Last updated on Feb 17, 2026

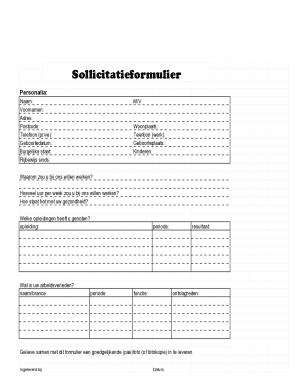

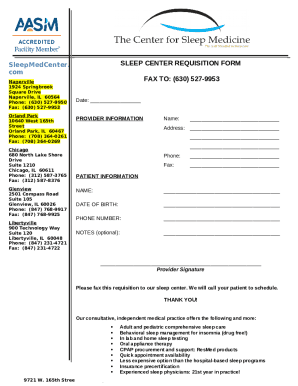

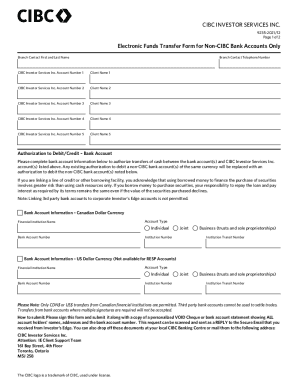

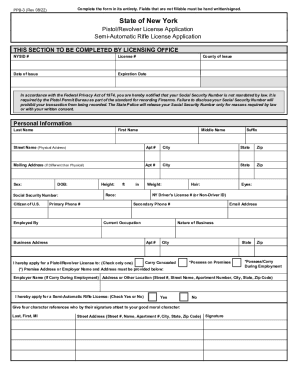

Lender Agreement Template free printable template

Show details

This document outlines the terms and conditions under which a lender agrees to provide a loan to a borrower, including definitions, loan details, repayment terms, interest rates, collateral, representations,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Lender Agreement Template

A Lender Agreement Template is a legal document that outlines the terms of a loan between a lender and a borrower.

pdfFiller scores top ratings on review platforms

What do you like best?

I like the fact pdf Fills stores and keep my documents in order!

I like it's easy to use, and it comes with a fax!!

I am very pleased that I can send a fax, and I am able to submit report!

Also, it come with live help that is an excellent feature!

What do you dislike?

I dislike the wait period of 30 minute if I forget my password!

The systems doesn't seem to lock in my password.

I believe I have changed passwords maybe 3 times in under a year.

Recommendations to others considering the product:

Try it! The price is good! The service is good! I have spoke with tech support a couple of time because I got locked out because I forgot my password and made to many attempts, so that's an excellent feature! You can also send faxes, so that's good. I will look to renew my subscription again! It's a good product!

What problems are you solving with the product? What benefits have you realized?

Well because of pdfFiller, I can send pdf files to coworkers and present files as needed!

Before pdfFiller, my pdf files were not accepted by my supervisor and staff computers, but now, I can send pdf files with no concerns using pdfFiller! With the company working from home and folks using different systems/computer it's good that pdfFiller documents are able to be received by all my coworkers!

What do you like best?

Ease of use, flexibility of tools and automatic saving. Full encompassing product, re-write, over test, add images, move fields, add e-signatures, and complete forms. All gets saved in a highly professional manner, and saved automatically to my own personal files.

What do you dislike?

Having to re-verify login each time I visit the site often with delay whilst an email arrives, sometimes have to click through multiple screens.

Recommendations to others considering the product:

Try it, you'll be immediately hooked. On first use, give yourself 10mins to familiarise yourself with the product it is incredibly intuitive, easy to teach onesful.

What problems are you solving with the product? What benefits have you realized?

No Problems, benefits are to adjust and edit pdf documents with ease, adjust previously written words, add to them, over right, add images.

What do you like best?

Signature function. Helps to send documents securely

What do you dislike?

Having to download documents to my computer instead of being able to directly email to myself without a code

Recommendations to others considering the product:

None

What problems are you solving with the product? What benefits have you realized?

Sending official documents with my electronic signature is very helpful instead of having to mail documents

What do you like best?

It is much easier to use than Adobe Acrobat. Much more intuitive functions and file management. It has saved me a ton of time with the cloud storage of documents. I have used effectively for construction related documents.

What do you dislike?

Very rarely I have needed to use another platform because some municipalities require it but 98% of what I need to do is supported.

What problems are you solving with the product? What benefits have you realized?

Remote completion of forms and extracting text from PDF documents mostly.

What do you like best?

The ability to change/save PDF files, the online signatures, the ability to delete unwanted pages in a PDF.

What do you dislike?

The auto "next" field selector thing...I figure out a way around it, it's just annoying.

What problems are you solving with the product? What benefits have you realized?

I'm a CPA and I can easily type important forms for federal and state governments to keep them professional and easy to read.

What do you like best?

Easy to use when you need a fast, effective solution.

What do you dislike?

The email interface is a little cumbersome, but still very usable.

Recommendations to others considering the product:

Easy to use and deploy. No licensing to worry about and no updates!

What problems are you solving with the product? What benefits have you realized?

Filling out and modifying .pdf's. Also applying my signature to documents.

Who needs Lender Agreement Template?

Explore how professionals across industries use pdfFiller.

Lender Agreement Template Guide

How do you define a lender agreement template?

A lender agreement template serves as a starting point for structuring a loan agreement between a lender and a borrower. It outlines the responsibilities, rights, and obligations of both parties. Using a template ensures legal clarity and helps prevent misunderstandings during the lending process.

What are the key roles in a lender agreement?

-

The lender is the individual or entity that provides the loan, enabling the borrower to access the funds they need.

-

The borrower is the person or organization that receives the loan and commits to repaying it according to the agreed terms.

Recognizing these roles is crucial since each party has distinct legal rights and responsibilities. The lender typically expects repayment with interest, while the borrower seeks to use the funds for a specified purpose.

What are the essential components of a lender agreement?

-

Clearly state the lender's legal name and contact information.

-

Document the borrower's full legal name and address to avoid disputes.

-

Indicate the total amount being loaned, ensuring clarity on what is provided.

-

Detail the interest rate being applied, whether fixed or variable.

-

Clarify the duration for which the loan is granted, including start and end dates.

-

Outline consequences if the borrower fails to meet repayment obligations.

How to fill out the lender agreement template?

Filling out the lender agreement template should be done systematically. Start with the identification of both parties, followed by detailing the financial terms. Accuracy is critical to ensure that all conditions reflect the true intent of the agreement.

-

Enter the lender and borrower details accurately.

-

Specify the loan amount and interest rate clearly.

-

Define the repayment schedule and any penalties for default.

Common mistakes include overlooking signature lines or failing to specify payment methods, which can lead to disputes. Always double-check for accuracy.

What are the terms and conditions of a lender agreement?

-

A concise explanation of the purpose for the loan.

-

Clarify how the borrower intends to use the funds.

-

Include payment schedules and grace periods, if applicable.

-

Outline accepted payment methods and any relevant instructions.

How to manage your lender agreement?

Effective management of your lender agreement is essential for transparency and accessibility. Using pdfFiller, you can store and access your agreement securely and conveniently with cloud technology.

-

Utilize digital signatures for a quick and secure signing process without needing to print documents.

-

Share the document with multiple parties, allowing them to make edits or comments.

What legal considerations should you keep in mind?

Legal implications of lender agreements can vary by region, affecting enforcement of terms and conditions. It is critical to be aware of regulatory requirements to avoid pitfalls.

-

Understanding that non-compliance can lead to penalties for both lender and borrower.

-

It's essential to research applicable laws in your state or country.

-

Neglecting legal considerations can result in void agreements and hefty fines.

How to review and modify your lender agreement?

Regular reviews of your lender agreement ensure it stays relevant and compliant with current laws. With pdfFiller's tools, making edits to your agreement is quick and efficient.

-

Check for any outdated terms and ensure all information is current.

-

Use pdfFiller’s editing tools to make changes easily.

-

Consider modifications in case of changes in circumstances or legal requirements.

What are the final thoughts on using a lender agreement template?

Using a lender agreement template offers numerous benefits, including saving time and ensuring the inclusion of essential terms. By utilizing tools like pdfFiller, you not only streamline document management but also enhance collaboration and legal compliance.

To achieve optimal outcomes, make full use of the resources available. Always remember that clarity in legal documentation is vital for successful lending relationships.

How to fill out the Lender Agreement Template

-

1.Go to pdfFiller and upload the Lender Agreement Template PDF.

-

2.Review the document for any pre-filled information or placeholders that need to be completed.

-

3.Start with the 'Lender Information' section; input the full name and contact details of the lender.

-

4.Next, fill in the 'Borrower Information' section with the full name and contact details of the borrower.

-

5.Proceed to detail the loan amount, interest rate, and repayment terms in the appropriate sections.

-

6.Ensure the start date and maturity date are correctly filled in.

-

7.If applicable, include collateral information in the designated area.

-

8.Review the repayment schedule and ensure it matches the agreed terms.

-

9.After verifying all information is accurate, save the changes, and then download or print the completed document.

How do I write a lending agreement?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

What is a borrower-lender agreement?

(a) a credit agreement to finance a transaction between the borrower and the lender, whether forming part of that agreement or not; (b) a credit agreement: (i) to finance a transaction between the borrower and a person ("the supplier") other than the lender, and.

What is the agreement between lender and borrower?

The Lender agrees to lend to the Borrower and the Borrower agrees to borrow from the Lender for the purposes specified in Article 2 hereof and on the terms and conditions contained herein, a sum not exceeding Rs. __/-_ (Rupees __ only). The said sum is hereinafter referred to as “the Loan”.

What is a lender's agreement in principle?

An Agreement in Principle (AIP) is also known as a Mortgage Promise or Decision in Principle. This is often seen as your first step to buying or remortgaging a home. When you apply for an Agreement in Principle, the lender will ask about your finances and look at interest rates to work out what you can afford to repay.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.