Loan Assumption Agreement Template free printable template

Show details

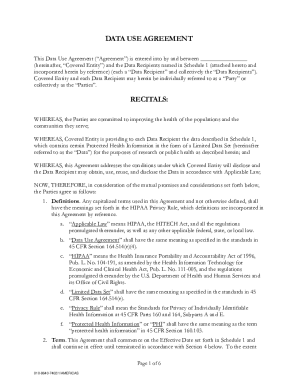

This document outlines the agreement between the Current Borrower, Assuming Borrower, and Lender regarding the assumption of an existing loan by the Assuming Borrower, detailing terms, conditions,

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Assumption Agreement Template

A Loan Assumption Agreement Template is a legal document that allows one party to assume the loan obligations of another party with the lender's consent.

pdfFiller scores top ratings on review platforms

I'm not always sure where it saves the documents to and would prefer to have a regular folder in which to save my documents

So far I'm loving the seamless editing features.

Good so far except I can't find the Illinois form 561 for student enrollment and attendance verification and I need it

Following my previous comment, I found the tax forms I was working on, but they were titled by the Form, not saved documents. Taking me well over an hour due to the labeling. Need a Saved Documents Option to simplify it.

Pretty easy to use. User friendly use it all the time ! Its great. Thank you.

I love the forms, they're easy to save and print. Also, by paying for the package deal upfront for the year I saved money. Thank you!!

Who needs Loan Assumption Agreement Template?

Explore how professionals across industries use pdfFiller.

Loan Assumption Agreement Template Form

How do you define a loan assumption agreement?

A Loan Assumption Agreement is a legal document that allows a borrower to transfer the obligations of a loan to another party. It serves the purpose of facilitating the transfer of responsibility for loan payments and any associated collateral to the assuming borrower. This agreement is beneficial because it enables the current borrower to relieve themselves of debt obligations while allowing the assuming borrower to take over the loan under its existing terms.

-

Transferring loan obligations can free up credit for the current borrower and potentially provide a lower interest rate for the assuming borrower.

-

The key parties include the Current Borrower, who wants to transfer the loan, the Assuming Borrower, who will take on the obligation, and the Lender, who must approve the agreement.

What are the essential components of the agreement?

-

This is crucial as it signifies when the agreement commences and the loan obligations transition.

-

Clearly identifying the Current Borrower and the Assuming Borrower avoids any confusion during the transfer process.

-

The agreement should include information about the Lender and their role in approving the assumption.

-

Recitals provide context for the agreement, outlining the rationale for the assumption.

How is the loan described in the agreement?

-

This represents the initial size of the loan and indicates the level of debt being transferred.

-

This balance must be computed to ensure the assuming borrower knows exactly what they are taking over.

-

Understanding the annual interest rate is necessary, as it affects monthly payments and overall loan cost.

-

Details regarding how and when payments are to be made should be clearly outlined to set expectations.

-

This date is significant as it tells when the loan will be fully paid off.

-

Collateral provides security to the lender, and it is crucial to clarify what assets are involved.

What are the steps for completing the loan assumption agreement?

-

Collect all relevant financial and personal documentation necessary for both borrowers.

-

Diligently follow instructions for each section to ensure the agreement is filled out correctly.

-

Utilize pdfFiller’s features to ensure the document is error-free before signing.

-

Use the eSigning process through pdfFiller to make the signing step quick and efficient.

How can you manage your loan assumption agreement?

-

After completion, modifications might be necessary; pdfFiller allows for easy updates.

-

Store all agreements securely on pdfFiller’s cloud platform to ensure they are accessible yet protected.

-

Utilize collaboration tools within pdfFiller to manage agreements effectively and ensure all parties are informed.

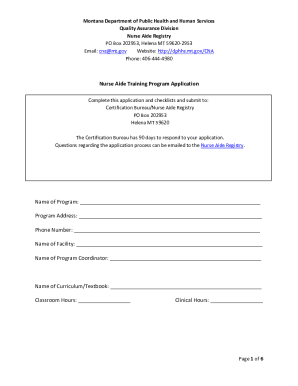

How to fill out the Loan Assumption Agreement Template

-

1.Obtain the Loan Assumption Agreement Template, either digitally or in printed format.

-

2.Review the template to understand the necessary sections, such as borrower details, lender information, and loan specifics.

-

3.Fill in the names and contact information of the original borrower and the new borrower who will assume the loan.

-

4.Include the loan details such as the loan amount, interest rate, payment schedule, and remaining balance.

-

5.If applicable, mention any required lender consent or conditions for the loan assumption in the designated section.

-

6.Review and verify all entered information for accuracy before finalizing the form.

-

7.Sign and date the agreement where necessary, and obtain signatures from all involved parties, including the lender if required.

-

8.Make copies of the completed agreement for all parties and ensure it is submitted to the lender for approval.

What is the assumption agreement for a loan?

A loan assumption agreement is an agreement between a lender, original borrower, and a new borrower, where the new borrower agrees to assume responsibility for the debt owed by original borrower. These agreements are commonly seen in mortgages and real estate.

What is an example of a loan assumption?

For example, if Sarah is selling her home with an FHA loan at 3.25% with 25 years remaining and $250,000 left on the balance, buyer Mike could assume this mortgage and continue making payments under these exact terms rather than applying for a brand-new mortgage at today's rates.

What are the rules for assumption of a loan?

An assumable mortgage allows a home buyer to not just move into the seller's former house but to step into the seller's loan, too. This means that the remaining balance, repayment schedule and rate will be taken over by the new owner.

How do I write a simple loan agreement?

Start Your Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.