Loan Between Employer and Employee Agreement Template free printable template

Show details

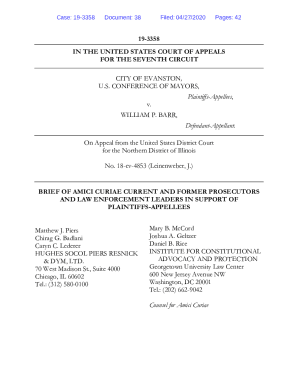

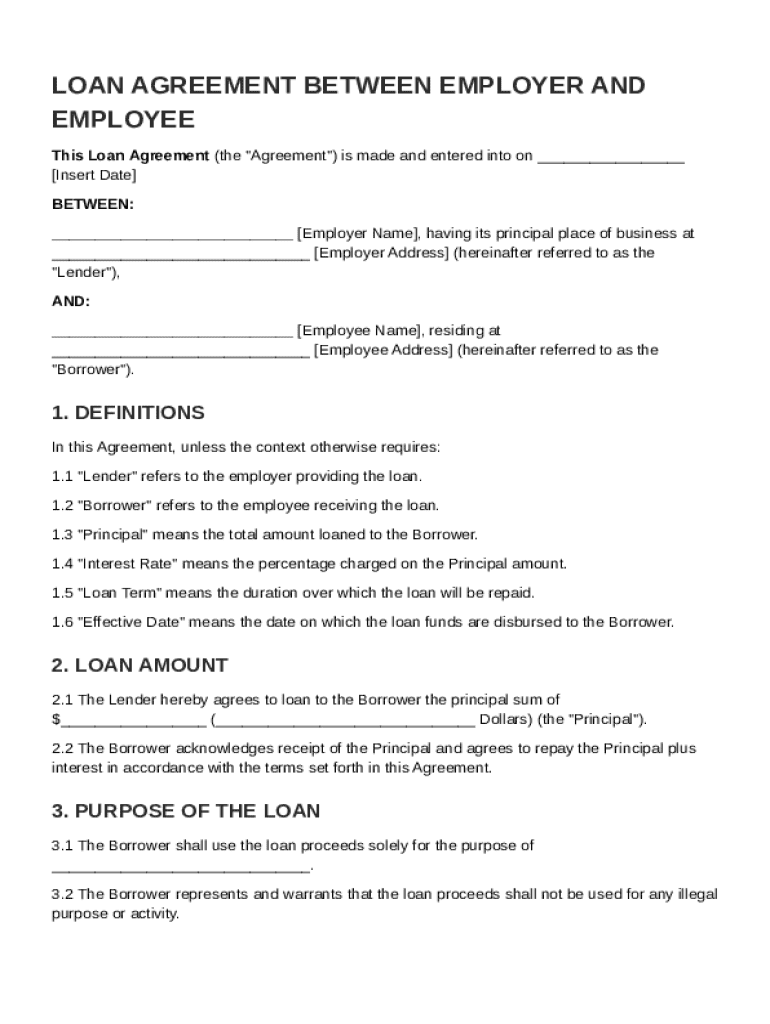

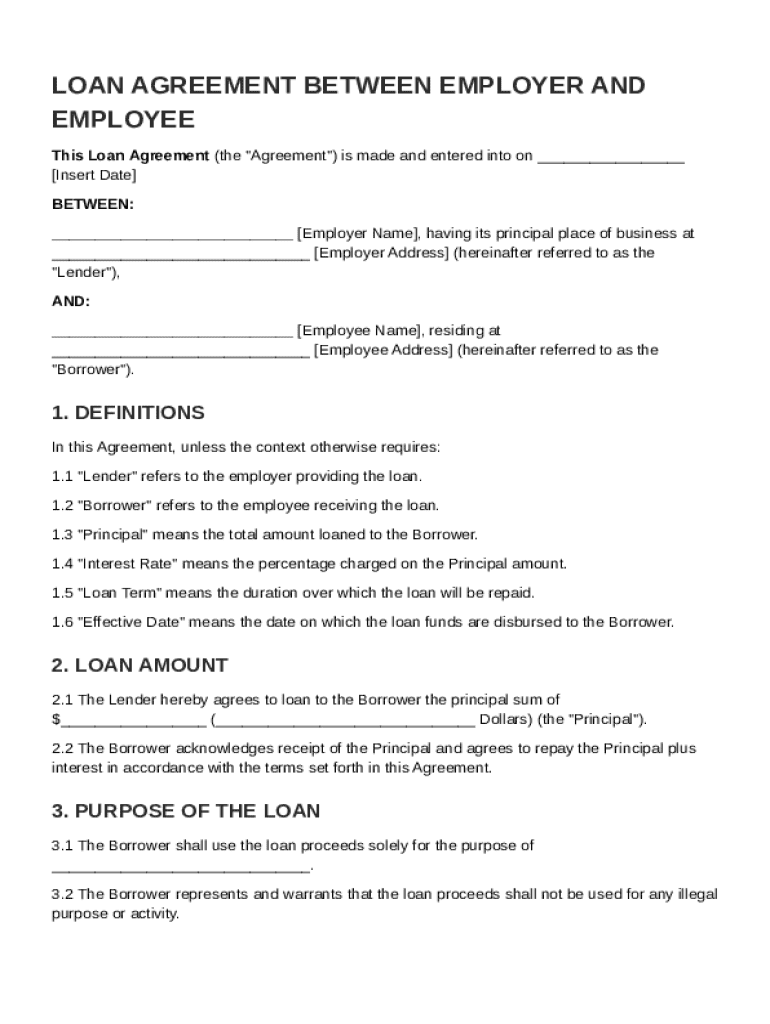

This document outlines the terms and conditions of a loan agreement between an employer and an employee, including loan amount, interest rate, repayment terms, and default provisions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

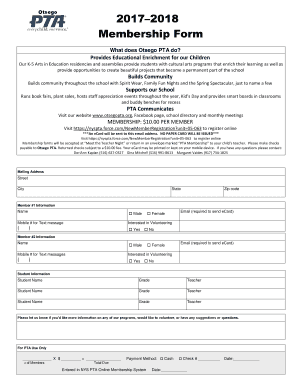

What is Loan Between Employer and Employee Agreement Template

A Loan Between Employer and Employee Agreement Template is a formal document that outlines the terms of a loan extended by an employer to an employee.

pdfFiller scores top ratings on review platforms

easy to use

Easy to work with.

it is helpful just need more experience/exposure working with it

Good

Very helpful once I figured it out.

user friendly and effective

Who needs Loan Between Employer and Employee Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Creating a Loan Between Employer and Employee Agreement

A Loan Between Employer and Employee Agreement is essential for formalizing financial assistance within an organization. This guide outlines the key components and procedures to effectively create and manage such agreements.

In this guide, we will cover the fundamentals of employee loan agreements, essential components, interest rate specifications, and repayment terms, among other critical topics.

-

A legal document outlining the terms of a loan given by an employer to an employee.

-

Ensures clarity and protects both parties in the event of disputes.

-

The employer acts as the lender while the employee is the borrower, both having defined roles and responsibilities.

What are the essential components of the loan agreement?

Every effective loan agreement should include crucial information to safeguard both parties throughout the loan's duration.

-

Establishes when the agreement becomes binding.

-

Includes detailed information about both the lender (employer) and borrower (employee).

-

Clarifies key terms such as Principal (the amount loaned), Interest Rate, and Loan Term, aiding in mutual understanding.

How do you determine the loan amount and purpose?

Determining the loan amount and its intended purpose is vital to the agreement. The employer must ensure compliance with company policies during this process.

-

Evaluate the employee's needs and repayment capability before finalizing the amount.

-

Clearly define the use of loan funds—this prevents potential misuse and aligns with company policy.

-

Employers must adhere to legal frameworks governing employee loans to avoid complications.

What should you include regarding interest rate specifications?

Interest rates should be carefully set to align with industry standards and comply with legal requirements to prevent misunderstandings.

-

Research current market rates to set a fair rate for both parties.

-

Provide a clear method for how interest is calculated, ensuring transparency in its accrual.

-

Evaluate implications of the selected interest rate, considering the employee's financial situation.

How do you structure repayment terms?

Establishing structured repayment terms is key to ensuring the employee understands their obligations and how payments are managed.

-

Detail how and when repayments will occur, ensuring clarity.

-

Discuss acceptable methods, emphasizing convenience for both the employer and employee.

-

Clearly define potential repercussions to establish seriousness in adherence to the terms.

What is the step-by-step process for creating the agreement?

Creating a Loan Between Employer and Employee Agreement involves gathering necessary information and drafting the document meticulously.

-

Ensure you have complete details regarding the employee, employer, and loan specifics.

-

This platform facilitates a seamless editing and signing process, making it user-friendly.

-

Meticulously check the completed document to ensure all details are correct.

How can you manage loan agreements effectively?

Using tools like pdfFiller enhances collaboration and management of loan agreements, allowing secure access and updates.

-

These prioritize document security and ease of access for involved stakeholders.

-

Keep a record of all changes made to the agreement for transparency.

What are the pros and cons of lending to employees?

While lending to employees can build loyalty, it also presents certain risks that need careful consideration.

-

Fostering trust and supporting employee financial stability can significantly enhance workplace morale.

-

There is potential for financial loss and workplace tension if repayment issues arise.

-

Assess the employee's financial health to mitigate risks before approving a loan.

What are the conclusion and next steps?

In summary, creating a Loan Between Employer and Employee Agreement involves meticulous planning and clear communication.

Utilizing pdfFiller can streamline the document process, allowing for easy editing and collaboration. Explore other document templates for additional support.

How to fill out the Loan Between Employer and Employee Agreement Template

-

1.Open the Loan Between Employer and Employee Agreement Template on pdfFiller.

-

2.Begin by entering the date the agreement is being signed.

-

3.Fill in the full name of the employer and the employee involved in the loan agreement.

-

4.Specify the loan amount being extended by the employer to the employee.

-

5.Detail the purpose of the loan to ensure clarity on its intended use.

-

6.Outline the repayment terms, including the repayment schedule and interest rate if applicable.

-

7.Include any conditions or warranties related to the loan; this could involve collateral or guarantees.

-

8.Add a section for any potential late fees or penalties that may apply to missed payments.

-

9.Have both parties review the filled document for accuracy and mutual agreement.

-

10.Once all information is completed, save the document and share it with the employee for signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.