Inheritance Agreement Template free printable template

Show details

This document outlines the terms for the distribution of the Testator\'s estate and assets in accordance with their wishes after their death, including definitions, identification of parties, asset

We are not affiliated with any brand or entity on this form

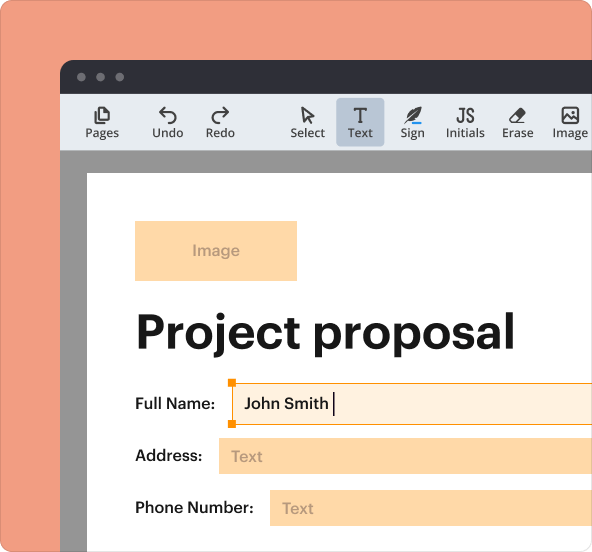

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Inheritance Agreement Template

An Inheritance Agreement Template is a legal document that outlines the distribution of a deceased person's assets among beneficiaries.

pdfFiller scores top ratings on review platforms

I have tested it and every elements concerning my line of work are deeply thought out and very crisp.

I had a problem of sending a folder but the solution is in merging the files to create one new file to send.

The software is brilliant and less costly than all the competition I have tested.

It has been a great asset to me and has allowed me to communicate with my employer which is located in CT.

So far it has been good. I am still new and learning so once I use it more I will be happy to review again.

PDF Filler save time and easy to use. I would recommend this to a friend.

Exceptional ease of use and a fast learning curve

I enjoy the flexibility. I only wish that there were fonts available with the ability to chose your own font size.

Who needs Inheritance Agreement Template?

Explore how professionals across industries use pdfFiller.

Inheritance Agreement Template Guide

Creating an Inheritance Agreement Template form can streamline the estate planning process. This guide walks you through the essential elements of the agreement, provides clear instructions on filling out the template, and addresses common issues that may arise.

What is an inheritance agreement?

An inheritance agreement is a legal document that outlines the distribution of assets after a person's death. It is important to clearly define all terms and conditions within the agreement, as it helps prevent disputes among heirs and clarifies the wishes of the testator, the person who creates the agreement.

-

A formal document that specifies how an individual's assets will be distributed upon their death.

-

Clear definitions prevent misunderstandings and ensure that all parties are aware of their rights and obligations.

-

The testator is responsible for drafting the agreement, while heirs are the beneficiaries who will receive the assets.

What are the key components of the inheritance agreement?

Understanding the key components of an inheritance agreement is critical for effective estate planning. These components ensure that all significant details regarding parties involved and the estate being administered are documented.

-

Clearly identify the testator and the heirs involved in the agreement.

-

Include full names, addresses, and relationships to the testator to avoid any confusion.

-

Detail all assets being distributed, including real estate, bank accounts, and personal property.

-

Clarify how each heir is related to the testator to ensure proper understanding of the agreement.

How do you fill out the inheritance agreement template?

Filling out the inheritance agreement template requires careful attention to detail. A step-by-step guide can help ensure that all necessary information is accurately represented.

-

Start by filling in the parties involved, followed by detailing the assets and their distribution.

-

Avoid vague language and ensure all assets are listed to minimize disputes.

-

Provide specific details about each asset, including addresses for real property and account numbers for financial assets.

What legal considerations are there for inheritance agreements?

Legal considerations are crucial to ensure the validity of an inheritance agreement. Each state may have different regulations governing these documents.

-

Research your state’s laws regarding inheritance agreements to ensure compliance.

-

Notarizing the agreement adds a level of authenticity and helps to prevent future challenges.

-

Clearly outlining terms and ensuring all parties agree can help reduce potential legal conflicts.

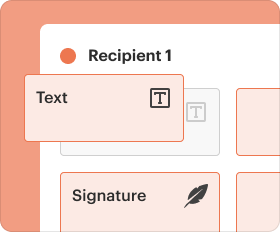

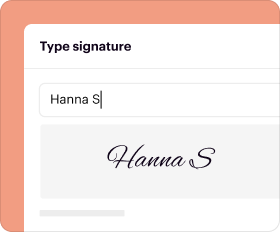

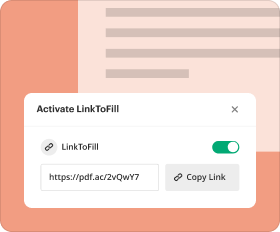

How can pdfFiller assist with document management?

pdfFiller offers a comprehensive platform for editing and managing your inheritance agreement. Leveraging these features can simplify the document creation and management process.

-

Easily edit your inheritance agreement and add electronic signatures without the need for physical paperwork.

-

Work with teams to manage documents collaboratively, improving efficiency and accuracy.

-

Keep track of different versions of your document, allowing for easier amendments and storage.

What are alternatives to the inheritance agreement?

In some cases, you might consider alternative estate planning tools such as a will or a trust. Each option has its pros and cons, depending on your specific needs.

-

A legally binding document specifying how assets should be distributed upon death, but may require probate.

-

A legal entity that holds assets for designated beneficiaries, avoiding probate and potentially saving time.

-

Consider each option's strengths and weaknesses before deciding on the best form for your situation.

How to fill out the Inheritance Agreement Template

-

1.Open the Inheritance Agreement Template on pdfFiller.

-

2.Review the document to understand the sections covered such as asset description, beneficiary details, and executor roles.

-

3.Begin by filling in the deceased person's full name and date of death in the designated areas.

-

4.List all assets that will be included in the inheritance, ensuring to provide a clear description and value for each item.

-

5.Identify each beneficiary by full name, relationship to the deceased, and specify their share or specific assets they will receive.

-

6.Include the name and contact information of the executor responsible for carrying out the wishes stated in the agreement.

-

7.Review the document for accuracy, ensuring all information is correct and complete.

-

8.Once satisfied, save the document and consider getting it reviewed by a legal professional for compliance.

-

9.Finalize the document by signing it in the presence of a notary, if required, to make it legally binding.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.