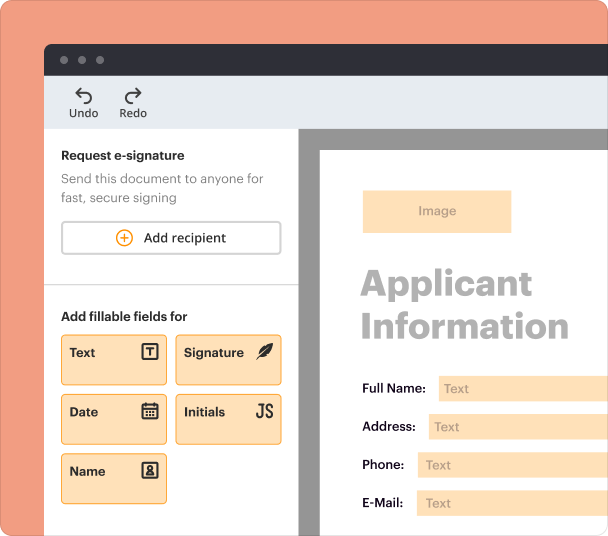

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

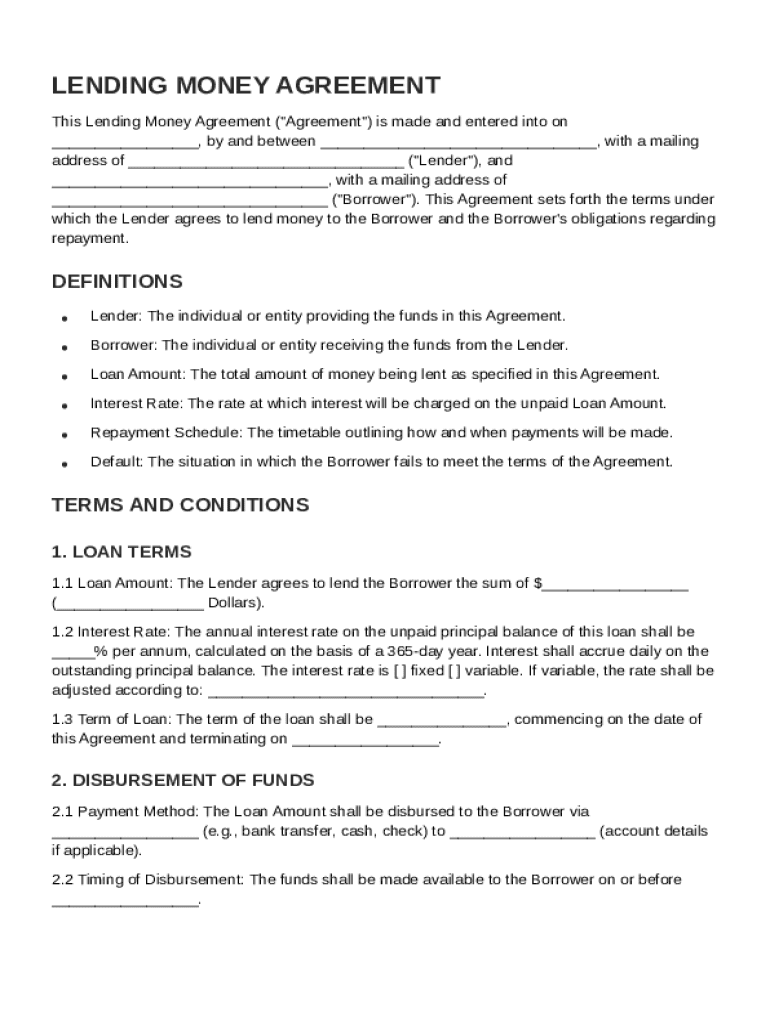

Lending Money Agreement Template free printable template

Show details

This document is a legal agreement between a lender and a borrower outlining the terms and conditions of a loan, including amount, interest rate, repayment schedule, and default consequences.

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

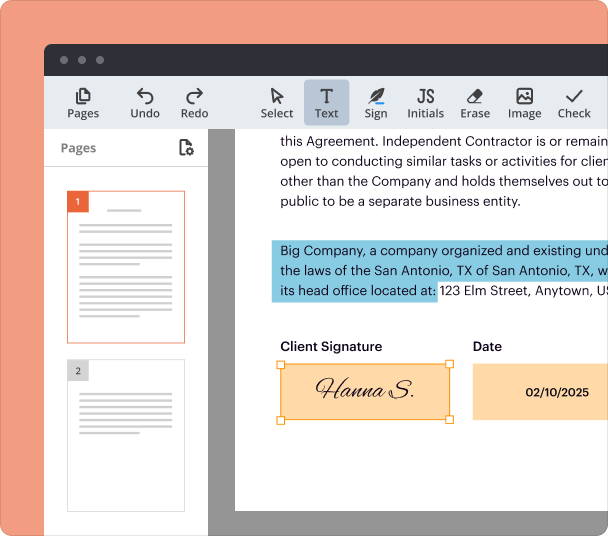

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

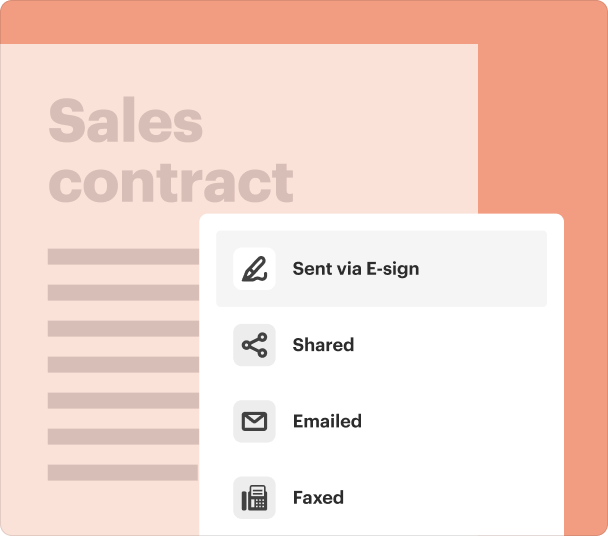

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

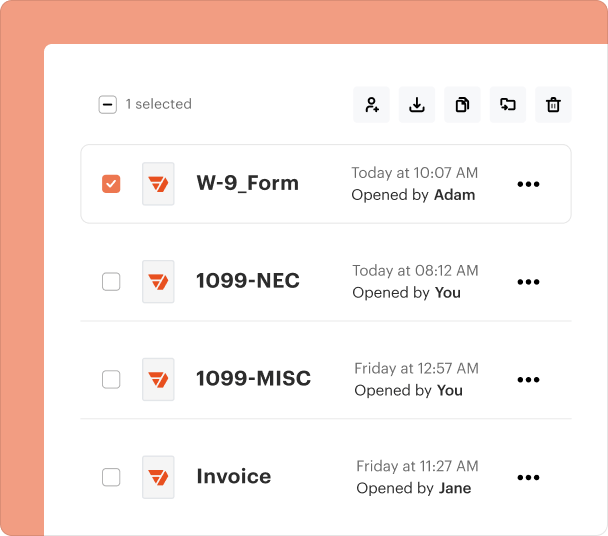

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Lending Money Agreement Template

Here you will find essential guidelines on how to effectively edit and fill out the Lending Money Agreement Template using pdfFiller.

How to edit Lending Money Agreement Template

pdfFiller makes editing your Lending Money Agreement Template simple and efficient. Follow these steps:

-

1.Click ‘Get form’ on this page to access the Lending Money Agreement Template.

-

2.Create a pdfFiller account or log in if you already have one.

-

3.Once logged in, upload the document by choosing it from your files or import it directly from a URL.

-

4.Utilize the editing tools available to make modifications to the template; you can add text, adjust formatting, and include digital signatures as needed.

-

5.After completing your edits, save the document to your pdfFiller account or download it for future use.

How to fill out Lending Money Agreement Template

Filling out the Lending Money Agreement Template is crucial for accurately documenting loan agreements. Obtaining and completing this template is straightforward through pdfFiller.

-

1.Start by clicking ‘Get form’ on this page to access the Lending Money Agreement Template.

-

2.Log into your pdfFiller account or create a new account if you don’t have one.

-

3.Fill in the required fields, including the names of the parties involved and the loan amount.

-

4.Specify the repayment terms, including interest rates and payment schedules.

-

5.Add any specific conditions or clauses as needed for protection and clarity.

-

6.Review the document to ensure all information is accurate and complete.

-

7.Sign the agreement electronically using pdfFiller’s eSignature feature.

-

8.Save and download the completed document for your records.

All you need to know about Lending Money Agreement Template

This section provides an overview of what a Lending Money Agreement Template entails and its importance in financial transactions.

What is a Lending Money Agreement Template?

A Lending Money Agreement Template is a legal document that establishes terms between a lender and a borrower. It details the loan amount, interest rates, repayment terms, and consequences for default.

Definition and key provisions of a Lending Money Agreement

Understanding the core components of a Lending Money Agreement Template is critical for both parties involved. The key provisions typically include:

-

1.Identification of the lender and borrower.

-

2.Loan amount and disbursement details.

-

3.Interest rates applicable.

-

4.Repayment schedule and due dates.

-

5.Clauses regarding default and late payments.

-

6.Governing law jurisdiction.

-

7.Signature lines for both parties.

When is a Lending Money Agreement used?

A Lending Money Agreement is used whenever a loan is extended, whether between friends, family, or business entities. It formalizes the arrangement, ensuring clarity and reducing the potential for disputes.

Main sections and clauses of a Lending Money Agreement

The main sections of a Lending Money Agreement Template are essential for clarity. Below are the primary sections you can expect:

-

1.Title of the agreement

-

2.Parties’ information and identifiers

-

3.Loan details

-

4.Interest rate provisions

-

5.Payment terms

-

6.Default and remedies section

-

7.Signatures and date fields

What needs to be included in a Lending Money Agreement?

To ensure a comprehensive Lending Money Agreement Template, include the following elements:

-

1.Names and contact information of the lender and borrower.

-

2.Loan amount and purpose of the loan.

-

3.Specific interest rate and any applicable fees.

-

4.Clear repayment schedule with dates.

-

5.Consequences for non-payment or late payment.

-

6.Governing law that is applicable to the agreement.

-

7.Signature lines for both parties and date of the agreement.

How to write a contract for lending money?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

What is the agreement for lending someone money?

A written loan agreement is a contract between the person lending the money and the person borrowing the money. A written loan agreement should include details of: the full names and addresses of the parties. the principal amount of the loan.

How do you write a money agreement?

You can create a simple payment contract with these steps: Look for examples of payment agreement contracts online. Format your document. Write your title. Outline the parties involved in the agreement. Clearly write out the terms of the loan. Explain that the contract represents the entire agreement.

How do I make a promissory note for lending money?

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers — include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

pdfFiller scores top ratings on review platforms

I only have one contract to fill out as a real estate agent...My contracts are months apart so only need one month of service. after the learning curve this program is fairly easy to finish my needs....

It's great, aside from it being a littele tricky to fill in the text boxes

Its's great for insurance form preparation for our office.

Saved me a lot of time. brilliant system.

solo pedi esta herramienta por un año con un costo de 72 al año y me cobraron $1,330.62Solicito se me devuelva el importe cobrado a mi tarjeta de credito

Love the forms and data entry, but after purchasing this service, I find it difficult to print.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.