Loan Forgiveness Agreement Template free printable template

Show details

This Agreement outlines the terms and conditions under which a Borrower\'s loan may be forgiven as per applicable regulations and guidelines.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Forgiveness Agreement Template

A Loan Forgiveness Agreement Template is a formal document that outlines the terms and conditions under which a borrower may have their loan forgiven.

pdfFiller scores top ratings on review platforms

Not so intuitive at the beginning. Signature section is not compatible with those who do not have PDF. Defeats the purpose of making a doc to sign...

These forms are exceptional, they are precise and highly recommended

I'd like to be able to edit directly within a pdf

It is very easy to use and this is one of the most crucial web that i was looking for. Thank you so much.

This is so very helpful and e4asy to use!

I enjoy using PDFfiller because I have essential tremor and cannot fill out forms by hand.

Who needs Loan Forgiveness Agreement Template?

Explore how professionals across industries use pdfFiller.

How to Fill Out a Loan Forgiveness Agreement Template on pdfFiller

TL;DR: How to fill out a Loan Forgiveness Agreement Template form

To fill out a Loan Forgiveness Agreement Template form, start by collecting all required information, including details about the lender, borrower, and loan specifics. Follow the step-by-step instructions provided in your template, ensuring all eligibility criteria and documentation are properly completed. Utilize pdfFiller's interactive editing tools to finalize and eSign your document before submission.

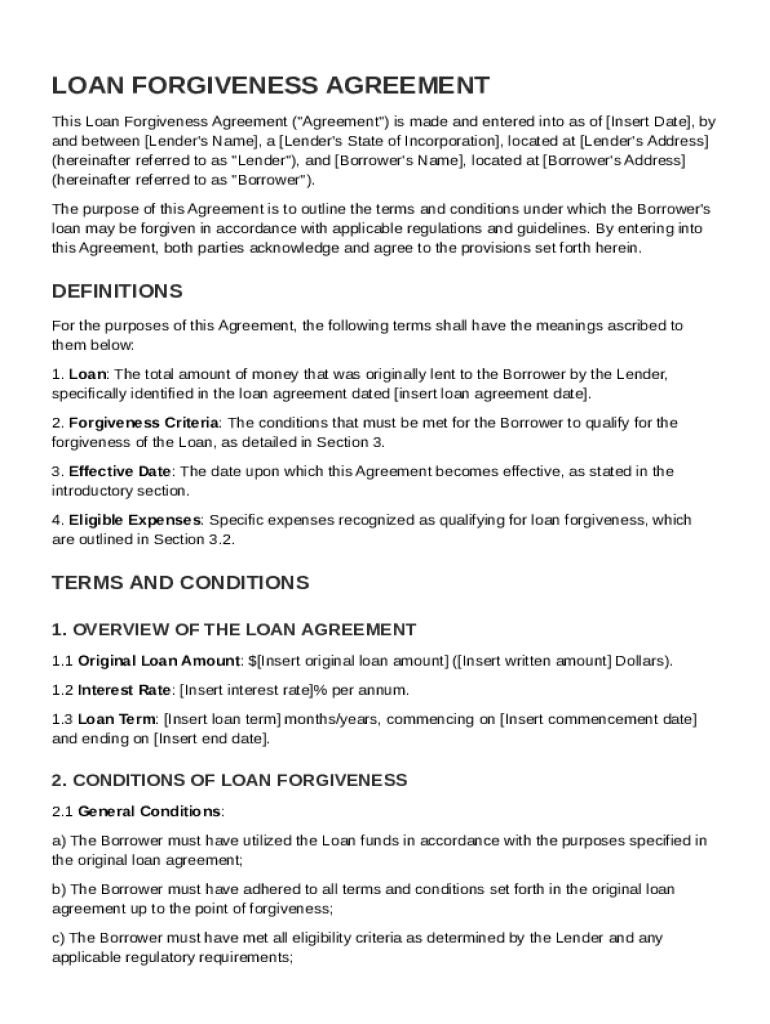

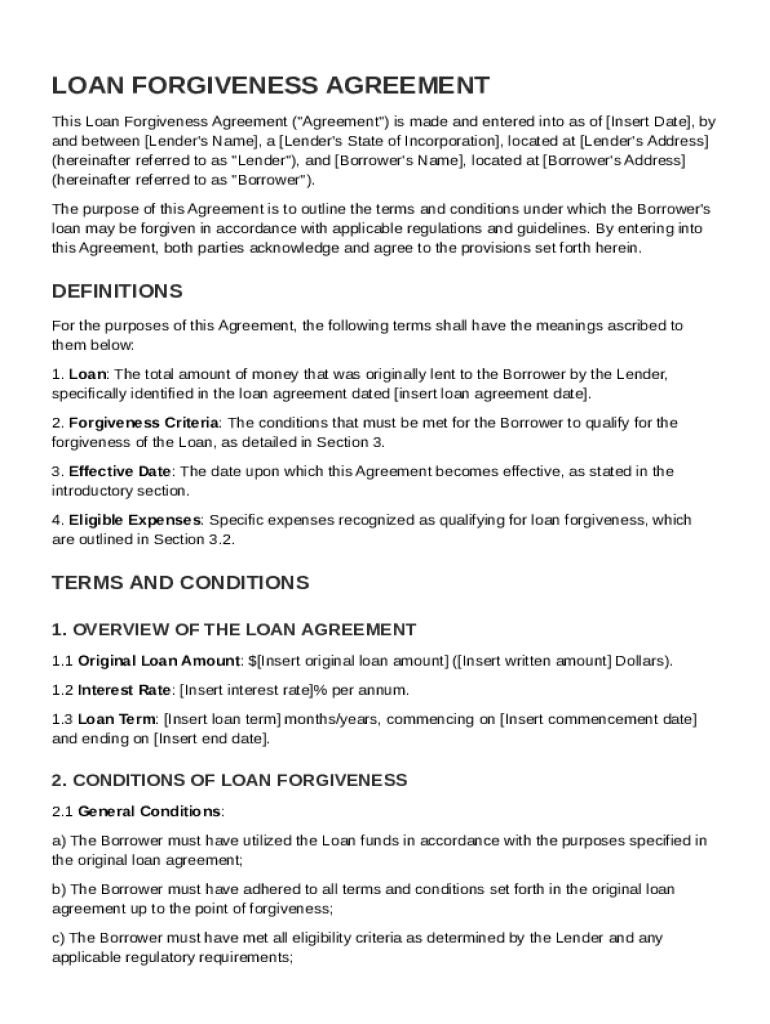

What is a loan forgiveness agreement?

A Loan Forgiveness Agreement is a legal document outlining the conditions under which a borrower can have their loan forgiven by a lender. This agreement specifies the obligations of both parties and ensures that appropriate measures are in place for compliance with regulations. Understanding the terms of these agreements is crucial to protect both borrower and lender interests.

-

This document is designed to outline the forgiveness process, making it clear under what conditions a loan can be forgiven.

-

These include definitions of essential terms like 'loan', 'forgiveness criteria', and 'eligible expenses'.

-

Both parties must adhere to established guidelines to avoid legal penalties and ensure smooth transaction execution.

What are the key components of a loan forgiveness agreement?

A well-structured Loan Forgiveness Agreement contains several vital components to ensure clarity and enforceability. These components provide important details about each party involved and the overall loan terms.

-

It is essential to include full legal names and contact information for both parties to avoid miscommunication.

-

Clearly defining what constitutes the loan amount, forgiveness criteria, and eligible expenses is critical for mutual understanding.

-

This section outlines the original loan amount, interest rate, and loan terms that govern the agreement.

What are the terms and conditions of a loan forgiveness agreement?

Terms and conditions are foundational for the Loan Forgiveness Agreement, as they define the rules both parties must follow. These should be outlined clearly to facilitate effective communication and uphold accountability.

-

This includes overarching requirements that must be met for the borrower to qualify for forgiveness.

-

Clearly list the precise requirements that borrowers need to fulfill, such as employment duration or income levels.

-

Both parties must maintain proper records to comply with the terms, which will protect against future disputes.

How do you fill out the Loan Forgiveness Agreement Template?

Filling out the Loan Forgiveness Agreement Template correctly is crucial to ensure all parties understand their rights and obligations. Following clear, step-by-step instructions can help avoid errors and streamline the process.

-

Ensure that you go through each section of the template diligently, filling out all necessary information accurately.

-

Double-check details like names and amounts to prevent any potential issues during processing.

-

Make full use of pdfFiller's editing and collaboration features, which simplify the signing and sharing process.

What interactive features does pdfFiller offer for loan management?

pdfFiller provides several features designed to enhance your experience in managing loan documents. These tools can significantly improve the efficiency of completing your Loan Forgiveness Agreement.

-

Ensure that your signature is protected through pdfFiller's secure signing process, which complies with legal standards.

-

You can easily share documents with team members, allowing for simultaneous editing and feedback.

-

Access your documents from anywhere, ensuring you have the necessary files at your fingertips no matter where you are.

What compliance notes should you consider for region-specific requirements?

Different regions may have varying guidelines regarding loan forgiveness agreements. Being aware of these variations is crucial for both legal compliance and the successful implementation of the agreement.

-

Understand the specific rules that apply to your location, which can greatly affect eligibility and terms.

-

Certain industries may have unique compliance items to consider; being aware of these can save you from potential legal issues.

-

Stay informed on current regulations through associations or legal resources that specialize in loan management.

What are some real-life scenarios of loan forgiveness?

Real-life cases of loan forgiveness can provide valuable insight into the practical application of these agreements. Understanding these scenarios can help borrowers grasp what is achieved through forgiveness.

-

Reviewing successful loan forgiveness cases can motivate borrowers and clarify what can be achieved.

-

Explore situations such as public service loan forgiveness, which is a common pathway for many borrowers.

-

Analyzing past examples helps develop best practices that can be applied in future agreements.

How to fill out the Loan Forgiveness Agreement Template

-

1.Begin by downloading the Loan Forgiveness Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller, where you can view the editable fields.

-

3.Fill in the borrower's name and contact information at the top of the document.

-

4.Provide the loan details, including the loan amount, date, and specific terms for forgiveness.

-

5.Include any conditions for forgiveness, such as service requirements or payment terms that must be met.

-

6.Review and include any relevant signatures from both the borrower and the lender.

-

7.Ensure all parties agree to the terms outlined in the document by including a date next to the signatures.

-

8.Save your completed agreement and consider sending copies to all involved parties for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.