Loan Extension Agreement Template free printable template

Show details

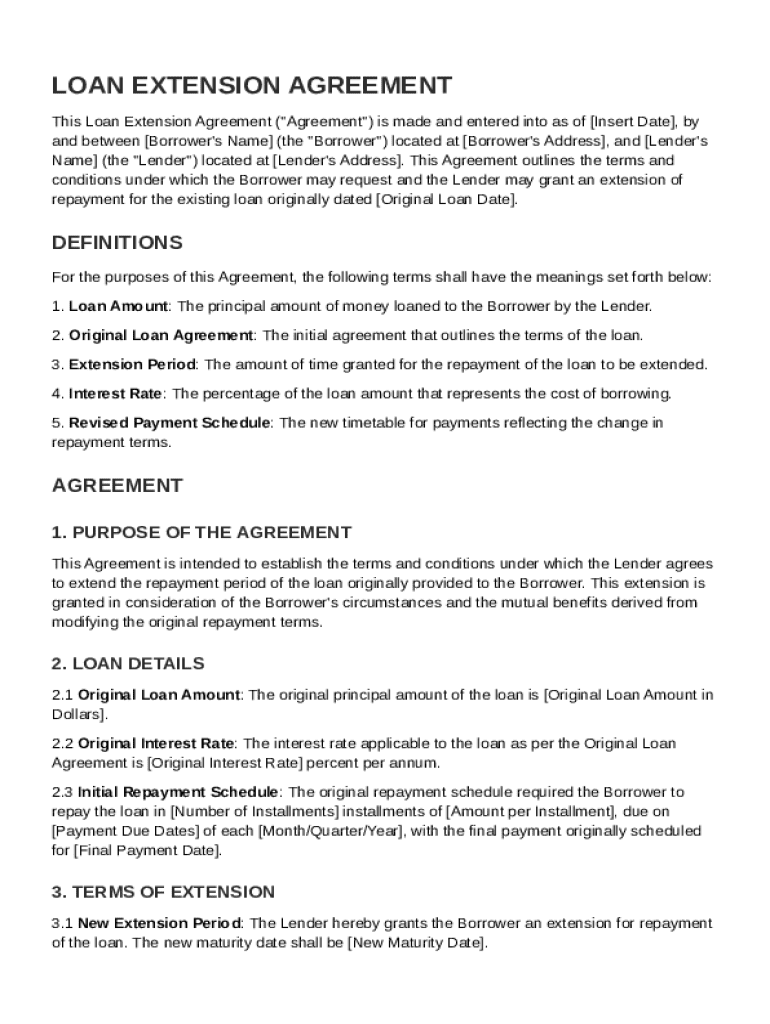

This document outlines the terms and conditions for extending the repayment period of an existing loan between a borrower and a lender.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

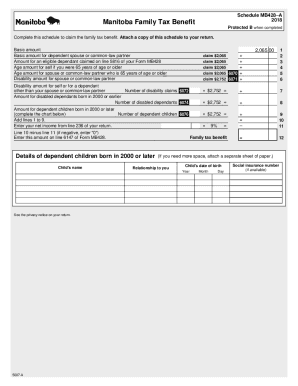

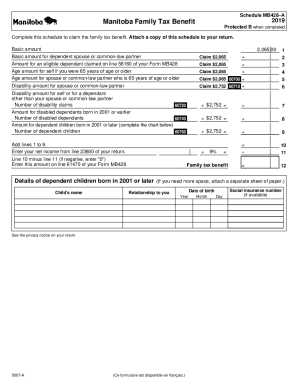

What is Loan Extension Agreement Template

A Loan Extension Agreement Template is a legal document that outlines the terms for extending the repayment period of an existing loan.

pdfFiller scores top ratings on review platforms

HAVE BEEN ABLE TO FILL OUT FORMS AND SIGN THEM TOO.

I used the PDF filler for my 1099 sending to IRS- so far so good. We will see if IRS received these on time and if no errors and are accepted.

Works really great for work! I've been using it towrite documents without my bad handwriting

so far so good. I hope the tax filing goes through. If so, very convenient and effective.

glitchy at times; sometimes cannot open files to edit them

Working remotely this application has greatly facilitated the approval process in relation to documents sent from the office and has saved so much money on paper! Love it!

Who needs Loan Extension Agreement Template?

Explore how professionals across industries use pdfFiller.

Your Complete Guide to a Loan Extension Agreement

How does a Loan Extension Agreement work?

A Loan Extension Agreement is a document that modifies the terms of an existing loan, allowing the borrower more time to repay it. With financial circumstances often changing, it's crucial for both borrowers and lenders to understand the importance of a formal agreement. This agreement serves to safeguard the interests of both parties involved, making loan extensions clear and legally binding.

-

It formalizes an extension of the loan period while detailing new terms.

-

Having a written document helps prevent misunderstandings and provides a legal reference.

-

The main parties are the borrower (who is receiving the loan) and the lender (who provides the funds).

What key components are in a Loan Extension Agreement?

Several integral components make up a Loan Extension Agreement. Understanding these elements helps both parties align their expectations to avoid future disputes.

-

The total amount of the loan that is being extended must be clearly stated.

-

The new timeline for repayment should be well defined, detailing when payments will resume.

-

Any changes to the interest rate during the extension should be addressed.

-

A new payment schedule must be outlined that reflects adjustments due to the extension.

Why might you consider a Loan Extension?

There are several valid reasons a borrower might seek a loan extension. These extensions can provide much-needed relief during tough financial times.

-

Unexpected expenses or loss of income can make it difficult to meet original payment terms.

-

A temporary dip in cash flow can necessitate an extension of loan terms.

-

If a borrower’s financial situation changes, extending a loan can provide flexibility.

How can you write a Loan Extension Agreement?

Creating a Loan Extension Agreement involves careful drafting to ensure clarity and legal compliance. Follow these structured steps to simplify the process.

-

Collect necessary documents from both borrower and lender before drafting.

-

Use a suggested structure: title, date, names of parties, and terms.

-

Clearly outline all critical components to avoid ambiguity and ensure enforceability.

How to use pdfFiller for your Loan Extension Agreement?

pdfFiller provides an easy-to-use platform for creating, editing, and signing Loan Extension Agreements. Here’s a step-by-step approach.

-

Visit pdfFiller and locate the Loan Extension Agreement Template for your needs.

-

Utilize pdfFiller's collaboration and editing functionalities to complete the agreement.

-

Once completed, use pdfFiller to eSign the agreement, making it legally binding.

What to do after the agreement is signed?

After signing the Loan Extension Agreement, managing any changes is vital for ongoing compliance. Keeping the lines of communication open between parties is crucial.

-

If issues arise, it's important to know how to amend the agreement accurately.

-

Both parties should maintain regular communication regarding any further developments.

-

Keep accurate records of all agreements and updated payment schedules for future reference.

What are some popular forms related to Loan Extensions?

There are various forms related to Loan Extensions that borrowers and lenders often require. Understanding these can ease the documentation process.

-

These forms include the standard terms and conditions often used in loans.

-

pdfFiller offers easily accessible templates for a variety of loan-related documents.

-

Comparing a Loan Extension Agreement with a standard Loan Agreement helps clarify differences.

How to fill out the Loan Extension Agreement Template

-

1.Download the Loan Extension Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller and read through the pre-filled sections.

-

3.Enter the borrower's name and contact details in the designated fields.

-

4.Provide the lender's name, address, and contact information.

-

5.Fill in the loan details including the original loan amount, interest rate, and original term.

-

6.Specify the new loan term and any changes in interest rates if applicable.

-

7.Include dates relevant to the extension like the new payment start date.

-

8.Review all entered information for accuracy and completeness.

-

9.Add any additional clauses if required and ensure all parties agree to the terms.

-

10.Once completed, save the document and email it to all parties involved for signatures.

How to write a loan extension?

Tips for Writing an Effective Loan Extension Letter Be Clear and Concise: Stick to the facts and keep your letter straightforward. Maintain a Professional Tone: Use formal language throughout the letter. Provide Supporting Documents: Attach relevant documents like:

What is a loan extension agreement?

A loan extension agreement is a mutual agreement between a lender and borrower that extends the maturity date on a borrower's loan. Most commonly used when a borrower falls behind on payments, a loan extension agreement can restructure the loan payment schedule to get the borrower back on track.

How to extend the term of a loan?

Application for a loan modification is the first step when seeking an extension of your loan term. Most lenders will request proof that you have the financial capability to meet the new loan installments after a loan modification. Some lenders may also request your credit report.

How to write a loan agreement contract?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.