Last updated on Feb 17, 2026

Invoice Discounting Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender provides invoice discounting services to a borrower, including definitions, responsibilities of the parties, fees, and confidentiality.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

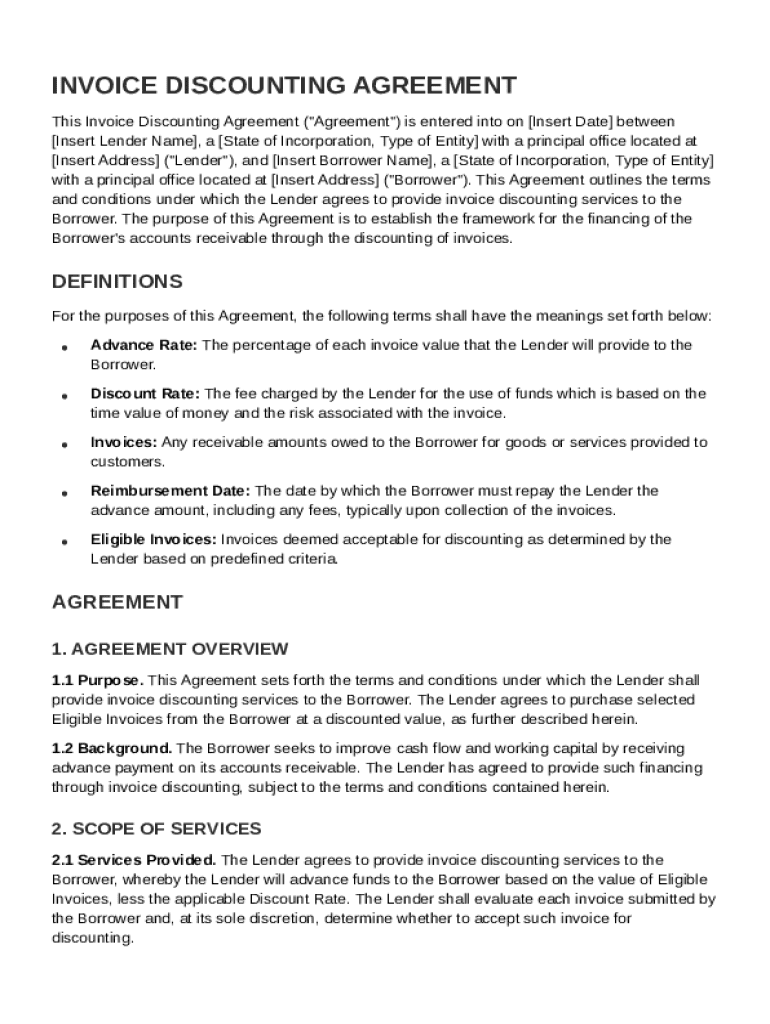

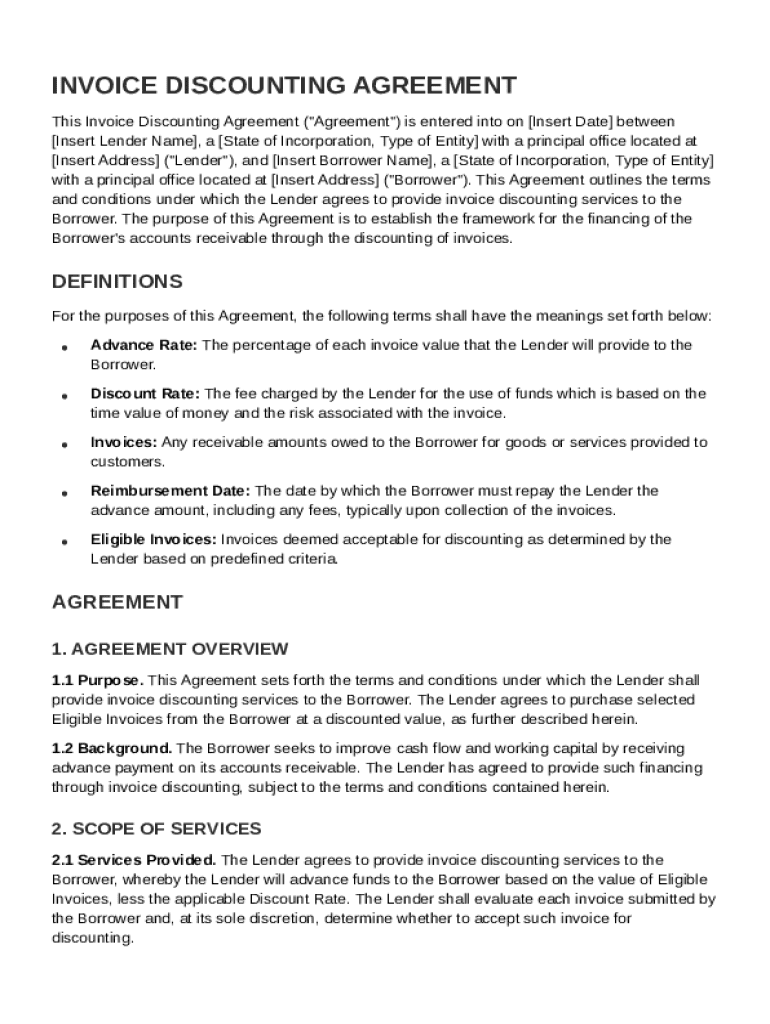

What is Invoice Discounting Agreement Template

An Invoice Discounting Agreement Template is a document that formalizes the terms under which a business can obtain immediate cash by selling its unpaid invoices to a financial institution at a discount.

pdfFiller scores top ratings on review platforms

Its easy to use

Its easy to use, and has so many options.Affordable and does everything i could want. Perfect for my shop. I'm extremely happy with this program!

It is an excellent product for an…

It is an excellent product for an online user.

Love it

Love it! so easy to use and got what I needed done within seconds!

Great and so helpful

Great and so helpful - really useful for so many things

very good tool for editing pdf documents.

very good site for editing the documents.

This website is amazing and so very…

This website is amazing and so very helpful for my classes I'm taking where I have to fill out documents...saves a lot of paper and printer ink!

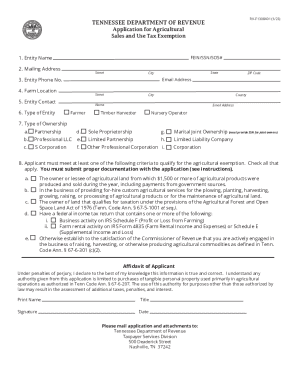

Who needs Invoice Discounting Agreement Template?

Explore how professionals across industries use pdfFiller.

Your complete guide to the Invoice Discounting Agreement Template form

How does an invoice discounting agreement work?

An Invoice Discounting Agreement is a financing solution allowing businesses to borrow against unpaid invoices. This mechanism provides immediate cash flow by unlocking funds tied up in accounts receivable. Through understanding the fundamentals, businesses can make informed decisions benefiting both borrowers and lenders.

-

This agreement is a financial arrangement where a business sells its invoices to a third party (a lender) at a discount to receive immediate cash.

-

1. A business issues invoices to customers. 2. It forwards these invoices to a lender. 3. The lender evaluates the invoices and provides a percentage of their value upfront, usually between 70-90%.

-

Borrowers gain fast access to cash, improving cash flow. Lenders benefit from interest and fees, turning invoices into profitable assets.

What are the key components of the invoice discounting agreement template?

An effective Invoice Discounting Agreement Template contains essential elements to ensure clarity and compliance. These details facilitate smooth transactions while providing a framework for expectations between parties.

-

The template should begin with a clear introduction outlining the purpose and parties involved in the agreement.

-

Include specific dates and the full names and addresses of all parties involved for legal clarity.

-

Define crucial terms like 'advance rate' and 'eligible invoices' to avoid confusion.

-

Outline the responsibilities and expectations of the lender and borrower, ensuring both sides are covered legally.

How do you fill out the invoice discounting agreement template?

Filling out the Invoice Discounting Agreement Template involves several key steps. Attention to detail during this process ensures the agreement is accurate and serves its purpose effectively.

-

The date marks when the agreement becomes effective. It is crucial for tracking terms and conditions.

-

Accurate details regarding the lender, including contact information and terms of the agreement, are essential.

-

Detail the borrower's full legal name and business details to avoid liabilities.

-

State the advance and discount rates clearly; this defines how much cash the borrower can expect to receive.

-

List the specific invoices that qualify for discounting and the expected reimbursement timeline to ensure clarity in transactions.

What interactive tools can enhance the invoice discounting agreement process?

Utilizing interactive tools like pdfFiller can significantly streamline the process of creating and managing your Invoice Discounting Agreement. These modern solutions provide features that enhance the user experience.

-

With pdfFiller, users can upload and modify the agreement template as per their needs, making personalized documentation effortless.

-

Integrate electronic signatures for quick, secure, and legally binding agreement finalizations.

-

Collaborate with your team, allowing multiple users to edit and make real-time changes to the document.

What are the common pitfalls in invoice discounting agreements?

Understanding the risks associated with Invoice Discounting Agreements can help borrowers avoid significant pitfalls. Awareness of these potential drawbacks is essential for effective agreement management.

-

Inaccuracies or ambiguities in the agreement can lead to financial losses or legal complications for both parties.

-

Ensure all terms are clearly defined to prevent disputes during the agreement lifespan.

-

Familiarize yourself with local regulations to avoid non-compliance, which could nullify the agreement.

What are the best practices for managing your invoice discounting agreement?

Establishing best practices can facilitate effective management of Invoice Discounting Agreements. Regularly reviewing and maintaining communication leads to better outcomes for borrowers.

-

It is advisable to reassess the agreement terms regularly to accommodate any changes in your business or financial landscape.

-

Proactively discuss terms and conditions with your lender, fostering better relationships and understanding.

-

Keep meticulous invoice records to ensure compliance and facilitate smoother financial transactions.

What lessons can be learned from case studies of successful invoice discounting?

Examining case studies can offer valuable insights into the successful use of Invoice Discounting. Understanding how various businesses effectively utilized this financing option can guide your own strategies.

-

Many companies have successfully enhanced their cash flow using invoice discounting, showcasing its real-world effectiveness.

-

Different sectors provide unique insights into invoice discounting utilization, revealing tailored strategies for specific needs.

-

Reflecting on past case studies helps businesses understand common mistakes and the best practices to adopt.

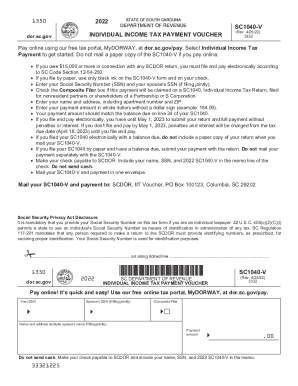

How to fill out the Invoice Discounting Agreement Template

-

1.Open the Invoice Discounting Agreement Template in pdfFiller.

-

2.Begin by filling out the header with your business name and contact information.

-

3.Include the date of the agreement and the name of the financial institution involved.

-

4.Specify the details of the invoices being discounted, including amounts and invoice numbers.

-

5.Outline the terms of the discounting, including fees, interest rates, and repayment timelines.

-

6.Include any additional clauses that may be relevant, such as confidentiality or liability terms.

-

7.Review the document to ensure all necessary fields are completed accurately.

-

8.Save your changes and download the finalized agreement for both parties' signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.