Indemnification Agreement Template free printable template

Show details

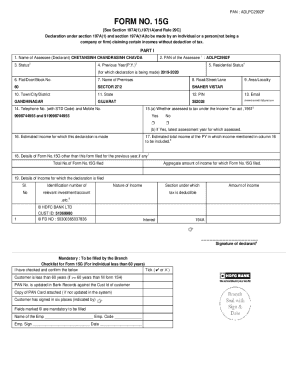

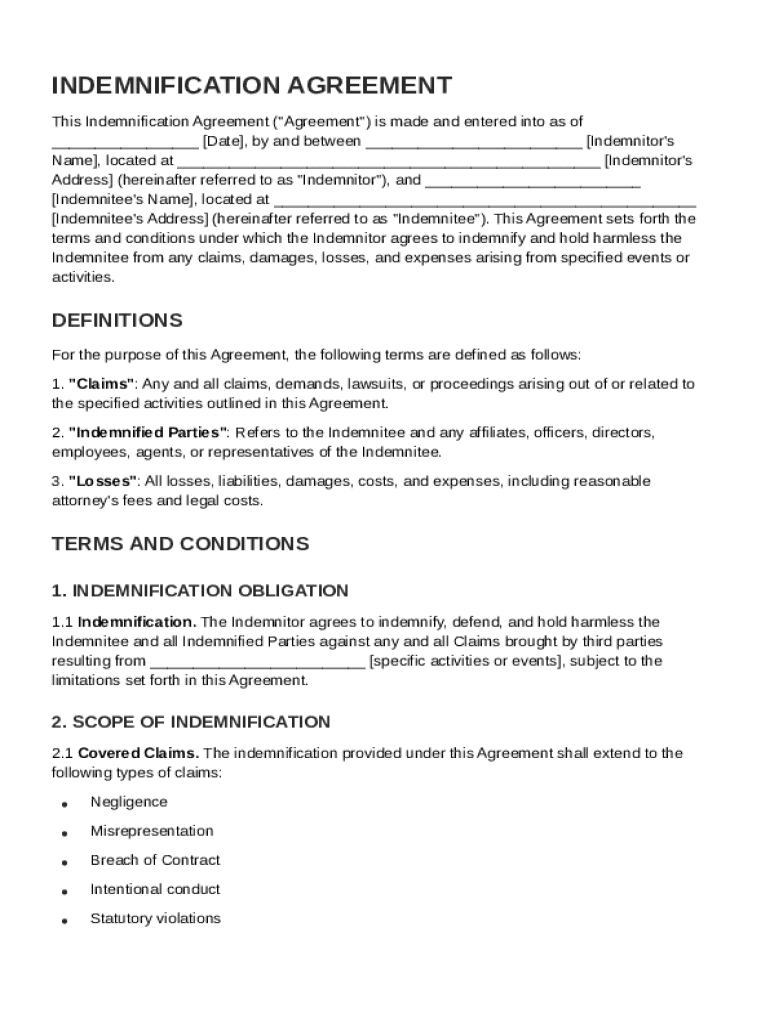

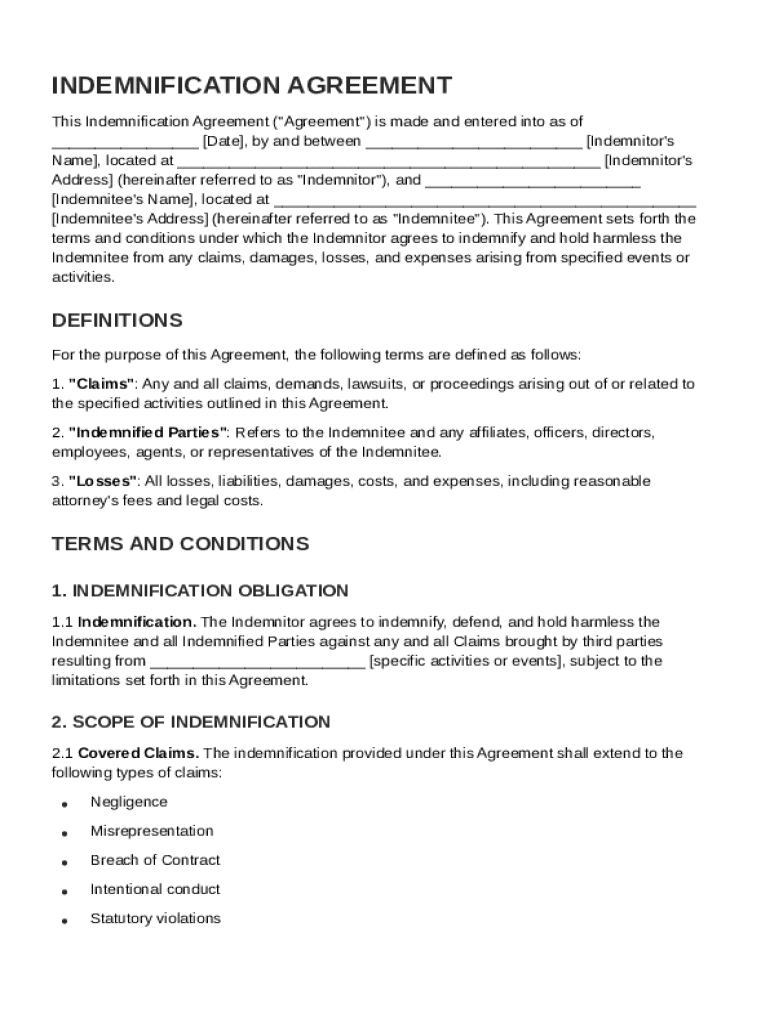

This document outlines the terms under which an Indemnitor agrees to indemnify and hold harmless the Indemnitee from various claims and losses arising from specified activities or events.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Indemnification Agreement Template

An Indemnification Agreement Template is a legal document that outlines the terms under which one party agrees to compensate another for specific damages or losses.

pdfFiller scores top ratings on review platforms

super!

super! Its amazing

I’m new to using any type of online…

I’m new to using any type of online filler, and the support I got from pdffiller was beyond my expectations, I highly recommend.

Good, Cost-Effective Option

Good, cost-effective pdf editing option. Easy to use.

I highly recommend Pdffiller!

Pdffiller is an amazing software and tool for any business. It is a tremendous value and their technical support is also outstanding.

I will buy it as soon as I can

I will buy it as soon as I can

Little clumsy and sometimes box is…

Little clumsy and sometimes box is covering where one is supposed to fill in - but overall great.

Who needs Indemnification Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Ultimate Guide to Indemnification Agreements

How does an indemnification agreement work?

An indemnification agreement serves as a legal contract that delineates the responsibilities between parties regarding compensation for damages or losses. At its core, it defines responsibilities in situations where one party must cover the costs incurred by another party. Understanding this agreement is essential for individuals and businesses alike, ensuring clear communication and mitigation of risks.

-

An indemnification agreement is designed to protect one party (the indemnitee) from financial losses resulting from the actions or negligence of another party (the indemnitor).

-

The indemnitor agrees to compensate the indemnitee for specified losses, making it crucial to define roles clearly.

-

These agreements are often utilized in contracts involving services, real estate transactions, and construction projects.

What are the essential components of the indemnification agreement?

To construct a valid indemnification agreement, certain components must be included. Each part outlines specific obligations and expectations of the involved parties, ensuring comprehensive protection.

-

The date is crucial as it denotes the agreement's validity period, while identification clarifies who is involved.

-

Clear definitions help prevent misunderstandings regarding what is covered under the agreement.

-

It’s vital to specify under what circumstances and how far the indemnification extends.

How can you fill out the indemnification agreement?

Completing an indemnification agreement can be straightforward if you follow a structured approach. Utilizing pdfFiller’s interactive tools can streamline this process, making it easier to ensure accuracy.

-

Begin by selecting the appropriate template on pdfFiller and input the required details.

-

Use pdfFiller's tools to edit the document directly, sign electronically, and ensure all parties can review the final version.

-

Double-check all entries for correctness, including names, dates, and terms, to prevent disputes later.

What common claims are covered under indemnification?

Indemnification agreements typically cover various situations, but understanding exclusions is just as essential. Claims often involve negligence or misrepresentation, but it’s equally important to be aware of circumstances that would not trigger indemnification.

-

These claims arise when one party's failure to act responsibly leads to financial losses for another.

-

Certain cases, such as intentional misconduct or illegal acts, are typically excluded from indemnification.

-

Clarifying the limitations safeguards against overly broad interpretations of responsibility.

How can you manage and edit your indemnification agreement with pdfFiller?

pdfFiller offers excellent functionalities for managing and editing your indemnification agreement efficiently. From cloud-based document collaboration to seamless integration with other tools, users can streamline their workflows.

-

Easily share documents with stakeholders for collaborative edits, ensuring everyone’s input is considered.

-

Take advantage of pdfFiller's storage capabilities to keep all your documents organized and accessible.

-

The platform supports various integrations that allow for further customization and efficiency.

What are the legal considerations and compliance aspects for indemnification agreements?

Understanding legal considerations in indemnification agreements is vital for compliance and enforceability. Various state-specific regulations may impact how these agreements function, necessitating careful review before signing.

-

Always verify state regulations regarding indemnity to ensure that your agreement aligns with local laws.

-

Certain terms may render an agreement unenforceable, so clarity is necessary in drafting.

-

Neglecting to define terms or allowing overly broad indemnification can lead to complications.

Why is using an indemnification agreement important?

Utilizing an indemnification agreement is crucial for mitigating risk and ensuring protection against potential claims. Not only does it provide a sense of security, but it also clarifies expectations regarding responsibility in various scenarios.

-

Indemnification agreements outline the obligations of parties, define risks, and provide clarity in business operations.

-

Leverage pdfFiller’s comprehensive platform for creating, editing, and securely managing indemnification agreements.

How to fill out the Indemnification Agreement Template

-

1.Access the Indemnification Agreement Template on pdfFiller.

-

2.Begin by entering the date of the agreement at the top of the document.

-

3.Fill in the names and contact information of all parties involved in the agreement.

-

4.Specify the scope of indemnification by detailing the risks, liabilities, or claims being covered.

-

5.Insert any limitations on indemnification, such as specific exclusions or caps on liability, if necessary.

-

6.Review the terms to ensure clarity and mutual understanding between parties.

-

7.Sign the agreement at the designated signature lines, ensuring that all parties have their signatures collected.

-

8.Save the completed document in your preferred format or print it for distribution.

How do you write an indemnity agreement?

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. Draft the Indemnification Clause. Outline the Indemnification Period and Scope of Coverage. State the Indemnification Exceptions. Specify How the Indemnitee Notifies the Indemnitor About Claims. Write the Settlement and Consent Clause.

What is the basic indemnification agreement?

Definition of an Indemnification Clause An indemnification clause is an agreement where one party, the indemnifier, agrees to cover the losses or damages of the other party, the indemnitee, under specific circumstances defined in the contract. It is also known as the indemnity clause or the "hold harmless" provision.

How to write an indemnification clause?

Each party shall indemnify, defend, and hold harmless the other party, its affiliates, and their respective officers, directors, employees, and agents from and against any and all claims, damages, liabilities, costs, and expenses (including reasonable attorneys' fees) arising out of or related to any breach of this

What are the three types of indemnification?

This makes the subcontractor the indemnitor who agrees to save and hold harmless the general contractor (the indemnitee) and, usually, the owner. There are three basic types of indemnities. From an insurance perspective, the indemnities are broken down into limited form, intermediate form, and broad form.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.