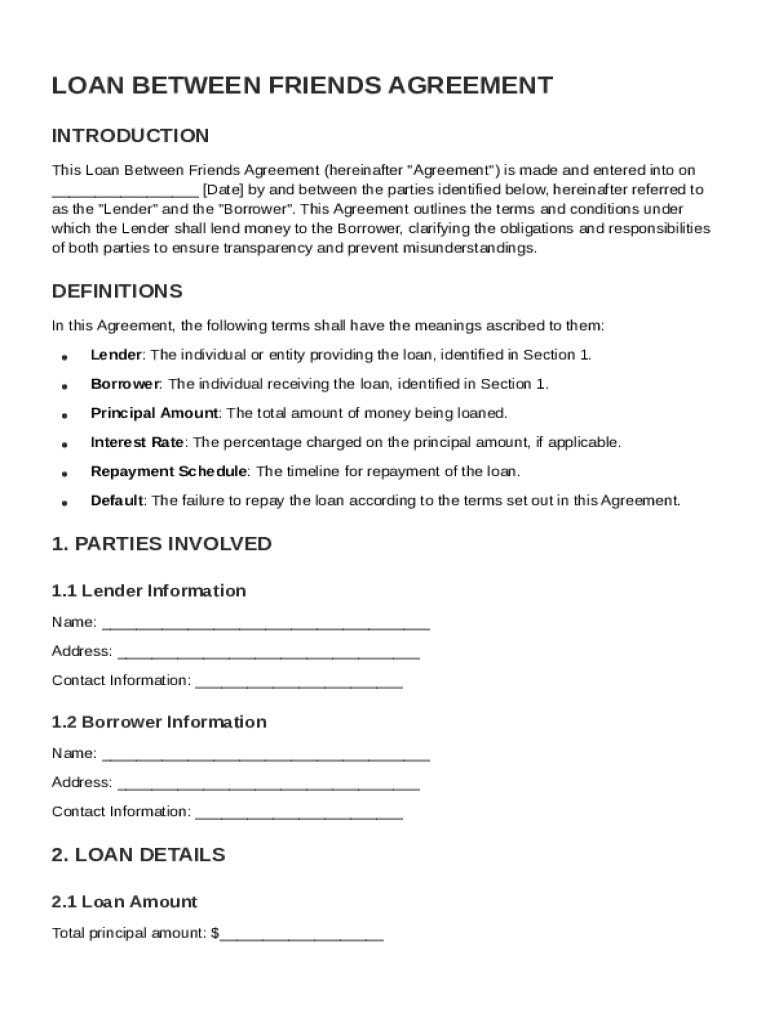

Loan Between Friends Agreement Template free printable template

Show details

This document outlines the terms and conditions under which one party (the Lender) loans money to another party (the Borrower), detailing obligations, repayment terms, and remedies in case of default.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Between Friends Agreement Template

A Loan Between Friends Agreement Template is a legal document outlining the terms and conditions of a loan provided between friends to ensure clarity and mutual understanding regarding repayment.

pdfFiller scores top ratings on review platforms

VERY EASY TO USE ALTHOUGH TEMPLATES DON'T ALWAYS UPLOAD

Great app. I like it very much. Very Practical

i would like a webinar to learn more about using PdfFiller

good

Love it

I lost a few completed PDF forms before I successfully saved one but overall this website is a great place to work from and one I couldn't have done without

Who needs Loan Between Friends Agreement Template?

Explore how professionals across industries use pdfFiller.

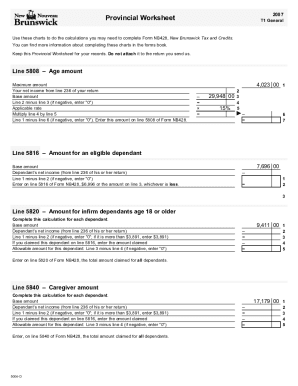

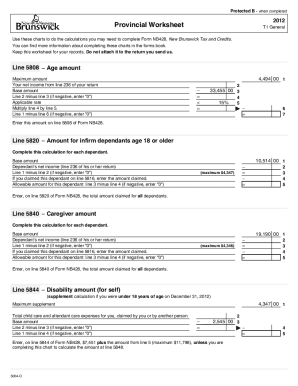

Loan Between Friends Agreement Guide

Navigating financial agreements between friends can be challenging, but a well-crafted Loan Between Friends Agreement Template form can simplify the process. This guide provides essential insights into creating a clear and effective agreement to ensure that both parties are protected and informed.

What is a Loan Between Friends Agreement?

A Loan Between Friends Agreement is a written document formalizing the financial arrangement between two parties: the lender and the borrower. Establishing a written agreement is crucial to avoid misunderstandings and ensure that both parties are aware of their rights and responsibilities. Unlike formal loan contracts which involve extensive legal jargon and terms, this agreement aims to simplify the borrowing process among friends.

What are the key definitions in the agreement?

-

The individual or entity providing the funds, responsible for outlining the terms of repayment.

-

The individual receiving the funds, who is obligated to repay according to the agreement.

-

The initial sum of money loaned, central to calculating interest and repayment.

-

The cost of borrowing, which can be fixed or variable, defining how much extra will be repaid.

-

The outline of when payments are due, ensuring clarity in the repayment process.

-

The failure to meet repayment terms, which can have legal and financial implications.

Who are the parties involved in the agreement?

The Loan Between Friends Agreement typically involves two parties: the lender and the borrower. Clearly identifying both parties includes essential information such as names, addresses, and contact information. Providing incorrect details can lead to complications in the agreement's enforcement and understanding.

How can you customize the loan details?

-

Set realistic expectations by discussing what each party can agree upon, considering the borrower's capacity to repay.

-

Consider whether to use a fixed or variable rate based on the arrangement's nature and how it impacts repayments.

-

Clearly state the purpose of the loan, as it can influence the terms of the agreement and expectations.

How do you establish clear repayment terms?

-

Define the timeline and frequency of payments, which helps keep both parties accountable.

-

Clearly specify due dates to avoid any confusion about when payments are expected.

-

Identify how repayments can be made, whether through bank transfers, checks, or cash.

What should you know about default and remedies?

-

Clearly outline conditions that may lead to default to mitigate misunderstandings.

-

Discuss available options in case of default, including potential legal actions.

-

Establishing clear clauses can help protect both parties in the event of non-payment.

How can you fill out your loan agreement form?

-

Follow the steps carefully to ensure all information is accurately represented.

-

pdfFiller provides user-friendly tools to edit the agreement easily, enhancing efficiency.

-

Utilize e-signature features for secure and quick completion of agreements.

What are the legal considerations and compliance issues?

Understanding local regulations governing private loans is critical for both lenders and borrowers. State-specific lending laws can vary significantly, affecting how agreements are constructed and enforced. Ensuring compliance safeguards the legal rights of both parties, making it paramount to stay informed.

How to fill out the Loan Between Friends Agreement Template

-

1.Download the Loan Between Friends Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller and review the pre-filled information.

-

3.Fill in the full names and addresses of both the lender and the borrower.

-

4.Specify the loan amount in clear terms, such as currency and exact figures.

-

5.Detail the interest rate, if any, and repayment duration—include dates for payment.

-

6.Include sections for terms regarding late payments or default consequences.

-

7.Read through the completed document for accuracy and completeness.

-

8.Save the document and share it with the other party for their review and signature.

-

9.Ensure both parties sign and date the agreement to finalize the contract.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.