Home Equity Loan Agreement Template free printable template

Show details

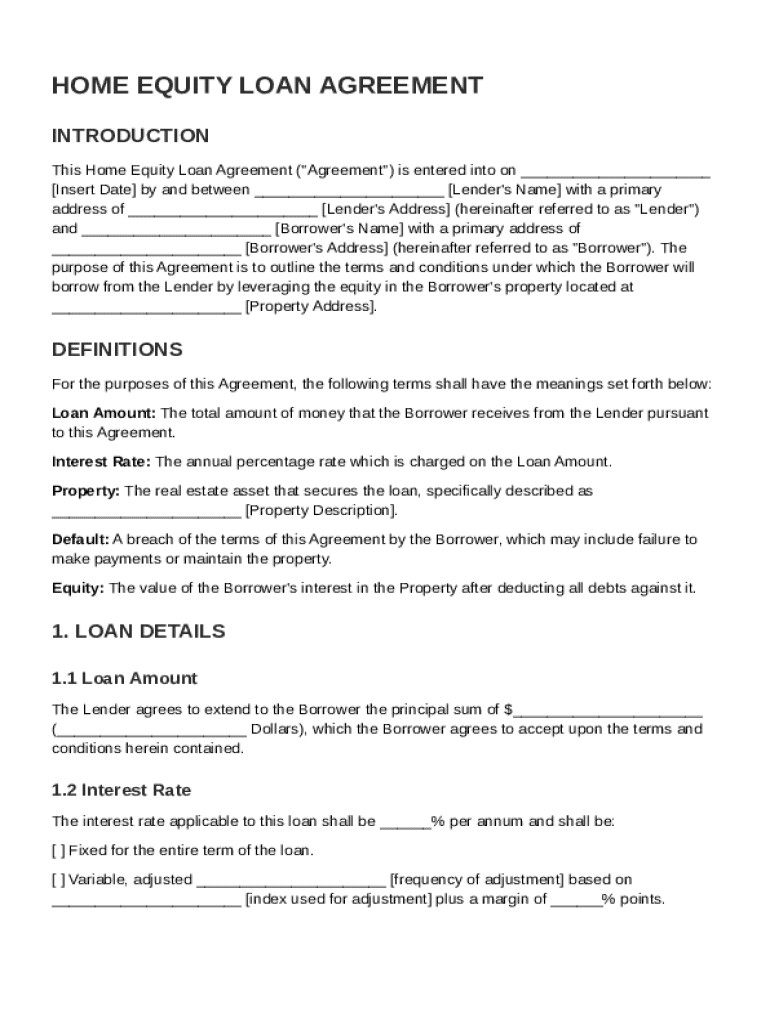

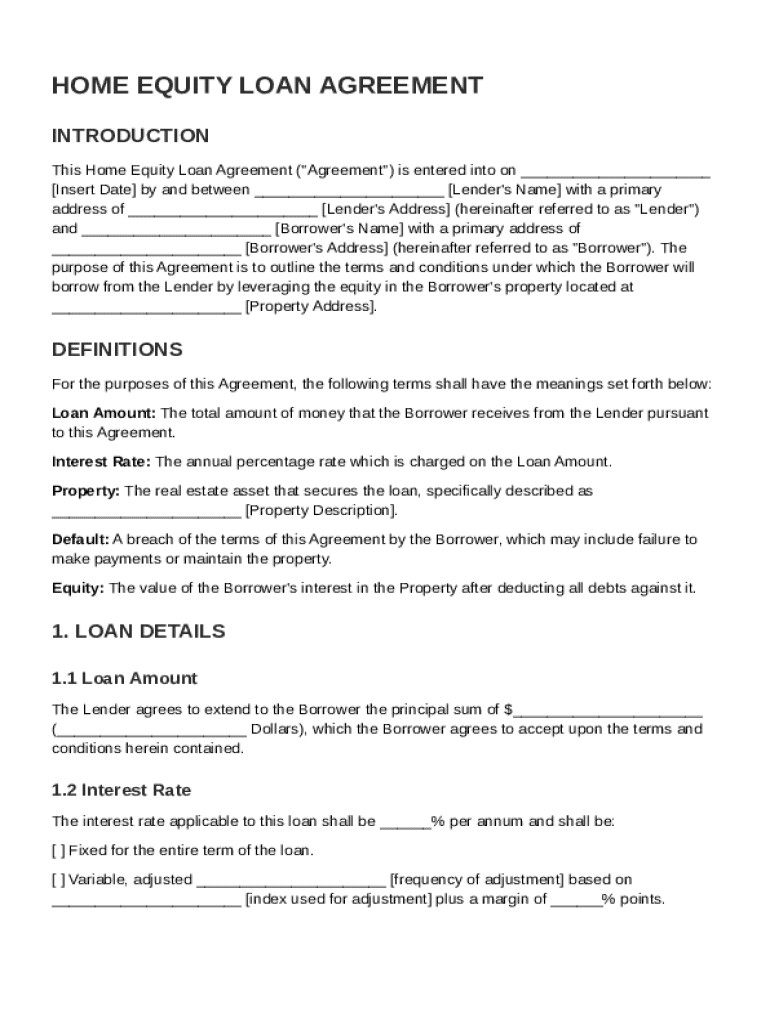

This document outlines the terms and conditions under which a borrower can obtain a loan by leveraging the equity in their property.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Home Equity Loan Agreement Template

A Home Equity Loan Agreement Template is a legal document that outlines the terms and conditions of borrowing against the equity in a property.

pdfFiller scores top ratings on review platforms

Excellent

Good one to use for effective document's corrections and conversions...

it is very easy to use

it is very easy to use, it has very clear tool box, however i haven't used it for very long. but this far i am completely satisfied. but i will always give 1 star left because i know there is always a room for improvisation

Initially

Initially, it was a bit difficult to insert the text; but after a while I discovered the "T" tool for aligning texts. I also like the fact that I had choices for signatures.

very easy and simple to work with.

very easy and simple to work with.

great product and easy to use!

great product and easy to use!

5 STARS

The best PDF software I have ever used!!!

Who needs Home Equity Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Home Equity Loan Agreement Guide

If you’re looking to understand the intricacies of a Home Equity Loan Agreement Template, this guide is for you. Learn how to fill out the form accurately, review essential components, and navigate the post-signing process.

What is a home equity loan agreement?

A Home Equity Loan Agreement is a legal document between the borrower and lender that outlines the terms of a loan secured by the borrower's home equity. This type of loan enables homeowners to leverage the equity built up in their property, often for home improvements, debt consolidation, or other financial needs.

Why are home equity loans important for homeowners?

Home equity loans provide homeowners with crucial access to funds, often at lower interest rates than unsecured loans. They can use these loans for necessary expenses such as renovations, education, or medical costs, making them a valuable financial tool.

How do home equity loans work?

Home equity loans function by allowing homeowners to borrow against the value of their home. The loan amount is usually determined by assessing the equity in the home, which is based on the home's current value minus any outstanding mortgage balance.

What are the key components of a home equity loan agreement?

-

This section identifies the borrower, lender, and any critical parties involved, establishing the agreement's framework.

-

Common definitions include Loan Amount, Interest Rate, Property, Default, and Equity, each critical for clarity and understanding.

-

This includes specific information such as the Loan Amount, terms of the Interest Rate, and Loan Term, outlining everything from repayment to maturity.

What should you prepare before the agreement?

-

Having your personal details and financial records ready helps facilitate the loan application process and expedites approval.

-

Know your property’s address, current market value, and any existing liens against it, as these are vital for determining loan eligibility.

-

A solid understanding of your credit score and equity in your home will guide your decision-making and help you negotiate better terms.

How do you fill out the home equity loan agreement?

-

Carefully read through each section of the agreement, filling in accurate information as required to ensure compliance.

-

Watch out for missing signatures, incorrect information, or inconsistent details that can complicate the process.

-

Double-check all entries and consider having a secondary party review the filled form for additional clarity.

What should you review in the agreement?

-

Ensure that the loan amount, interest rates, and terms align with what was initially discussed with the lender.

-

Review all additional costs including origination fees, appraisal fees, and closing costs that might affect your loan.

-

It’s essential to understand what happens in case of default and any clauses that exist regarding loan modifications.

How do you sign the home equity loan agreement?

-

pdfFiller offers seamless electronic signing options which can save time and streamline the entire process.

-

Ensure all parties are aware of the signing order and understand the legal implications of signing the agreement.

-

Some agreements may require witnesses or notarization to be legally binding, enhancing their credibility.

How should you manage your loan agreement after signing?

-

Utilize pdfFiller functionalities such as cloud storage to keep track of your loan documents securely and accessibly.

-

Set reminders for payments to avoid default, ensuring you stay within the terms of the agreement.

-

Understand the process for making adjustments to your loan terms through communication with your lender.

What additional considerations should you keep in mind?

-

Be aware of your region's regulations regarding home equity loans and ensure your agreement complies.

-

Familiarize yourself with the rights of both parties to protect your interests during the borrowing process.

-

Ensure that all necessary disclosures are provided by the lender, informing you of any risks associated with the loan.

How to fill out the Home Equity Loan Agreement Template

-

1.Start by downloading the Home Equity Loan Agreement Template from pdfFiller.

-

2.Open the document in pdfFiller's editor tool.

-

3.Enter the borrower's full name and address in the designated fields.

-

4.Provide the lender's name and address, ensuring accurate contact details.

-

5.Specify the loan amount being requested from home equity.

-

6.Detail the interest rate and repayment terms, including duration and monthly payment amount.

-

7.Insert the property information, including the legal description and address of the home being used as collateral.

-

8.Include any applicable fees, such as closing costs or origination fees which should be clearly stated.

-

9.Review the agreement for accuracy and completeness before finalizing.

-

10.Save the completed document back to your account, or print it for signatures from both parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.