity Buyouts

Home equity buyouts are essential legal arrangements in situations where two or more parties co-own a property. The agreement facilitates the transfer of ownership interests from one party to another through a buyout. Understanding the intricacies of these agreements can help co-owners navigate their options effectively.

-

Home equity is the difference between the market value of a property and the remaining balance of any liabilities against it, such as mortgages. A buyout is the process where one owner purchases the other's equity in the property.

-

Home equity buyouts are crucial when relationships among co-owners change, whether due to divorce, death, or financial issues. They allow one party to retain ownership while compensating the other for their equity.

-

Common scenarios include divorce proceedings, the death of a co-owner, or financial strains that require one party to exit the property. Understanding these situations can illuminate when a buyout is appropriate.

Key Components of a Home Equity Buyout Agreement

A comprehensive home equity buyout agreement must include several key components. Each element ensures clarity and legality to protect the interests of both parties involved in the transaction.

-

The agreement must specify the roles of the buyer, the party purchasing the equity, and the seller, the party selling their equity stake in the property.

-

It is essential to provide a detailed description of the property, including its legal address and any identifying features that clarify which property is involved.

-

An accurate assessment of the property's market value is critical. This establishes the equity available for buyout after considering any existing liabilities.

-

Disclosing any mortgages, liens, or financial encumbrances on the property helps determine the true equity amount for the buyout.

Section Breakdown: Filling Out the Agreement

Accurate completion of a home equity buyout agreement is necessary for its legal enforcement. Understanding what to include in each section can streamline the process.

-

Begin the agreement by clearly stating the date and the full legal names of both the buyer and seller to avoid any future misuse.

-

Include comprehensive details about the property address, ensuring all relevant identifiers are captured.

-

Document the market value assessment clearly, referencing the appraiser's details or methods used for valuation.

-

A complete list of any existing financial claims against the property will streamline calculations concerning equity.

Calculating the Buyout Amount

Determining the proper buyout amount is crucial for equitable transactions. This involves thorough valuation and negotiation based on the remaining equity that one co-owner likely wishes to purchase.

-

To calculate the total equity, subtract any existing liabilities from the current market value of the property. This figure represents the worth available for buyout.

-

The buyout amount can depend on mutual agreements considering the interests and motivations of both parties involved in the transaction.

-

Establish clear payment terms to ensure both parties comprehend how the buyout amount will be settled—whether through lump-sum payments or installment agreements.

Finalizing the Home Equity Buyout

The finalization of a home equity buyout includes several steps that underpin the security of the transaction. Ensuring all legal formalities are observed is vital.

-

The closing date marks the end of the agreement’s negotiation phase, bringing both parties to finalize the sale in a legally binding manner.

-

Both parties must sign the agreement in the presence of a notary public. This official recognition helps to legitimize the agreement.

-

Following the closing, the buyer’s name should be updated on property records, ensuring they possess the ownership interest outlined in the agreement.

Utilizing pdfFiller for Home Equity Buyout Agreements

pdfFiller provides a streamlined solution for creating a home equity buyout agreement. Its features can enhance the document management process.

-

Easily access the home equity buyout agreement template on pdfFiller’s platform and customize it to fit your specific transaction needs.

-

Take advantage of electronic signing features that ensure a quick and secure sign-off from all parties involved.

-

Engage with legal advisors directly on pdfFiller to ensure that the agreement meets all legal requirements before finalization.

Legal Considerations for Home Equity Buyouts

Navigating the legal landscape of home equity buyouts is essential to avoid pitfalls. Awareness of state-specific laws will guide compliant agreement formation.

-

Accuracy and compliance with local laws are critical for valid agreements. Review these regulations based on your state to avoid legal complications.

-

Avoid pitfalls such as failing to disclose existing liens and inaccuracies in valuation. These oversights can lead to disputes post-agreement.

-

Consult with a lawyer specialized in real estate law when drafting or finalizing agreements. Professional legal advice can protect your interests in the transaction.

Best Practices for Home Equity Buyout Agreements

Implementing best practices for home equity buyout agreements not only facilitates a smooth transaction but also fosters better communication among parties.

-

Both parties should participate in discussions that lead to mutual agreement on terms. This can help avoid conflicts later on.

-

Open lines of communication ensure that both parties express their needs and expectations regarding the buyout. This transparency can enhance negotiation outcomes.

-

Maintain a checklist that includes all necessary steps—from property assessment to legal sign-off—to ensure a structured and thorough buyout process.

How to fill out the Home Equity Buyout Agreement Template

-

1.Open the Home Equity Buyout Agreement Template in pdfFiller.

-

2.Provide the names and contact information of both parties in the designated fields.

-

3.Fill in the property details, including its address and legal description.

-

4.Enter the agreed-upon purchase price for the equity being bought out.

-

5.Specify the payment terms, including any deposits and financing arrangements.

-

6.Include any contingencies or conditions that must be met for the buyout to proceed.

-

7.Add sections for signatures and dates, ensuring both parties understand the commitment.

-

8.Review all the entered information thoroughly for accuracy and completeness.

-

9.Save the completed document and send it to all parties for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.