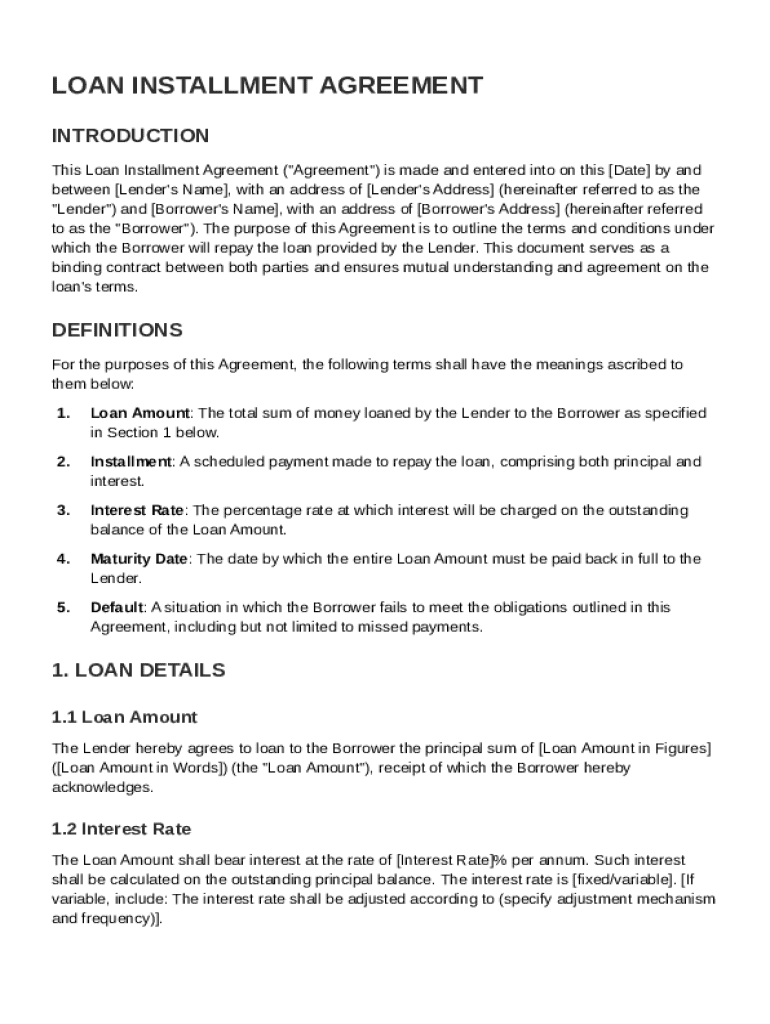

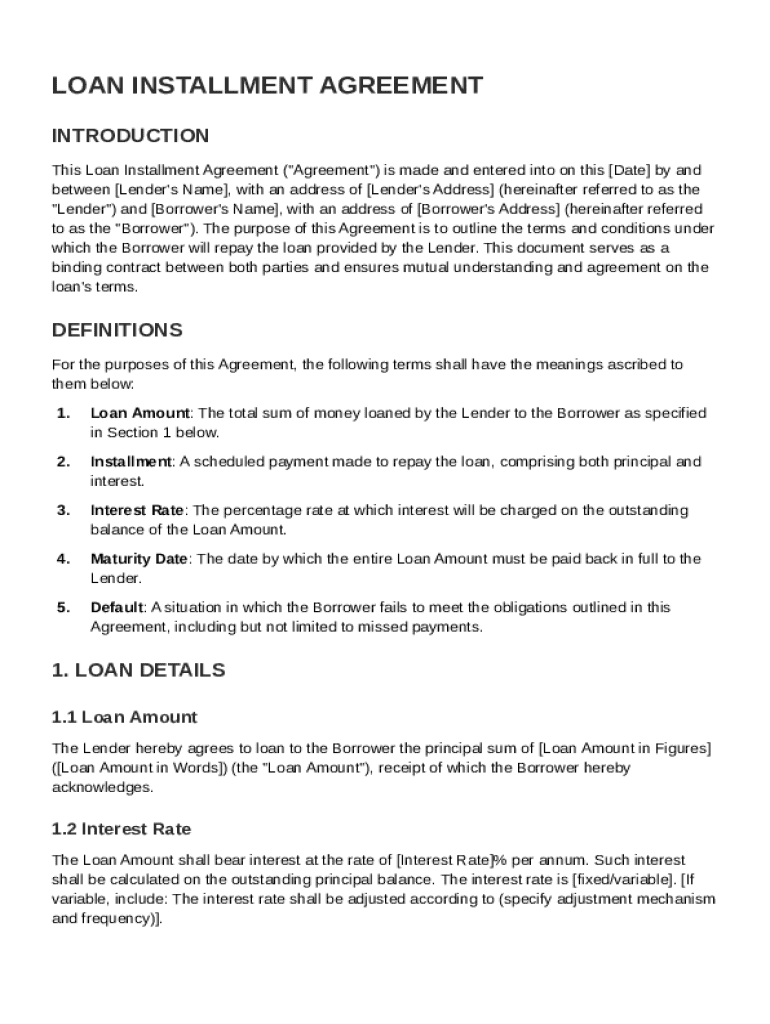

Loan Installment Agreement Template free printable template

Show details

This document outlines the terms and conditions for repaying a loan agreed upon by the Lender and Borrower, serving as a binding contract.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Installment Agreement Template

A Loan Installment Agreement Template is a legal document outlining the terms under which a borrower agrees to repay a loan to a lender in specified installments over a defined period.

pdfFiller scores top ratings on review platforms

Quick and easy refund

I had excellent customer service after I was charged a monthly fee by error. The service response to my initial email was very quick; 3 easy, practical solutions were offered and following my choice my refund was processed very quickly.Very grateful.John

The support was fast

The support was fast. They were able to understand my problem and found a fast and effective solution to it! Thanks to Kara for her help

great

greats highly recommend

Very easy to use

I know of no further activities that I…

I know of no further activities that I require this service

great services with great results.

Who needs Loan Installment Agreement Template?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Loan Installment Agreement Templates on pdfFiller

What is a Loan Installment Agreement?

A Loan Installment Agreement is a legally binding document that outlines the terms under which a borrower will repay a loan to a lender. Creating a written agreement protects both parties by clarifying expectations and responsibilities. The key parties involved are the lender, who provides the loan, and the borrower, who receives the loan and agrees to repay it in installments.

-

A formal document outlining the loan terms and conditions, ensuring both parties understand their obligations.

-

To provide transparency and legal footing in financial transactions, reducing the chances of misunderstandings.

-

Typically involves a lender and a borrower, both of whom must agree to the terms set forth in the agreement.

What are the key components of a Loan Installment Agreement?

Understanding the essential components of a Loan Installment Agreement is crucial for both lenders and borrowers. Key components include the loan amount, interest rate, maturity date, payment schedules, and definitions related to default. These elements help ensure clear communication and expectations.

-

The total sum borrowed, clearly stated in the agreement to avoid confusion.

-

The percentage of the loan that is charged as interest, impacting the total repayment amount.

-

The date by which the loan must be fully repaid, providing a timeline for repayment.

-

Details on how and when payments will be made, ensuring both parties are on the same page.

-

Definitions of what constitutes default and the corresponding consequences if payments are not made.

How do fill out a Loan Installment Agreement?

Filling out a Loan Installment Agreement requires careful attention to detail. Start by providing complete information in each section of the agreement, ensuring that all essential clauses are included. pdfFiller offers user-friendly editing tools to help customize and modify your agreement easily.

-

Follow step-by-step guidelines to ensure you cover all aspects of the agreement.

-

Adapt the agreement to fit specific needs or circumstances unique to your situation.

-

Take advantage of editing, e-signature, and collaborative features available on the platform.

What common mistakes should avoid when creating an agreement?

Many individuals overlook critical details when drafting a Loan Installment Agreement. Common mistakes include providing incomplete information, failing to specify terms of default, and neglecting to include essential clauses. Avoiding these missteps can prevent potential disputes and confusion.

-

Ensure all information regarding the lender and borrower is accurate and complete.

-

Clearly state how payments will be made and the actions that will be taken in case of default.

-

Inclusion of specific terms helps to safeguard interests and minimize misunderstandings.

What tools help manage a Loan Installment Agreement?

Successful management of a Loan Installment Agreement can be achieved using various interactive tools provided by platforms like pdfFiller. Features such as electronic signing and secure sharing enhance the user experience, facilitating efficient collaboration.

-

Tools enabling you to keep track of all documents associated with your loan agreement.

-

Securely sign your agreement online, eliminating the need for physical paperwork.

-

Efficiently work with team members or advisors to finalize and manage the agreement.

What are the legal considerations for Loan Installment Agreements?

Regulations governing Loan Installment Agreements vary by region, making it essential to familiarize yourself with applicable local laws. Compliance with both state and federal regulations ensures your agreement is legally enforceable. Always consider seeking legal advice prior to finalizing your document.

-

Understanding region-specific regulations helps safeguard legal standing in transactions.

-

Ensure your agreement adheres to all relevant laws to avoid potential legal issues.

-

Consult professionals to clarify any complex legal aspects of your agreement.

What can we learn from successful Loan Installment Agreement case studies?

Real-life examples of Loan Installment Agreements demonstrate the value of having clear, written contracts. These case studies show how effective communication in agreements mitigates risks and ensures better outcomes for all parties involved. They highlight valuable lessons learned from both successes and challenges.

-

Many businesses and individuals report successful outcomes due to clear agreements.

-

Experiences can guide future practices and avoid repeating mistakes.

-

Proper agreements can address and minimize risks, protecting both lenders and borrowers.

How to fill out the Loan Installment Agreement Template

-

1.Download the Loan Installment Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Begin by filling in the date the agreement is created.

-

4.Insert the borrower's name and contact information in the designated fields.

-

5.Provide the lender's name and contact information similarly.

-

6.Specify the loan amount clearly within the form.

-

7.Indicate the interest rate applicable to the loan.

-

8.Outline the repayment schedule, including the frequency of payments (weekly, monthly).

-

9.Fill in the start date and the total number of installments required.

-

10.Incorporate any additional terms or conditions in the designated section.

-

11.Review the entire document for accuracy and completeness.

-

12.Save the completed agreement and export it as needed for signing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.