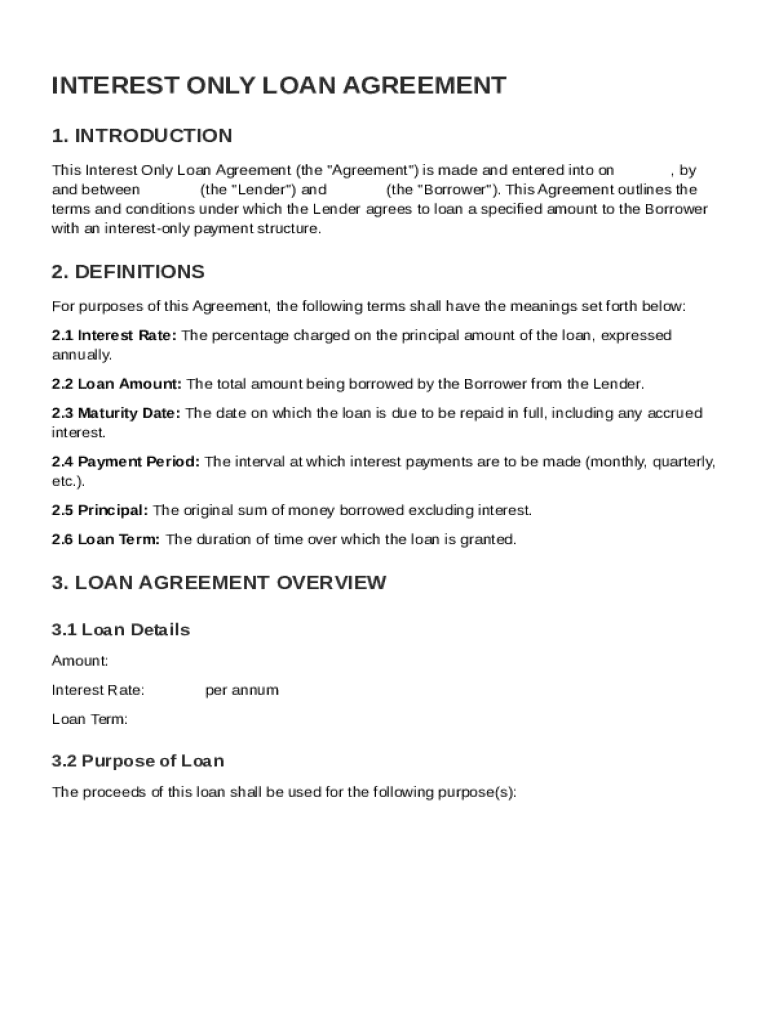

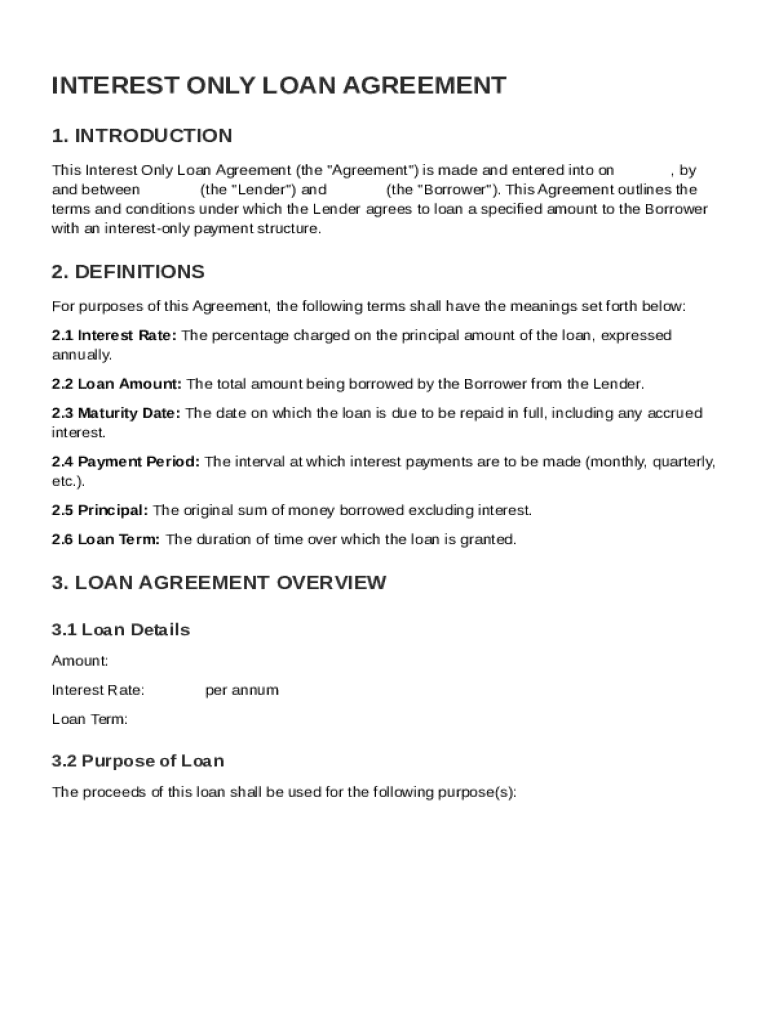

Interest Only Loan Agreement Template free printable template

Show details

This document serves as an agreement between a Lender and a Borrower outlining the terms of an interest only loan, including payment schedules, definitions of key terms, and conditions upon default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Interest Only Loan Agreement Template

An Interest Only Loan Agreement Template is a legal document outlining the terms under which a borrower agrees to pay only the interest on a loan for a specified period.

pdfFiller scores top ratings on review platforms

I'm just primarily looking to quickly print resumes.

I love this program makes tax season easy

It took me some 'playing around' to…

It took me some 'playing around' to figure out a few things but very easy to input and export your resume and/or Cover letter or anything else needed

ease of subbitting

It can be a little confusing and I thought my docs from previous years were saved so they would populate but they didn't but I like the ease of submitting the forms to the IRS.

great

great product

Who needs Interest Only Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Interest Only Loan Agreement: Comprehensive Guide

How to fill out an Interest Only Loan Agreement form

To properly fill out an Interest Only Loan Agreement form, follow these steps: gather necessary financial information, carefully fill in the details of the agreement including interest rates and payment periods, and ensure all parties sign the document. Using tools like pdfFiller can simplify the process further by allowing you to edit and sign PDF forms digitally.

What are interest only loans?

Interest only loans are mortgage options where the borrower pays only the interest on the loan for a predetermined period. This can be beneficial for short-term financing but may lead to larger payments later when the principal must start being paid back. Understanding these loans' mechanics is crucial for potential borrowers.

-

A loan type where borrowers pay only the interest for a specified term, after which they must start repaying the principal.

-

Initially, payments are significantly lower, allowing for more cash flow; however, this can result in larger overall payments down the line.

-

While lower initial payments may ease immediate financial burdens, borrowers face increased risk due to larger conversion payments and potential negative equity.

What are the key terms and definitions?

Understanding particular terminology in an Interest Only Loan Agreement is essential. This knowledge helps borrowers know their obligations and rights.

-

This is the cost of borrowing expressed as a percentage, affecting monthly payments and total loan cost significantly.

-

The total amount borrowed, which influences repayment terms and overall interest costs.

-

The set date when the loan period ends and principal repayment must start; it's crucial for planning finances.

-

Defines how often payments are made; for loans, understanding this can help track payment schedules effectively.

-

The original sum borrowed that must be repaid in addition to any interest accrued.

-

Refers to the duration of the loan, influencing both payment size and interest rates.

What does a loan agreement include?

A well-defined loan agreement outlines essential aspects such as interest rates, loan amounts, and payment terms. A clear understanding of these details prior to signing is vital.

-

All terms must be explicitly listed in the agreement, including index rate conditions and caps on interest rates.

-

Understanding what documents are required and what factors influence approval can help streamline the borrowing process.

-

Typically used for short-term investments or property purchases where immediate cash flow is prioritized.

How are payment terms structured?

The terms of payment for an interest only loan specify the exact schedule for interest payments and any principal repayment following the initial period.

-

Specifies when interest payments are due, which is important for cash flow management.

-

Borrowers must understand whether their loan utilizes simple or compound interest, as this affects total cost.

-

Clarifying schedules for payments helps avoid missed due dates and should be aligned with the borrower’s financial situation.

What are principal repayment options?

When the interest only period ends, borrowers must decide how they will repay the principal, which can impact their financial planning.

-

The maturity date marks the transition to paying down the principal, affecting future cash flow.

-

Choosing between paying off the principal in one go or in smaller installments can depend on the borrower’s financial stability.

-

Exploring options to pay off the loan sooner may save on interest costs, but should be assessed against potential penalties.

How do you fill out the template?

Filling out the Interest Only Loan Agreement Template correctly is key to avoiding pitfalls.

-

Essential to follow structured guidance while entering data to prevent common mistakes.

-

Ensuring all information is accurate and complete can save time and legal issues later.

-

Leveraging online tools helps streamline the signing process, enabling quick and secure completion.

How to manage your loan agreement effectively?

Management of an Interest Only Loan Agreement involves tracking payments and maintaining communication with lenders.

-

Setting reminders and organizing finances can safeguard against missed payments and subsequent penalties.

-

Tools for document management can enhance organization and ease of access to important paperwork.

-

Effective communication can mitigate risks and clarify any questions about terms or obligations.

What’s a comparative analysis of interest only vs. traditional loans?

Interest only loans differ significantly from traditional loans in terms of payment structure and long-term financial implications.

-

Interest only loans often have lower initial payments than their traditional counterparts, causing a real cash flow advantage at the start.

-

Borrowers can face increased debt load later if principal payments are not planned early in the loan's life.

-

These loans may be ideal in circumstances where expected financial growth is anticipated or for temporary financing needs.

What are the legal considerations for these agreements?

Adherence to legal regulations is non-negotiable when dealing with loan agreements.

-

Lenders must ensure compliance with federal and state regulations to avoid legal pitfalls.

-

Different states may have specific requirements affecting the loan agreement outlook, important for borrowers to know.

-

Effective reviews and legal consultations can safeguard against unfair terms in the agreement.

How to fill out the Interest Only Loan Agreement Template

-

1.Open the Interest Only Loan Agreement Template on pdfFiller.

-

2.Fill in your personal information in the designated fields at the top of the document.

-

3.Provide the loan details including the principal amount, interest rate, and the interest-only period.

-

4.Complete the borrower's information section with names and addresses.

-

5.Specify the lender's details in the corresponding section.

-

6.Review the payment schedule to ensure clarity on due dates and amounts.

-

7.Include any additional terms or conditions specific to the loan arrangement.

-

8.Sign and date the agreement at the end of the document, ensuring all parties involved do the same.

-

9.Save the completed document and consider sending it to all parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.