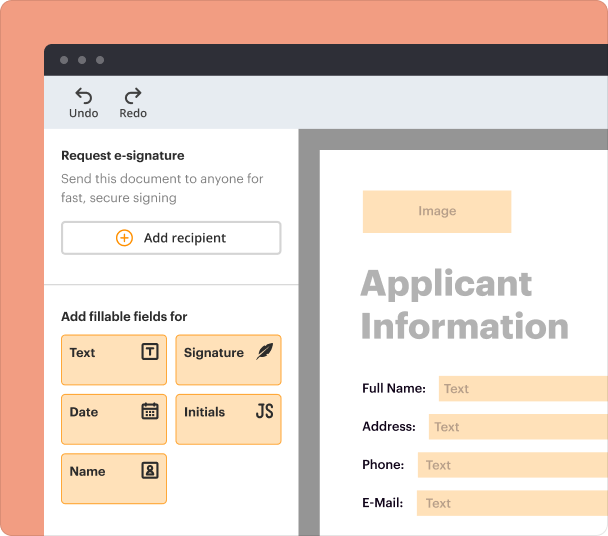

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Get the free Loan Business Agreement Template

Show details

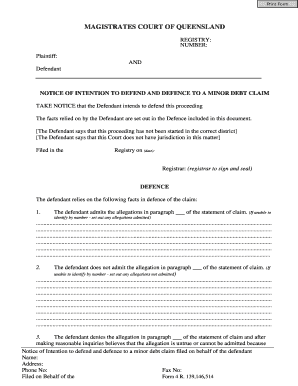

This document outlines the terms and conditions for a loan extended by a lender to a borrower, including details about the loan amount, interest rate, repayment schedule, and default provisions.

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

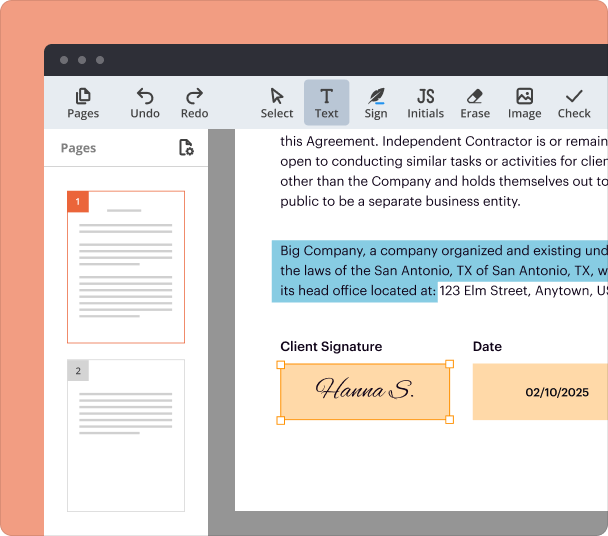

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Loan Business Agreement Template

Discover the necessary steps to effectively edit and fill out your Loan Business Agreement Template using pdfFiller.

How to edit Loan Business Agreement Template

Editing your Loan Business Agreement Template with pdfFiller is a straightforward process that offers flexibility and control:

-

1.Click on ‘Get form’ on this page to access the Loan Business Agreement Template.

-

2.Sign up for a free pdfFiller account if you don’t have one, or log in to your existing account.

-

3.Once the template opens, utilize the editing tools provided to make necessary modifications such as adding text, images, or signatures.

-

4.Save your changes regularly to ensure that no information is lost during the editing process.

-

5.Once complete, download your edited document or share it directly with others via email or collaboration tools.

All you need to know about Loan Business Agreement Template

This section covers the essential aspects of the Loan Business Agreement Template, providing insights into what it entails and how to use it effectively.

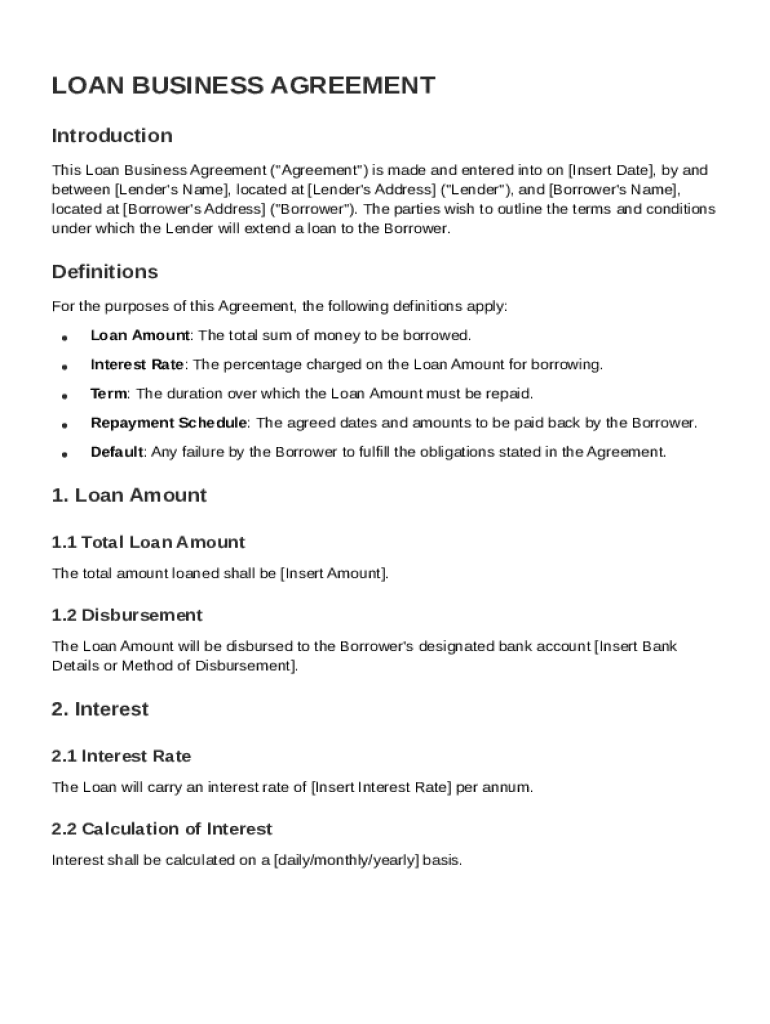

What is a Loan Business Agreement Template?

A Loan Business Agreement Template is a legally-binding document that outlines the terms and conditions under which a loan is granted between a lender and a borrower. It serves to protect both parties involved by detailing loan amounts, interest rates, repayment schedules, and other stipulations.

Definition and key provisions of a Loan Business Agreement

This section highlights the foundational aspects of a Loan Business Agreement Template, ensuring clarity on important provisions.

When is a Loan Business Agreement used?

A Loan Business Agreement is typically used when a business requires financial support from a lender and establishes the framework for repayment and responsibilities associated with the loan. This agreement is crucial during business expansions, acquisitions, and for managing cash flow needs.

Main sections and clauses of a Loan Business Agreement

-

1.Loan Amount: The total sum being borrowed.

-

2.Interest Rate: The percentage charged on the borrowed amount.

-

3.Repayment Terms: The schedule and conditions for repaying the loan.

-

4.Default Provisions: Terms outlining what happens in case of late payments.

-

5.Collateral: Assets pledged by the borrower to secure the loan.

What needs to be included in a Loan Business Agreement?

-

1.Identification of the parties: Names and addresses of the lender and borrower.

-

2.Loan amount details: Specifics regarding the funds being lent.

-

3.Terms of the loan: Clear phrasing of repayment schedules and amounts.

-

4.Conditions for default: Stipulations outlining consequences for late payments.

-

5.Signature lines: Spaces for both parties to legally affirm the agreement.

pdfFiller scores top ratings on review platforms

PDFiller saved me a lot of time completing forms W2C.

PDFFiller has made my work 10 times easier. Wish I discovered this application a long time ago.

VERY HELPFUL AND EASY TO USE. GREAT PRODUCT.

Was able to quickly and easily fill out a Quit Claim Deed (with some minor "beginner" setbacks).

Just started to use this product and found it easy to start up and complete forms that were down loaded.

I would recommend this product to others needing a simple but very capable pdf manager.

This service is amazing it has really made paperwork and filling simple.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.