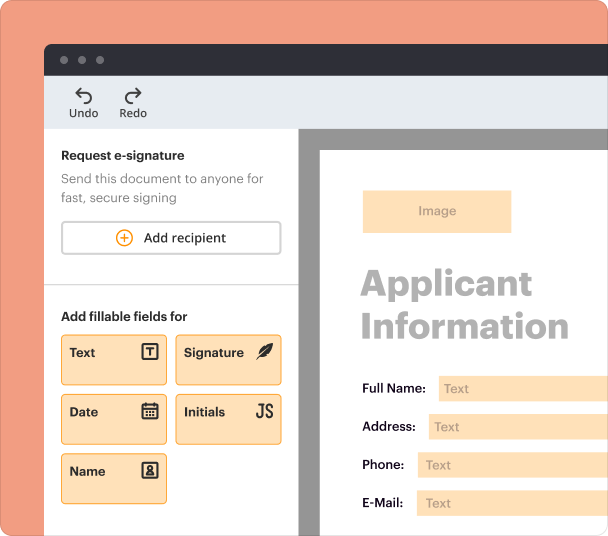

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

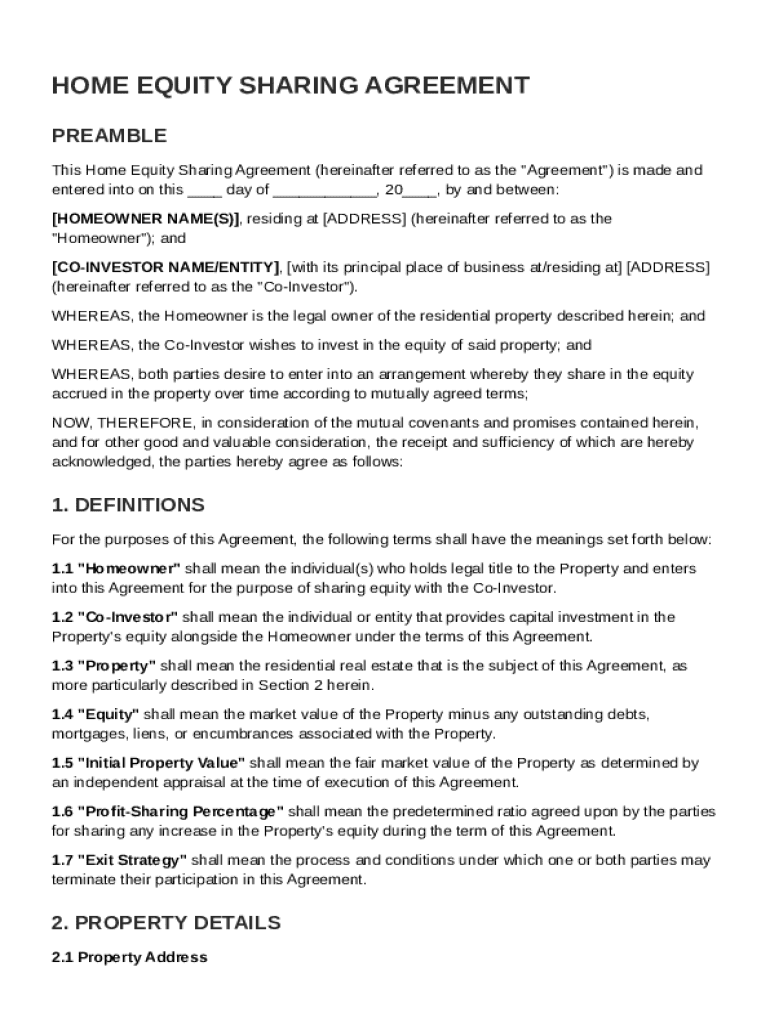

Home Equity Sharing Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a homeowner and coinvestor agree to share equity in a property, detailing responsibilities, investment terms, and exit strategies.

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

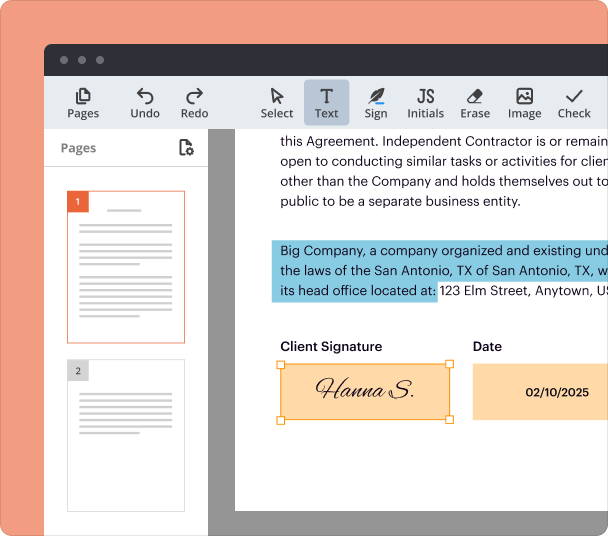

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

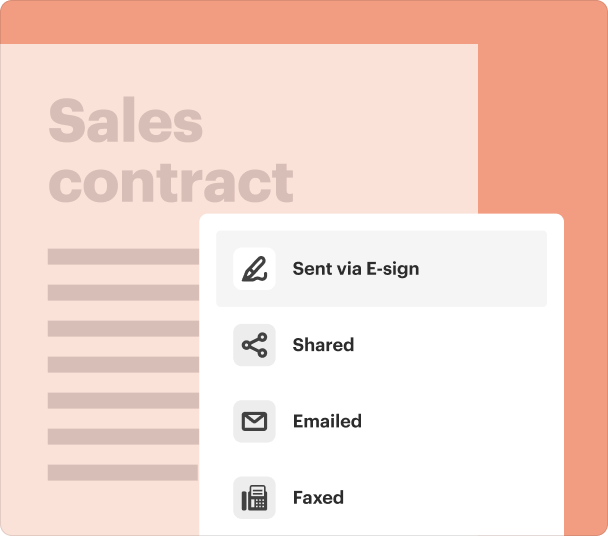

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

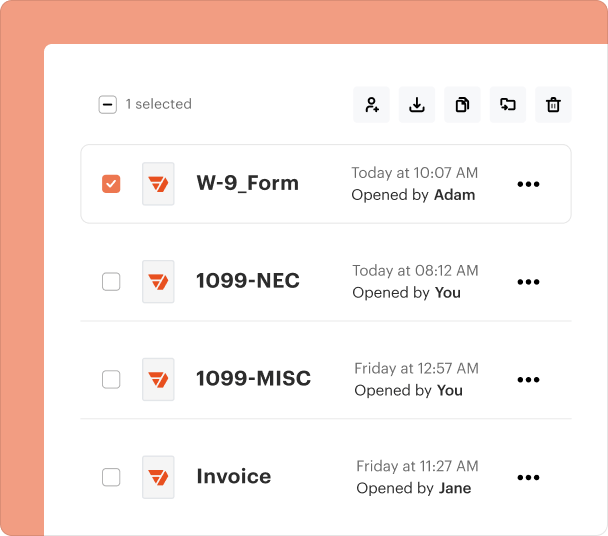

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Home Equity Sharing Agreement Template

Here you will find essential guidance on how to efficiently edit and fill out the Home Equity Sharing Agreement Template using pdfFiller.

How to edit Home Equity Sharing Agreement Template

Editing the Home Equity Sharing Agreement Template is a straightforward process with pdfFiller that ensures precision and clarity.

-

1.Click ‘Get form’ on this page to retrieve the Home Equity Sharing Agreement Template.

-

2.Create a pdfFiller account or log in if you already have one.

-

3.Once logged in, upload the template to your dashboard.

-

4.Use the editing tools in pdfFiller to make the necessary modifications, such as adding text, changing font styles, or inserting images.

-

5.When you’re satisfied with your edits, save your changes before downloading or sharing the completed document.

How to fill out Home Equity Sharing Agreement Template

Filling out the Home Equity Sharing Agreement Template is essential for ensuring clarity in financial arrangements. To do it effectively, simply start by obtaining the form through pdfFiller.

-

1.Click ‘Get form’ on this page to access the Home Equity Sharing Agreement Template.

-

2.Create an account on pdfFiller if you haven’t done so already, or log in to your existing account.

-

3.Download the template to your computer, or open it directly in pdfFiller.

-

4.Begin filling out the necessary fields, providing complete and accurate information as required.

-

5.Continue to review the document for any missing or incorrect data.

-

6.If any section requires additional context or clarification, provide detailed notes in the designated areas.

-

7.Once completed, ensure that all information is double-checked, then save your changes.

-

8.Final step: download, print, or electronically share the filled template as needed.

All you need to know about Home Equity Sharing Agreement Template

This section will provide comprehensive insights into the Home Equity Sharing Agreement Template and its significance.

What is a Home Equity Sharing Agreement Template?

The Home Equity Sharing Agreement Template is a legal document designed to outline the terms of shared equity arrangements between property owners and investors. Its primary goal is to define the roles, responsibilities, and financial rights of each party involved in the agreement.

Definition and key provisions of a Home Equity Sharing Agreement

The Home Equity Sharing Agreement typically includes several provisions that ensure clarity and protection for all parties:

-

1.Definitions of terms and roles of each party.

-

2.The percentage of equity each party holds.

-

3.Conditions under which the property can be sold.

-

4.Details regarding the division of profits from appreciation or rental income.

-

5.Procedures for resolving disputes.

When is a Home Equity Sharing Agreement used?

A Home Equity Sharing Agreement is commonly used in situations where individuals or groups want to invest in real estate together without taking on full mortgage responsibilities alone. It's beneficial for first-time home buyers, property investors, and those looking to maximize returns on real estate investments.

Main sections and clauses of a Home Equity Sharing Agreement

The Home Equity Sharing Agreement will generally encompass the following sections and clauses:

-

1.Introduction and purpose of the agreement.

-

2.Equity ownership structure.

-

3.Financial contributions and obligations.

-

4.Dispute resolution and termination clauses.

-

5.Signatures and date of agreement’s execution.

What needs to be included in a Home Equity Sharing Agreement?

To ensure the Home Equity Sharing Agreement is solid and clear, the following elements should always be included:

-

1.Personal details of all parties involved.

-

2.Property details and legal descriptions.

-

3.Terms for maintenance and repairs.

-

4.Procedure for decision making regarding the property.

-

5.Exit strategy for parties wishing to withdraw from the agreement.

What is an equity sharing agreement?

Home equity sharing agreements involve selling a percentage of your home's value or appreciation to an investor in exchange for a lump sum upfront. The agreement typically is settled, with the homeowner paying back the investor, after the home is sold or at the end of a 10- to 30-year period.

How to create an equity agreement?

Equity agreements commonly contain the following components: Equity program. This section outlines the details of the investment plan, including its purpose, conditions, and objectives. Identifying information. Term. Closing and delivery. Representation and warranties.

What is the standard equity agreement?

An equity agreement is like a partnership agreement between at least two people to run a venture jointly. An equity agreement binds each partner to each other and makes them personally liable for business debts.

What is an example of point equity sharing?

Total home value. Some companies calculate your repayment as a simple percentage of your home's total value (with any value adjustments factored in). For example, let's say your home is worth $800,000, and you receive $80,000 to fund a new home addition in exchange for 20% of your home's total value in 10 years.

pdfFiller scores top ratings on review platforms

easy to use and takes the hassle out of trying to sort documents

The Best !, I did not expect this to be par excellence, It meet my expectations and even more - I will recommend, the engine, design and it covers the Business requirements and needs.

P.Patrick

MUY PRACTICO, NO ENCUENTRO LA HERRAMIENTA PARA AMPLIAR EL ESPACIO DE ESCRITURA

Actually, quite a good system. Disappointed that USPS does not actually do this for free of course.

It is a huge help for me as a teacher, I'm doing all of my marking on it and then using the email function. A huge time saver.

i wasn't provided with the email address to send my address change (8822). Especially after adding my card information for the payment. Other than that, my experience was very fast and to the point. i loved that.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.