Loan Settlement Agreement Template free printable template

Show details

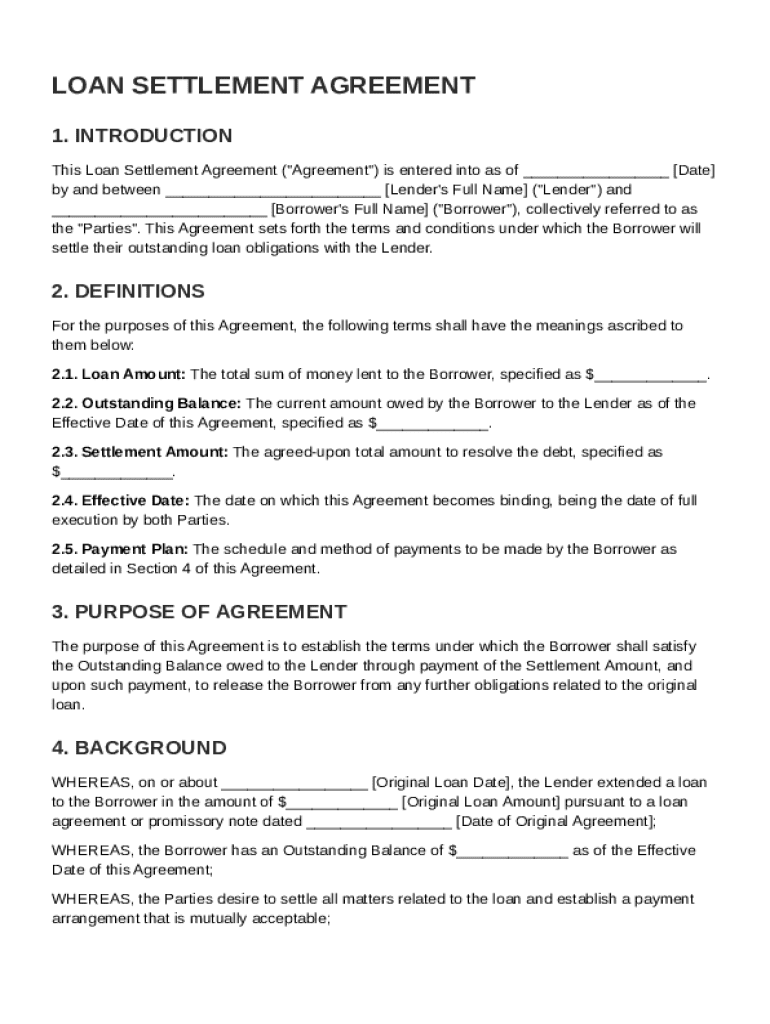

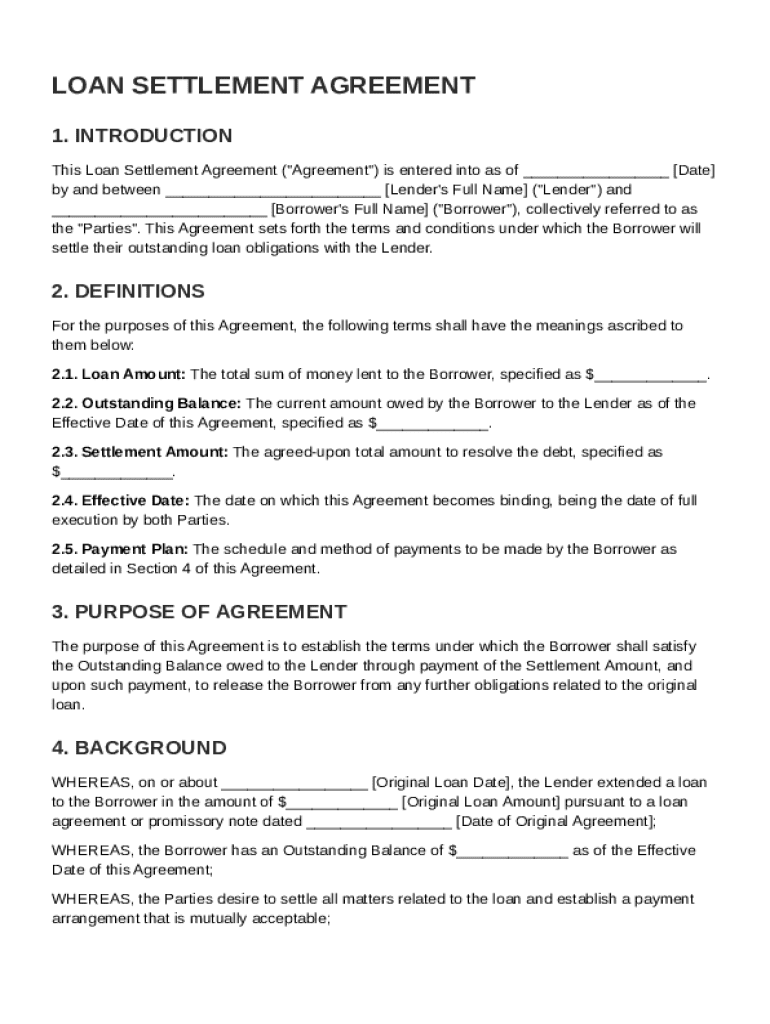

This document outlines the terms and conditions under which a borrower can settle outstanding loan obligations with a lender.

We are not affiliated with any brand or entity on this form

Why pdfFiller is the best tool for managing contracts

End-to-end document management

From editing and signing to collaborating and tracking, pdfFiller has all the PDF tools you need for your contract workflow.

Mobile ready

pdfFiller is cloud-based, letting you edit, sign, and share contracts from your computer, smartphone, or tablet.

Legally binding & secure

pdfFiller lets you securely manage contracts with eSignatures that comply with global laws like ESIGN and GDPR. It's also HIPAA and SOC 2 compliant.

What is Loan Settlement Agreement Template

A Loan Settlement Agreement Template is a legal document that outlines the terms and conditions for settling a loan between a lender and borrower.

pdfFiller scores top ratings on review platforms

Great program

Great program. Can't find anything it doesn't do.

Was able to get started on a project…

Was able to get started on a project easily.

Definitely helps filling out the forms…

Definitely helps filling out the forms so that they look nice and presentable.

love this program

This program is so easy to use and it does everything one needs to get taxes completly done and filed.

I am Mexican

I am Mexican. good experience.

This was the easiest

This was the easiest, most customer friendly service yet!

Who needs Loan Settlement Agreement Template?

Explore how professionals across industries use pdfFiller.

Loan Settlement Agreement Template Guide

TL;DR on filling out a Loan Settlement Agreement form

To fill out a Loan Settlement Agreement form, identify the parties involved, detail the loan amount, and define the settlement amount. Customize the payment plan structure to fit your situation, ensuring all information is accurate for compliance and legal standards.

What is a Loan Settlement Agreement?

A Loan Settlement Agreement is a legal document outlining the terms under which a borrower can settle their debt with a lender. It serves to formalize the agreement between both parties, ensuring clarity and legality in the arrangement.

-

It's a contractual agreement that modifies the loan terms to allow for settlement at a lower amount, often due to financial hardship of the borrower.

-

The primary aim is to reduce the borrower’s total debt while providing a structured plan for repayment, helping both parties avoid further legal complications.

-

The lender, often a financial institution, and the borrower, who is responsible for repaying the debt, are the main parties to the agreement.

What are the essential components of a Loan Settlement Agreement?

-

Both the lender and borrower must be accurately identified, including their full names and contact details.

-

This section clarifies the original loan amount and the current outstanding balance, ensuring both parties agree on the figure to be settled.

-

Specifying the chargeable settlement amount and establishing the effective date indicate when the agreement turns legally enforceable.

-

This includes a clear, structured repayment plan detailing how the settlement will be paid over time.

What steps should you follow to draft your Loan Settlement Agreement?

Drafting a Loan Settlement Agreement requires meticulous attention and clarity. Start by outlining your objectives and ensuring all necessary components are included to prevent misunderstandings later.

-

Begin with your details, followed by the lender’s information, then fill in the current loan amount and create a detailed payment plan.

-

Misinformation or omissions can lead to legal disputes later, making this a critical part of the drafting process.

-

Adapt the terms to fit unique circumstances, like your financial status and repayment capability.

-

Ensure all terms are documented clearly, without ambiguity, leaving no room for differing interpretations.

How do you fill out and edit the Loan Settlement Template on pdfFiller?

Utilizing pdfFiller allows users to conveniently upload and manage their Loan Settlement Agreement templates. Its interactive tools ensure that editing is both straightforward and efficient.

-

Start by uploading your document into pdfFiller's interface, where you can make any necessary changes.

-

Employ features like text editing, form filling, and formatting options to perfect your agreement.

-

Incorporate eSignatures for all relevant parties directly through the platform to make the document legally binding.

What legal compliance and considerations should you be aware of?

Compliance with local laws and regulations is essential when drafting a Loan Settlement Agreement. Each region or industry may have specific requirements that must be adhered to.

-

Review applicable laws in your area to ensure the agreement meets all legal standards.

-

Different industries might have regulations that influence how loan settlements are handled, such as those in finance vs. personal loans.

-

Understand the legal ramifications of the agreement, particularly if the terms are not fully adhered to.

How to manage your Loan Settlement after the agreement is signed?

After the agreement is finalized, managing the repayment process is crucial. This involves keeping track of payments and being proactive about any possible issues that may arise.

-

Ensure that all payments are made as scheduled in the agreed timeline.

-

Communicate any difficulties with the lender promptly to seek potential adjustments to the payment plan.

-

If financial situations change, review the terms of your agreement and discuss options with your lender.

How to fill out the Loan Settlement Agreement Template

-

1.Download the Loan Settlement Agreement Template from pdfFiller.

-

2.Open the PDF file in pdfFiller's editor.

-

3.Begin by entering the date of the agreement at the top of the document.

-

4.Fill in the names and addresses of both the borrower and the lender in the designated fields.

-

5.Specify the loan amount and the agreed-upon settlement amount clearly.

-

6.Detail the terms of the settlement, including any payment plan or timeline if applicable.

-

7.Include any additional clauses that may be necessary for the specific agreement.

-

8.Review all entered information for accuracy and completeness.

-

9.Save the document within pdfFiller and proceed to print or share as needed.

How do I write a debt settlement agreement?

What To Include in Your Debt Settlement Agreement. The letter should include your personal contact information, full name, mailing address, and account number. Specify the amount that you can pay, as well as what you expect from the creditor in return.

How to write a settlement agreement?

Drafting a settlement agreement Consult with legal counsel. Always get legal advice when drafting or entering into a settlement agreement. Detail the dispute. Clearly outline the nature of the dispute and the reasons for the settlement. Specify terms. Include a release. Maintain confidentiality. Sign and date.

How to get a settlement on a loan?

Contact your creditors Start by calling their customer service line and requesting to speak with a representative who handles hardship cases or settlements. Ask about hardship plans before jumping to settlement. If you move forward, explain that you're unable to pay in full but can offer a reduced lump sum payment.

How to write a loan agreement contract?

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. Date of the agreement. Interest rate. Repayment terms. Default provisions. Signatures. Choice of law. Severability.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.