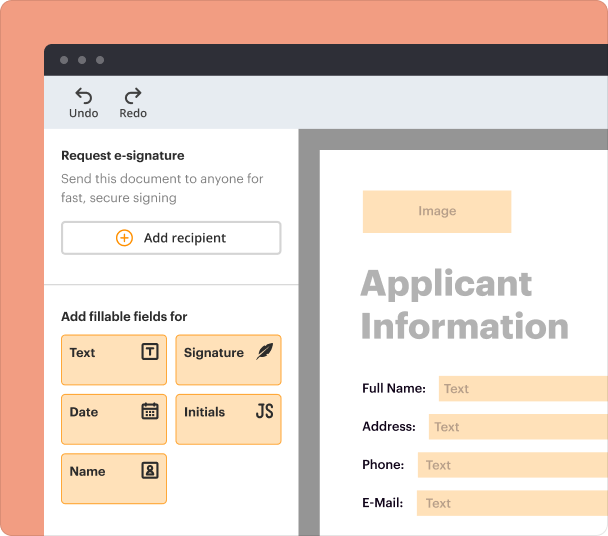

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Get the free Intra Family Loan Agreement Template

Show details

This document outlines the terms and conditions for a loan agreement between family members, including loan details, interest rates, repayment schedules, and representations and warranties of both

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

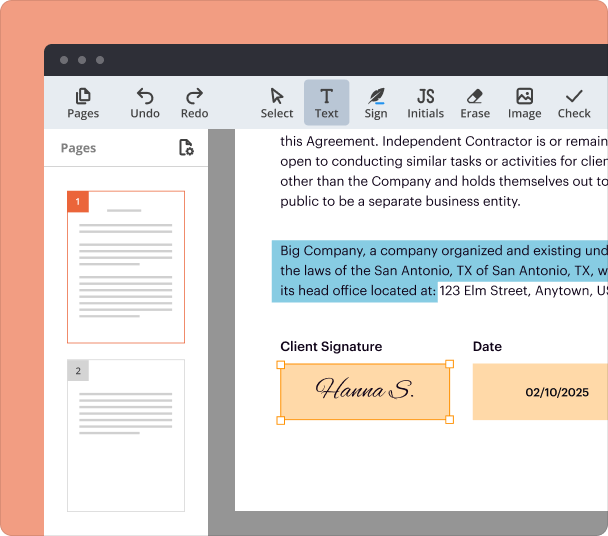

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Intra Family Loan Agreement Template

Discover how to effectively edit and fill out the Intra Family Loan Agreement Template with the powerful features of pdfFiller, ensuring a hassle-free experience.

How to edit Intra Family Loan Agreement Template

With pdfFiller, editing the Intra Family Loan Agreement Template is straightforward and efficient. Follow these simple steps to get started:

-

1.Click 'Get form' on this page to access the Intra Family Loan Agreement Template.

-

2.If you don’t have an account, create one by entering your email and setting a password. You will receive a confirmation email to activate your account.

-

3.Log in to your pdfFiller account to access the document.

-

4.Use the editing tools provided to modify text, add new fields, or make any relevant changes required for your agreement.

-

5.Once you have made all the necessary edits, you can save your document or download it in your preferred format.

How to fill out Intra Family Loan Agreement Template

Filling out the Intra Family Loan Agreement Template is crucial for clarity and compliance. Here’s how to easily do it:

-

1.Begin by clicking 'Get form' on this page to download the template.

-

2.Review the agreement terms to ensure they meet your specific family loan situation.

-

3.Fill in the required fields, including borrower and lender details, loan amount, terms, and conditions.

-

4.Be sure to specify the interest rate and repayment schedule clearly.

-

5.Sign the document electronically once all information is filled in and double-checked.

-

6.If multiple parties are involved, circulate the document for the necessary signatures.

-

7.Save a copy of the filled-out agreement for your records.

-

8.Consider sharing the document with all parties involved for transparency.

All you need to know about Intra Family Loan Agreement Template

Gain comprehensive insights into the Intra Family Loan Agreement Template, including its definition, uses, and what should be included.

What is an Intra Family Loan Agreement Template?

The Intra Family Loan Agreement Template is a legal document that outlines the terms and conditions of a loan made between family members. It is essential for defining the obligations of both lender and borrower in familial financial arrangements.

Definition and key provisions of an Intra Family Loan Agreement

This section highlights the critical elements involved in drafting an Intra Family Loan Agreement Template:

-

1.Identification of the parties involved (lender and borrower).

-

2.Loan amount and purpose.

-

3.Interest rate and repayment terms.

-

4.Consequences of default and dispute resolution process.

-

5.Signatures of all parties involved.

When is an Intra Family Loan Agreement used?

An Intra Family Loan Agreement is commonly used in situations where family members want to lend money to one another for various purposes, such as purchasing a home, funding education, or supporting a business venture. It provides legal safeguards and clarifies expectations to prevent misunderstandings.

Main sections and clauses of an Intra Family Loan Agreement

Understanding the key sections of an Intra Family Loan Agreement is paramount. Typically, the following are included:

-

1.Loan Amount

-

2.Interest Rate

-

3.Repayment Schedule

-

4.Default Provisions

-

5.Amendments and Modifications

-

6.Signatures

What needs to be included in an Intra Family Loan Agreement?

For a comprehensive and enforceable Intra Family Loan Agreement, ensure to include the following:

-

1.The full names and contact information of the lender and borrower.

-

2.The exact amount of the loan being provided.

-

3.Defined interest rate and any other fees associated with the loan.

-

4.A detailed repayment schedule indicating payment dates.

-

5.Terms regarding early repayment or penalties for late payments.

-

6.A statement about the loan's purpose, if applicable.

-

7.Signatures of all parties to validate the agreement.

pdfFiller scores top ratings on review platforms

Just started using, but so far seems great. Easy to use!

REally enjoying the convenience of the ability to fax and as a social worker, great to do applications, helps me focus and be more precise

Was fairly easy to navigate. Was able to print documents I needed.

its very swift as well as easy to learn. Very helpful fool

as a Real Estate Sales Rep I use it a lot for forms and signatures, saves time and is very convenient

Sometimes clients do not receive the email requests. Specific

ally, clients who don't use gmail. Otherwise, it's great.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.