Loan Guarantee Agreement Template free printable template

Show details

This document outlines the terms and conditions under which the Guarantor agrees to guarantee certain obligations of the Borrower to the Lender relating to a loan.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

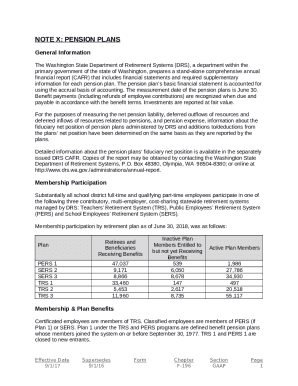

What is Loan Guarantee Agreement Template

A Loan Guarantee Agreement Template is a formal document outlining the conditions under which a lender agrees to provide financial assistance to a borrower, secured by a third-party guarantor.

pdfFiller scores top ratings on review platforms

It works! And when I asked for help I got it prmptly. Thanks.

It has made it so much easier to fill out court forms

I liked the access to all the forms. It was great. And as I tried to do ever more complicated things with the forms (strikethroughs, initialing the corrections in random places, etc.) I learned more and more about the tools the platform has. It has just about everything you could imagine.

So far so great! In a pinch and PDF filler has come through!! A bit disappointed that there is not a more expanded, cheaper personal version, but as I said before we are in a bit of a pinch.

Easy to use! I like how it works but would like to know more about other functions.

MAKES FILLING,PRINTING, AND SAVING FORMS VERY EASY

Who needs Loan Guarantee Agreement Template?

Explore how professionals across industries use pdfFiller.

Loan Guarantee Agreement Template Guide

A Loan Guarantee Agreement Template serves as a crucial tool for borrowers and guarantors alike in securing loans. This guide will provide you with a comprehensive understanding and instructions on how to effectively fill out, edit, sign, and ultimately utilize this important legal document.

What is a Loan Guarantee Agreement?

A Loan Guarantee Agreement is a legal document in which a guarantor agrees to cover a borrower’s debt in the event of default. The presence of this agreement can significantly enhance a borrower’s chance of obtaining a loan by providing additional security to lenders.

-

Definition: A formal promise made by the guarantor to repay a loan if the borrower defaults.

-

Importance: Facilitates easier lending, especially for borrowers with weaker credit histories.

-

Key Parties Involved: Guarantor (the one responsible for payment), Borrower (the one receiving the loan), and Lender (the financial institution).

When should you consider using a Loan Guarantee Agreement?

Loan Guarantee Agreements are particularly useful in scenarios where lenders need additional security against the risk of borrower default. This agreement shields lenders by transferring some of that risk to the guarantor.

-

Situations of Risk: Borrowers with limited credit history or high debt-to-income ratios often need guarantees.

-

Risk Assessment: Evaluate both the economic environment and the borrower’s history.

-

Use Cases: Startups seeking funding, college students without credit history, or anyone requiring co-signers.

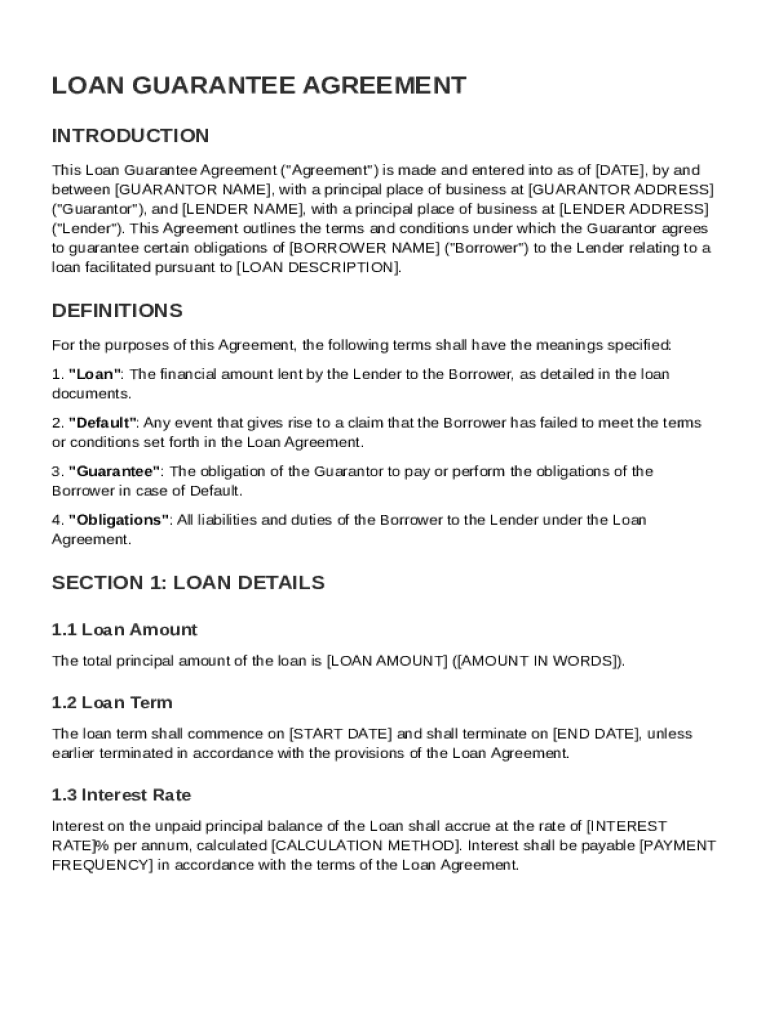

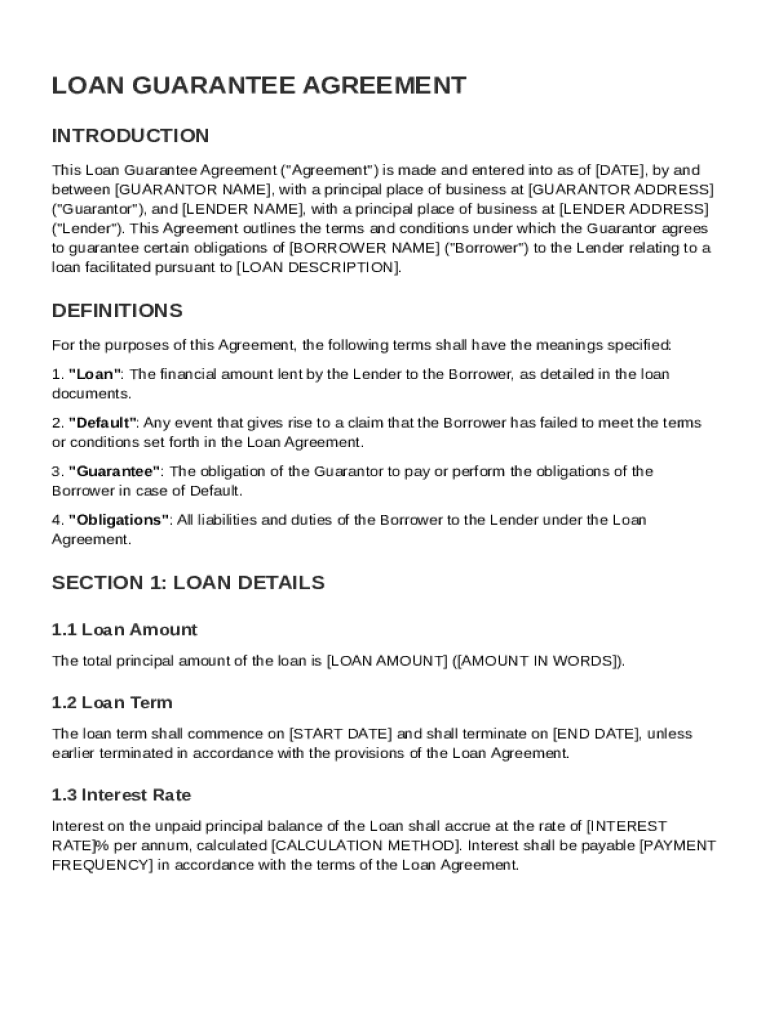

What are the key components of a Loan Guarantee Agreement?

Understanding the components of a Loan Guarantee Agreement is vital for ensuring that all parties involved are aware of their rights and responsibilities. Each component serves to clarify the terms of the loan and the scope of guarantees.

-

Agreement Terms: Details regarding repayment schedules, interest rates, and the total loan amount.

-

Definitions: Terms like 'Loan', 'Default', and 'Guarantee' should be clearly defined to avoid ambiguity.

-

Specifics: Information on collateral, if applicable, and stipulations regarding late payments.

How to fill out a Loan Guarantee Agreement?

Filling out a Loan Guarantee Agreement requires careful attention to detail. Accurate information leads to smoother transactions and helps prevent disputes.

-

Step-by-step Guide: Follow a structured format, ensuring all required fields are filled adequately.

-

Key Fields: Information such as Guarantor Name, Borrower Name, Loan Amount, and Terms is essential.

-

Accuracy Tips: Double-check all entries to avoid legal and financial repercussions.

How to edit and customize your agreement using pdfFiller?

pdfFiller offers powerful editing tools that allow users to customize their Loan Guarantee Agreements efficiently. This cloud-based platform ensures accessibility from any device.

-

Upload: Start by uploading your template to the pdfFiller platform.

-

Editing Tools: Use text boxes to input details, or draw fields where required.

-

Benefits: Experience ease-of-use and enhanced collaboration features that streamline document management.

What steps are involved in signing and finalizing your agreement?

Securing a loan guarantee agreement requires legally binding signatures. Understanding the signing process ensures that all parties feel secure about their commitments.

-

eSigning: Explore the legality and acceptance of electronic signatures in your jurisdiction.

-

eSign Process: Follow simple steps to securely eSign your Loan Guarantee Agreement.

-

Storage Options: Use pdfFiller to efficiently store and manage your agreements post-signing.

What are your obligations under a Loan Guarantee Agreement?

Understanding the obligations under a Loan Guarantee Agreement is crucial for the guarantor. These obligations carry significant legal repercussions that must not be overlooked.

-

Guarantor’s Duties: The guarantor must fulfill their obligations in case of the borrower’s default.

-

Legal Scope: Definitions relating to the extent and limitations of the guarantee must be clear.

-

Importance of Knowledge: Understanding these obligations can prevent unforeseen liabilities.

Looking for something else?

If you're in need of related documents or templates, pdfFiller offers a variety of forms that may suit your needs. Additionally, you can reach out to support for personalized guidance.

-

Related Documents: Explore a range of lending-related templates available on pdfFiller.

-

Less Common Forms: Discover forms that cater to special lending scenarios.

-

Support Assistance: Contact customer support for personalized assistance with documentation.

How to fill out the Loan Guarantee Agreement Template

-

1.Start by downloading the Loan Guarantee Agreement Template from pdfFiller.

-

2.Open the template in the editor on pdfFiller.

-

3.Fill in the parties' names and contact details in the designated fields.

-

4.Specify the loan amount and terms clearly in the appropriate sections.

-

5.Indicate the guarantor's information, including their responsibilities.

-

6.Review all terms and conditions for clarity and accuracy; consider consulting legal advice.

-

7.Include signatures for all parties at the end of the document where indicated.

-

8.Save the filled template and, if needed, convert it to PDF format for distribution.

What is a guarantee in a loan agreement?

A loan guarantee, in finance, is a promise by one party (the guarantor) to assume the debt obligation of a borrower if that borrower defaults. A guarantee can be limited or unlimited, making the guarantor liable for only a portion or all of the debt.

How to write a guarantee letter for a loan?

Supply All Necessary Information State clearly any limitations to your guarantee, whether it involves financial or time factors. Indicate all necessary information that is required from you, which may include bank account numbers, annual income, and even social security number.

How to draft a guarantee agreement?

The Guarantor(s) declare that the Guarantor(s) has/have not received any security from the Borrower for the giving of this guarantee and the Guarantor(s) agree that so long as any moneys remain owing by the Borrower to the Bank or any liability incurred by the Bank remains outstanding, the Guarantor(s) will not take

How do I write a simple loan agreement?

Start Your Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.