Loan Payment Agreement Template free printable template

Show details

Este documento describe un acuerdo de prstamo entre un prestamista y un prestatario, incluyendo detalles sobre el monto del prstamo, la tasa de inters, el acuerdo de pago y las condiciones de incumplimiento.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Payment Agreement Template

A Loan Payment Agreement Template is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan to a lender.

pdfFiller scores top ratings on review platforms

It has been a positive experience, no issues, everything ran smooth from start to finish. I would like to learn more about PDFfiller. I am looking forward to attending a webinar

I have found it great. But I am still a novice and would love to learn more about the features

I'm a beginner

The only problem is having to share my…

The only problem is having to share my feedback right in the middle of doing my work. Otherwise, great product!!

Very helpfull support!

Very good service, easy to get in contact with the extremly helpfull support.

Saving me so much time!

Saving me so much time!

Who needs Loan Payment Agreement Template?

Explore how professionals across industries use pdfFiller.

Loan Payment Agreement Template Guide

How to fill out a loan payment agreement form

Filling out a loan payment agreement form involves gathering essential information, clearly stating the loan amount and terms, and setting a structured payment schedule. This process ensures both the lender and borrower fully understand their responsibilities under the agreement.

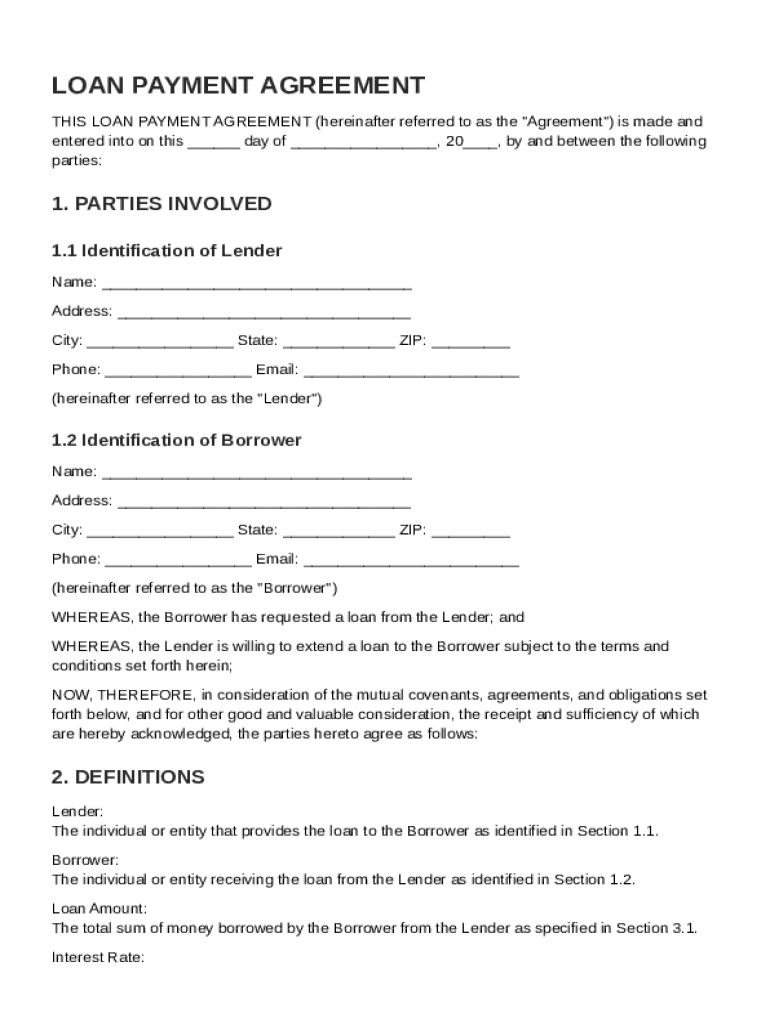

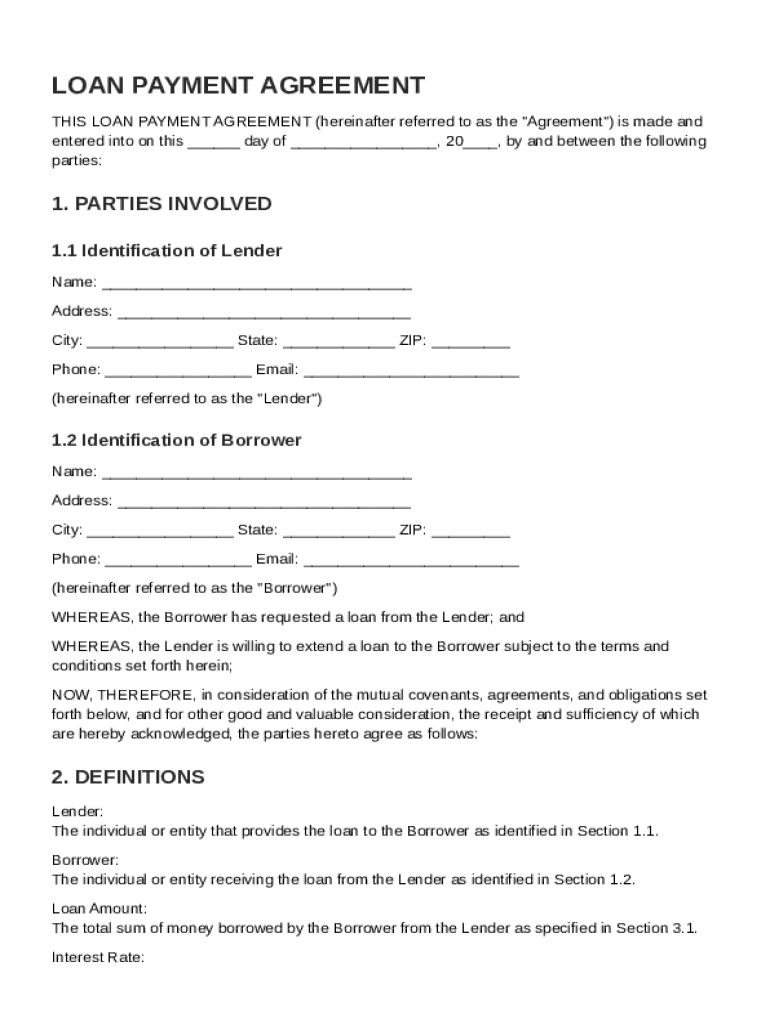

What is a loan payment agreement?

A loan payment agreement is a legally binding contract outlining the terms between a lender and borrower. It establishes the specifics of the loan, including the amount borrowed, interest rate, repayment schedule, and conditions under which defaults may occur.

-

It is a formal document detailing the borrowed funds and the obligation to repay them under agreed-upon terms.

-

It protects both parties and provides clarity on the repayment expectations, reducing disputes and misunderstandings.

-

Typical situations include personal loans, business loans, or any informal lending to friends or family members.

What are the key components of a loan payment agreement?

Understanding the key components of a loan payment agreement is vital to ensure completeness and legality. Each element must be clearly defined to uphold enforceability and mutual understanding.

-

Clearly state the names and contact information of both the lender and borrower.

-

Specify the total amount loaned and the applicable interest rate to avoid confusion over payments.

-

Outline how often payments are due (e.g., monthly, quarterly) and specific due dates.

-

Define what constitutes a default on the loan, such as missed payments, and the repercussions thereof.

How to fill out a loan payment agreement

Filling out a loan payment agreement correctly is crucial. Start by gathering all necessary documentation related to the loan and personal details of both parties.

-

Collect personal details and specific financial information that should be included in the agreement.

-

Accurately enter the names, addresses, and contact information of the lender and the borrower.

-

Clearly indicate the total loan amount, the interest rate, and any specific repayment terms.

-

Outline the payment frequency and provide clarity on due dates for each installment.

How to edit your loan payment agreement on pdfFiller

Using pdfFiller simplifies the process of editing your loan payment agreement. With intuitive tools at your disposal, making changes is straightforward.

-

Access the platform's various features to adjust text and details easily.

-

Utilize the electronic signature feature for secure and efficient signing of the agreement.

-

Store your agreement on pdfFiller's cloud platform for easy retrieval and management.

What types of loan agreements are there?

Various types of loan agreements exist, each serving different purposes. Understanding these distinctions helps in selecting the appropriate agreement for your situation.

-

A loan agreement outlines terms while a promissory note is a simpler document affirming the promise to pay back a loan.

-

Business loans often have different terms and requirements compared to personal loans, reflecting their intended use.

-

Choose an agreement that best fits your financial situation, whether for personal use, family lending, or business financing.

What are the compliance and legal considerations?

Legal compliance is paramount when creating a loan payment agreement. Understanding the implications ensures the document is enforceable in court.

-

Both parties should be aware of their rights and obligations as stated within the loan agreement.

-

Different states might have specific rules regarding loan agreements, which must be adhered to.

-

Design the agreement with legal standards, including necessary signatures and dates.

Where to find a sample loan payment agreement template

A sample loan payment agreement template can provide a solid starting point. This can help ensure that important terms are not overlooked.

-

Look for templates that allow custom edits to satisfy specific financial situations.

-

A good template will outline crucial sections clearly, helping users understand what to include.

-

Templates should come with clear guidelines on how to fill in and adapt each section appropriately.

When is a loan payment agreement necessary?

Recognizing scenarios when a loan payment agreement is necessary can shield lenders and borrowers from future disputes. Being proactive with agreements is a best practice.

-

Any time a sum of money is lent, especially in larger amounts or unfamiliar relationships, an agreement is advisable.

-

Lacking an official agreement can lead to misunderstandings and potential loss of funds.

-

Indications include the size of the loan, interest involved, and relationship dynamics.

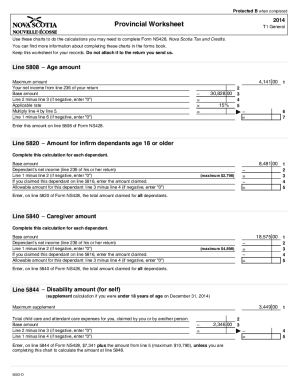

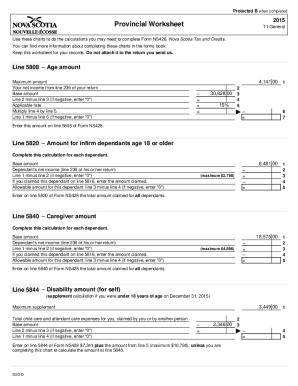

How to fill out the Loan Payment Agreement Template

-

1.Download the Loan Payment Agreement Template from pdfFiller.

-

2.Open the document in the pdfFiller platform.

-

3.Fill in the date at the top of the document to indicate when the agreement is created.

-

4.Enter the full name and contact details of both the lender and the borrower in the designated sections.

-

5.Specify the loan amount clearly in the corresponding field.

-

6.Define the interest rate applicable to the loan, if any, and ensure it complies with state laws.

-

7.Outline the repayment terms, including payment frequency (monthly, bi-weekly), and the duration of the loan.

-

8.Insert the payment due date for each installment to provide clarity on repayment expectations.

-

9.Include any penalties for late payment in a separate clause to protect the lender's interests.

-

10.Review the entire document for accuracy and completeness before saving it.

-

11.Sign the agreement at the bottom, and ensure both parties retain a copy for their records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.