Interest Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions of a loan agreement between a lender and a borrower, detailing the loan amount, interest rate, repayment period, and obligations of both parties.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Interest Loan Agreement Template

An Interest Loan Agreement Template is a legal document outlining the terms and conditions related to a loan, including interest rates, payment schedules, and borrower and lender obligations.

pdfFiller scores top ratings on review platforms

My team of Advocates just LOVE

My team of Advocates just LOVE, Love PDF Filler! It's made our job so much easier and our patients love the security and how easy it is for them to sign their documents!

My only problem is how do I get this…

My only problem is how do I get this report to the IRS?

Very great tool for any business…

Very great tool for any business regardless of size. It makes things so easier to be able to complete transactions seamlessly.

Excellent product and excellent customer service team.

Excellent product of easy manipulation with expected result. They have an excellent customer service team. I recommend!!

good service

good service,but expensive.

PDFfiller exceeded my expectations

PDFfiller exceeded my expectations. It's user friendly and makes dealing with PDF products a breeze. Anna in Customer Service was a pleasure to deal with when I had a Billing issue (caused by me). I would definitely recommend PDFfiller to anyone.B. Revelle

Who needs Interest Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out an interest loan agreement template form

What is an interest loan agreement?

An interest loan agreement serves as a formal contract between a lender and a borrower, outlining the terms and conditions of a loan. This document is crucial as it details elements like the loan amount, interest rate, and repayment period. A well-structured agreement ensures that both parties are clear about their obligations, playing a significant role in minimizing misunderstandings and disputes.

-

It lays down the fundamental understanding of the loan's purpose and conditions.

-

Includes essential details like loan amount, interest rate, and repayment period, which help to clarify the agreement's framework.

-

Clearly stipulating terms protects both the lender's and borrower's interests, making it vital for everyone involved.

What are the key components of an interest loan agreement?

An effective interest loan agreement is composed of several key components that warrant careful consideration. Understanding these elements ensures that both parties fully comprehend the contract they are entering into, which can lead to more successful loan management.

-

This is the total sum borrowed, which should be clearly stated to avoid future disputes.

-

Define how the interest will be calculated – annually, monthly, or through another method, as it impacts the total repayment.

-

Specify the duration of repayment and any intervals, which aids in budgeting and financial planning.

-

Address what happens in case of defaults including penalties, and the procedures for prepayments.

How can craft a comprehensive loan terms section?

Drafting the loan terms section is pivotal, as it dictates the financial responsibilities between the lender and borrower. A comprehensive approach to this section will include necessary elements while ensuring legal compliance.

-

Include crucial loan details: amount borrowed, interest rate, and repayment period to ensure clarity.

-

Providing an example can assist readers in visualizing what completed terms should look like.

-

Always include any legal considerations or disclosures necessary based on the region's laws and agreements.

How do establish payment schedules and structures?

Establishing a precise payment schedule is critical for the loan's viability and the borrower's financial planning. The type of payment structure chosen affects the overall affordability of the loan.

-

Choose between monthly or quarterly payments, as this decision changes the financial dynamics for both parties.

-

Detail how much will be paid in each install, ensuring that both parties agree upfront.

-

Outline any fees incurred for late payments and the legal follow-up processes to be undertaken.

What are the rights and obligations within the agreement?

Each party’s rights and obligations within the agreement provide a framework for behavior and expectations. Understanding these rights helps ensure fairness and accountability.

-

The lender can impose late fees and potentially seek legal actions if repayment terms are not met.

-

Outlines what is expected from the borrower to fulfill the agreement.

-

Both parties are shielded by established rights and obligations, promoting smoother transactions.

How can use pdfFiller to create and manage my loan agreements?

pdfFiller provides a user-friendly platform for those looking to draft and manage their interest loan agreements efficiently. The ability to collaborate on documents makes it especially versatile.

-

Follow guided steps to seamlessly create a customized loan agreement, ensuring all elements are included.

-

Utilize tools for team collaboration, making the drafting process faster and easier.

-

pdfFiller provides secure options for document management, ensuring both confidentiality and accessibility.

What are common questions and concerns regarding interest loan agreements?

Individuals often have concerns about interest loan agreements, highlighting the need for clarity and post-agreement support. Understanding these issues can help users be more proactive.

-

Addresses typical concerns like missing information and conflicting terms in agreements.

-

Users should be aware of what to look for if templates are modified over time.

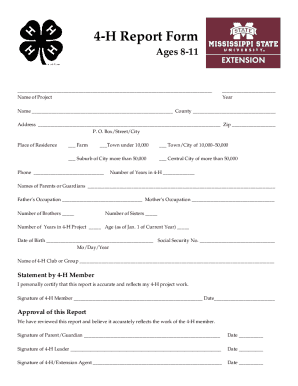

How to fill out the Interest Loan Agreement Template

-

1.Download the Interest Loan Agreement Template from pdfFiller or open an existing PDF file.

-

2.Begin by filling in the date of the agreement at the top of the document.

-

3.Enter the names and contact information of both the borrower and lender in the designated fields.

-

4.Specify the loan amount and the interest rate to be applied, ensuring clarity on financial terms.

-

5.Outline the repayment schedule, including due dates and payment methods.

-

6.Include any additional terms or conditions that may apply to the loan, such as penalties for late payments.

-

7.Review the agreement for accuracy, ensuring all details reflect the agreement between the parties.

-

8.Have both parties sign and date the document to make it legally binding.

-

9.Save the completed document and distribute copies to both lender and borrower for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.