Loan Payment Plan Agreement Template free printable template

Show details

This Agreement outlines the terms and conditions under which the Borrower will repay the loan amount provided by the Lender, ensuring mutual understanding of obligations and repayment structure.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

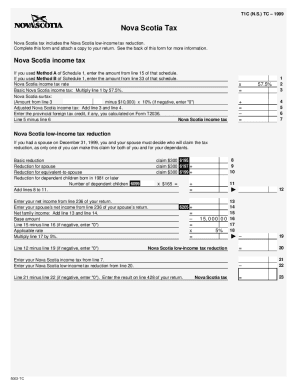

What is Loan Payment Plan Agreement Template

A Loan Payment Plan Agreement Template is a legal document outlining the terms and conditions under which a borrower agrees to repay a loan over a specified period.

pdfFiller scores top ratings on review platforms

It was great, I only needed this for a one time document. Thank so much!

Settled on filler because of ease to use and storage. Am concise ring to upgrade after first month expires.

I had problems using this program. Customer support helped me to figure out what was causing the problem and fixed it. I appreciate their time and effort.

This has been such a timesaver and produces more professional documents than handwritten ones.

I have tried a couple other products and they do not compare with the ease of the PDFfiller product. I am over 80 and faced with a great deal of medical paperwork regarding insurance, test results, doctors paperwork and hospital paperwork.

My handwriting is a bit shaky with age and at times people can not read what I have attempted to write. I used PDFfiller on a several pages of a doctor's information form and it was a breeze and people could read my answers. The doctors staff wanted to know how I did it and thanked me many times for doing it with PDFfiller.

I had stroke on August 10,2014...this program is easy as it can be for me to fill out.Thank you.

Who needs Loan Payment Plan Agreement Template?

Explore how professionals across industries use pdfFiller.

Loan Payment Plan Agreement Guide on pdfFiller

Filling out a Loan Payment Plan Agreement form is a straightforward process that requires careful attention to detail. This guide will provide you with the necessary steps to properly complete this important document.

What is a loan payment plan agreement?

A Loan Payment Plan Agreement is a structured document that lays out the terms under which a borrower agrees to repay a loan. It serves as a legal record for both parties, aiming to clarify expectations and obligations. Understanding this agreement is crucial for both borrowers and lenders as it helps prevent misunderstandings.

-

The agreement clearly defines how loan repayments will be made, ensuring both the borrower and lender are on the same page.

-

It provides legal protection to both parties, outlining terms such as payment amounts, schedules, and penalties for default.

-

Common uses include personal loans, business loans, and situations where repayment terms need clear documentation.

What are the key components of the agreement?

A well-crafted Loan Payment Plan Agreement includes several critical components, which ensure all parties involved know their roles and responsibilities.

-

The agreement identifies the borrower and lender, detailing their definitions and responsibilities within the contract. This clarity establishes accountability.

-

It specifies crucial elements such as loan amount, interest rate (fixed or variable), term of the loan, and maturity date to avoid future disputes.

-

This section outlines how often payments are due, what the next due date is, the payment amount, and acceptable payment methods, ensuring efficient transactions.

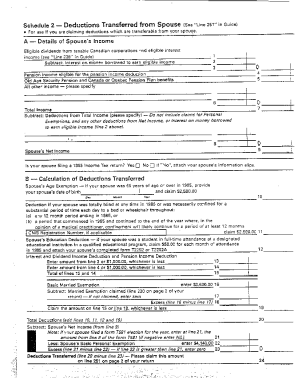

What are legal obligations and default conditions?

Legal obligations are a significant part of the Loan Payment Plan Agreement, as they define what happens if either party defaults. Default conditions must be clearly laid out to protect both parties.

-

Circumstances such as failure to make timely payments or declaring bankruptcy can lead to default, creating serious ramifications.

-

Default can have dire consequences, including legal action, the report of non-payment to credit bureaus, and potential asset seizure.

-

Lenders can pursue remedies such as restructuring the payment plan or initiating collection proceedings, which underscores the need for thoroughness in the agreement.

How to fill out a Loan Payment Plan Agreement

Filling out the agreement correctly is essential for its validity. Follow these simple steps to complete the form effectively.

-

Begin by accurately entering the party information and the loan details, then specify the payment terms based on the pre-discussed agreement.

-

Choose the right template based on your specific needs, ensuring that it is tailored for the type of loan in question.

-

pdfFiller offers tools to edit and customize your agreement, including eSign capabilities that make the agreement legally binding.

How to manage your loan payment plan agreement

Proper management of your agreement is key to a smooth repayment process. Using pdfFiller can simplify this task significantly.

-

Use pdfFiller to keep your agreements secure and accessible, ensuring you can retrieve them whenever necessary.

-

The platform allows for easy collaboration with other stakeholders, maintaining communication and transparency.

-

Set up reminders and keep track of your payment schedule through pdfFiller to avoid any late fees.

Why choose pdfFiller for your loan payment plan needs?

pdfFiller stands out as a cloud-based document management solution, offering numerous benefits tailored for seamless form management.

-

Accessing and managing your documents from anywhere is a crucial advantage offered by pdfFiller, enhancing flexibility.

-

With its intuitive design, pdfFiller simplifies the process of editing and managing documents, making them accessible for users of all skill levels.

-

pdfFiller provides extensive customer support and resources to assist users in managing their agreements efficiently.

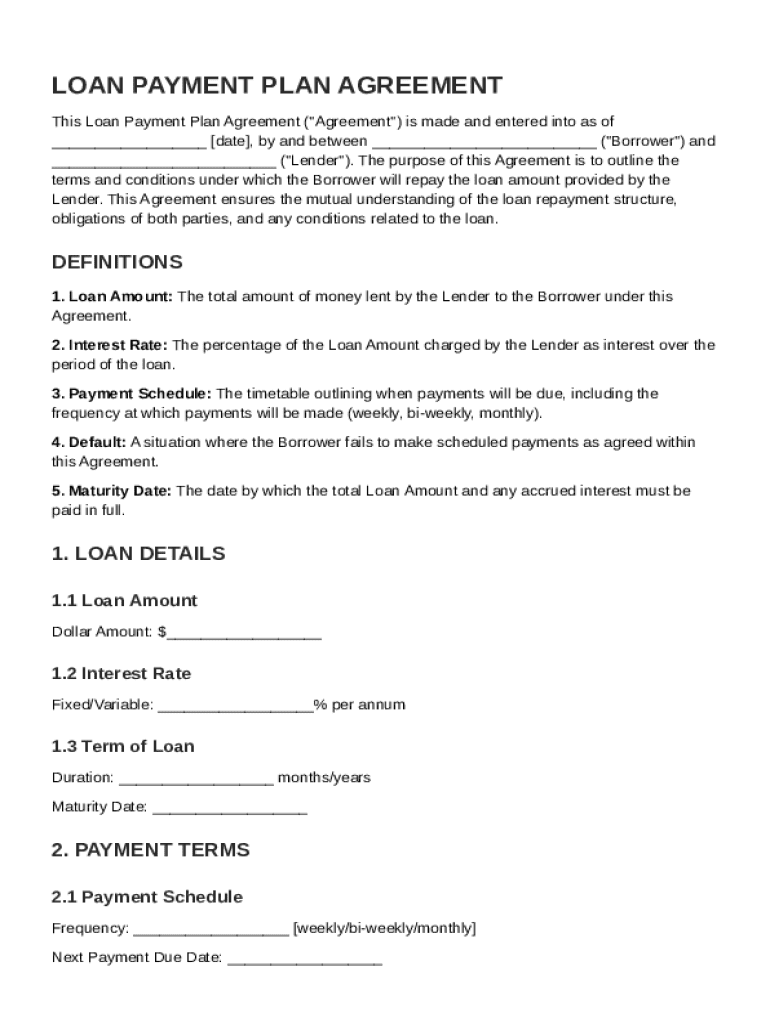

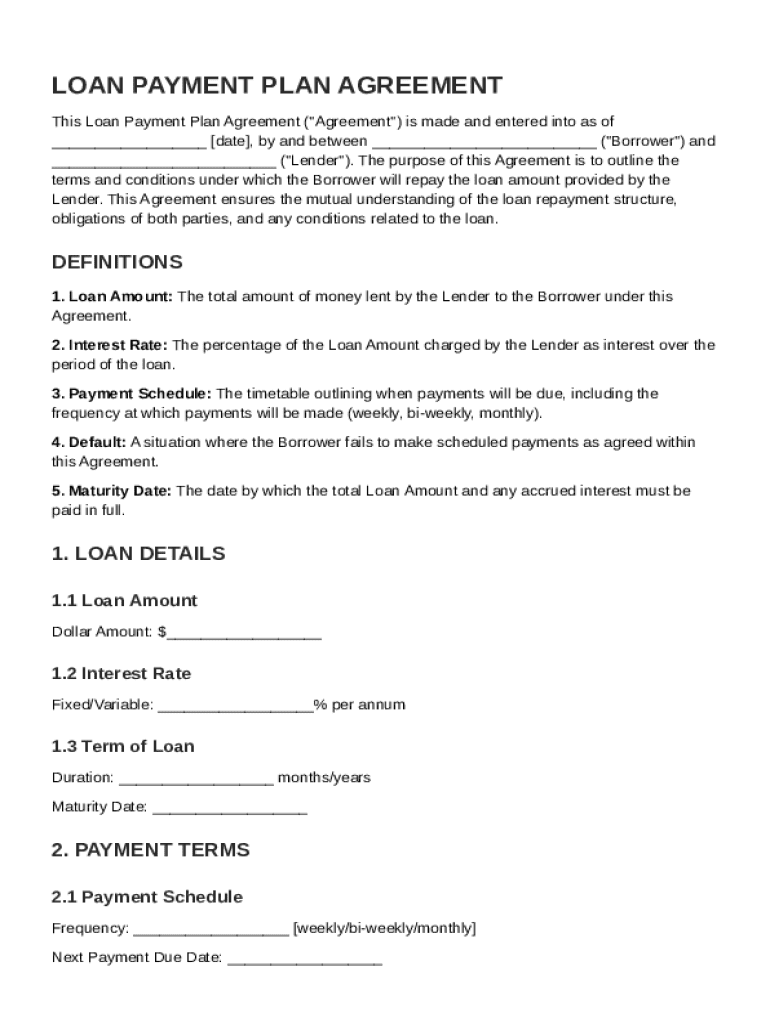

How to fill out the Loan Payment Plan Agreement Template

-

1.Open the Loan Payment Plan Agreement Template in pdfFiller.

-

2.Start by entering the date in the designated section at the top of the document.

-

3.Fill in the names and addresses of the borrower and lender in the appropriate fields.

-

4.Specify the loan amount clearly, ensuring accuracy for both parties.

-

5.Outline the repayment schedule, including the start date, frequency of payments, and total duration.

-

6.Detail the payment amount due at each interval, making sure calculations are correct.

-

7.Include any applicable interest rate or fees in the designated area, if applicable.

-

8.Mention any collateral or guarantees attached to the loan in the relevant section.

-

9.Have both parties review all filled information for accuracy and clarity.

-

10.Finally, add signature fields for both the borrower and lender, ensuring that all signatories acknowledge the agreement.

How do I write a payment plan agreement?

A Payment Plan Agreement should include the following details: Names and contact information of both the creditor and debtor. Description of the debt being repaid. Total amount owed. Payment schedule, including due dates and amounts. Interest rate (if applicable) Consequences of late or missed payments.

How to write a loan repayment agreement?

Key elements of a repayment agreement Parties involved. Clearly define the lender and borrower, including their contact information. Loan amount and interest. Specify the principal amount and any interest to be charged. Repayment schedule. Late fees: Outline any penalties for late payments. Default terms. Governing law.

How do I offer someone a payment plan?

Explain the total cost of your services and the proposed length of time the payment plan will run. Outline the payment schedule, including the due date for each work milestone and the expected payments. Discuss any interest or fees that may be associated with the plan, including how you calculate those costs.

What is an example of a payment arrangement?

Example of a payment arrangement clause "The Client agrees to pay the total sum of [$amount] to the Supplier as follows: an upfront deposit of [$amount], due upon signing this Agreement; a second payment of [$amount] due on [specified date], and the remaining balance of [$amount] due upon completion of the project.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.