Invoice Factoring Agreement Template free printable template

Show details

This document outlines the terms and conditions for an Invoice Factoring Agreement between a factoring company and a client, including definitions, obligations, financial terms, and confidentiality

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

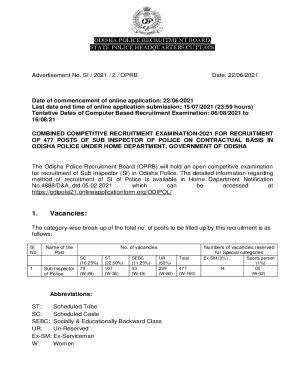

What is Invoice Factoring Agreement Template

An Invoice Factoring Agreement Template is a legal document that outlines the terms and conditions under which a business sells its accounts receivable to a third party at a discount for immediate cash flow.

pdfFiller scores top ratings on review platforms

Realy useful! :-)

Really good

excellent experience using the PDFfiller it does everything what i need it to do

steep learning curve but the formulas seem to work , so yay!

Easy to navigate

great product and customer service is…

great product and customer service is prompt and easy to understand!

Who needs Invoice Factoring Agreement Template?

Explore how professionals across industries use pdfFiller.

Your comprehensive guide to the Invoice Factoring Agreement Template

How to effectively fill out an Invoice Factoring Agreement Template

To fill out an Invoice Factoring Agreement Template, begin by collecting necessary information such as your business details, invoice specifics, and the terms of the agreement. This document can be easily completed using pdfFiller’s intuitive platform, which allows for seamless editing, signing, and sharing.

What are Invoice Factoring Agreements?

Invoice factoring agreements are financial contracts where a business sells its accounts receivable (invoices) to a third party, known as a factoring company, at a discount. This arrangement helps businesses improve their cash flow by converting outstanding invoices into immediate cash, which can be critical for operations.

-

These agreements define the terms under which businesses sell their invoices for upfront cash, often to a specialized factoring company.

-

They provide quick access to funds, enabling businesses to pay bills, payroll, and invest in growth without waiting for customers to pay their invoices.

-

Understanding the costs, such as factoring fees and the advance rate, is crucial to evaluate the financial implications on your business.

What are the key components of an Invoice Factoring Agreement?

Understanding the key components of an Invoice Factoring Agreement is essential for both parties involved. The fundamental aspects include the roles of the factoring company and the client, along with critical definitions that outline expectations and responsibilities.

-

The primary parties in a factoring agreement are the factoring company, which purchases the invoices, and the client, the business selling the invoices.

-

Key terms such as Accounts Receivable (the money owed to the business), Factoring Fee, and Advance Rate need clear definitions to prevent misunderstandings.

-

For instance, if a business sells a $10,000 invoice at an advance rate of 80%, it might receive $8,000 upfront, with details on how the factoring fee affects the final payment.

How can you fill out your Invoice Factoring Agreement Template?

Filling out your Invoice Factoring Agreement Template using pdfFiller is straightforward. Begin by entering your company's information, followed by details about the invoices you wish to factor.

-

Navigate to the pdfFiller platform, select the Invoice Factoring Agreement template, and input your details in each required field.

-

Before starting, compile your business identification information, invoice dates, amounts, customer's information, and terms of the factoring agreement.

-

Ensure that all fields are completed accurately, and use pdfFiller’s e-signature feature to sign the document electronically.

What is the eligibility criteria for Invoice Factoring?

Not all invoices qualify for factoring; understanding the eligibility criteria is critical for businesses considering this financing option. Factors typically assess the creditworthiness of your customers and the nature of the invoices.

-

Invoices must be issued to creditworthy customers with reliable payment histories to be considered for factoring.

-

Factoring companies often perform credit checks to ensure that funds will be collected without issues; bad credit can lead to disqualification.

-

If an invoice does not meet these criteria, the business must seek alternative financing options, which can affect their cash flow.

What role does the Factor play and what services do they offer?

The factor, or factoring company, provides essential services to businesses looking for cash flow solutions. They are responsible for purchasing the invoices and managing collections, thereby allowing the business to focus on operations.

-

Factors often provide additional services such as collections management and credit risk assessment, adding value beyond just cash advance.

-

Once the factor purchases the invoice, they directly handle collection from the customer, ensuring timely payment.

-

Factors typically advance a percentage of the invoice value upfront, with the remainder paid after the customer’s payment, minus the factoring fee.

What are common drawbacks of Invoice Factoring Agreements?

While invoice factoring can provide quick access to funds, it is essential to be aware of potential drawbacks that may impact your business operations. Understanding these can help you make informed decisions.

-

Factors may charge high fees, reducing the overall amount received from the sale of invoices, which can be a financial burden.

-

Relying heavily on factoring may lead to issues with customer relations if they perceive the factor's collection tactics as intrusive.

-

Businesses should explore other financing options such as bank loans or lines of credit that could provide more affordable solutions compared to factoring.

What interactive tools are available for Invoice Factoring management?

Interactive tools can significantly enhance the management and tracking of invoices and agreements. pdfFiller offers specialized features to help businesses keep their financial documents organized and accessible.

-

pdfFiller provides a suite of tools to manage invoice statuses, track payments, and facilitate agreements, all from a single platform.

-

Users can quickly view outstanding invoices and payments made, ensuring transparency and timely follow-ups.

-

The platform boasts collaboration tools that allow multiple team members to work on documents concurrently, streamlining communication and efficiency.

What final considerations should you have when using Invoice Factoring?

Before finalizing an Invoice Factoring Agreement, it's crucial to go through a checklist of considerations to ensure that you're making the best decision for your business. Factors can vary by region, and legal compliance is essential.

-

Review the terms, ensure clarity on fees, and confirm the eligibility of invoices being factored.

-

Different regions may have specific legal requirements for factoring, making it critical to consult with legal experts.

-

Listening to user testimonials and reviews about their experiences with factoring can provide insights into its effectiveness and reliability.

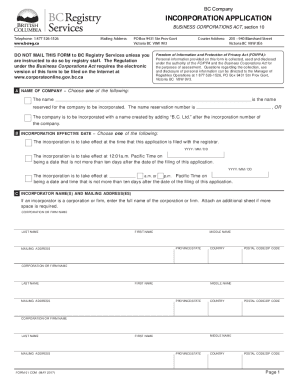

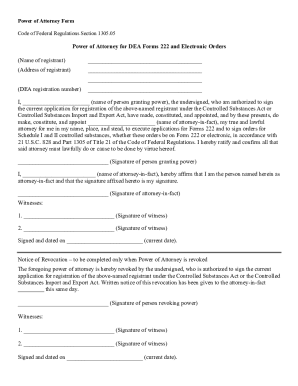

How to fill out the Invoice Factoring Agreement Template

-

1.Open the Invoice Factoring Agreement Template on pdfFiller.

-

2.Review the introductory section to understand the purpose of the agreement.

-

3.Fill in the date at the top of the document.

-

4.In the 'Party Information' section, input the names and addresses of both the seller (the business) and the buyer (the factoring company).

-

5.Specify the details for each invoice being factored, including invoice numbers and amounts.

-

6.Indicate any fees or interest rates applicable to the factoring arrangement.

-

7.If a duration for the agreement is specified, fill that in under the relevant section.

-

8.Include any additional terms in the designated area to cover anything unique to the agreement.

-

9.After ensuring all fields are complete, review the document for accuracy and legality.

-

10.Save the filled document and download it or print it out for signatures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.