Insurance Broker Agreement Template free printable template

Show details

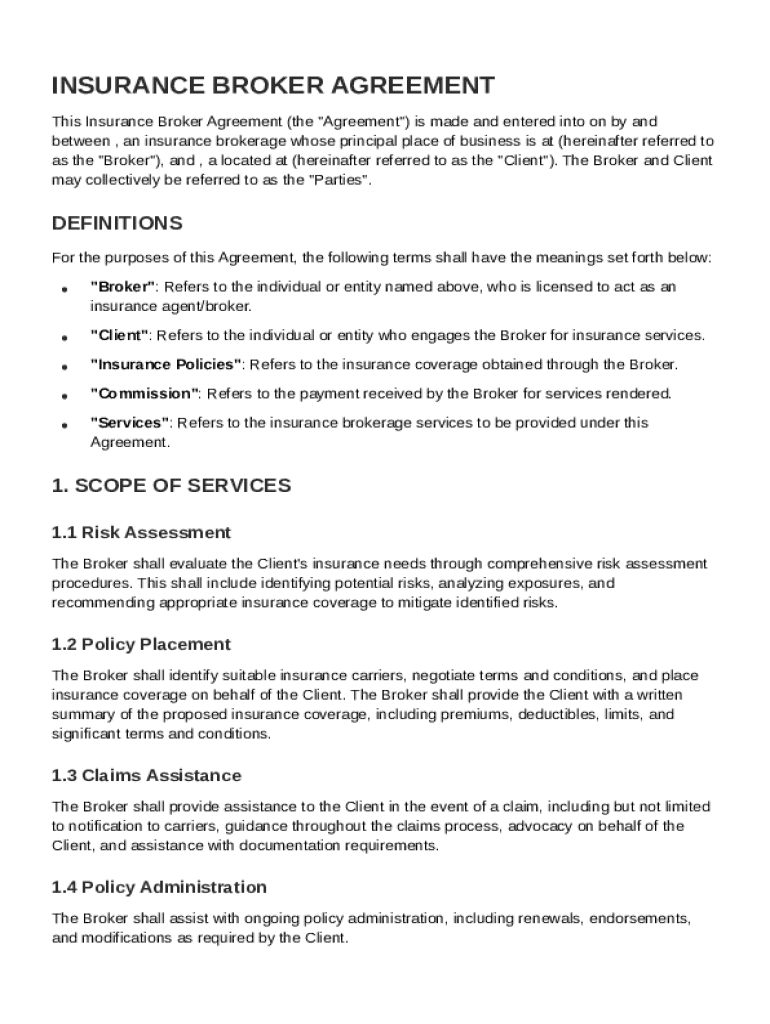

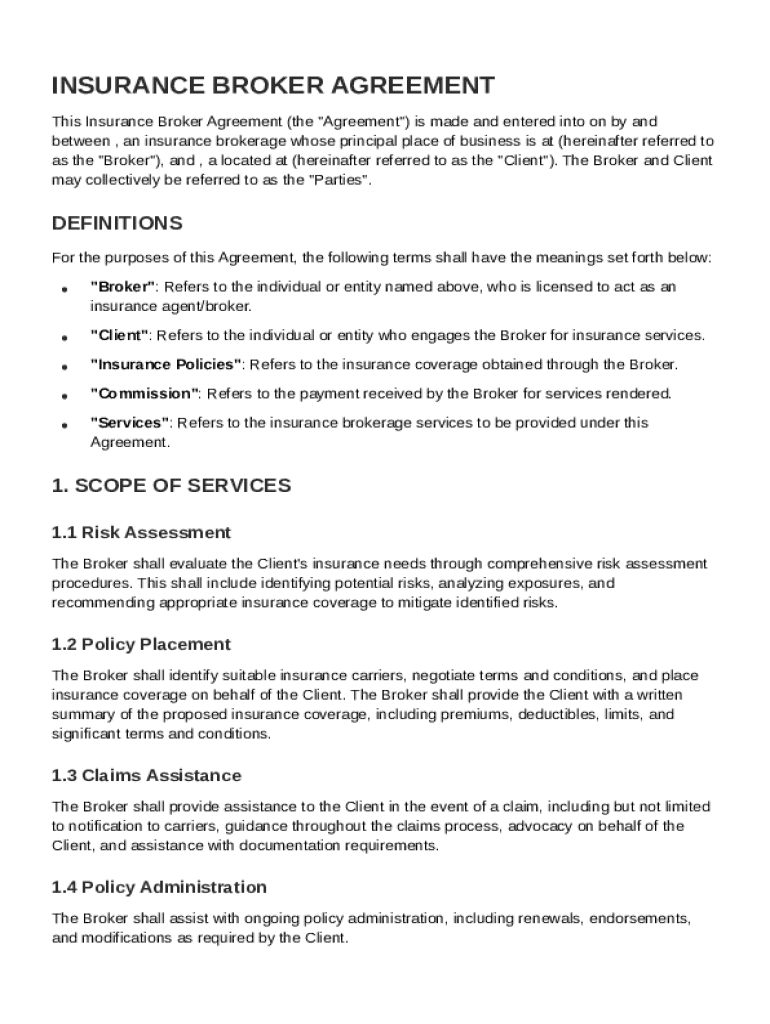

This document outlines the terms and conditions between an insurance brokerage and a client regarding the provision of insurance brokerage services.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Insurance Broker Agreement Template

An Insurance Broker Agreement Template is a formal document outlining the relationship and responsibilities between an insurance broker and a client.

pdfFiller scores top ratings on review platforms

It is a good program.. wish I could change the font size

Makes my life easier to fill in the blanks for very important issues I am dealing with !!

It was useful, and easy to navigate. I just wish the templates were more diverse.

Easy to use great to use best way to work,, would

I can sign and update any PDF file. This is easy to use

Easy friendly to use and very efficient to get the job done.

Who needs Insurance Broker Agreement Template?

Explore how professionals across industries use pdfFiller.

Insurance Broker Agreement Template Guide

How to fill out an Insurance Broker Agreement Template form

Filling out an Insurance Broker Agreement Template form involves reviewing and customizing key sections to fit the specific needs of both the broker and the client, ensuring all relevant details about services and obligations are clearly outlined.

What are the key terms in your Insurance Broker Agreement?

Defining key terms is crucial in ensuring clarity in an Insurance Broker Agreement. This clarity helps both parties understand their roles and responsibilities.

-

A broker is a licensed individual or entity responsible for facilitating insurance transactions between clients and carriers.

-

The client is the individual or entity entering into the agreement to receive insurance brokerage services.

-

Insurance policies refer to the coverage options that the broker finds suitable for the client.

-

Commission details state how the broker will be compensated for their services, typically as a percentage of premiums.

-

The services provided by the broker include risk assessment, policy placement, claims assistance, and ongoing support.

How to navigate the scope of services in the agreement?

The scope of services defines the extent of the broker's responsibilities, which is fundamental for both parties.

-

The risk assessment process helps in identifying potential risks relevant to the client and analyzing exposures to recommend necessary insurance coverage.

-

This involves identifying appropriate insurance carriers based on the client's needs and providing a written summary that includes key conditions.

-

The broker plays an essential role in claims notification and advocacy, ensuring proper documentation requirements during the claims process.

-

This covers discussions about renewals, endorsements, and modifications required by the client, highlighting the importance of good communication.

What are the broker obligations in the agreement?

Broker obligations in the agreement ensure adherence to legal and professional standards.

-

Brokers must maintain valid licenses to operate, ensuring their professional qualifications to serve clients.

-

The broker must manage the client's insurance portfolio diligently, maintaining integrity and transparency in their services.

What are the common pitfalls and important considerations?

Understanding common pitfalls during the agreement phase can prevent future misunderstandings and disputes.

-

Mistakes can occur due to a lack of clarity or information, leading to legal disputes.

-

Each region has specific regulations that affect how brokers operate, which must be thoroughly understood.

How to utilize interactive tools for filling out the agreement?

Interactive tools can significantly streamline the process of completing and managing your Insurance Broker Agreement.

-

Use pdfFiller to easily edit and eSign documents from any device, making the process efficient.

-

pdfFiller provides clear instructions on how to manage your agreement, simplifying complex tasks.

What additional information is available on Insurance Broker Agreements?

Gaining additional insights into legislation affecting insurance agreements can enhance your understanding and compliance.

-

It’s crucial to understand how local laws impact the structure of Insurance Broker Agreements in your area.

-

Exploring resources for common questions can clarify misunderstandings and assist in proper draft completion.

How to fill out the Insurance Broker Agreement Template

-

1.Download the Insurance Broker Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller application for editing.

-

3.Begin by entering the names and contact details of both the broker and the client at the top of the document.

-

4.Specify the scope of services the broker will provide in the appropriate section.

-

5.Clearly outline the commission structure, including percentage rates and payment timelines.

-

6.Include any relevant terms and conditions that govern the relationship, such as duration of the agreement and termination clauses.

-

7.If necessary, add additional provisions for confidentiality and dispute resolution.

-

8.Review the completed document to ensure all fields are accurately filled out and comply with legal standards.

-

9.Once finalized, save your changes and download a copy for both parties to sign.

-

10.Ensure that both the broker and the client retain a signed copy of the agreement for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.