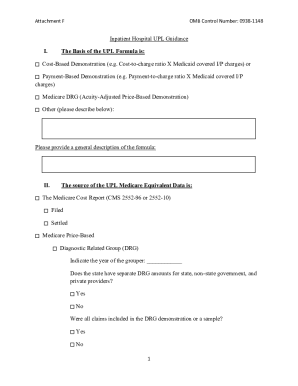

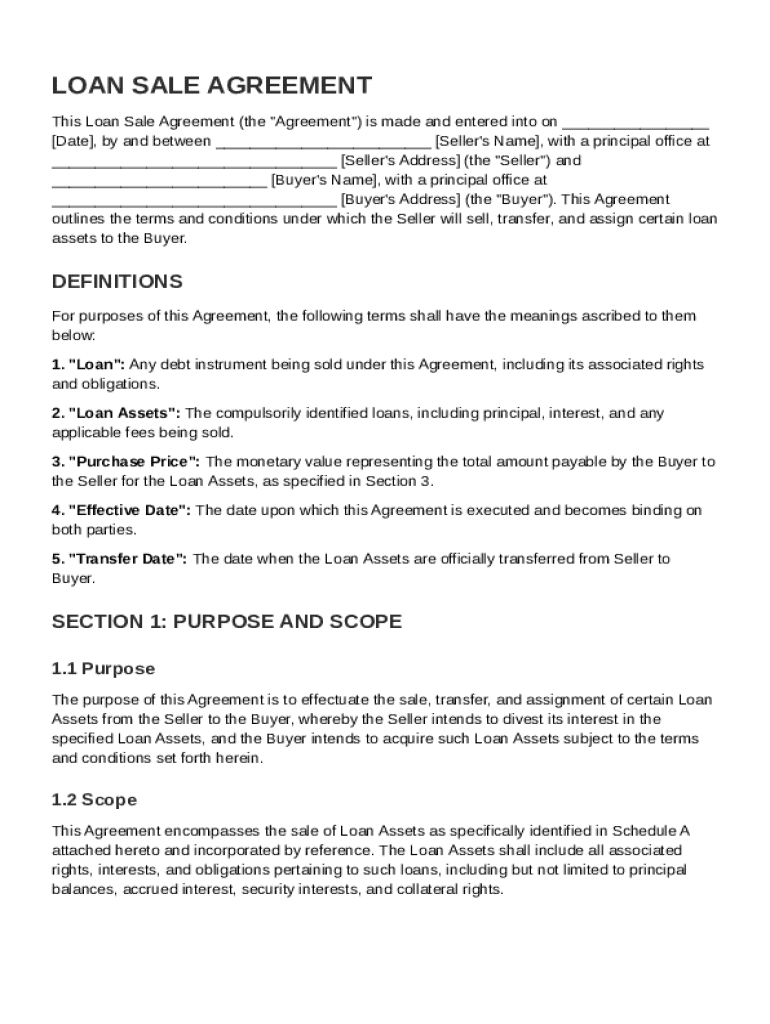

Loan Sale Agreement Template free printable template

Show details

This document outlines the terms and conditions under which the Seller will sell, transfer, and assign certain loan assets to the Buyer.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Sale Agreement Template

A Loan Sale Agreement Template is a legal document used to outline the terms and conditions under which a loan will be sold from one lender to another.

pdfFiller scores top ratings on review platforms

this is an amazing website it doers amazing things and its an awesome fast thing for us brojkers

Great Site to find any form you may need! As a Restaurant and Bar owner, it's really convenient when you need a specific form quick, they have everything I have ever looked for! Quick and easy! 5 Stars and 2 thumbs up!!!

In a public library trying to print a document and the site has crashed on two separate web browsers (Firefox and Internet Explorer).

Finally, I do not have to navigate the IRS website for their forms!

It makes submitting insurance claims so much easier! And, I'm slowly putting other types of documents in there as well.

so far so good. Could not locate one form that I needed and pdffiller did not recognize t he url

Who needs Loan Sale Agreement Template?

Explore how professionals across industries use pdfFiller.

Loan Sale Agreement Guide

How to fill out a Loan Sale Agreement form

Filling out a Loan Sale Agreement form requires careful attention to detail to ensure that all necessary information is accurately captured. Begin by gathering key documentation, defining the loan assets, and determining a fair purchase price. Utilize the template provided to mark specific fields for both seller and buyer. Ensure to review for common mistakes that can delay the agreement.

What is a Loan Sale Agreement?

A Loan Sale Agreement is a legal document that facilitates the transfer of loan assets from one party to another. It outlines the terms and conditions of the sale, ensuring both parties understand their rights and obligations. Understanding the nuances of this agreement is vital for effective asset management.

-

A Loan Sale Agreement details the process of transferring loan assets from a seller to a buyer, including rights and obligations.

-

Essential components include the identification of loan assets, purchase price, and effective dates.

-

Unlike other loan agreements, Loan Sale Agreements focus specifically on asset transfer rather than on a loan’s terms.

When should you use a Loan Sale Agreement?

A Loan Sale Agreement is particularly important in circumstances where a lender wishes to liquidate their loan portfolio or transfer loan obligations. Understanding when to utilize this agreement can protect both parties and clarify their responsibilities.

-

Situations such as business restructuring, asset liquidation, or portfolio management often necessitate a Loan Sale Agreement.

-

Using a Loan Sale Agreement can provide clarity, reduce legal risks, and ensure compliance with regulations.

-

There are inherent risks, such as potential disputes over asset valuation and adherence to legal standards.

What are the key elements of a Loan Sale Agreement?

A proper Loan Sale Agreement includes various essential elements that define the transaction. These components ensure clarity and mitigate disputes later on.

-

Key terms defined include Loan, Loan Assets, Purchase Price, Effective Date, and Transfer Date.

-

Vital sections outline the purchase particulars, payment terms, and conditions of the sale.

-

Consider incorporating clauses that detail the obligations post-sale, warranties, and indemnities.

How to prepare for a Loan Sale Agreement?

Before proceeding with the Loan Sale Agreement, thorough preparation is essential. Collecting relevant documentation and identifying the loan assets helps lay the groundwork for a smooth transaction.

-

Essential documents include previous agreements, financial statements, and asset appraisals.

-

Clearly define which loan assets are up for sale and their valuations.

-

Conduct fair market valuation to establish a reasonable purchase price.

How to fill out the Loan Sale Agreement?

Completing the Loan Sale Agreement involves following a structured approach. Understanding each section and field ensures accurate representation of both parties.

-

Begin with basic information followed by details regarding the loan assets, pricing, and parties involved.

-

Accurately enter the legal names and details of the entities involved.

-

Review for errors in dates, amounts, and party information that could invalidate the agreement.

What are the steps for signing and executing the Loan Sale Agreement?

Signing and executing the Loan Sale Agreement requires adherence to legal standards to protect both parties involved. Utilizing electronic signing tools boosts efficiency in this process.

-

Using platforms like pdfFiller allows for secure and efficient eSigning of agreements.

-

Ensure compliance with regional laws governing electronic signatures.

-

Maintain signed copies and use secure methods to store them post-signature.

How to manage your Loan Sale Agreement after execution?

Post-execution management of the Loan Sale Agreement is crucial for tracking compliance and performance. Using tools can help streamline this process.

-

Monitoring the transfer date and loan asset status ensures compliance with contractual obligations.

-

Utilize pdfFiller to make amendments and keep documents up to date.

-

Consider cloud-based platforms for easy access, sharing, and secure storage.

What are the legal responsibilities and compliance issues for Loan Sales?

Understanding and adhering to legal responsibilities when executing a Loan Sale Agreement is crucial to avoid potential disputes. Compliance requirements differ by region, hence research is vital.

-

Review regional laws governing loan sales to ensure compliance.

-

Ensure that all necessary disclosures are documented to avoid future liabilities.

-

Utilize tools such as pdfFiller to stay compliant with the needed documentation and formats.

What are the benefits of using pdfFiller for Loan Sale Agreements?

pdfFiller streamlines the document management process, facilitating easy editing, signing, and collaboration on Loan Sale Agreements. Its features enhance efficiency and security for users.

-

A cloud-based platform allows access and management of Loan Sale Agreements from anywhere.

-

Collaborative tools allow multiple parties to provide input and finalize documents effectively.

-

Using pdfFiller for eSigning enhances security while reducing execution times.

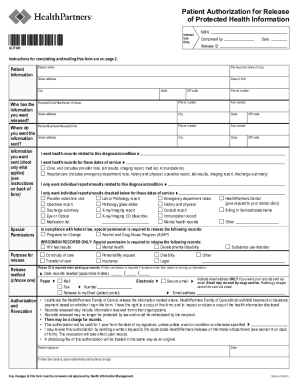

How to fill out the Loan Sale Agreement Template

-

1.Download the Loan Sale Agreement Template from pdfFiller.

-

2.Open the template in pdfFiller's editor.

-

3.Begin by entering the date of the agreement at the top of the document.

-

4.Fill in the names and contact information of the seller (current lender) and the buyer (new lender).

-

5.Specify the details of the loan being sold, including the loan amount, interest rate, and payment terms.

-

6.Outline any warranties or representations made by the seller regarding the loan.

-

7.Include a section for any fees associated with the sale of the loan, if applicable.

-

8.Review all entered information for accuracy to ensure clarity and completeness.

-

9.Sign the document electronically using pdfFiller's e-signature feature.

-

10.Once completed, save the agreement and download it or send it directly to the involved parties.

How do I write a simple loan agreement?

Start Your Loan Agreement The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How to create a sales agreement?

Sales agreement contracts generally consist of the following sections: Buyer and seller contact information. A description of the item being sold. The price of the item being sold. The terms of payment. The frequency of payments and maturity date, if applicable. The date the item will transfer to the buyer. Disclosures.

What is a loan purchase agreement?

A loan purchase agreement is an agreement between a lender and borrower that states how a secured financial asset, such as real estate or equipment, will be purchased. The buyer of this type of security agrees to buy the asset at some point for an agreed-upon price.

How do I write a simple loan agreement between friends?

All in all, a formal loan agreement between family members or friends should include: Both the lender's and borrower's personal details. The exact amount being lent. The purpose of the loan. How and when repayments will be made. If interest will be charged, the interest rate, and how it will be worked out.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.