Lloyds Loan Agreement Template free printable template

Show details

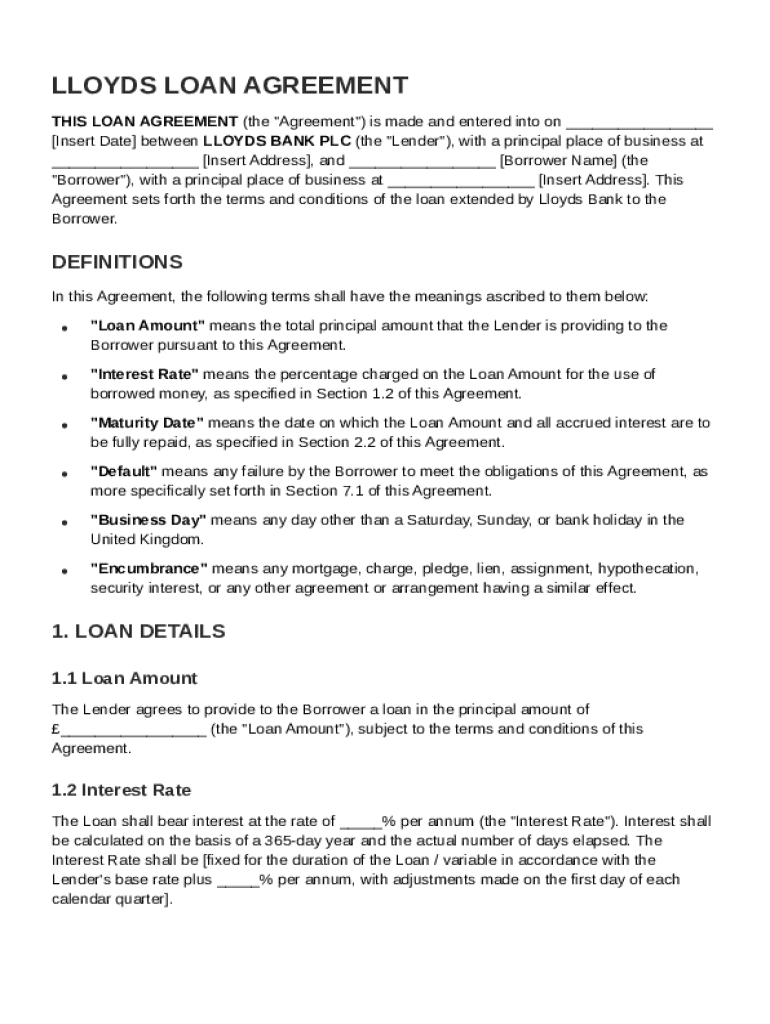

This document outlines the terms and conditions of a loan provided by Lloyds Bank to a borrower, defining the loan amount, interest rate, repayment schedule, obligations of the borrower, and rights

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Lloyds Loan Agreement Template

The Lloyds Loan Agreement Template is a standardized document used to outline the terms and conditions of a loan provided by Lloyds Bank.

pdfFiller scores top ratings on review platforms

It's needs to be more user friendly.

well today is my 1st day ever using it but I needed it to fill out an rental application and so far it has worked well.

easy access to forms

Very user friendly. Only problem is the date is in US format which is not the same as Australian / UK format - maybe give us an option?

Everything

overall nice

Who needs Lloyds Loan Agreement Template?

Explore how professionals across industries use pdfFiller.

Lloyds Loan Agreement Template Guide

Understanding the Lloyds Loan Agreement

A Lloyds Loan Agreement is a formal document outlining the terms of a loan between a lender and a borrower. This agreement serves to protect both parties by clearly stating the conditions under which the loan is granted. Key stakeholders involved in this agreement include the lender, typically a financial institution like Lloyds, and the borrower, who could be an individual or business in need of financing.

-

The Lloyds Loan Agreement formalizes the loan terms and specifies the rights and responsibilities of each party.

-

Lenders and borrowers form the main parties; understanding their roles is crucial.

-

A well-structured agreement minimizes disputes and enhances clarity.

What are the key components of the agreement?

The effectiveness of a Lloyds Loan Agreement relies heavily on its key components. Each element plays a vital role in determining how the loan operates and what expectations are placed on both parties.

-

This refers to the total sum borrowed and is critical as it impacts repayment plans.

-

Interest can be fixed or variable; understanding this affects financial planning and commitments.

-

This is the deadline for completing repayment, underlining the loan's timeline.

-

Default entails failing to meet loan obligations, which can have serious consequences like legal action.

-

Defined as any day other than a weekend or public holiday, affecting deadlines and processes.

-

Refers to claims or liabilities against the loan that could affect repayments.

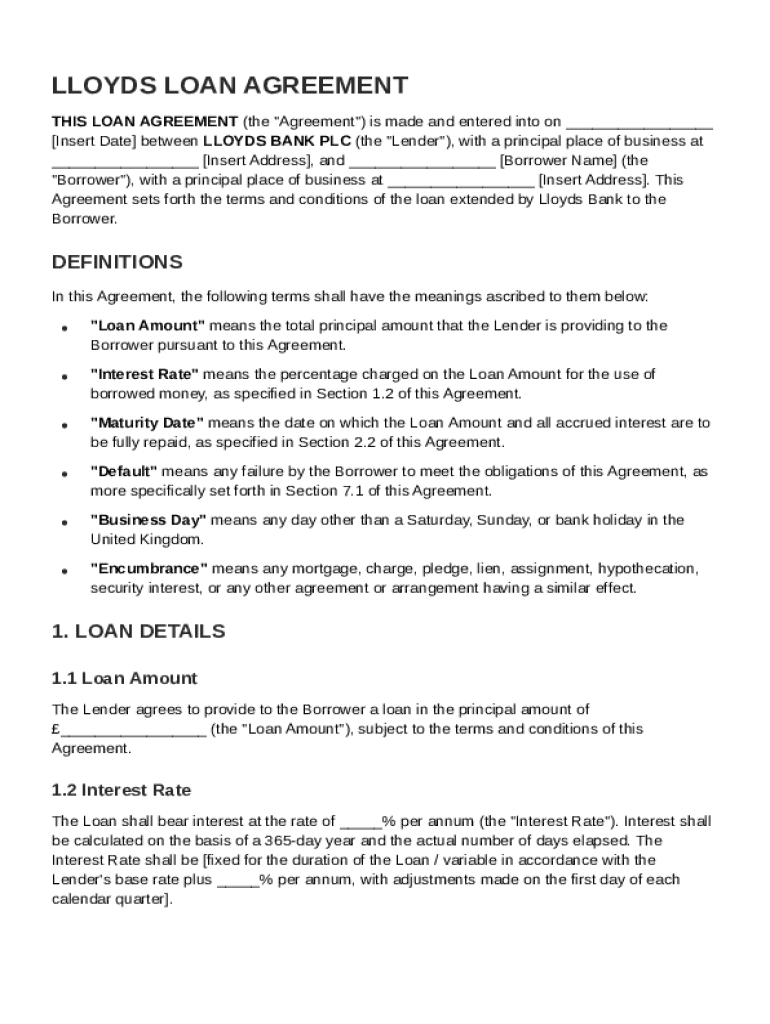

How do you fill out the agreement template?

When filling out the Lloyds Loan Agreement template, accuracy is paramount. Each section requires careful attention to ensure that all necessary information is correctly presented.

-

Ensure that you format the date correctly, typically as 'DD/MM/YYYY'. This sets the agreement in time.

-

Provide complete and accurate addresses for both the lender and borrower to avoid confusion.

-

Calculate the amount carefully based on your financial needs and repayment capacity.

-

Choose a rate that reflects current market trends and your financial situation.

-

Consider factors like income and expenses to choose a realistic repayment deadline.

How can you edit and customize your agreement?

Editing your Lloyds Loan Agreement is straightforward with tools like pdfFiller. This platform not only allows for modifications but also enables team collaboration.

-

Adjust any section to better fit your needs, ensuring accuracy and satisfaction.

-

Share the document with colleagues for input to refine terms before finalizing.

-

Utilize pdfFiller’s security features to protect your completed document.

What are the steps to sign and finalize the agreement?

Finalizing your Lloyds Loan Agreement involves ensuring completion and signing the document. Electronic signatures have gained legality and are a convenient way to expedite the process.

-

In the UK, electronic signatures are legally recognized, simplifying agreements.

-

Follow prompts on pdfFiller to complete the signing process seamlessly.

-

Review to ensure both parties understand and agree before completing the agreement.

How do you manage your Lloyds Loan Agreement?

Managing your Lloyds Loan Agreement is crucial for successful loan repayment. Make use of tools to keep your tasks organized and efficient.

-

Set reminders for due dates to ensure timely payments and avoid defaults.

-

Have a plan in place outlining steps to take should repayment issues arise.

-

Keep all related documents organized within the platform for easy access whenever needed.

How to fill out the Lloyds Loan Agreement Template

-

1.Access the Lloyds Loan Agreement Template on pdfFiller.

-

2.Review the document for any pre-filled information specific to your loan.

-

3.Fill in the borrower's personal information, including full name, address, and contact details.

-

4.Provide details about the loan, including the loan amount, purpose, and repayment terms.

-

5.Enter the interest rate and any applicable fees associated with the loan.

-

6.Include repayment schedule information, detailing due dates and amounts.

-

7.Review all entered information for accuracy and completeness.

-

8.Add any necessary signatures in the designated areas, ensuring all parties sign the document.

-

9.Save the completed document and consider sending it for further review before finalization.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.