Income Sharing Agreement Template free printable template

Show details

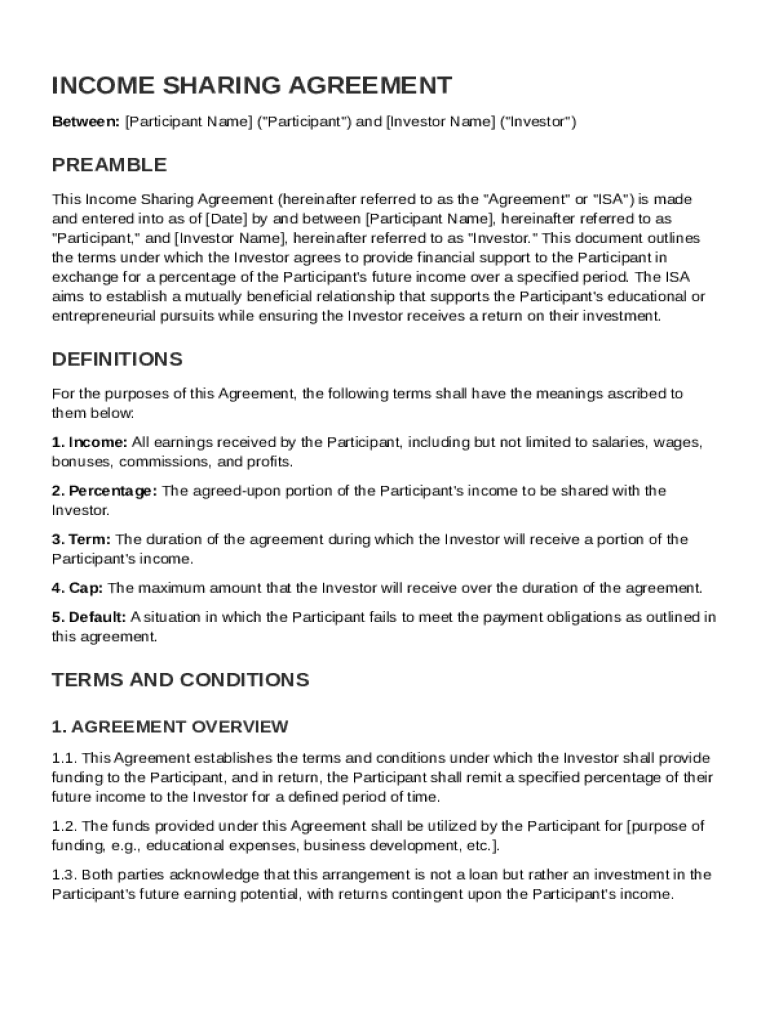

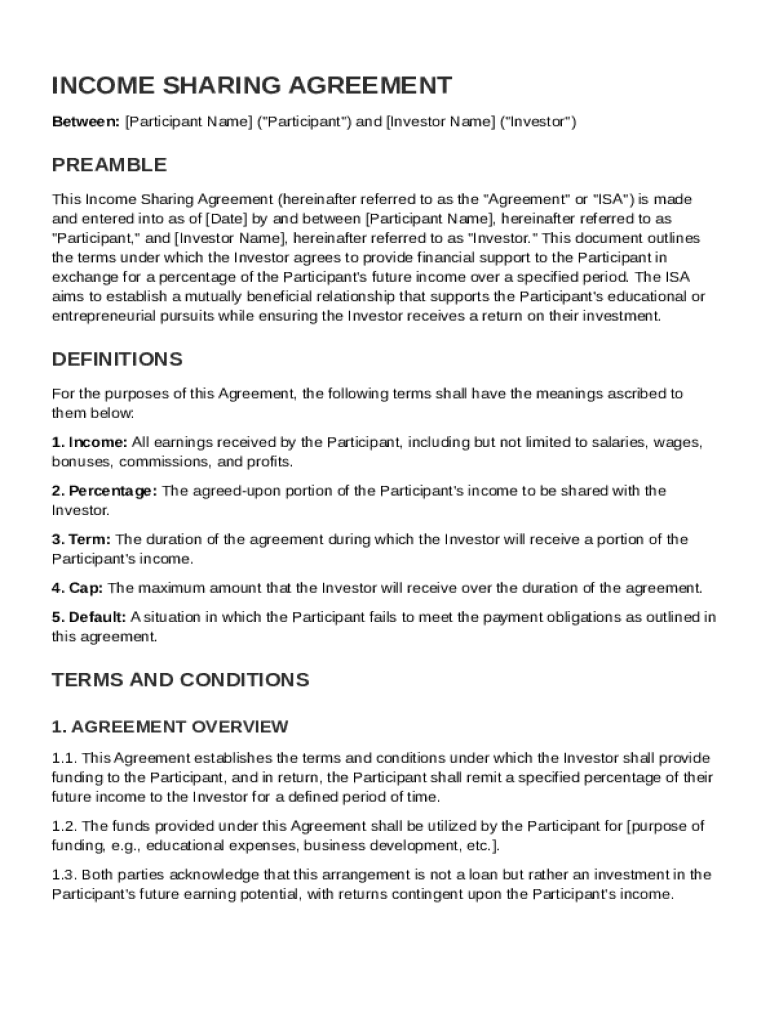

This document outlines the terms under which an investor agrees to provide financial support to a participant in exchange for a percentage of the participant\'s future income.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Income Sharing Agreement Template

An Income Sharing Agreement Template is a legal document outlining the terms under which one party agrees to share a percentage of their future income with another party in exchange for financial support or funding.

pdfFiller scores top ratings on review platforms

easy to make forms and complete and print

easonably easy to use, lots of helpful tools

Had problems with page not working at first. But now all is ok.

I enjoy the ability to convert PDF files back into MS Word. Very Often I will start in MS Word and send the document to an employer who then sends me a final version in PDF which is OK until such time as there is a need amend it. As I don't travel with a copier, printer or scanner this creates problems.

I can feel absolutely in control of what I would like to do with the document to complete the task and make it best suitable to my requirement.

I couldn't function without it. Very helpful product.

Who needs Income Sharing Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out an Income Sharing Agreement Template

What is an Income Sharing Agreement (ISA)?

An Income Sharing Agreement (ISA) is a financial tool that allows students or entrepreneurs to receive funding in return for a percentage of their future income. Unlike traditional loans, ISAs do not require fixed payments and are often contingent on the recipient's earnings. This model is gaining traction as a viable alternative for educational and entrepreneurial ventures.

How do ISAs differ from loans?

The key difference between ISAs and loans is the repayment structure. ISAs tie repayments to the recipient's income, allowing flexibility based on earning power. In contrast, loans require fixed repayments regardless of financial circumstances, often leading to significant stress for borrowers.

How do Income Sharing Agreements work?

ISAs are structured so that participants agree to pay back a percentage of their income for a defined period. This arrangement ensures that repayment is manageable, especially for those whose financial prospects may vary post-graduation or venture initiation. Both parties usually benefit; students or entrepreneurs gain initial financial support while investors potentially earn returns aligned with their investment’s success.

What are the essential components of the agreement?

-

Filling out names accurately is crucial for the legality of the document.

-

This section establishes mutual understanding and intent between the parties.

-

Key terms like 'Income,' 'Percentage,' and 'Cap' should be clearly defined to avoid ambiguity.

What should you know about the terms and conditions?

Every ISA has specific terms outlining how financial support and repayment will function. Understanding these terms helps participants know the conditions under which investors will receive returns. A clear grasp of these conditions can prevent disputes and misunderstandings later on.

How to fill out the Income Sharing Agreement Template?

-

Collect all required documentation and personal information needed for the agreement.

-

Utilize pdfFiller’s features for editing and filling out the template accurately.

-

Follow the prompts to electronically sign your completed agreement and share it with interested parties.

What legal considerations should be made?

Local regulations regarding ISAs can vary widely, so it’s important to familiarize yourself with applicable laws. Ensure the agreement is legally binding by understanding crucial legal terms specific to your region. This step not only protects all parties involved but enhances the reliability of the document.

How do you manage your Income Sharing Agreement?

Proper management of ISAs includes tracking income to fulfill repayment obligations effectively. pdfFiller can assist in organizing and managing documentation, enhancing accountability. Establishing best practices for communication with both investors and participants is also vital for maintaining trust and transparency throughout the process.

How can you maximize the benefits of your agreement?

-

ISAs can be a powerful means to fund educational pursuits without the burden of traditional debt.

-

Creating a productive rapport with your investor can lead to better outcomes for both parties.

-

Both participants and investors should understand what to expect from each other to foster a successful partnership.

How to fill out the Income Sharing Agreement Template

-

1.Download the Income Sharing Agreement Template from pdfFiller.

-

2.Open the PDF file in pdfFiller's editing interface.

-

3.Begin by entering the names and addresses of both parties involved in the first section.

-

4.Specify the amount of financial support being provided and the percentage of future income that will be shared.

-

5.Define the duration of the agreement and any conditions that may lead to its termination.

-

6.Include any additional terms and conditions relevant to the agreement, such as repayment terms or income reporting requirements.

-

7.Review all entered information for accuracy and completeness.

-

8.Save the document and, if needed, share it with the parties for signatures before finalizing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.