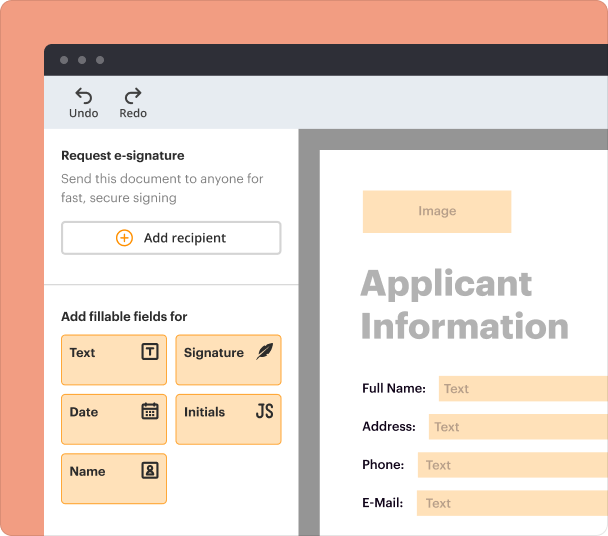

Create a document with fillable fields or use templates and bulk pre-fill to save time and reduce errors.

Get the free Loan Guarantor Agreement Template

Show details

This document outlines the terms and conditions under which a guarantor agrees to guarantee the repayment of a loan extended by a lender to a borrower.

We are not affiliated with any brand or entity on this form

All your contracts, one secure solution

Access all the PDF tools for effortless contract management.

Prepare agreements

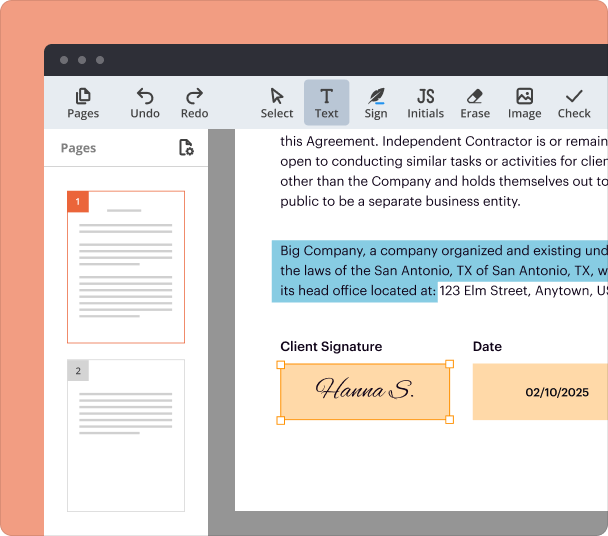

Edit and sign

Add or delete text. Highlight details, redact sensitive info, add notes. Type, draw, or upload your signature.

Share and collaborate

Share agreement to fill out, edit, and sign. Exchange comments directly in the document for quick reviews and approvals.

Track, organize & store

Track signing progress live, store contracts in folders your entire team can access, or securely store them in the cloud.

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

Instructions and help about Loan Guarantor Agreement Template

This section provides essential guidance on how to edit and fill out the Loan Guarantor Agreement Template effectively.

How to edit Loan Guarantor Agreement Template

Editing the Loan Guarantor Agreement Template using pdfFiller is a straightforward process that allows you to make necessary modifications with ease. Follow the steps below:

-

1.Click the ‘Get form’ button on this page to access the Loan Guarantor Agreement Template.

-

2.Create an account on pdfFiller if you don’t already have one, or log in to your existing account.

-

3.Once logged in, the template will open in the pdfFiller editor, where you can access various editing tools.

-

4.Utilize the text box feature to add or modify information, ensuring that all necessary fields are filled correctly.

-

5.Make use of additional features like eSigning, commenting, or adding images as required.

-

6.After completing your edits, save your document, and consider downloading it as a PDF or sharing it directly from the platform.

How to fill out Loan Guarantor Agreement Template

Filling out the Loan Guarantor Agreement Template correctly is crucial to ensuring a clear and legally compliant document. Here’s how to do it:

-

1.Click ‘Get form’ on this page to access the Loan Guarantor Agreement Template.

-

2.Review the document to understand what information is required before starting to fill it out.

-

3.Begin entering the required information in the appropriate fields, such as names, dates, and financial details.

-

4.Double-check the accuracy of all entered data to prevent any mistakes.

-

5.If any changes are needed, you can easily edit the form in pdfFiller as described above.

-

6.Once completed, consider eSigning the document if necessary, which can also be done within the pdfFiller platform.

-

7.Save your filled-out form and choose to download it or share it directly for submission.

All you need to know about Loan Guarantor Agreement Template

This section outlines the key aspects of the Loan Guarantor Agreement Template, providing insights into its definitions and typical use cases.

What is a Loan Guarantor Agreement Template?

A Loan Guarantor Agreement Template is a legal document that formalizes the arrangement between a borrower and a guarantor, where the guarantor agrees to take on the responsibility for the loan if the borrower defaults. This template serves as a structured form to ease the process of creating such an agreement.

Definition and key provisions of a Loan Guarantor Agreement Template

Understanding the definition and provisions of this template is essential for ensuring it meets specific legal standards:

-

1.<strong>Guarantor's obligations:</strong> Details the responsibilities the guarantor undertakes regarding the loan.

-

2.<strong>Loan amount:</strong> Specifies the total loan amount that is being guaranteed.

-

3.<strong>Terms of repayment:</strong> Includes information on how and when repayments will be made.

-

4.<strong>Duration of guarantee:</strong> States the period during which the guarantor will be responsible.

-

5.<strong>Conditions for default:</strong> Outlines the circumstances under which the guarantor becomes liable.

When is a Loan Guarantor Agreement Template used?

This template is typically used when an individual or organization is applying for a loan but may not have sufficient creditworthiness or financial standing to qualify independently. It is also used in business transactions involving larger sums of money or when lenders require additional security.

Main sections and clauses of a Loan Guarantor Agreement Template

The following are common sections and clauses included in a Loan Guarantor Agreement Template:

-

1.<strong>Parties involved:</strong> Identification of the borrower and the guarantor.

-

2.<strong>Loan details:</strong> Description of the loan amount and interest rates.

-

3.<strong>Guarantee clause:</strong> The guarantees provided by the guarantor regarding the loan.

-

4.<strong>Default terms:</strong> Explanation of what constitutes a default.

-

5.<strong>Governing law:</strong> Specifies which jurisdiction’s laws govern the agreement.

What needs to be included in a Loan Guarantor Agreement Template?

To ensure that the Loan Guarantor Agreement is comprehensive and legally binding, include the following:

-

1.The full names and addresses of the borrower and guarantor.

-

2.The specific loan amount that is being guaranteed.

-

3.A timeline for repayment of the loan.

-

4.Descriptions of the guarantor’s obligations and circumstances under which they would need to act.

-

5.Conditions for declaring a default.

-

6.Signature lines for both parties to demonstrate their agreement and commitment.

How to write a guarantor form for a loan?

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

What is the guarantor agreement for a loan?

The Guarantor(s) agree/s as a pre-condition of the credit facility granted by the Bank to the Borrower that in case any default is committed in the repayment of the loan/advance or in repayment of interest thereon or any of the agreed instalment of the loan on due date/s, the Bank and/or the Reserve Bank of India will

What are the rules for loan guarantors?

A guarantor will only become liable for the amount they have guaranteed (which could be up to the full amount of the home loan, along with interest and reasonable enforcement expenses) in the event the borrower(s) can't meet the repayment terms and conditions of their loan contract.

What is an example of a guarantor clause?

The Guarantor hereby fully and unconditionally guarantees to each Holder the due and punctual payment of the Guarantee Payments, as and to the extent applicable (without duplication of amounts theretofore paid by the Issuer) when and as the same shall become due and payable, according to the terms of the Preferred

pdfFiller scores top ratings on review platforms

It is not as easy to line up words I type with words already on the page, but it sure is better than using a typewriter!

I am am extremely impressed with this service. Very easy to use. I recommend this to any private person and businesses seeking a convenient document fill product.

Not ready to share my experience, it is to much recent

I am still trying to work out how to create an editable PDF document

t nd t vry hdrd to work. C n ont. Look t th tyng

I used it satisfactorily a couple of times, and I'm continuing to experiment with it.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.