Irrevocable Trust Agreement Template free printable template

Show details

This document establishes an irrevocable trust, detailing the roles of the Grantor, Trustee, and Beneficiaries, as well as the terms for managing and distributing the trust assets.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Irrevocable Trust Agreement Template

An Irrevocable Trust Agreement Template is a legal document that establishes a trust, which cannot be altered or revoked once executed, protecting assets and providing specific instructions for their management and distribution.

pdfFiller scores top ratings on review platforms

It eliminates so many steps in completing a PDF. It has always been such a headache to work with PDF documents.

so far it help me to do school paperwork tremendously

I am just getting started and would like training.

It works great. Easier for me to work with than many others

so far its Great the only part is when i sign it it diplays the PDF Filter logo on th e document meaning i have to print it and sign it and scan the document deveafting the whole purpose of your system

Excellent, easy to use, navigate,and understand!

Who needs Irrevocable Trust Agreement Template?

Explore how professionals across industries use pdfFiller.

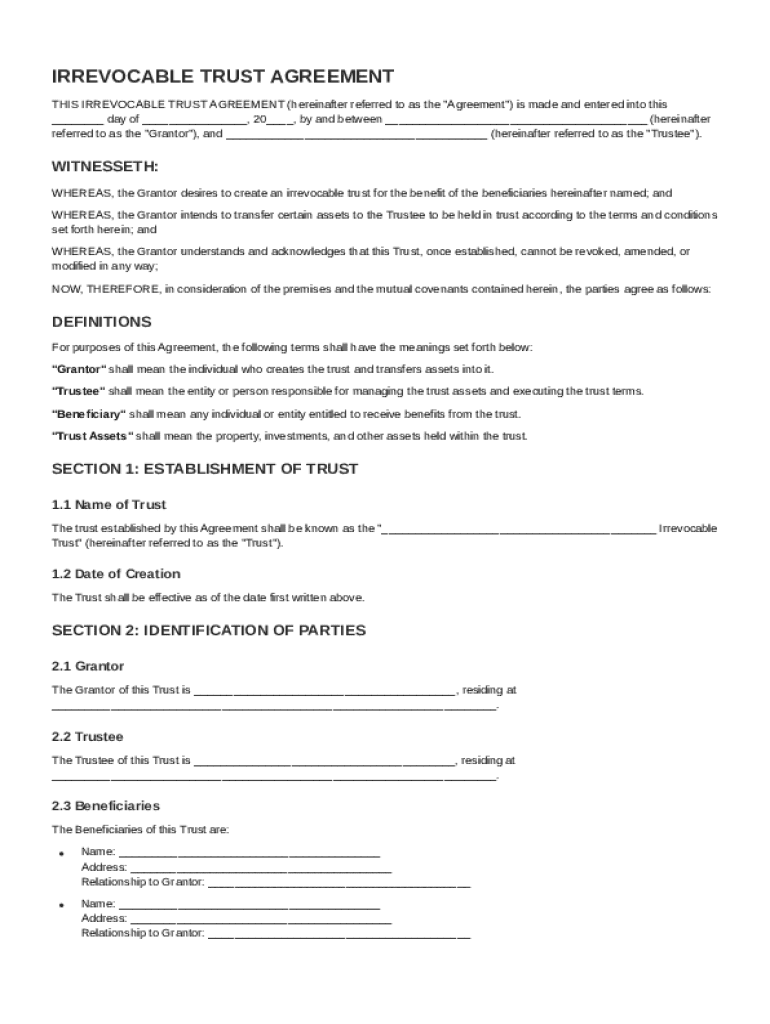

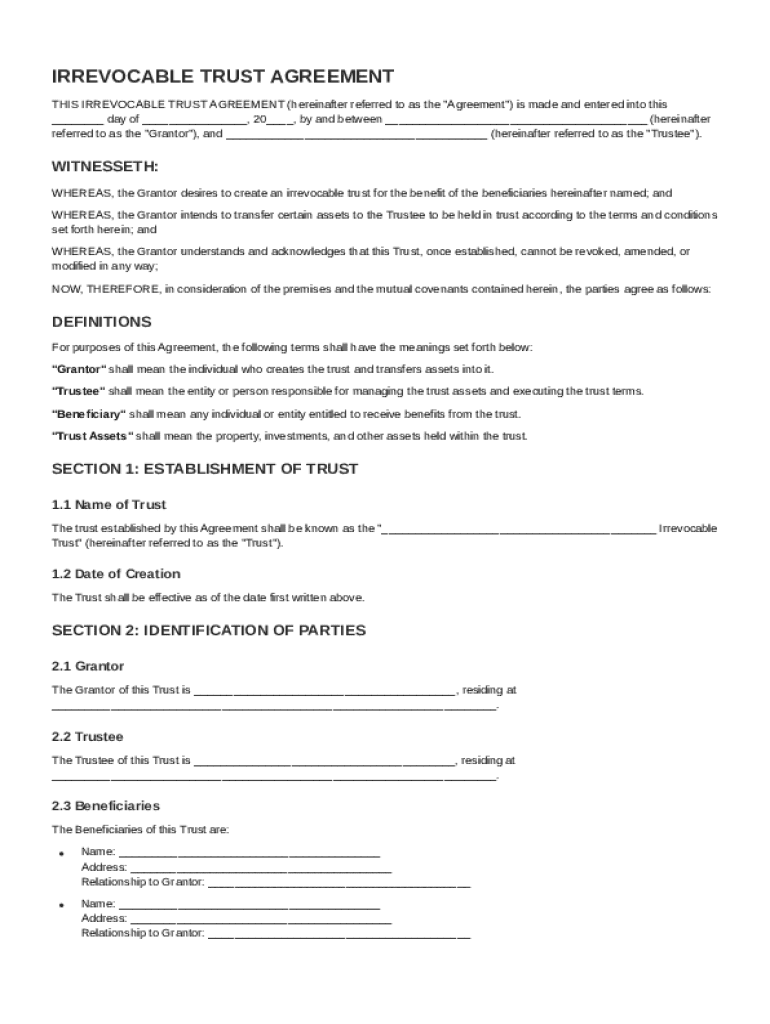

Irrevocable Trust Agreement Template

Creating an Irrevocable Trust Agreement Template form involves understanding the intricacies of trust law and the specific requirements for your unique situation. This guide provides step-by-step instructions on how to fill out an Irrevocable Trust Agreement and details about the essential components of such an agreement.

What is an irrevocable trust?

An irrevocable trust is a type of trust that, once established, cannot be altered or dissolved without the consent of the beneficiaries. This form of trust provides substantial benefits in terms of estate planning, asset protection, and tax advantages.

-

An irrevocable trust transfers ownership of assets from the grantor to the trust, which is then managed by a trustee for the benefit of the beneficiaries.

-

These include protection from creditors, estate tax benefits, and the ability to govern how assets are distributed.

-

Many believe that irrevocable trusts are inflexible; however, they can be tailored to meet specific needs and objectives.

What are the key components of an irrevocable trust agreement?

An irrevocable trust agreement contains four key components: the grantor, trustee, beneficiaries, and trust assets. Understanding these roles and responsibilities is crucial for anyone looking to create an effective irrevocable trust.

-

The grantor is the person who creates the trust and transfers assets into it, defining the terms of the trust.

-

The trustee manages the trust's assets and ensures that they are distributed according to the grantor's instructions.

-

These are the individuals or entities that benefit from the trust, and their roles must be clearly defined.

-

This includes all types of assets that the grantor wishes to include in the trust, such as real estate, investments, and personal property.

How do you create your irrevocable trust?

Creating an irrevocable trust involves several steps to ensure it is legally binding and meets your estate planning needs.

-

Collect details regarding the grantor, trustee, and beneficiaries to ensure that all terms are accurately documented.

-

Determine which assets you wish to place into the trust, including investments, real estate, or savings.

-

Pay special attention to sections concerning the rights of beneficiaries, duties of the trustee, and any specific instructions.

-

Consult with a legal professional to ensure all state-specific requirements are met for the agreement to be valid.

How can pdfFiller assist in managing your irrevocable trust agreement?

pdfFiller provides a comprehensive solution for filling out and managing your Irrevocable Trust Agreement Template. With interactive tools and capabilities, users can efficiently create their trust agreements online.

-

Easily complete the Irrevocable Trust Agreement Template with user-friendly online forms.

-

Teams can review and collaborate on the trust agreement in real-time, ensuring all parties are in agreement.

-

The platform allows for secure, legally binding signatures, eliminating the need for paper forms.

What does a sample irrevocable trust agreement look like?

A well-structured sample irrevocable trust agreement includes specific clauses and examples that can serve as a guide for your agreement.

-

A detailed outline showcases how to properly fill in the trust agreement using practical examples.

-

You can personalize a sample agreement to better fit the specific needs and requirements of your situation.

-

It’s vital to comprehend the language and terms used within the agreement to avoid confusion.

How to fill out the Irrevocable Trust Agreement Template

-

1.Obtain the Irrevocable Trust Agreement Template in PDF format.

-

2.Open the document using pdfFiller to enable editing.

-

3.Begin by filling in the date of the agreement at the top of the page.

-

4.Identify the trustor(s) by providing their full names and addresses.

-

5.List the name(s) of the trustee(s) responsible for managing the trust assets.

-

6.Clearly state the beneficiaries' names and their relationship to the trustor.

-

7.Specify the assets to be placed in the trust, detailing each item or account included.

-

8.Include specific instructions on how the assets should be distributed among the beneficiaries.

-

9.If necessary, add any additional provisions or conditions related to the trust.

-

10.Review the filled-out form for accuracy and completeness before saving.

-

11.Save the document and consider printing it for signatures from the trustor and trustee.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.