Loan No Interest Agreement Template free printable template

Show details

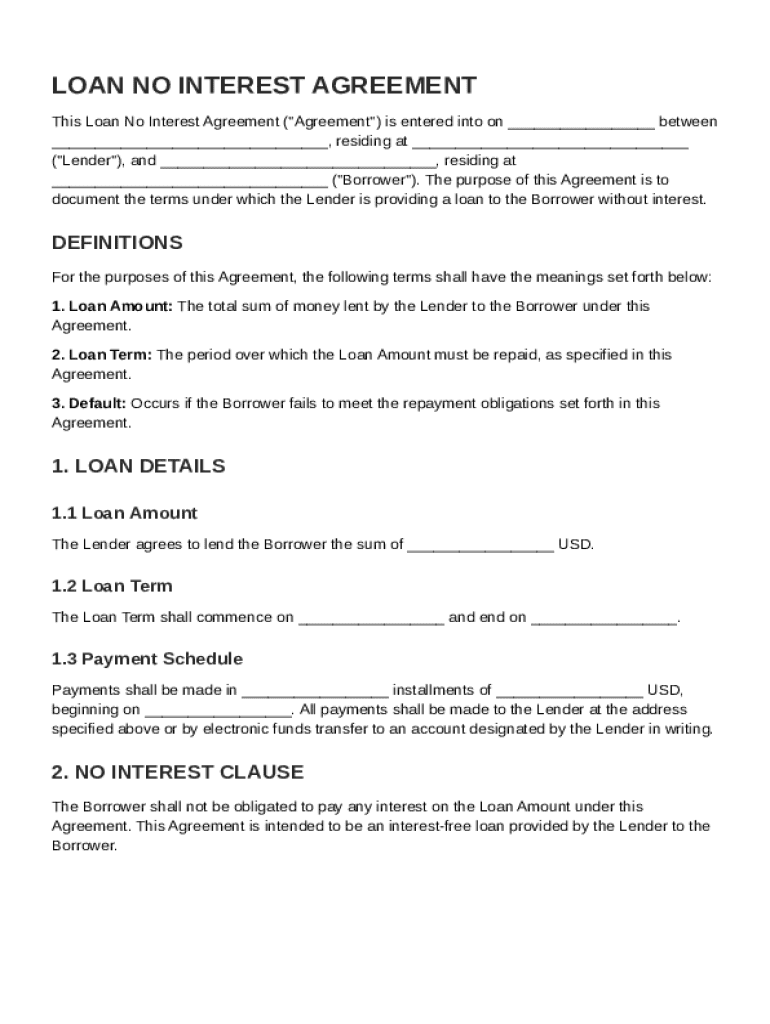

This document outlines the terms of an interestfree loan agreement between a lender and a borrower, detailing loan amount, repayment terms, and default remedies.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan No Interest Agreement Template

A Loan No Interest Agreement Template is a legal document outlining the terms of a loan that does not accrue interest between the parties involved.

pdfFiller scores top ratings on review platforms

I got my questions answered quickly and I got what I needed from the service, a signed PDF document. Thank you

Thank you for your support. It has been a very Big help in getting my paper work done and in a hurry I appreciate your service.

Easy to use, but sometimes doesn't show exactly what I need with form being listed under another name or title (e.g. a search for DA 31 gave me the AR 600-1 132 page doc but not the Leave and Pass Form).

Pretty good. Just wish it was a little better at navigating naturally through the forms

Very handy and works exactly as advertized.

Very user friendly, somewhat intuitive and very easy to use!

Who needs Loan No Interest Agreement Template?

Explore how professionals across industries use pdfFiller.

Loan No Interest Agreement Guide

How to fill out a Loan No Interest Agreement form

Filling out a Loan No Interest Agreement form involves gathering relevant details about the loan, identifying terms and conditions, and ensuring all parties consent to the terms outlined. The process may include specified loan amounts, repayment schedules, and any special arrangements. Utilize tools available on pdfFiller for seamless editing and signing.

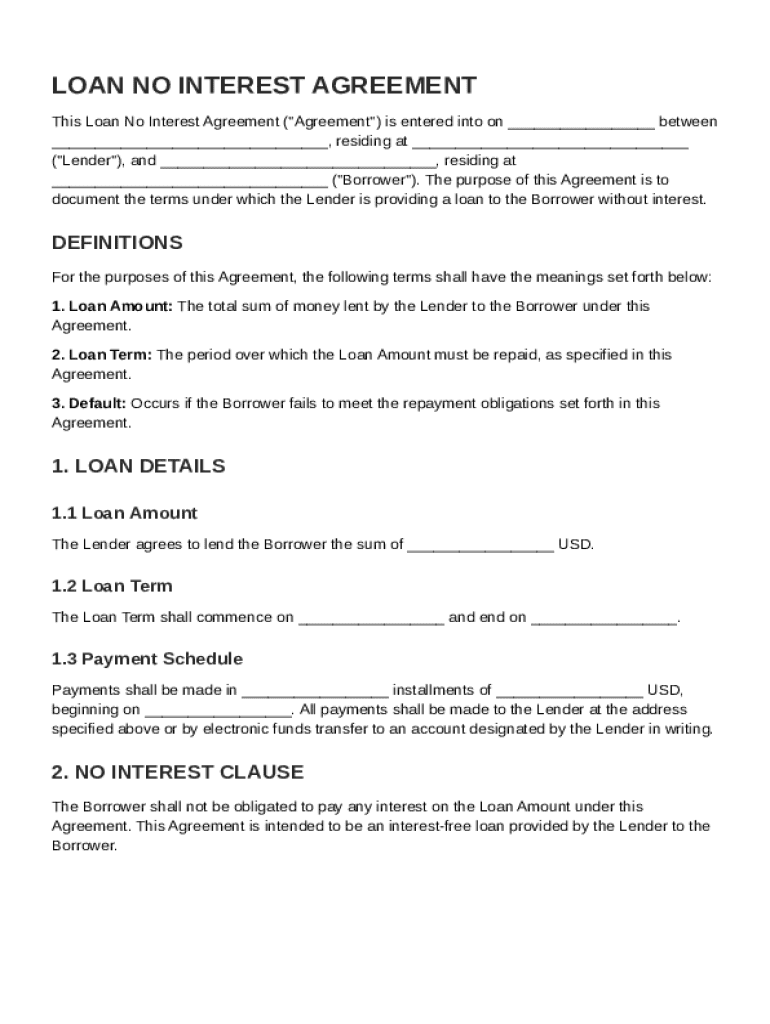

Understanding the Loan No Interest Agreement

A Loan No Interest Agreement outlines the terms under which money is lent without the borrower paying any interest on the loan amount. These agreements are significant as they eliminate the cost of interest, making borrowing more accessible and affordable for the borrower.

-

This agreement specifies the principal amount lent and confirms the borrower’s obligations without any added interest costs.

-

They can foster trust in personal relationships and reduce the financial burden on borrowers. Additionally, they help in avoiding instances of usury and predatory lending.

-

These agreements are often employed in family loans, among friends, or even in certain business settings where formal contracts are needed without the cost of interest.

What are the key components of the Loan No Interest Agreement?

Understanding the key components of a Loan No Interest Agreement ensures clarity and helps prevent future disputes. This agreement typically includes the essential loan details and specific clauses that govern its terms.

-

This section specifies the total amount loaned and any associated fees, ensuring transparency in financial dealings.

-

The total sum of money that the lender is agreeing to give to the borrower without interest charges.

-

The specific duration within which the loan must be repaid, critical for both parties to know.

-

This section outlines the repayment intervals, whether monthly, quarterly, or as agreed upon by parties.

-

Clearly delineating the absence of interest serves to avoid ambiguity and protect both lender and borrower.

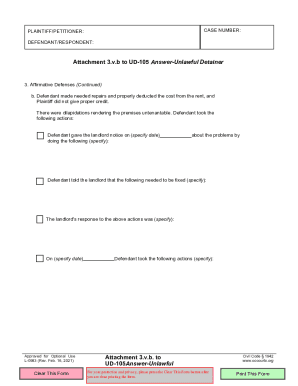

How are terms and conditions defined?

Defining terms and conditions in a Loan No Interest Agreement is crucial to establish legal guidelines and expectations for compliance.

-

Default occurs when the borrower fails to adhere to the repayment schedule, leading to potential legal consequences.

-

In case of default, the lender may seek remedies such as legal action, restructuring the loan, or negotiating alternative payment arrangements.

-

Both parties must understand their legal responsibilities to mitigate risks and ensure compliance with the terms set forth in the agreement.

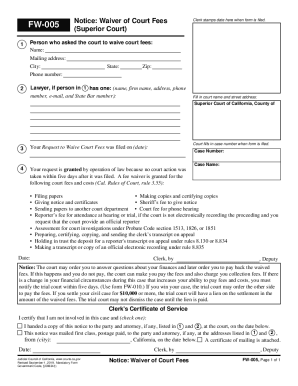

How to fill out the Loan No Interest Agreement

Completing a Loan No Interest Agreement may initially seem complex, but following a systematic step-by-step approach can simplify the process.

-

Begin by clearly outlining all the necessary details such as borrower and lender information, loan amount, and repayment terms.

-

Utilize pdfFiller’s online tools for creating and modifying your agreement, allowing for easy collaboration and editing.

-

Ensure all terms are clearly articulated and that no fields are left blank, which could lead to misunderstandings in the future.

How to manage your Loan No Interest Agreement

Managing your Loan No Interest Agreement is essential for maintaining compliance and ensuring both parties are adhering to the terms outlined.

-

Regularly monitor repayment dates and amounts to avoid potential defaults.

-

Leverage pdfFiller’s cloud-based features to stay updated on documents and alterations, enhancing organizational efficiency.

-

Should discrepancies arise, open communication is vital along with thorough documentation of any modifications made to the original terms.

What can we learn from case studies and examples?

Examining case studies and examples can provide valuable insights into effective uses of Loan No Interest Agreements, as well as potential pitfalls.

-

These can range from simple family loans to more complex arrangements between friends, showcasing the flexibility of such agreements.

-

Studying outcomes from real-world scenarios highlights the importance of adhering to terms and understanding ramifications of defaulting.

-

Gaining insights from past applications aids individuals in avoiding common mistakes while structuring their loans.

Why choose pdfFiller for your loan agreements?

Choosing pdfFiller for managing Loan No Interest Agreements empowers you with efficient tools and the convenience of seamless document management online.

-

pdfFiller offers intuitive editing tools and eSigning capabilities, making the process of finalizing agreements straightforward.

-

Collaboration features enable multiple users to work on a document simultaneously, fostering teamwork and efficiency.

-

This ensures that your documents are accessible from anywhere, making it easy to manage and share agreements when necessary.

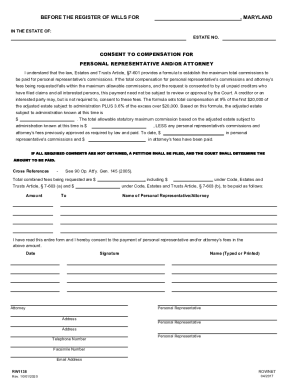

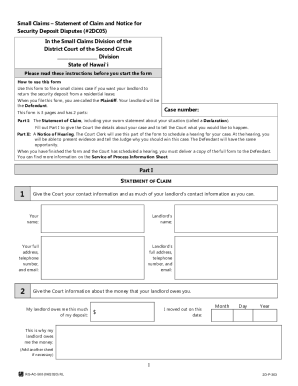

How to fill out the Loan No Interest Agreement Template

-

1.Download the Loan No Interest Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller and review the provided fields.

-

3.Begin by entering the date of the agreement at the top of the document.

-

4.Fill in the full names and addresses of both the lender and borrower in the designated fields.

-

5.Specify the loan amount that is agreed upon, ensuring it is clearly stated.

-

6.Detail the repayment terms, including the schedule and any provisions for late payments or changes.

-

7.If needed, include a section for additional terms or conditions that both parties may want to agree upon.

-

8.Review the completed document for accuracy and ensure all necessary fields are filled in.

-

9.Once satisfied, save the document and share it with the other party for a signature.

-

10.Consider having a witness or notary if required for legal validity.

How to make a loan without interest?

The only interest free loan option is to borrow from friends or family members. All banks & financial institutions will charge you an interest because lending is a business for them.

What is the no interest clause in a loan agreement?

Here's how a "no interest" clause might appear in a contract or financing agreement: "The Borrower agrees to repay the principal loan amount of [$amount] in monthly installments over a period of [time frame], with no interest charged on the outstanding balance during the term of the loan.

Can I take a loan with no interest?

There's no such thing as an interest-free or 0% interest loan. If you take out a personal loan with a lender, they will always charge interest. The only way you may be able to get an interest-free loan is if you borrow from a family member or a friend.

How to write a simple loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.