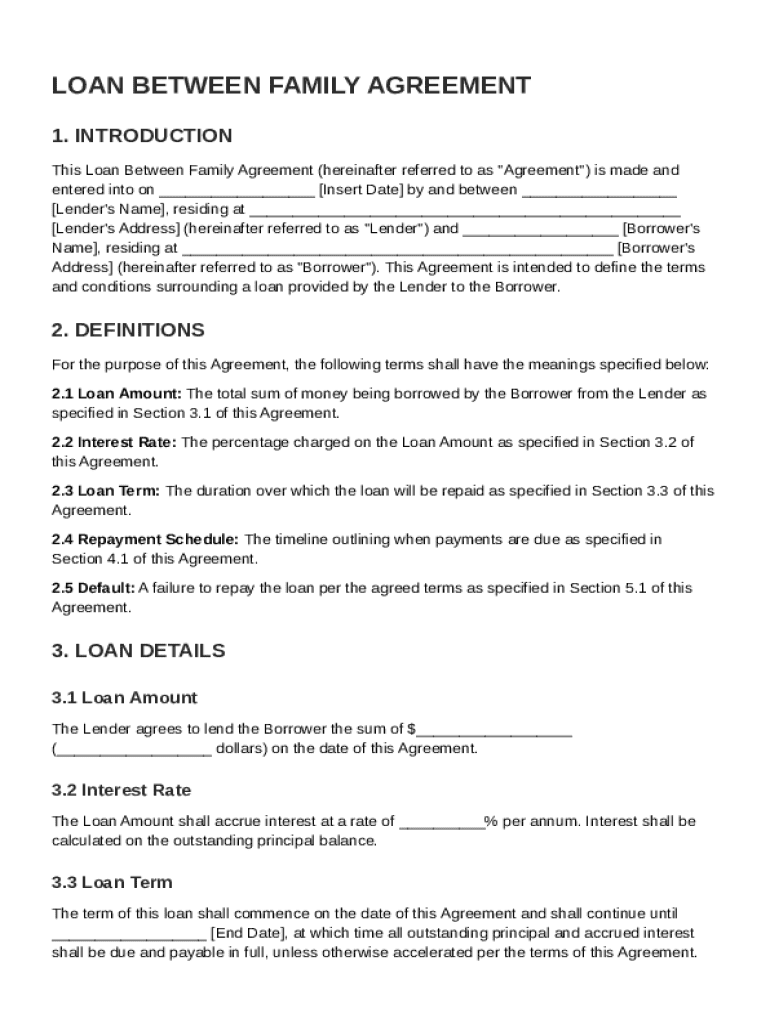

Loan Between Family Agreement Template free printable template

Show details

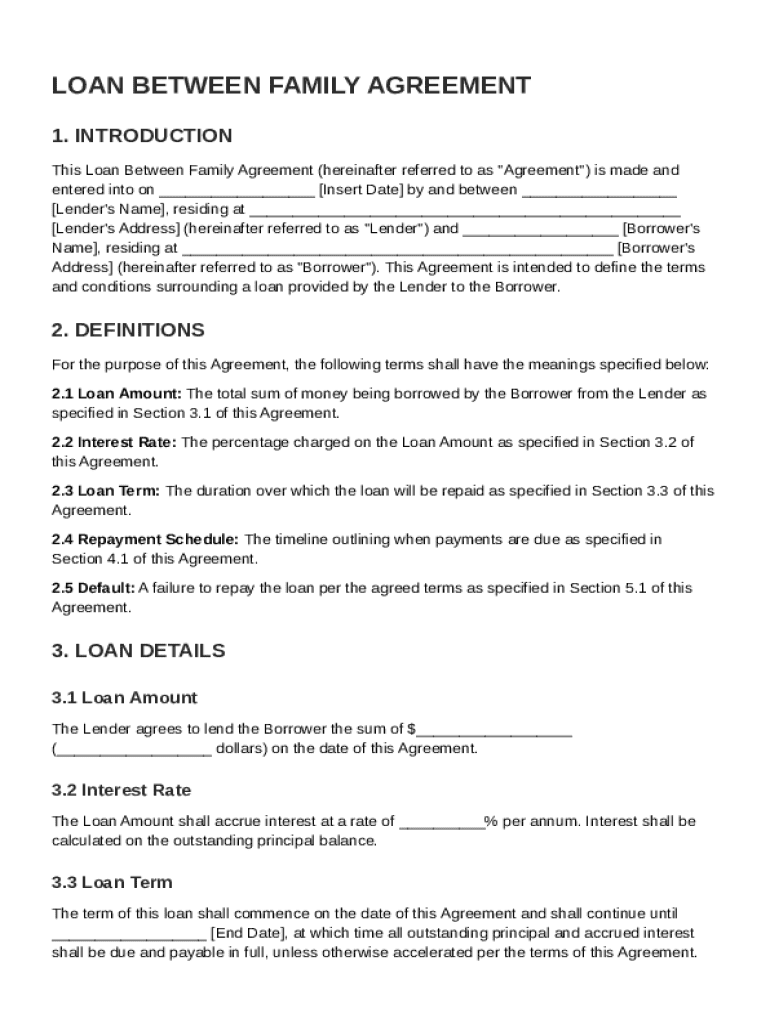

This document outlines the terms and conditions of a loan agreement between family members, detailing the loan amount, interest rate, repayment schedule, and default terms.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Between Family Agreement Template

A Loan Between Family Agreement Template is a legal document outlining the terms of a loan provided by one family member to another.

pdfFiller scores top ratings on review platforms

very impressed so far

very easy and good services

great

works great love this site

Saved us time and frustration

We searched everywhere for a software that would let our applicants fill out a 39-page government document without having to type the same information over and over. PdfFiller saved us tons of time and frustration.

Dee was fabulous

Dee was fabulous! I was in a state of panic after not being able to find my file I had work soooo hard on for several days. She was so calm, helpful and supportive. Thank you so much!! Joyce Whitfield

I'm am satisfied with the services and…

I'm am satisfied with the services and Support PDFFiiller provides.. Very Helpful and I highly recommend. Thank You

Who needs Loan Between Family Agreement Template?

Explore how professionals across industries use pdfFiller.

Loan Between Family Agreement Guide

How do you understand family loan agreements?

A Loan Between Family Agreement Template form serves as a formal record of the terms and conditions agreed upon by family members when one lends money to another. Having a structured agreement is crucial, as it minimizes potential misunderstandings and disputes. Different family dynamics can influence the terms, highlighting the need for clarity and mutual consent.

-

A family loan agreement is a written contract outlining the borrowed sum, repayment schedule, and interest rate between family members.

-

It is essential to have a written agreement to ensure that both parties are aware of their obligations and safeguarding against miscommunication.

-

Family relationships can complicate financial transactions; hence, outlining expectations is critical.

What are the key components of a family loan agreement?

Understanding the essential components of a family loan agreement is vital for ensuring fairness and transparency. Key elements include the loan amount, interest rate, and loan duration, which dictate the financial arrangement between the parties involved.

-

It is crucial to define the total loan amount, the interest rate that may apply, and the duration over which repayments will occur.

-

Terms like 'Default' and 'Repayment Schedule' must be clearly defined to avoid ambiguity.

-

To ensure the agreement is legally binding, it should satisfy specific requirements and follow local laws.

How do you draft your family loan agreement?

Drafting your family loan agreement can be straightforward with the right template. Begin with a clear step-by-step approach to fill out the necessary details and incorporate specific terms as required.

-

Start with basic information: names of the lender and borrower, loan amount, payment terms, and any necessary conditions.

-

Ensure to list any specific conditions or agreements that are unique to your transaction.

-

Utilize pdfFiller’s features for easy editing and signing of documents to streamline the process.

What are the financial implications of family loans?

Financial implications of a family loan can be significant, influencing both lender and borrower. It's essential to assess the loan amount alongside applicable interest rates to ensure an equitable arrangement.

-

Determine a fair loan amount based on the borrower's needs and the lender's capacity.

-

Clearly outline repayment schedules and methods for clarity and to avoid familial tension.

-

Understand potential consequences of default or late payments which can strain family relationships.

What legal considerations should you keep in mind?

Legal considerations can differ based on state-specific regulations governing family loans. Borrowers and lenders should be aware of any potential tax implications and the necessity of formal legal advice when drafting agreements.

-

Each state may have unique laws that affect family loans, so familiarize yourself with local requirements.

-

Both lender and borrower should consult with a tax professional to understand their potential tax liabilities.

-

Engaging with a lawyer can provide clarity and help in drafting agreements that mitigate risk.

How do you finalize your agreement?

Finalizing your family loan agreement is crucial to ensure all parties are committed to the documented terms. Reviewing the document and collaborating on amendments if necessary can help hedge against future disputes.

-

Confirm all terms are correct and meet everyone's expectations before signing.

-

pdfFiller offers collaboration features enabling multiple parties to review and edit the document seamlessly.

-

Use secure methods for signing and storing the agreement to ensure it remains protected.

What are the benefits of using pdfFiller for family loan agreements?

Utilizing pdfFiller for your loan agreement enhances the overall document creation process. The platform offers numerous features that cater to individual and collaborative needs.

-

Users can easily edit and customize PDF forms to suit individual agreements.

-

Quick document finalization through electronic signatures speeds up the process.

-

pdfFiller provides interactive tools and templates that facilitate better document management.

What are common mistakes to avoid?

Being aware of common pitfalls can save both parties from future misunderstandings. Attention to detail is vital when documenting terms, particularly in financial agreements.

-

Failing to write down critical components may lead to confusion about obligations.

-

Not specifying detailed repayment options can lead to disputes down the line.

-

Relying on verbal agreements can be risky; written contracts provide necessary legal protections.

How to fill out the Loan Between Family Agreement Template

-

1.Obtain the Loan Between Family Agreement Template from a reliable source like pdfFiller.

-

2.Open the template in pdfFiller by clicking 'Upload' or selecting it from your documents.

-

3.Fill in the borrower's name and address in the designated fields.

-

4.Enter the lender's name and address to identify the parties involved.

-

5.Specify the loan amount clearly, ensuring it matches the agreed terms.

-

6.Set the repayment terms including the interest rate, due dates, and payment frequency.

-

7.Include any collateral details if applicable to secure the loan.

-

8.Review the document to ensure all information is accurate and complete.

-

9.Add signatures of all parties involved at the designated signing areas.

-

10.Save the completed agreement and send copies to all parties for their records.

How do I write a loan agreement between families?

Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

How to arrange a loan between family members?

Create a written agreement. A written loan agreement is essential. For smaller amounts, an informal written agreement is probably enough. However, if you're lending a large amount of cash, get in touch with a legal professional to take you through the process.

How to fill a loan agreement form?

Here are the essential items your loan agreement form sample must cover: Parties Involved. Clearly identify the lender and borrower with their full legal names. Loan Amount & Interest. Repayment Schedule. Late Payment Fees. Collateral (For Secured Loans) Default Consequences. Governing Law. Signatures.

How do I make an agreement to borrow money?

How to write a loan agreement contract. Agree to terms. First, negotiate terms with the other party. Create a draft for everyone to review. Make adjustments if needed. Add signatures (and notarization). Distribute copies of the executed agreement.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.