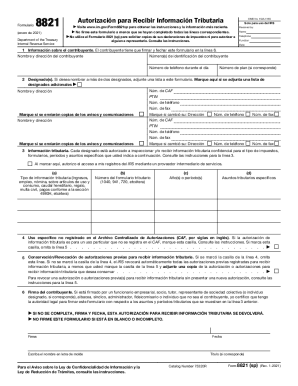

LLC Partnership Agreement Template free printable template

Show details

This document outlines the terms and conditions for forming and operating a Limited Liability Company (LLC) by the Partners, detailing definitions, capital contributions, ownership interests, management

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

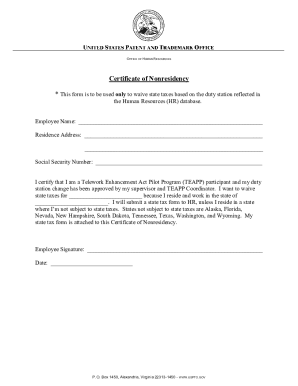

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is LLC Partnership Agreement Template

An LLC Partnership Agreement Template is a legal document outlining the terms and conditions of a partnership within a Limited Liability Company.

pdfFiller scores top ratings on review platforms

It is a very useful tool. A lot easier than filling out paper work by hand.

Does just what it says on the tin. And more... Great job!

At first, not good....too expensive for a one time use. Sarah's response was great and her instructions were, too. She convinced me to use the program gratis to see how it works. It was fantastic.

It's been wonderful. Little difficult at first but the customer service person was really sweet.

It can be great, but it's a little buggy at times. The signature feature often crashes the signer's device, whether mobile or desktop, and the API integration with Zapier is very finicky as well.

Does exactly what it needs to, and doesn't require an expensive upfront cost.

Who needs LLC Partnership Agreement Template?

Explore how professionals across industries use pdfFiller.

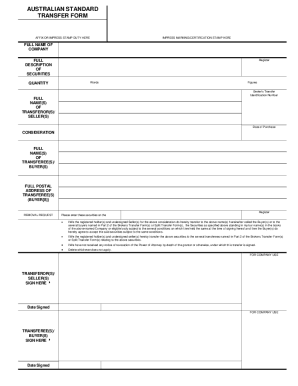

Partnership Agreement Template

Creating an LLC Partnership Agreement Template is essential for establishing partnerships that protect the rights and responsibilities of all partners involved.

This guide outlines the critical components of an LLC Partnership Agreement, detailing how to fill it out effectively.

What is a partnership agreement?

A partnership agreement is a formal contract between business partners that outlines the management structure, profit distribution, and legal responsibilities.

-

Establishes the legal framework for the partnership, clarifying roles and expectations.

-

Includes details such as capital contributions, decision-making processes, and profit-sharing mechanisms.

What types of partnership agreements exist?

Understanding the various types of partnership agreements helps partners select the most appropriate structure for their business.

-

All partners share responsibilities and liabilities equally, making this the simplest form of partnership.

-

Includes at least one general partner who manages the business and one or more limited partners who contribute capital without personal liability.

-

Protects partners from personal liability for certain business obligations, ideal for professional services.

-

Customized for partners involved in real estate ventures, focusing on property management and investment.

How do you form your ?

Forming an LLC involves several strategic steps and an understanding of state requirements to ensure effective service.

-

Ensure the name complies with state regulations and is unique within your jurisdiction.

-

File the necessary documents with state authorities, fulfilling the legal requirements.

-

A physical address for your LLC must be provided, which may be used for legal notices.

-

Clearly define the roles and responsibilities of each partner to avoid conflicts down the road.

What are capital contributions in an ?

Capital contributions are essential as they define what each partner brings to the business and how potential profits will be shared.

-

The first investment made by partners should be documented, as it reflects ownership equity.

-

Can include cash, property, or services; understanding these differences is crucial.

-

The agreement should stipulate when and how further capital contributions can be requested.

Why outline your business purpose?

Clearly defining your business purpose protects against misunderstandings and ensures that all partners are on the same page.

-

A well-defined purpose guides strategic decision-making and partner behavior, enhancing operational efficiency.

-

Include procedures for altering the business purpose, emphasizing the need for partner consent.

How to divide profits and losses?

Establishing a fair system for profits and losses is vital for maintaining partner relationships and motivation.

-

Profits and losses must be defined according to Generally Accepted Accounting Principles (GAAP) to ensure transparency.

-

The partnership agreement should specify how profits and losses are allocated, typically based on ownership percentages.

How to edit and customize your agreement?

Editing and customizing your LLC partnership agreement is made easy via tools like pdfFiller, which allows for seamless document management.

-

This platform provides intuitive features for document editing, e-signing, and collaboration with partners.

-

Step-by-step guides for signing and managing the document ensure everyone is on board and accountable.

-

Utilize pdfFiller’s tools to facilitate discussions and edits among partners, streamlining the process.

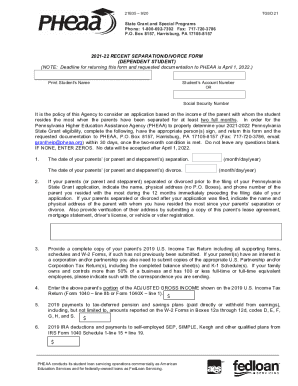

How to fill out the LLC Partnership Agreement Template

-

1.Download the LLC Partnership Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editing tool.

-

3.Begin by entering the full name of the LLC at the top of the document.

-

4.Fill in the names and addresses of each partner involved in the agreement.

-

5.Specify the ownership percentages for each partner in the designated section.

-

6.Detail the roles and responsibilities of each partner within the company.

-

7.Include provisions for how profits and losses will be distributed among partners.

-

8.Outline the process for adding or removing partners in the future.

-

9.Review the entire document for accuracy and completeness.

-

10.Save your changes and download or print the finalized agreement for signatures.

How do I make a simple operating agreement for an LLC?

How to create an LLC operating agreement in 9 steps Decide between a template or an attorney. Include your business information. List your LLC's members. Choose a management structure. Outline ownership transfers and dissolution. Determine tax structure. Gather LLC members to sign the agreement. Distribute copies.

How to make a partnership agreement template?

In summation, here's a general template for partnership agreement that you could follow: Partnership Name and Business Purpose. Term of Partnership. Capital Contributions. Ownership and Profit Sharing. Management and Decision-Making. Duties and Responsibilities. Withdrawal, Death, or Incompetency of a Partner.

What is the difference between a partnership agreement and an LLC agreement?

A partnership is governed by a partnership agreement, which specifies the rights and obligations of the entity and its partners. Similarly, an LLC is governed by an operating agreement, which specifies the rights and obligations of the entity and its members.

How much is a partnership agreement?

General pricing for a partnership agreement costs ranges from $500 to $2,000, depending on the length and complexity of the contract, local costs, and individual legal fees.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.