Last updated on Feb 17, 2026

Loan Assignment Agreement Template free printable template

Show details

This document outlines the terms and conditions under which the Assignor assigns its rights and obligations under a Loan Agreement to the Assignee.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

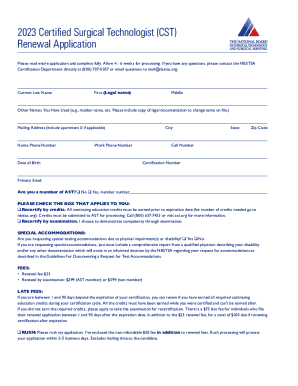

What is Loan Assignment Agreement Template

A Loan Assignment Agreement Template is a legal document that allows the transfer of rights and obligations of a loan from one party to another.

pdfFiller scores top ratings on review platforms

I found PDF filler to be very helpful, however there was a bit of confusion with the cost of the account account. I I thought that I would be getting charged $6 dollars per month however my bank account was charged $72 dollars for an entire years subscription. I do not fill out enough documents to make a years subscription worthwhile. If that is the case, I think the website should give you the option of a 30 day trial period, and then give you the option of committing to a 1 year subscription. Otherwise, be more clear that you all are charging the entire $72 as oppose to the $6 per month. I have since canceled my subscription and I do not intend to use the website any longer. I would definitely like a refund effective immediately.

EASY TO USE AND FINISHED DOCUMENT VERY PROFESSIONAL

When I go to save form it goes to my computer but I can not find it.

My experience has been great. The customer service department is also amazing.

Very useful for filling out forms used in my rental property.

Excellent way to create forms which I use in my classes. I like that I can edit pdf files.

Who needs Loan Assignment Agreement Template?

Explore how professionals across industries use pdfFiller.

How to fill out a Loan Assignment Agreement Template form

Understanding the Loan Assignment Agreement

A Loan Assignment Agreement is crucial for transferring the rights and obligations of a loan from one party to another. This document ensures that both the assignor (the party transferring the rights) and the assignee (the party receiving the rights) are clear about their responsibilities. Proper documentation helps to prevent misunderstandings and legal disputes, making it vital in both personal finance and lending industries.

-

A Loan Assignment Agreement formalizes the transfer of loan rights, clarifying obligations and ensuring the new holder has the authority to collect payments.

-

The assignor transfers the loan rights, while the assignee receives these rights, making their roles significant in the contract.

-

Documenting the assignment not only provides a legal record but also protects all parties in case of future disputes.

Situational analysis: When to use a Loan Assignment Agreement

Knowing when to use a Loan Assignment Agreement can save time and reduce complications. Both business contexts and personal situations may require such an agreement, especially when financial responsibilities change hands. Understanding typical scenarios where this document is necessary provides insight into its application.

-

Businesses often sell or transfer their debts, necessitating a formal agreement to protect all involved parties.

-

Individuals can also use this agreement for transferring personal loans, ensuring the lender's rights are respected.

-

Scenarios such as loan sales, unloading bad debts, or family member assistance may benefit from a Loan Assignment Agreement.

Key components of the Loan Assignment Agreement

A well-structured Loan Assignment Agreement must include essential components to function effectively. These components outline the essential terms and definitions, guiding the parties through their rights and obligations. Properly filling in critical information like dates, parties involved, and loan amounts is crucial for the document's validity.

-

Defining key terms ensures that both parties understand their responsibilities and rights under the agreement.

-

Details such as loan amount, parties' addresses, and the date of agreement are necessary for identifying the specifics of the loan.

-

Understanding the 'Effective Date' clarifies when the agreement is in force, impacting both parties' obligations.

Step-by-step guide to filling out the Loan Assignment Agreement

Filling out a Loan Assignment Agreement should be done carefully to ensure all details are accurate. Beginning with preliminary steps, such as gathering necessary information and documents, sets the stage for a successful agreement. Following through with detailed instructions regarding each section mitigates the risks of errors.

-

Collect all relevant information about the loan and both parties, ensuring clarity in communication.

-

Follow comprehensive instructions to fill out each section correctly, minimizing the chance of omissions.

-

Double-check the party names, addresses, and amounts to prevent legal issues stemming from inaccuracies.

Legal considerations in a Loan Assignment Agreement

Certain legal considerations are pivotal when drafting a Loan Assignment Agreement. Understanding the regulations and compliance requirements specific to your state is essential to ensure the agreement’s validity. Notifying involved parties and managing consent are also crucial in minimizing legal risks.

-

Each state has distinct laws about loan assignments, making it necessary to familiarize yourself with the applicable rules.

-

All parties involved must be informed about the assignment, as consent is often required.

-

Taking legal precautions can help minimize liability and prevent future disputes over the loan.

Benefits of using pdfFiller for your Loan Assignment Agreement

Using pdfFiller to manage your Loan Assignment Agreement streamlines the process significantly. This platform allows users to edit and manage PDF documents effortlessly, ensuring clarity and functionality. Collaborative features enable teams to work together seamlessly, while electronic signatures expedite the signing process.

-

pdfFiller empowers users to make modifications on-the-fly, accommodating necessary changes swiftly.

-

Teams can work together in real-time, enhancing productivity and ensuring every detail is accurate.

-

Electronic signatures not only speed up the document process but also facilitate secure, verifiable signings.

Finalizing your Loan Assignment Agreement

Before finalizing a Loan Assignment Agreement, reviewing all details is critical. Double-checking key components ensures that no vital information is missing. Once signed, securely saving and sharing the document can be easily managed through pdfFiller's platform.

-

Ensuring everything is in order before execution prevents mistakes that could lead to disputes.

-

Managing your agreement online with pdfFiller ensures easy access while maintaining security.

-

Understanding the next steps for both the assignor and assignee will help clarify obligations post-agreement.

Common mistakes to avoid in loan assignments

Failure to recognize potential pitfalls when drafting a Loan Assignment Agreement can lead to severe consequences. Omitting key details can invalidate the agreement, while misunderstanding legal implications may result in unintended liabilities. Communication is essential to ensure that all parties are informed.

-

Missing critical information can nullify the agreement or lead to disputes later on.

-

Not grasping the legal aspects may expose parties to liabilities they were unaware of.

-

All relevant parties must be kept in the loop to ensure consent and understanding of responsibilities.

How to fill out the Loan Assignment Agreement Template

-

1.Open the Loan Assignment Agreement Template on pdfFiller.

-

2.Begin by entering the names and contact details of the Assignor (the original lender) and the Assignee (the new lender).

-

3.Specify the loan details including the loan amount, interest rate, and original agreement date.

-

4.Indicate the effective date of the assignment and ensure it aligns with both parties' agreement.

-

5.Include any other relevant terms or conditions regarding the assignment in the designated section.

-

6.Review the document for accuracy, making sure all information is correct and complete.

-

7.Sign the agreement in the provided signature section. If necessary, include witness signatures.

-

8.Save the completed document and consider downloading or printing for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.