Legal Loan Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender agrees to loan funds to a borrower, including details on loan amount, interest rates, repayment terms, defaults, and governing

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Legal Loan Agreement Template

A Legal Loan Agreement Template is a formal document that outlines the terms and conditions of a loan between a lender and a borrower.

pdfFiller scores top ratings on review platforms

Just a bit complicated to learn how to use the system for an 'oldie' but I'm sure it would become more familiar with more frequent usage. Thank you for allowing a trial to test the systems functionality.

My experience as been wonderful and awesome

It's great to be able to fill out any pdf online. It looks so much more professional. I find the site to be very intuitive and self-explanatory. I've been able to figure out everything I needed just by doing it. I wish the subscription wasn't so expensive though because I don't feel I can afford it. The free trial is a great introduction.

Extremely easy to use and very user friendly. Does exactly what I want it to do.

PDF Filler resulted to me a very useful and agile application.

I liked the ease of using the pdf filler and being able to save and print my documents. If I needed this service regularly, I probably would purchase the service and explore pdf filler furthe

Who needs Legal Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

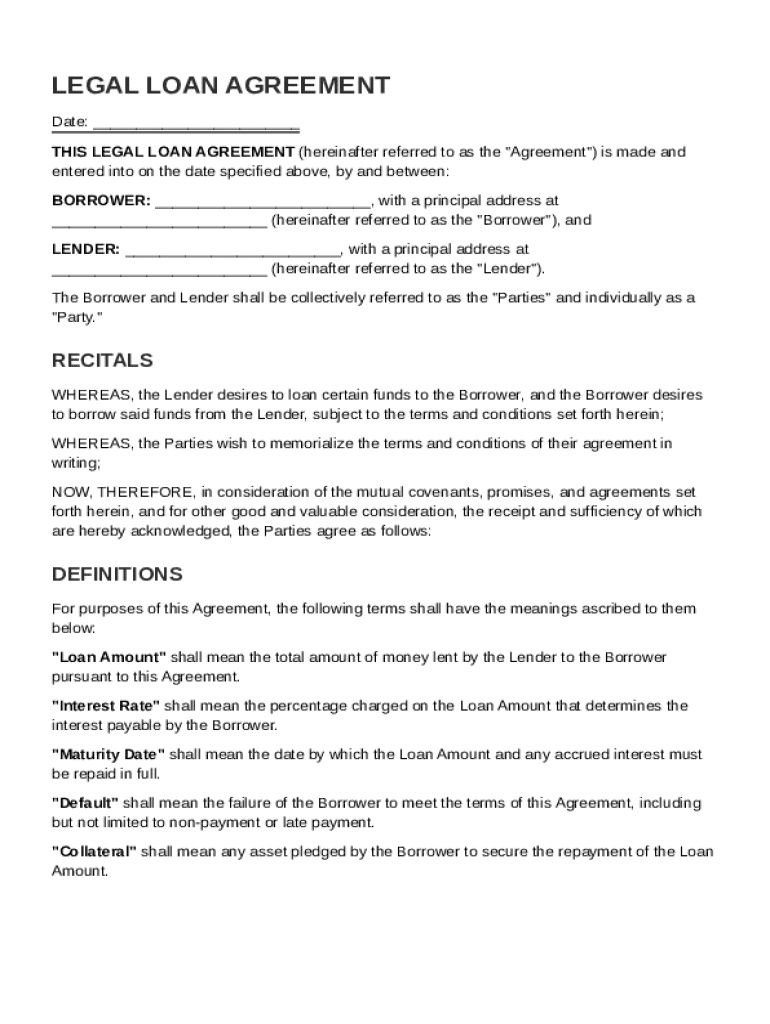

Comprehensive Guide to the Legal Loan Agreement Template Form

How does a loan agreement work?

A loan agreement serves as a crucial document in personal and business transactions, ensuring both parties understand their rights and responsibilities. It articulates the terms of borrowing and repayment, helping to prevent disputes down the line. By having a legal loan agreement template, borrowers and lenders can ensure all necessary details are captured for clarity and future reference.

-

A contract between a borrower and lender outlining the terms of the loan including amount, interest rate, and repayment schedule.

-

Secured loans require collateral, while unsecured loans do not. Do you want a formal or informal agreement? This choice impacts the level of detail and legal standing.

-

Having a written loan agreement protects both parties legally and financially, reducing ambiguity and providing clear recourse in case of disputes.

What are the key components of a legal loan agreement?

Each legal loan agreement should include essential components that ensure the protection of both parties involved. Understanding these key elements allows for better preparation and management of the loan.

-

The agreement should state the date it is signed, along with the names and roles of the borrower and lender.

-

The total amount borrowed (principal) and the charge for borrowing it (interest) must be clearly outlined.

-

Specify when the loan must be repaid and how payments will be made.

-

Outline what happens if payments are missed, including penalties and recourse.

How to fill out a legal loan agreement form?

Filling out a legal loan agreement template can seem daunting, but it becomes manageable when broken down into clear steps. Here’s a guide to assist you in filling out the agreement accurately using pdfFiller’s interactive tools.

-

The first essential piece of information is the date on which the agreement is signed. This establishes the timeline for the loan.

-

Clearly state the total amount being borrowed. Ensure this aligns with your understanding with the lender.

-

Clearly define how and when the borrower will repay the loan, providing details on any interest calculations.

-

Cross-check all filled information with the lender to confirm accuracy before finalizing the document.

Can you edit and customize a legal loan agreement?

Customizing a loan agreement template is crucial to reflect the specific needs and conditions applicable to your agreement. pdfFiller provides various tools for editing to ensure your document meets local laws and regulations.

-

Users can add clauses that pertain to their particular agreement, specifying additional terms or conditions.

-

pdfFiller offers tools to modify text, adjust formatting, and insert new sections to enhance clarity.

-

It's essential to ensure that your agreement complies with local laws. Consider consulting a legal professional in your jurisdiction.

Why is signing the loan agreement important?

The signing of a loan agreement is not just a formality; it is a legal act that binds both parties to the terms outlined in the document. Understanding the significance of e-signatures can streamline this process significantly.

-

E-signatures allow for quick and secure signing without the need for physical documents, enhancing accessibility.

-

Electronic signatures, when executed properly, are legally valid in many jurisdictions, addressing common concerns about legality.

-

Ensure the signed document is stored securely, and consider sending copies to both borrower and lender to ensure transparency.

How can you manage your loan agreement effectively?

Managing your loan agreement is crucial for effective repayment and maintaining good relationships with your lender. Utilizing pdfFiller's collaboration tools can streamline this process.

-

Leverage pdfFiller's tracking features to monitor payment schedules and ensure timely repayments.

-

Maintain open lines of communication between borrower and lender to address concerns proactively.

-

In case of default, knowing the steps to take and available resources can help mitigate issues effectively.

How to fill out the Legal Loan Agreement Template

-

1.Download the Legal Loan Agreement Template from pdfFiller.

-

2.Open the template in the pdfFiller editor.

-

3.Fill in the borrower's full name and contact information in the designated fields.

-

4.Enter the lender's name and contact details next.

-

5.Specify the loan amount in a clear and distinct manner.

-

6.Set the interest rate and include any applicable fees or charges.

-

7.Outline the repayment terms, including the loan duration and payment schedule.

-

8.Include conditions for default and any collateral described.

-

9.Sign the document digitally, ensuring both parties complete the necessary signature fields.

-

10.Save your completed loan agreement and distribute copies to all parties involved.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.