Last updated on Feb 17, 2026

LLC Contribution Agreement Template free printable template

Show details

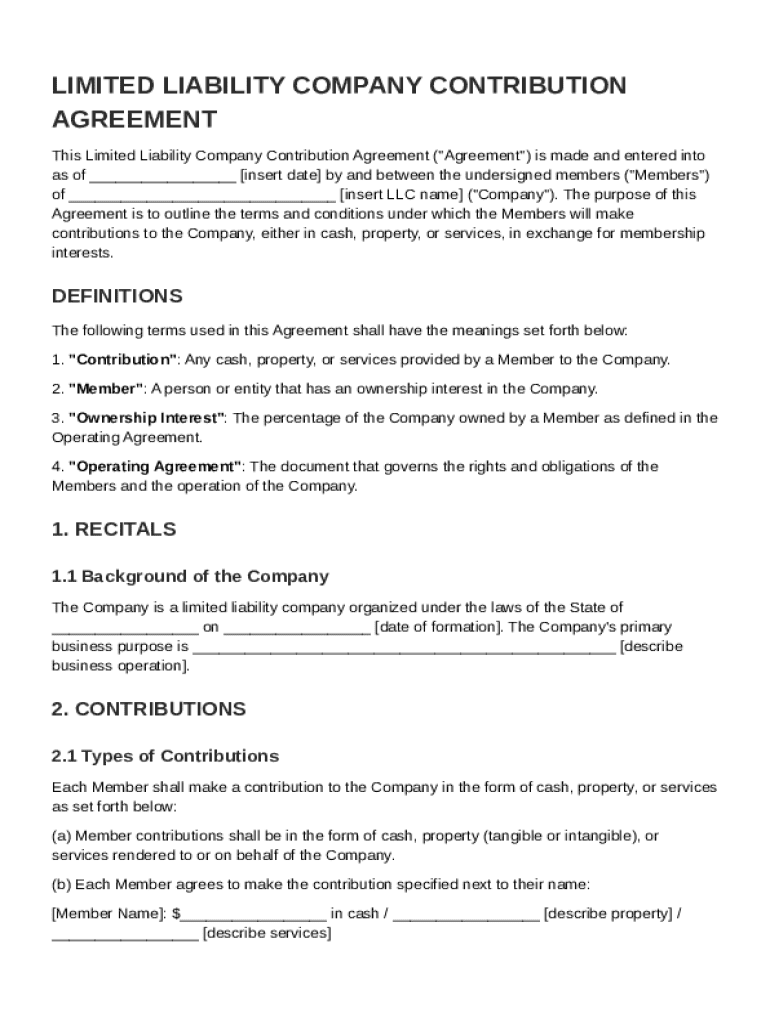

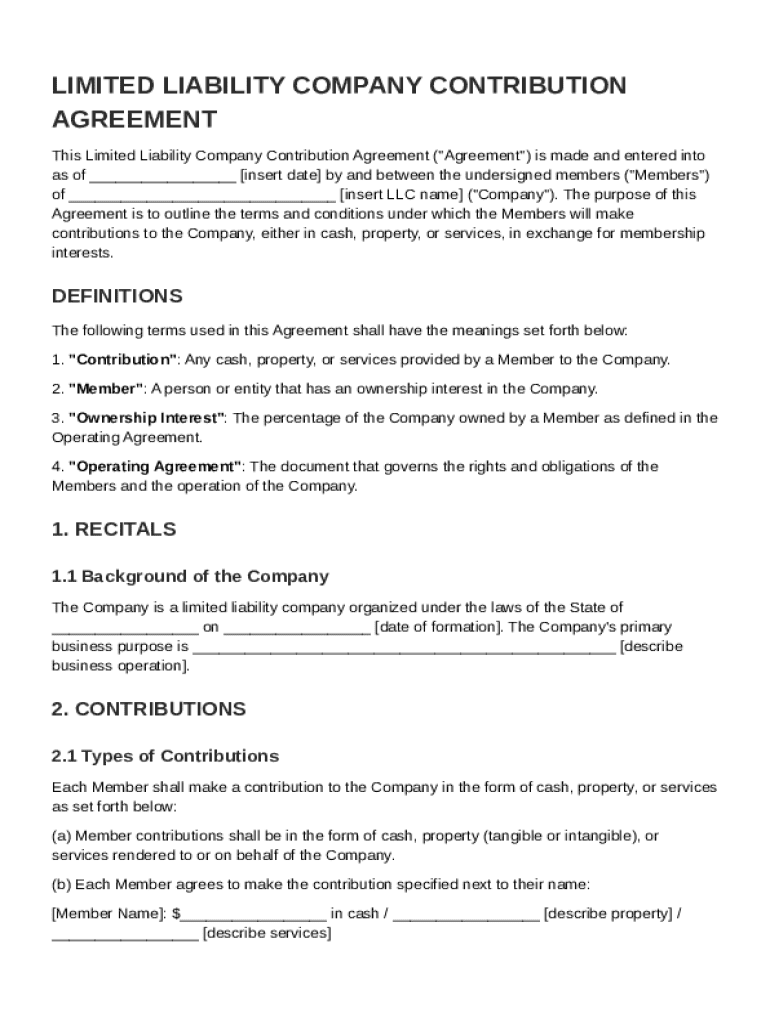

This document outlines the terms and conditions under which members of a limited liability company make contributions in exchange for membership interests.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is LLC Contribution Agreement Template

An LLC Contribution Agreement Template is a legal document outlining the terms under which members contribute capital or assets to a limited liability company (LLC).

pdfFiller scores top ratings on review platforms

It seems to be self explanatory

Very good tool

Very easy to use and produces great documents.

GREAT TOOL

GREAT TOOL, EASY TO USE

love it

love it would reccommend

I always receive excellent customer…

I always receive excellent customer service! any issues or questions I have are always resolved in a professional and timely manner.

Thank you!

Who needs LLC Contribution Agreement Template?

Explore how professionals across industries use pdfFiller.

Contribution Agreement Template Guide

How does an contribution agreement work?

An LLC Contribution Agreement is a crucial legal document that outlines the terms and details of contributions made by members into a Limited Liability Company (LLC). It serves to define what constitutes a contribution—whether it be cash, property, or services—and formalizes the ownership interests of each member based on their contributions. This agreement not only clarifies the financial and operational commitments of the members but also holds significant legal standing across various jurisdictions.

Understanding the Limited Liability Company contribution agreement

The LLC Contribution Agreement is a foundational document that delineates the rights and responsibilities of members concerning their contributions. It is essential as it protects both the company and the members by ensuring clarity on the expectations and contributions of each party. Different jurisdictions may have varying laws surrounding LLCs, making it integral to ensure that the agreement adheres to local compliance requirements.

-

Include definitions, contribution structures, and ownership interest clarifications.

-

Clarifies ownership stakes and enhances transparency among members.

-

Varies by region, necessitating jurisdiction-specific considerations.

What are key definitions within the agreement?

To fully grasp the LLC Contribution Agreement, it's pivotal to understand its core terminologies. For instance, a 'Contribution' may involve cash, property, or services provided by a member in exchange for ownership interest. Additionally, the term 'Member' refers to individuals or entities making these contributions, while 'Ownership Interest' ties directly to how the Operating Agreement defines each member’s stake in the company.

-

Defined as cash, property, or services contributed to the LLC.

-

An individual or entity contributing to the LLC.

-

Represents the member's stake as outlined in the Operating Agreement.

-

The document governing the operational rules and member relations of the LLC.

How is background and formation of the company documented?

Documenting the date and formation of the LLC is essential for establishing the legal foundation of the business. Along with this, articulating the company’s primary business purpose in the agreement ensures that all members understand the business objectives and their role. Moreover, regard for relevant state laws ensures compliance, fostering a legitimate operating environment.

-

Essential for legal verification and compliance checks.

-

Provides context for member contributions and responsibilities.

-

Differentiates operational boundaries and requirements based on location.

What types of contributions are made to the ?

Contributions to an LLC can fall into several categories, primarily cash, property, and services. Each member’s contributions must be quantifiable, and examples should be included in the agreement for later reference. It is essential to specify valuations, especially for non-cash contributions, to preempt disputes regarding ownership stakes.

-

Easy to document and instantly increases capital.

-

Valued at fair market prices, requires careful documentation.

-

Can complicate valuation; should include detailed descriptions.

How is valuation of non-cash contributions determined?

Valuing non-cash contributions is vital for accurately reflecting ownership stakes. Fair market value is the standard for this determination, often necessitating independent appraisals to ensure objectivity. Situations may also arise where members mutually agree on valuations, helping to foster collaboration rather than conflict.

-

Established based on market conditions and comparable transactions.

-

Provide neutral assessments, particularly for high-value properties.

-

Collaborative valuations can enhance member relations.

Using pdfFiller for your contribution agreement

pdfFiller offers an efficient platform for creating and managing your LLC Contribution Agreement. Users can easily edit, eSign, and collaborate on documents, ensuring all contributions and agreements are managed effectively. The document management tools available through pdfFiller ensure that members have seamless access to important forms and can maintain an organized record of agreements and amendments.

-

Edit your agreement in real time with collaborative tools.

-

Facilitates secure signing without the need for printing.

-

Easily store and retrieve important documents in cloud storage.

What common mistakes should be avoided in contribution agreements?

One of the most common pitfalls in drafting LLC Contribution Agreements is failing to document contributions clearly, which can lead to misunderstandings and disputes. Clarity in terms and conditions is crucial; vague language can open avenues for conflict. Furthermore, poorly drafted agreements can have significant legal consequences, including invalidation or undesired liability.

-

Ensure all contributions are clearly itemized and valued.

-

Avoid ambiguous language to protect all member interests.

-

Collaborate with legal counsel to minimize risks.

How to fill out the LLC Contribution Agreement Template

-

1.Download the LLC Contribution Agreement Template from pdfFiller.

-

2.Open the PDF file in pdfFiller's editor.

-

3.Fill in the LLC name at the top of the agreement.

-

4.List each member's name and their corresponding contributions in the specified sections.

-

5.Specify the type of contributions (cash, property, services, etc.) clearly for each member.

-

6.Indicate the date on which contributions are being made within the document.

-

7.Review the terms regarding ownership percentages or voting rights associated with each contribution in the agreement.

-

8.Make any necessary adjustments to the template language to fit your specific situation or needs.

-

9.Save the completed document and choose whether to print or share it electronically.

-

10.Ensure all members sign the agreement to formalize the contributions and retain copies for your records.

Can I write my own operating agreement?

The good news is that you're free to write your operating agreement in any way that you wish.

Does the state of Colorado require an operating agreement for an LLC?

No. Colorado state law does not require you to create and maintain an operating agreement for your LLC. However, you'll want to have an operating agreement for many aspects of running a business. Banks, landlords and investors will want to see proof of ownership when you deal with them.

Is an operating agreement required for an LLC in Illinois?

The state of Illinois does not require an LLC Operating Agreement, but it may still be recommended for many LLCs. Without an Operating Agreement, disputes are governed by the default LLC operating rules outlined in Illinois law (805 ILCS 180/).

What is the capital contribution agreement?

A capital contribution agreement is a contract between two or more parties that outlines the conditions of an investment made by one party into another. This legal document outlines how the funds will be used and who will benefit from it and what happens if any obligations are not met.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.