Loan Family Agreement Template free printable template

Show details

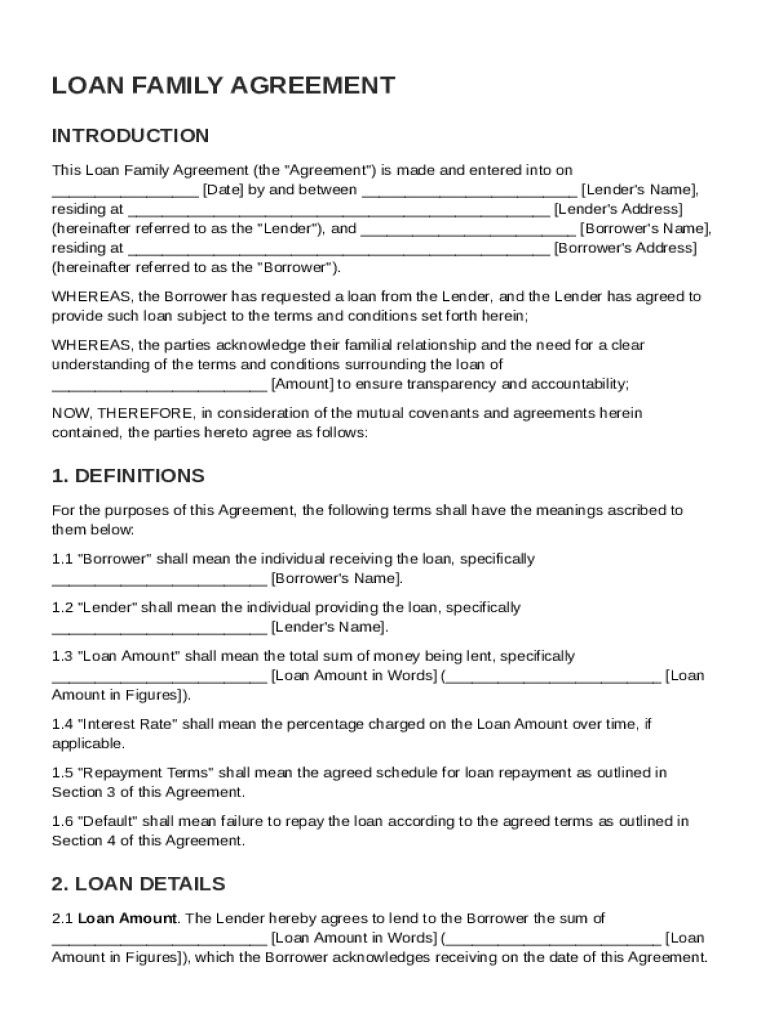

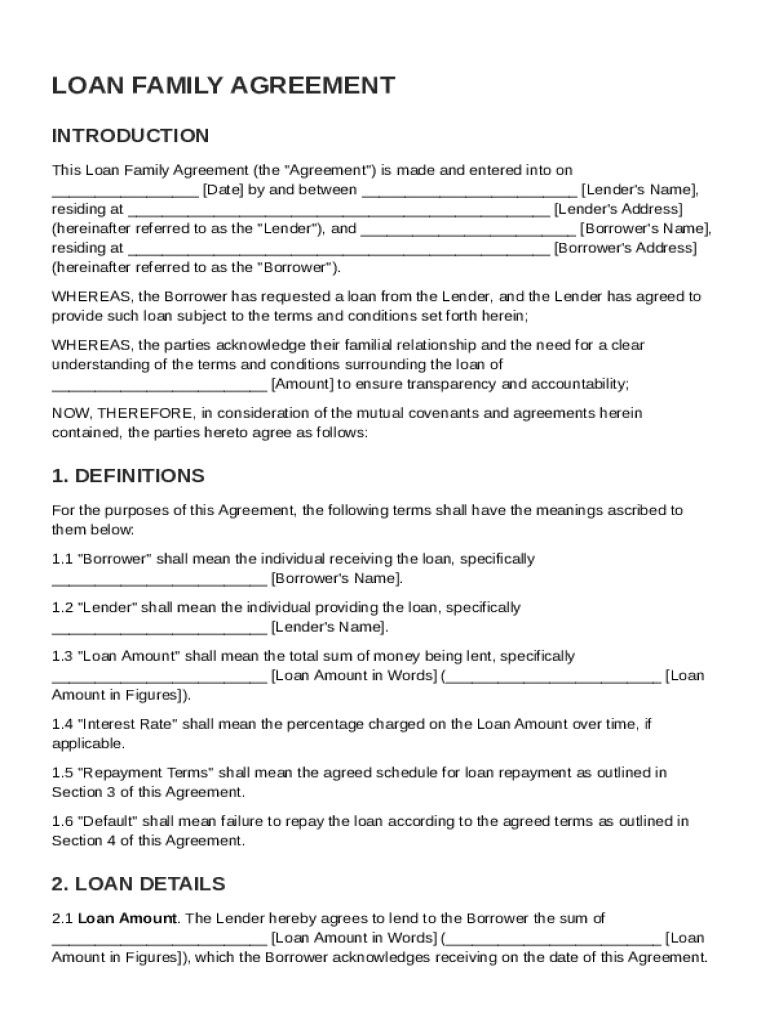

This document outlines the terms and conditions of a loan agreement between a lender and a borrower who are family members, detailing loan amount, repayment terms, and default conditions.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

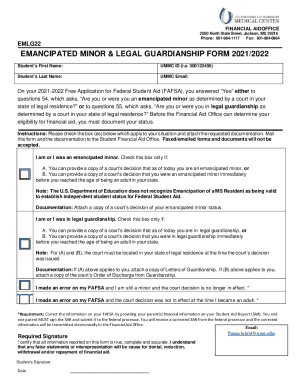

What is Loan Family Agreement Template

A Loan Family Agreement Template is a legal document used to outline the terms and conditions of a loan between family members.

pdfFiller scores top ratings on review platforms

I was in a total jam and needed forms right away. I was so afraid my only option was to type all these required forms and then have to write in the answers with a pen. It would have taken me days to complete! When I discovered PDFfiller online it was like my guardian angel had guided me to the site! The user friendly site was easy to navagate and had easy to understand instructions. I'm very much impressed with your product and when I need another PDF form, I most certainly will use your product again. Thank you so much!

Good except I have trouble figuring out how to pull up forms and save them with a different name after filling them with new information so I can save them all.

Very surprised that I could do this PDF filler so easy

One big feature that is missing, as is from many of these types of editing / fill in forms, is the basic "Cut","Copy", "Paste" functions. However once I got use to the program's idiosyncrasies, It has been quite helpful. Oh, one more thing, I think more detailed instruction by some useful examples of how the features can benefit in everyday design of a fill-able forms would make it that much more useful.

Very easy to use. Big time saver when you need a template that is not used everyday

have to get use to the signature , but it was a great tool

Who needs Loan Family Agreement Template?

Explore how professionals across industries use pdfFiller.

Complete Guide to Loan Family Agreement Template on pdfFiller

How to fill out a loan family agreement template form

Filling out a Loan Family Agreement Template requires careful consideration of the loan amount, purpose, repayment terms, and identification of the parties involved. Proper documentation ensures clarity and avoids misunderstandings.

Understanding Family Loan Agreements

A Family Loan Agreement is a written contract between family members that dictates the terms of a loan. Its purpose is to prevent misunderstandings and ensure clarity in expectations, which can significantly reduce potential conflicts.

-

This agreement outlines the specifics of the loan, including the amount, interest rate, and repayment schedule.

-

Clarity ensures that both parties understand their responsibilities, helping to maintain relationships.

-

Formal agreements can protect both lender and borrower in case of disputes, clarifying rights and obligations.

Why utilize a Family Loan Agreement?

Having a formal Family Loan Agreement benefits both parties. It helps in managing expectations and outlining responsibilities clearly.

-

A written document can enforce accountability and provide a point of reference for all parties.

-

Transparency ensures that all parties are aware of the terms, reducing the chance for disagreements.

-

Without an agreement, misunderstandings may lead to strained relationships or financial disputes.

Creating a Family Loan Agreement: Step-by-Step Guide

Following a structured process can simplify the creation of a Family Loan Agreement. Here are the essential steps.

-

Decide the total amount to lend or borrow. Specify clearly in both words and figures to avoid confusion.

-

Clearly articulate what the loan will be used for and specify any conditions that apply.

-

Establish a timeline for repayment, define interest rates if applicable, and outline consequences for defaulting.

Key Components of a Family Loan Agreement

A robust Family Loan Agreement should include all crucial components to ensure its effectiveness and legal standing.

-

This includes detailed information about both the lender and the borrower for legal clarity.

-

States the specifics like Loan Amount, Interest Rate, and understanding the implications of Default.

Best Practices for Family Loan Agreements

Implementing best practices enhances the effectiveness of Family Loan Agreements. Paying attention to professionalism and proper management is key.

-

Treat family loans as formal as business transactions to maintain clarity and seriousness.

-

Periodic reviews will ensure the agreement remains relevant and reflects the current situation.

-

pdfFiller empowers users by providing a platform for easy document management, ensuring your agreements are up-to-date.

How pdfFiller Facilitates Document Management

pdfFiller offers a suite of features that simplify the process of creating and managing Family Loan Agreements.

-

With user-friendly interfaces, pdfFiller allows seamless document customization and signing.

-

The platform promotes collaboration, making it easier for all parties to review and amend the agreement as necessary.

-

Keep your agreements organized and easily accessible for future reference, which is crucial in financial matters.

How to fill out the Loan Family Agreement Template

-

1.Download the Loan Family Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Begin by filling in the names and details of both the borrower and lender at the top of the document.

-

4.Specify the loan amount clearly in the designated section.

-

5.Indicate the interest rate, if applicable, and the repayment schedule including due dates.

-

6.Add additional terms such as penalties for late payments or conditions for early repayment as needed.

-

7.Review all information for accuracy and completeness to ensure mutual understanding.

-

8.Save the filled agreement within pdfFiller or download it for printing.

-

9.Both parties should sign and date the document to formalize the agreement.

How to write a family loan agreement?

Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

Can you make a loan to a family member?

A family loan is a loan between family members. You could create a similar loan arrangement between friends, significant others or roommates. With this type of loan, it's up to you and the lender to decide how it's structured. A family loan can have interest or not and be repaid in installments or a lump sum.

How do I write a personal loan contract agreement?

Preparing to Draft Your Personal Loan Agreement Gather Essential Information. Consult Legal and Financial Experts. Identifying the Parties Involved. Determining the Loan Amount and Purpose. Loan Purpose. Setting the Interest Rate and Repayment Terms. Default and Late Payment Penalties. Modifying and Terminating the Agreement.

How to write a promissory note for a family member?

To be thorough, a promissory note should include a core group of details: Total amount of money being loaned. Date of the loan. How the loan was delivered (cash, check, direct deposit) The name and address of the person loaning the money. The name and address of the person borrowing the money.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.